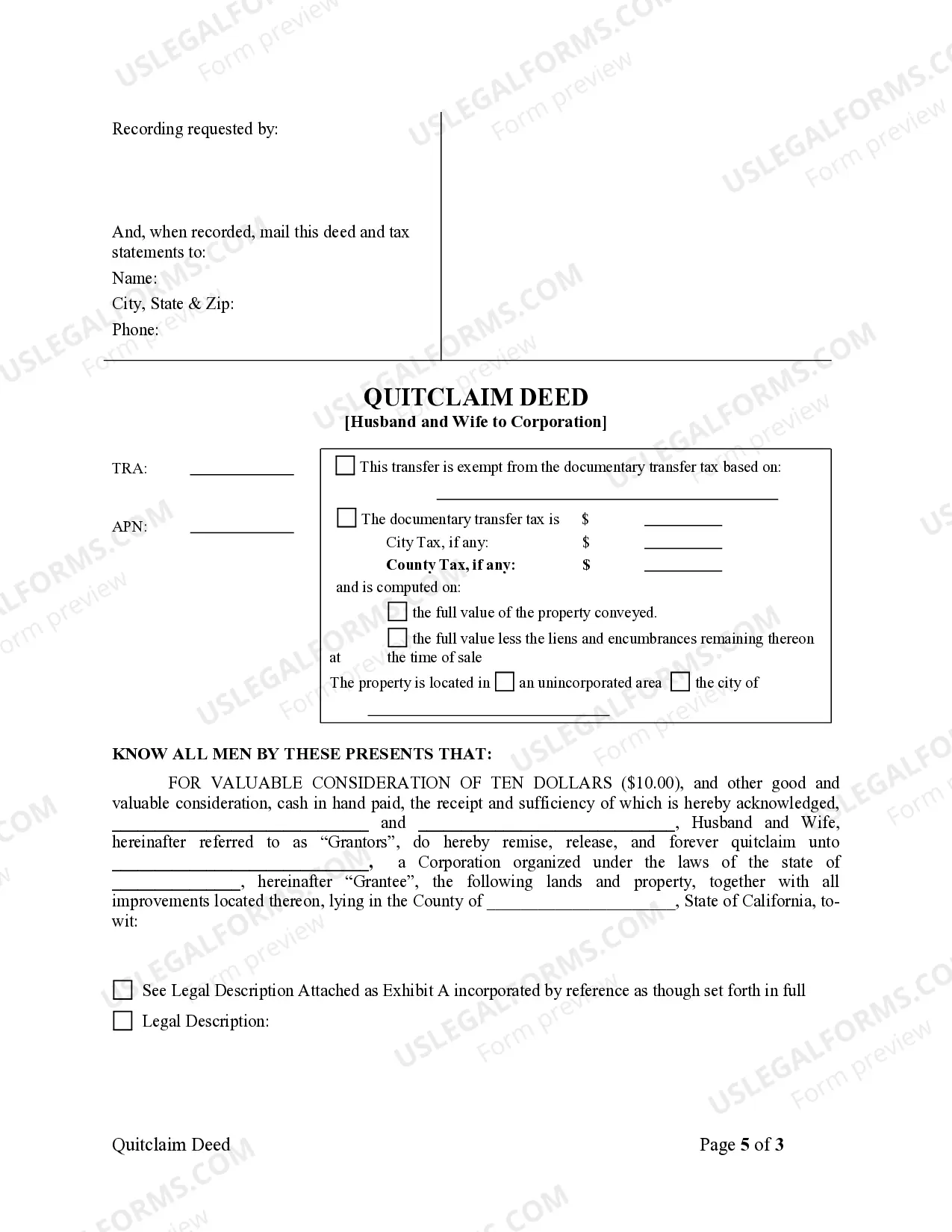

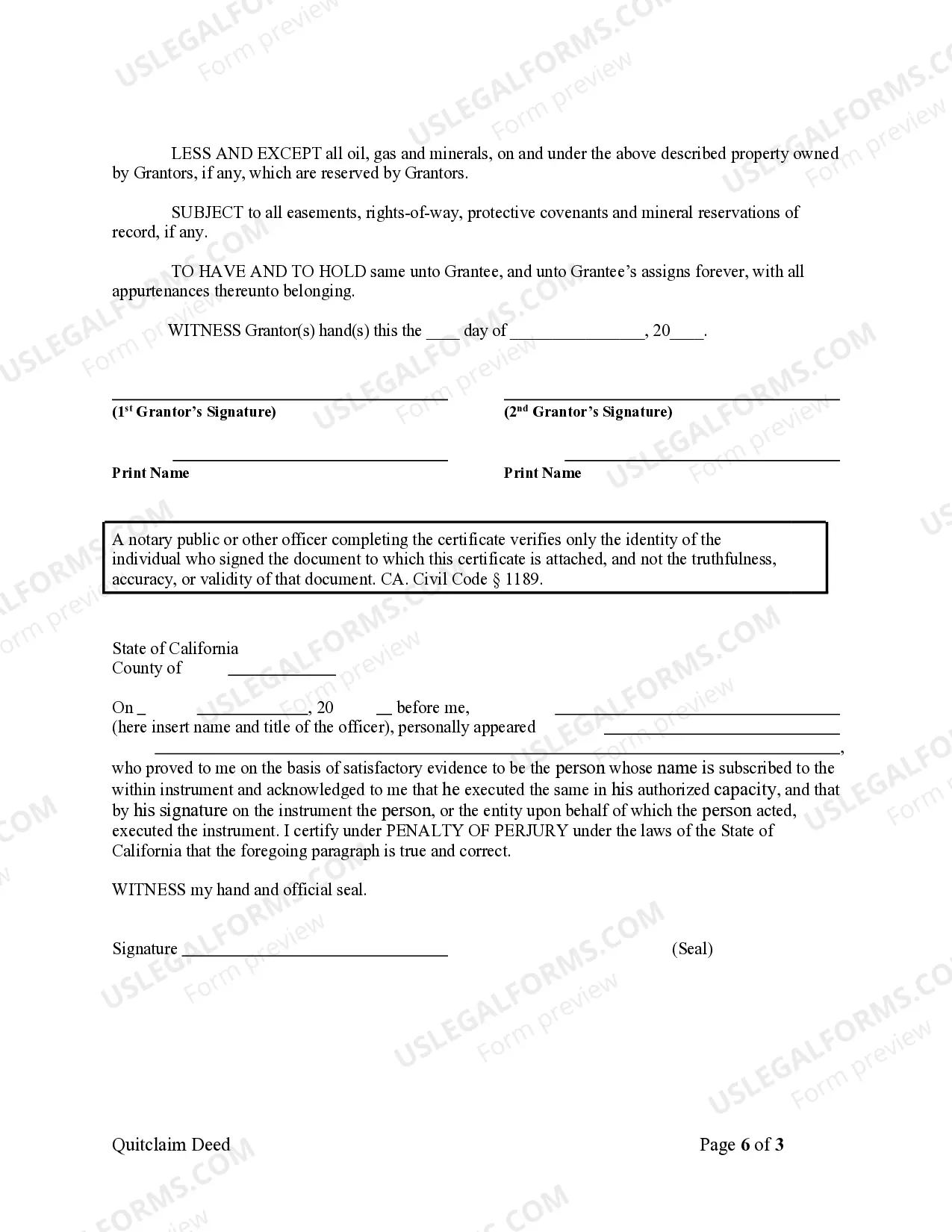

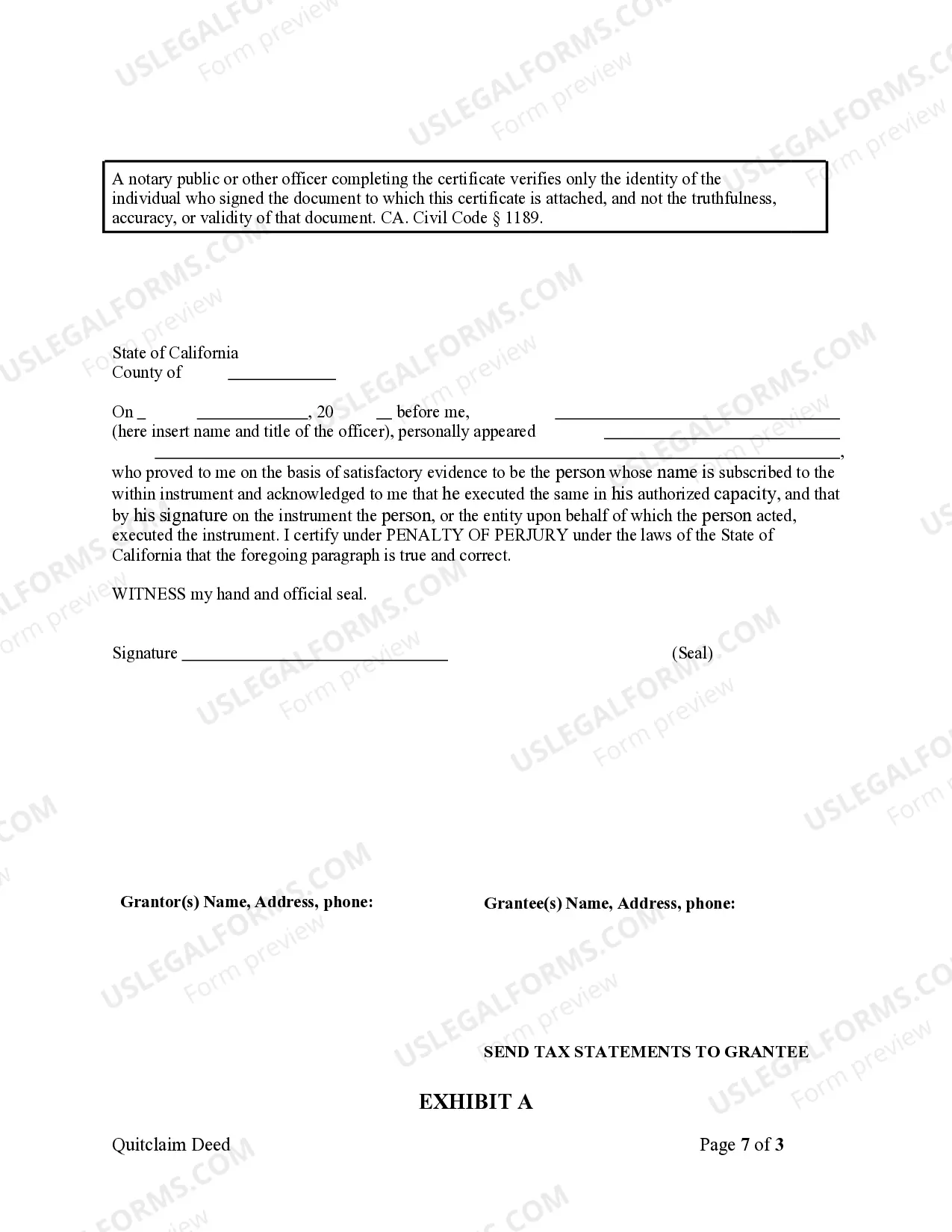

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Garden Grove California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of real property from a married couple to a corporation, using a quitclaim deed. This type of deed allows the couple, referred to as the granters, to relinquish any interest or claim they have in the property to the corporation, called the grantee. In Garden Grove, California, there are two main types of Quitclaim Deeds from Husband and Wife to Corporation, each serving a specific purpose: 1. Garden Grove California General Quitclaim Deed from Husband and Wife to Corporation: This type of quitclaim deed transfers complete ownership of the property without any warranties or guarantees regarding the title. The granters simply convey their interest without assuming responsibility for any potential liens, encumbrances, or claims against the property. 2. Garden Grove California Special or Limited Quitclaim Deed from Husband and Wife to Corporation: This type of quitclaim deed is similar to the general deed but restricts the transfer to specific portions or certain aspects of the property. Here, the granters may exclude certain portions or rights while conveying the identified interests to the corporation. While executing a Garden Grove California Quitclaim Deed from Husband and Wife to Corporation, it is essential to follow the legal requirements set forth by the state. These include: — Accurate Property Description: The deed must include a detailed and accurate description of the property being transferred. This typically includes the property's address, lot number, or legal description to ensure there is no ambiguity regarding the specific location. Granteror's and Grantee's Information: The deed should clearly state the full legal names of the husband and wife as granters, as well as the corporation's complete legal name as the grantee. Additionally, their mailing addresses must be included for future communication. — Notarization and Witnessing: Thgrantersrs' signatures must be notarized by a licensed notary public, and the deed should also be signed by at least two witnesses who are not beneficiaries or parties involved in the transaction. — Filing with County Recorder: To make the transfer official, the quitclaim deed must be filed with the Orange County Recorder's Office or the appropriate county recorder's office in Garden Grove, California. A recording fee is generally required. It is crucial to consult with an experienced real estate attorney or a qualified professional to ensure the proper execution of a Garden Grove California Quitclaim Deed from Husband and Wife to Corporation. This will help prevent any potential legal complications or issues related to the transfer of ownership.A Garden Grove California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer ownership of real property from a married couple to a corporation, using a quitclaim deed. This type of deed allows the couple, referred to as the granters, to relinquish any interest or claim they have in the property to the corporation, called the grantee. In Garden Grove, California, there are two main types of Quitclaim Deeds from Husband and Wife to Corporation, each serving a specific purpose: 1. Garden Grove California General Quitclaim Deed from Husband and Wife to Corporation: This type of quitclaim deed transfers complete ownership of the property without any warranties or guarantees regarding the title. The granters simply convey their interest without assuming responsibility for any potential liens, encumbrances, or claims against the property. 2. Garden Grove California Special or Limited Quitclaim Deed from Husband and Wife to Corporation: This type of quitclaim deed is similar to the general deed but restricts the transfer to specific portions or certain aspects of the property. Here, the granters may exclude certain portions or rights while conveying the identified interests to the corporation. While executing a Garden Grove California Quitclaim Deed from Husband and Wife to Corporation, it is essential to follow the legal requirements set forth by the state. These include: — Accurate Property Description: The deed must include a detailed and accurate description of the property being transferred. This typically includes the property's address, lot number, or legal description to ensure there is no ambiguity regarding the specific location. Granteror's and Grantee's Information: The deed should clearly state the full legal names of the husband and wife as granters, as well as the corporation's complete legal name as the grantee. Additionally, their mailing addresses must be included for future communication. — Notarization and Witnessing: Thgrantersrs' signatures must be notarized by a licensed notary public, and the deed should also be signed by at least two witnesses who are not beneficiaries or parties involved in the transaction. — Filing with County Recorder: To make the transfer official, the quitclaim deed must be filed with the Orange County Recorder's Office or the appropriate county recorder's office in Garden Grove, California. A recording fee is generally required. It is crucial to consult with an experienced real estate attorney or a qualified professional to ensure the proper execution of a Garden Grove California Quitclaim Deed from Husband and Wife to Corporation. This will help prevent any potential legal complications or issues related to the transfer of ownership.