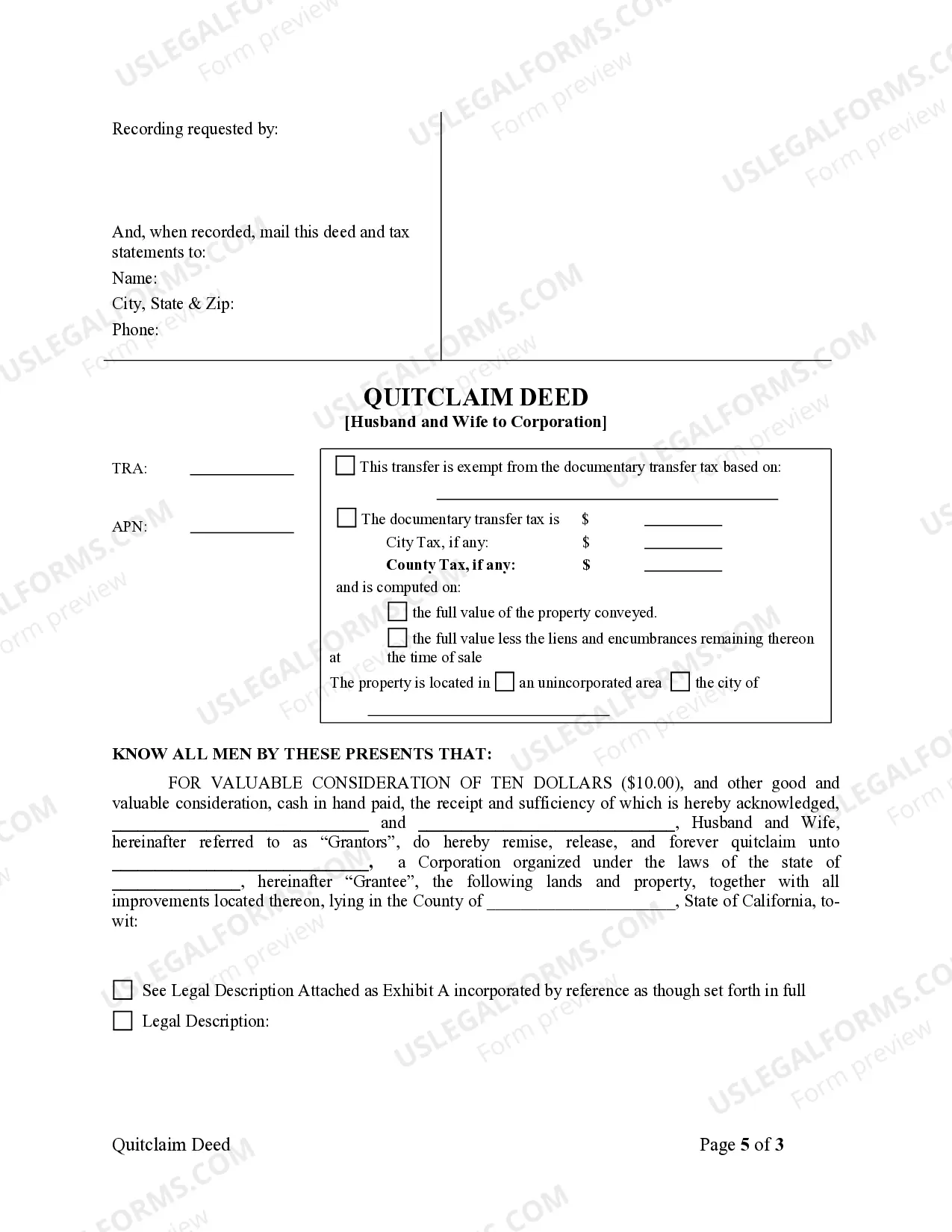

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Hayward California Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out California Quitclaim Deed From Husband And Wife To Corporation?

Are you searching for a trustworthy and affordable provider of legal forms to acquire the Hayward California Quitclaim Deed from Husband and Wife to Corporation? US Legal Forms is your ultimate option.

Whether you need a simple agreement to establish guidelines for living with your partner or a collection of documents to proceed with your separation or divorce in court, we have you covered. Our site features over 85,000 current legal document templates for both personal and business needs. All templates that we provide access to are not generic and are tailored according to the regulations of specific states and regions.

To obtain the document, you must Log In to your account, find the necessary form, and click the Download button next to it. Please remember that you can download your previously acquired form templates anytime from the My documents tab.

Are you a newcomer to our platform? No problem. You can set up an account in just a few minutes, but first, ensure you do the following.

Now you’re ready to create your account. Then choose the subscription plan and continue to payment. After the payment is processed, download the Hayward California Quitclaim Deed from Husband and Wife to Corporation in any available format. You can revisit the website whenever needed and redownload the document at no additional cost.

Acquiring current legal documents has never been simpler. Give US Legal Forms a shot today, and put an end to wasting your valuable time learning about legal paperwork online once and for all.

- Verify if the Hayward California Quitclaim Deed from Husband and Wife to Corporation aligns with the laws of your state and locality.

- Review the details of the form (if available) to ascertain who and what the document is appropriate for.

- Start your search anew if the form does not fit your particular situation.

Form popularity

FAQ

Most commonly, a quitclaim deed is used to transfer property between family members or in situations that do not require a title search. For example, it can facilitate a Hayward California Quitclaim Deed from Husband and Wife to Corporation, allowing easy ownership transfer. This form effectively conveys property rights without the detailed assessments typical of other deed types. Ultimately, it serves as a straightforward method for handling property ownership changes.

A quitclaim deed is not suitable for situations where the parties involved require a guarantee of clear title. For instance, if you are purchasing property from someone you do not know well, a Hayward California Quitclaim Deed from Husband and Wife to Corporation would not provide the necessary security. Additionally, if the property is financed with a mortgage, a quitclaim deed may complicate the lender's rights. Therefore, it's crucial to understand the limitations of a quitclaim deed in various transactions.

A quitclaim deed is ideal in scenarios where the parties involved have a strong trust relationship, such as family members or close friends. For example, if a husband and wife want to transfer property rights to a corporation they jointly own, a Hayward California Quitclaim Deed from Husband and Wife to Corporation simplifies this process. It allows for quick and uncomplicated transfers without the need for a lengthy title search. This makes it a straightforward choice for familial or informal transactions.

To submit a quit claim deed in California, first ensure that you have the correct form for a Hayward California Quitclaim Deed from Husband and Wife to Corporation. Fill out the deed with accurate information, including the legal description of the property. Once completed, sign the deed before a notary public to validate it. Finally, you must file the deed with the county recorder's office where the property is located to make it official and enforceable.

Any adult proficient in property law can prepare a quitclaim deed in California. This includes property owners, attorneys, or professionals from title companies. For a specific case like a Hayward California Quitclaim Deed from Husband and Wife to Corporation, consulting a qualified service such as US Legal Forms can provide you with templates and guidance to ensure compliance with state regulations.

In California, the parties involved in the property transfer must sign the quitclaim deed. This typically includes the spouse transferring their interest and may also require signatures from representatives of the corporation if it is the receiving party. It is crucial that all parties involved in a Hayward California Quitclaim Deed from Husband and Wife to Corporation understand their roles and responsibilities in the signing process.

A quitclaim deed in California can be prepared by the property owner, but engaging a professional is advisable for legal and clerical accuracy. Title companies and real estate attorneys frequently handle this process, especially for complex transfers like a Hayward California Quitclaim Deed from Husband and Wife to Corporation. Their expertise ensures that all requirements are met.

A spouse might choose to execute a quit claim deed to transfer their interest in property to another party, often the corporation. This action can simplify ownership matters during business transactions or facilitate estate planning. In situations involving a Hayward California Quitclaim Deed from Husband and Wife to Corporation, clarity in ownership can safeguard both personal and business interests.

In California, anyone can prepare a deed, including the property owner. However, legal experts often recommend using a professional, such as a real estate attorney or a title company, to ensure accuracy. When dealing with a Hayward California Quitclaim Deed from Husband and Wife to Corporation, having a knowledgeable professional can help prevent costly mistakes.

The primary purpose of an interspousal transfer deed is to facilitate the transfer of property between spouses, typically for estate planning or divorce purposes. This deed helps clarify ownership and ensure that both parties understand their rights in the property. It legally documents the intended transfer, which can help prevent future disputes. For seamless execution, consider using a service like US Legal Forms for the necessary resources.