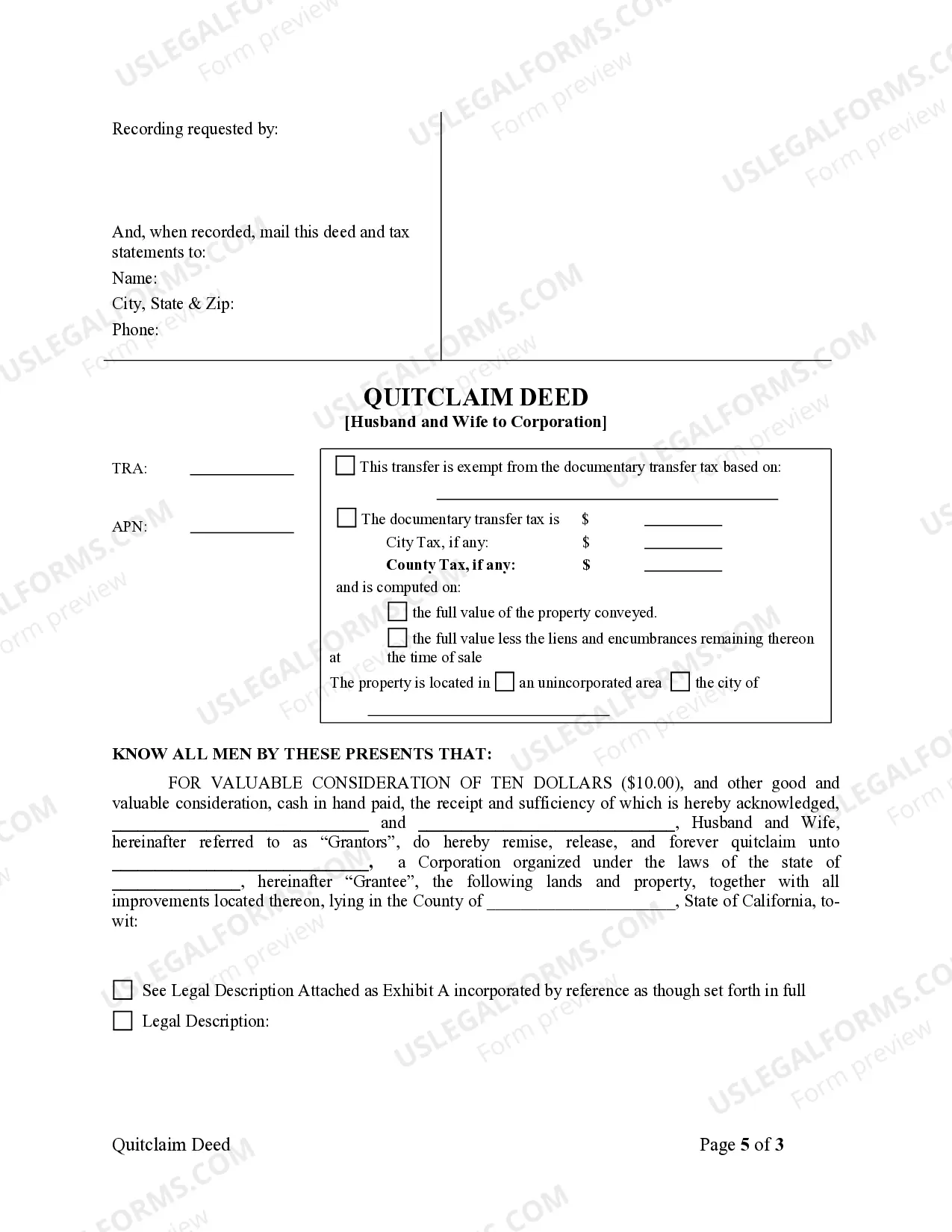

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Title: Inglewood, California Quitclaim Deed from Husband and Wife to Corporation: A Comprehensive Guide Description: Are you considering transferring a property from a husband and wife to a corporation in Inglewood, California? Look no further! This detailed description will clarify what an Inglewood California Quitclaim Deed from Husband and Wife to Corporation entails, while using relevant keywords. Inglewood, California Quitclaim Deed: A quitclaim deed is a legal document used to transfer ownership of a property from one party to another. In this case, it involves a transfer from a husband and wife to a corporation. By executing a quitclaim deed, the husband and wife relinquish any interest or claim they have to the property and transfer it to the corporation without any warranties or guarantees regarding the property's title. Keywords: Inglewood, California; Quitclaim Deed; Husband and Wife; Corporation; Property Transfer; Legal Document; Ownership; Title; Warranties; Guarantees. Types of Inglewood California Quitclaim Deed from Husband and Wife to Corporation: 1. Voluntary Transfer: This type of quitclaim deed occurs when the husband and wife willingly and without coercion or undue influence transfer their property ownership rights to a corporation. It often involves parties who have carefully considered the benefits of such a transfer and consent to it willingly. 2. Intergenerational Transfer: In some cases, a husband and wife may decide to transfer their property to a corporation to ensure its seamless transfer to the next generation. This form of quitclaim deed allows for an organized succession plan, enabling the corporation to maintain operational continuity and facilitate generational wealth transfer. 3. Asset Protection: Transferring property from a husband and wife to a corporation can sometimes serve as a strategic measure to protect personal assets. By placing the property under the corporation's ownership, individuals gain an additional layer of protection against potential legal liabilities and potential creditor claims. Keywords: Voluntary Transfer; Intergenerational Transfer; Asset Protection; Property Ownership; Succession Plan; Operational Continuity; Generational Wealth Transfer; Personal Asset Protection; Legal Liabilities; Creditor Claims. Executing an Inglewood California Quitclaim Deed from Husband and Wife to Corporation: To execute a valid Inglewood, California Quitclaim Deed from Husband and Wife to Corporation, it is crucial to follow specific legal procedures. These typically involve: 1. Drafting the Quitclaim Deed: Ensure that your quitclaim deed contains accurate and complete information about the parties involved, property description, legal descriptions, and any additional terms or conditions agreed upon. 2. Notarization: It is essential to have the quitclaim deed notarized by a licensed notary public to validate its legality. Notaries act as impartial witnesses and provide an added layer of authenticity to the document. 3. Filing with the County Recorder: Submit the executed quitclaim deed to the Inglewood County Recorder's Office or relevant authority to officially record the transfer of ownership. This step safeguards the interests of all parties involved and ensures the public record reflects the new property ownership. Keywords: Drafting; Notarization; County Recorder; Legal Procedures; Quitclaim Deed Execution; Accuracy; Completeness; Notary Public; County Recorder's Office; Transfer of Ownership; Public Record. In conclusion, an Inglewood California Quitclaim Deed from Husband and Wife to Corporation is a legally binding document that facilitates the transfer of property ownership from a couple to a corporation. Whether you are considering a voluntary transfer, an intergenerational plan, or asset protection, following the proper legal procedures throughout the execution process is vital.