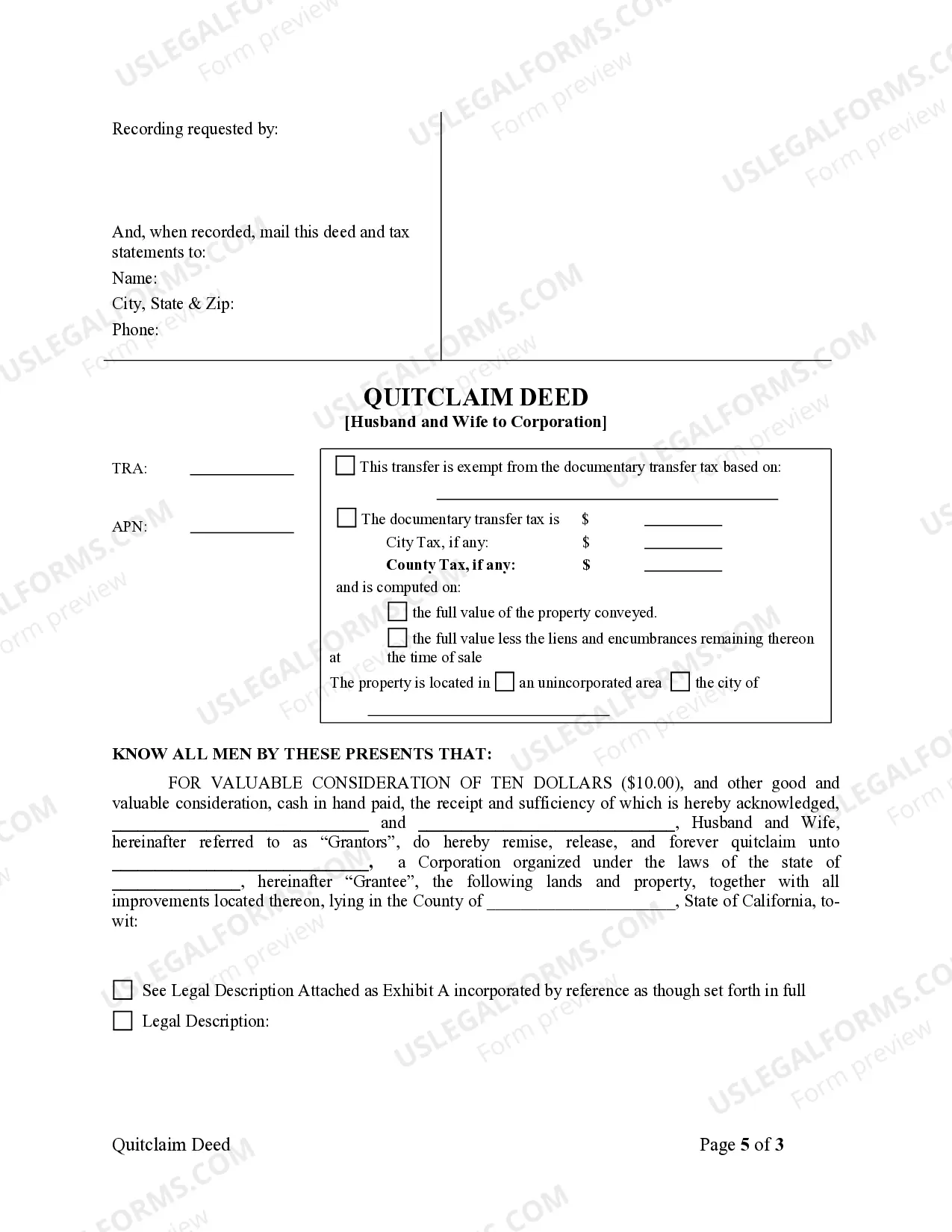

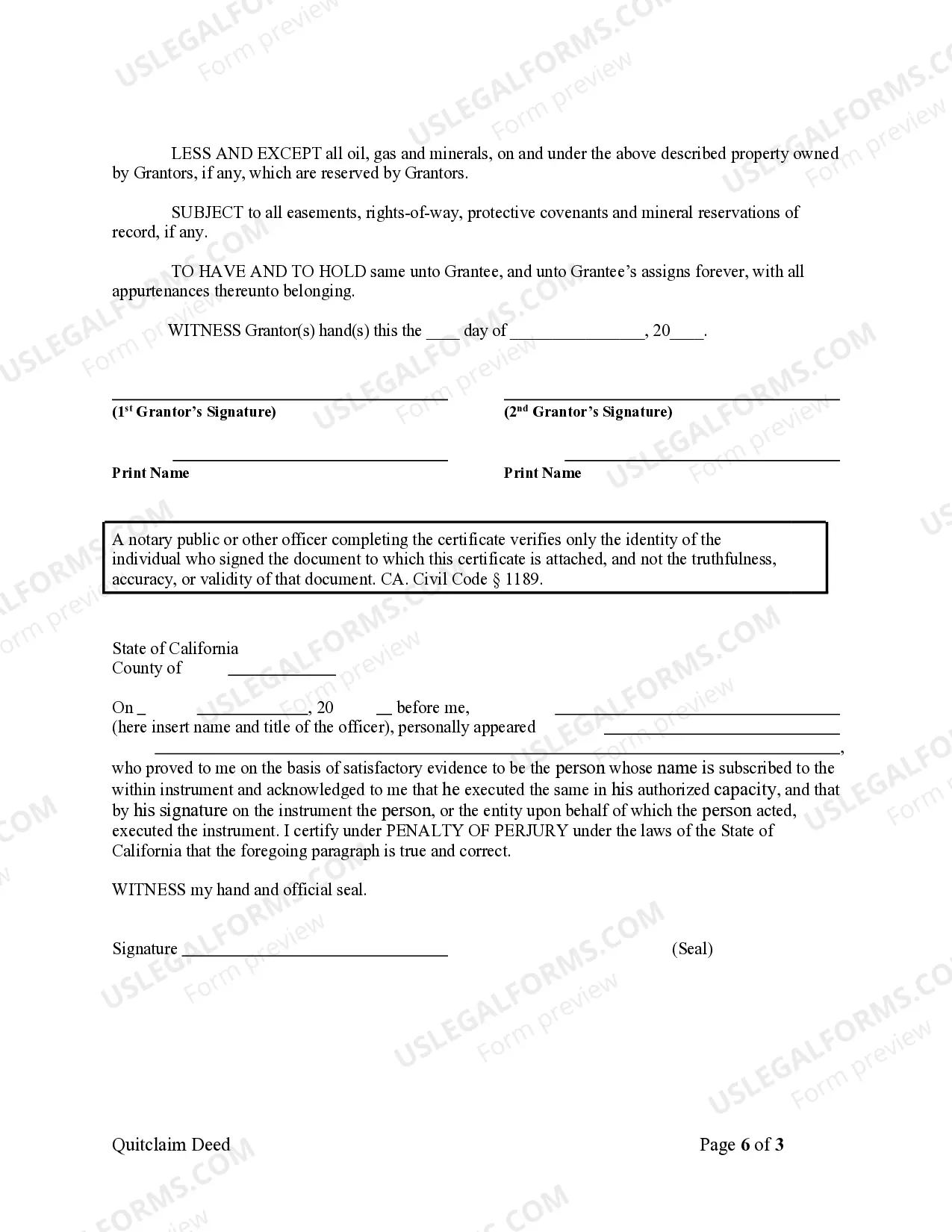

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Long Beach California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer the ownership of real estate property from a married couple to a corporation. This type of deed is commonly utilized when a husband and wife decide to transfer property ownership to their corporation, usually for business or asset protection purposes. The process involves relinquishing all ownership rights, interests, and claims the couple holds in the property, thus ensuring a clear and undisputed transfer to the corporation. There are several variations of Long Beach California Quitclaim Deeds from Husband and Wife to Corporation, each serving specific purposes: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used to transfer property ownership. It conveys the total ownership interests of both the husband and wife to the corporation and makes no warranties or guarantees regarding the property's title. This type of deed is typically used within close relationships where trust and transparency are established. 2. Joint Tenancy Quitclaim Deed: If the husband and wife hold the property as joint tenants, this deed can be used to transfer their joint tenancy interests to the corporation. Joint tenancy implies that both spouses have equal rights of survivorship, meaning that if one spouse passes away, the remaining spouse automatically inherits their share. By utilizing this deed type, both parties can ensure that the property is held by the corporation, bypassing potential probate issues. 3. Tenancy in Common Quitclaim Deed: If the husband and wife own the property as tenants in common, this deed can facilitate the transfer of their respective shares to the corporation. Unlike joint tenancy, tenancy in common allows each spouse to hold a distinct and separate ownership interest in the property. With this deed, they can convey their individual undivided interests to the corporation while remaining tenants in common with any other co-owners. 4. Trust Transfer Quitclaim Deed: In some cases, the husband and wife may hold the property in a trust. If they wish to transfer the property to a corporation held within the trust, a Trust Transfer Quitclaim Deed is executed. This deed transfers the property from the trust to the corporation, ensuring the property remains within the established trust structure. When executing a Long Beach California Quitclaim Deed from Husband and Wife to a Corporation, it is crucial to involve legal professionals such as real estate attorneys and notaries to ensure the legality and accuracy of the transfer. Additionally, it is essential to research and understand the specific requirements and regulations under Long Beach, California law to comply with all necessary procedures. By carefully navigating the process, the couple can successfully transfer the property ownership to their corporation while safeguarding their assets and achieving their business goals.A Long Beach California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer the ownership of real estate property from a married couple to a corporation. This type of deed is commonly utilized when a husband and wife decide to transfer property ownership to their corporation, usually for business or asset protection purposes. The process involves relinquishing all ownership rights, interests, and claims the couple holds in the property, thus ensuring a clear and undisputed transfer to the corporation. There are several variations of Long Beach California Quitclaim Deeds from Husband and Wife to Corporation, each serving specific purposes: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used to transfer property ownership. It conveys the total ownership interests of both the husband and wife to the corporation and makes no warranties or guarantees regarding the property's title. This type of deed is typically used within close relationships where trust and transparency are established. 2. Joint Tenancy Quitclaim Deed: If the husband and wife hold the property as joint tenants, this deed can be used to transfer their joint tenancy interests to the corporation. Joint tenancy implies that both spouses have equal rights of survivorship, meaning that if one spouse passes away, the remaining spouse automatically inherits their share. By utilizing this deed type, both parties can ensure that the property is held by the corporation, bypassing potential probate issues. 3. Tenancy in Common Quitclaim Deed: If the husband and wife own the property as tenants in common, this deed can facilitate the transfer of their respective shares to the corporation. Unlike joint tenancy, tenancy in common allows each spouse to hold a distinct and separate ownership interest in the property. With this deed, they can convey their individual undivided interests to the corporation while remaining tenants in common with any other co-owners. 4. Trust Transfer Quitclaim Deed: In some cases, the husband and wife may hold the property in a trust. If they wish to transfer the property to a corporation held within the trust, a Trust Transfer Quitclaim Deed is executed. This deed transfers the property from the trust to the corporation, ensuring the property remains within the established trust structure. When executing a Long Beach California Quitclaim Deed from Husband and Wife to a Corporation, it is crucial to involve legal professionals such as real estate attorneys and notaries to ensure the legality and accuracy of the transfer. Additionally, it is essential to research and understand the specific requirements and regulations under Long Beach, California law to comply with all necessary procedures. By carefully navigating the process, the couple can successfully transfer the property ownership to their corporation while safeguarding their assets and achieving their business goals.