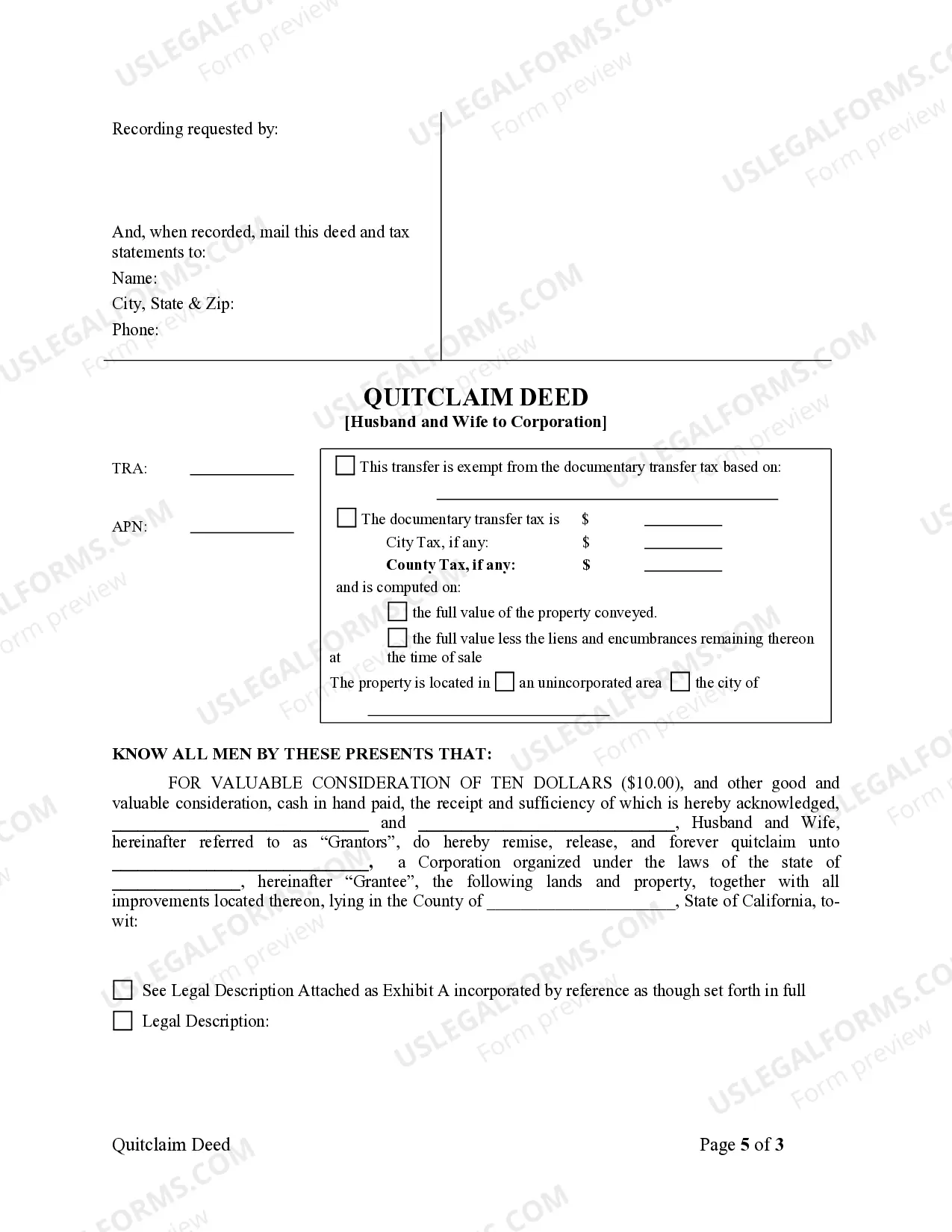

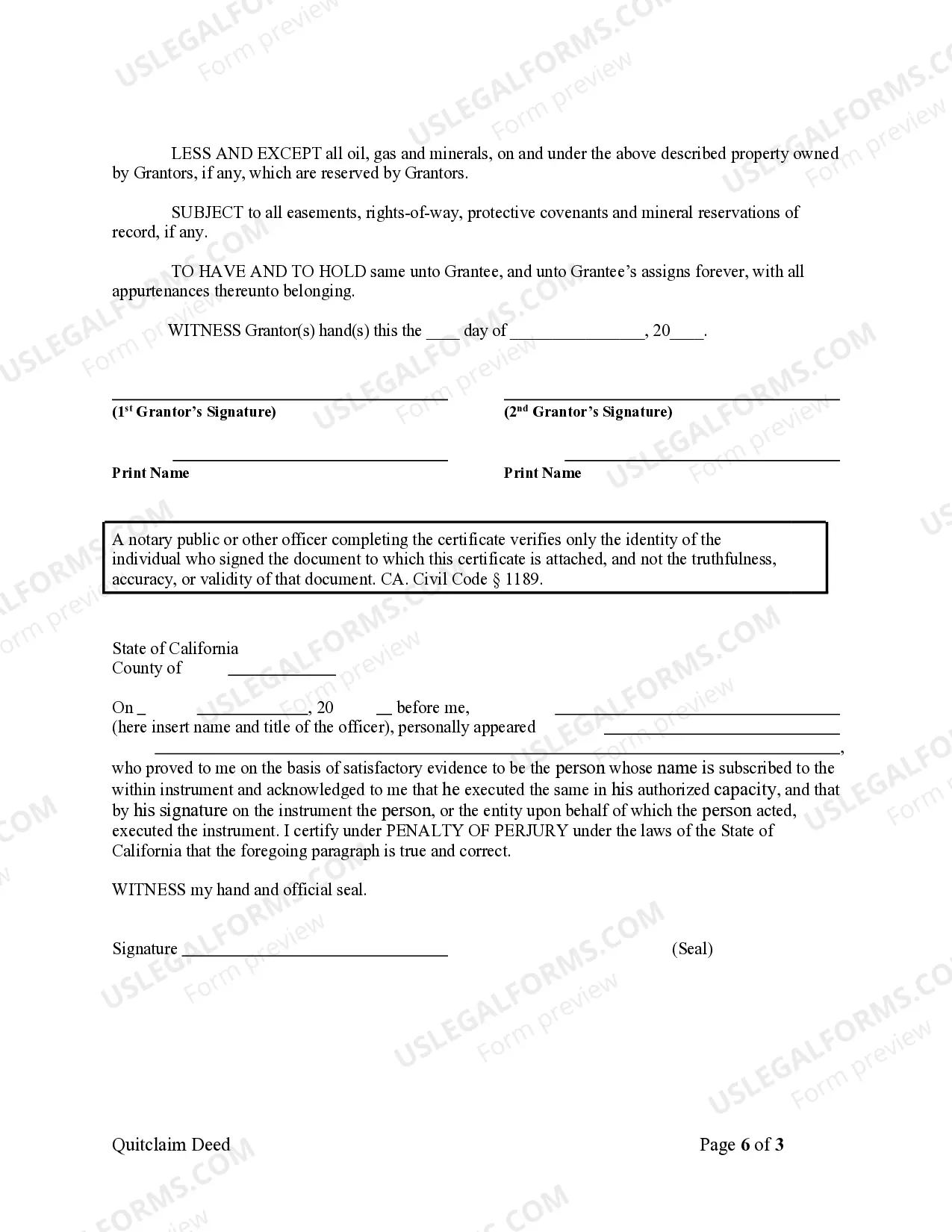

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

Pomona California Quitclaim Deed from Husband and Wife to Corporation

Description

How to fill out California Quitclaim Deed From Husband And Wife To Corporation?

If you are in search of a legitimate form template, it’s challenging to discover a superior platform than the US Legal Forms site – one of the most substantial collections on the internet.

Here you can locate thousands of document examples for business and personal purposes categorized by types and regions or keywords.

With the enhanced search feature, locating the latest Pomona California Quitclaim Deed from Husband and Wife to Corporation is as simple as 1-2-3.

Confirm your selection. Click the Buy now button. Then, choose the desired subscription plan and enter your information to register for an account.

Complete the transaction. Use your credit card or PayPal to finalize the registration process.

- Additionally, the validity of every document is confirmed by a group of experienced attorneys who routinely examine the templates on our platform and update them in accordance with the most recent state and county regulations.

- If you are already familiar with our system and possess a registered account, all you need to do to obtain the Pomona California Quitclaim Deed from Husband and Wife to Corporation is to Log In to your profile and click the Download option.

- If this is your first time utilizing US Legal Forms, simply follow the steps outlined below.

- Ensure you have found the sample you require. Review its details and utilize the Preview function (if available) to view its contents.

- If it doesn’t align with your Needs, use the Search bar near the top of the screen to find the suitable document.

Form popularity

FAQ

A quitclaim deed transfers the grantor's interest in the property without guaranteeing that the title is clear. In contrast, an interspousal transfer specifically pertains to transfers between spouses, often providing tax benefits and simplifying the transfer process. Both can relate to a Pomona California Quitclaim Deed from Husband and Wife to Corporation, but understanding their differences can help you make informed decisions during property transfers.

To submit a quitclaim deed in California, you must first complete the deed forms accurately. Once done, file the completed deed with the county recorder's office where the property is located. For example, if you have a Pomona California Quitclaim Deed from Husband and Wife to Corporation, this process ensures that the new ownership is officially recognized by local authorities.

Typically, a quitclaim deed in California can be prepared by either party involved in the property transaction or by a qualified legal professional. It is recommended to consult with an attorney or use reliable platforms like US Legal Forms to ensure all necessary information is included correctly. This ensures that the Pomona California Quitclaim Deed from Husband and Wife to Corporation is legally binding and properly executed.

In California, an interspousal transfer deed allows one spouse to transfer interest in a property to the other spouse without triggering tax consequences. This is beneficial for couples transitioning property ownership, particularly in cases of divorce or estate planning. When executing a Pomona California Quitclaim Deed from Husband and Wife to Corporation, this transfer method helps simplify the process and often retains marital property interests intact.

A quit claim deed can be deemed void if it lacks necessary signatures, fails to include important property descriptions, or does not comply with state laws. Additionally, if the grantor is under duress or lacks capacity, it may also be invalid. It’s wise to consult with platforms like US Legal Forms to understand the requirements better when preparing your Pomona California Quitclaim Deed from Husband and Wife to Corporation.

To properly fill out a quitclaim deed, you must clearly state the names of the grantors and the grantee, describe the property, and specify the type of transfer. Ensure that all signatures are notarized to meet California's legal requirements. Using US Legal Forms can simplify this process, providing templates that are compliant with local laws for a Pomona California Quitclaim Deed from Husband and Wife to Corporation.

Begin by accurately identifying the parties involved—both the husband and wife, as well as the corporation. Next, include a detailed property description and specify the intent to transfer ownership. For clarity and guidance, explore examples provided by US Legal Forms, tailoring them to your needs for your Pomona California Quitclaim Deed from Husband and Wife to Corporation.

Filling out an Interspousal transfer deed involves detailing both spouses' names, property description, and indicating the transfer to the corporation. To avoid potential errors, consider using resources from US Legal Forms, which can guide you through the correct format. It's crucial to observe the legal stipulations for a Pomona California Quitclaim Deed from Husband and Wife to Corporation, ensuring everything is in order.

Yes, you can handle a quitclaim deed yourself in Pomona, California. However, it is essential to ensure that the documents are filled out correctly and meet all legal requirements. Many people find using a reliable service like US Legal Forms beneficial to streamline the process. This can help you avoid mistakes that might invalidate your Pomona California Quitclaim Deed from Husband and Wife to Corporation.

In California, anyone can prepare a quitclaim deed, including the parties involved in the transaction. However, it is essential for the document to comply with state laws to ensure its validity. Many people prefer to work with legal professionals to handle the paperwork, but using reliable online platforms like US Legal Forms can simplify the process. When considering a Pomona California Quitclaim Deed from Husband and Wife to Corporation, ensure that you provide clear and accurate information to avoid potential issues later.