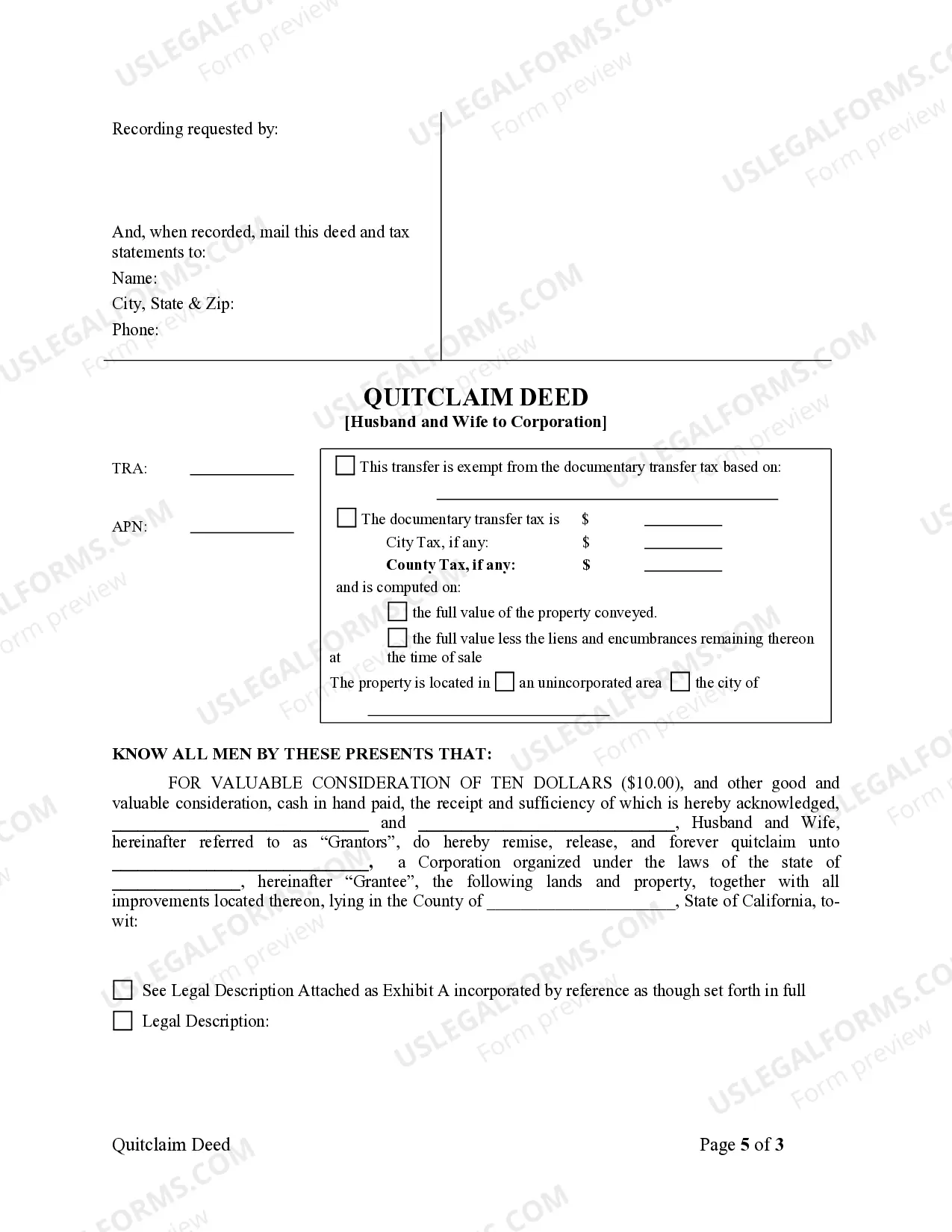

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A San Bernardino California Quitclaim Deed from Husband and Wife to Corporation is a legal document used to transfer the ownership of real estate from a married couple to a corporation, using a quitclaim deed. The quitclaim deed is a type of deed that transfers whatever interest the granter has in the property, without any guarantees or warranties. This particular type of deed is commonly used when a married couple wishes to transfer ownership of a property they own jointly to a corporation they have established. This transfer can occur for a variety of reasons such as tax benefits, liability protection, or restructuring of assets. When executing a San Bernardino California Quitclaim Deed from Husband and Wife to Corporation, it is crucial to ensure it complies with the specific laws and regulations of San Bernardino County and the state of California. Consulting with a qualified real estate attorney or an experienced title company is highly recommended ensuring a smooth and legally sound transaction. Different variations or scenarios that may arise in a San Bernardino California Quitclaim Deed from Husband and Wife to Corporation include: 1. "San Bernardino California Quitclaim Deed from Husband and Wife to Corporation for Tax Planning": This type of quitclaim deed may be used when the couple intends to transfer the property to their corporation to take advantage of specific tax benefits or deductions available to corporations. 2. "San Bernardino California Quitclaim Deed from Husband and Wife to Corporation for Asset Protection": In situations where the couple wants to protect their personal assets from potential liabilities or creditors, they may choose to transfer the property to their corporation. This can help shield their personal wealth from potential legal actions against the corporation. 3. "San Bernardino California Quitclaim Deed from Husband and Wife to Corporation for Estate Planning": Couples may opt to transfer the property to their corporation as part of their estate planning strategy, aiming to simplify the transfer of ownership to their heirs or beneficiaries in the future. It is important to note that the specific circumstances and objectives of the husband and wife will determine the appropriate variation of the quitclaim deed to be used. Executing a San Bernardino California Quitclaim Deed from Husband and Wife to Corporation ensures that the legal transfer of property ownership occurs smoothly, protecting the interests of all parties involved. By adhering to the applicable laws and regulations, seeking professional guidance, and considering the specific objectives of the transfer, husband and wife can efficiently transfer their property to a corporation while achieving their desired goals.