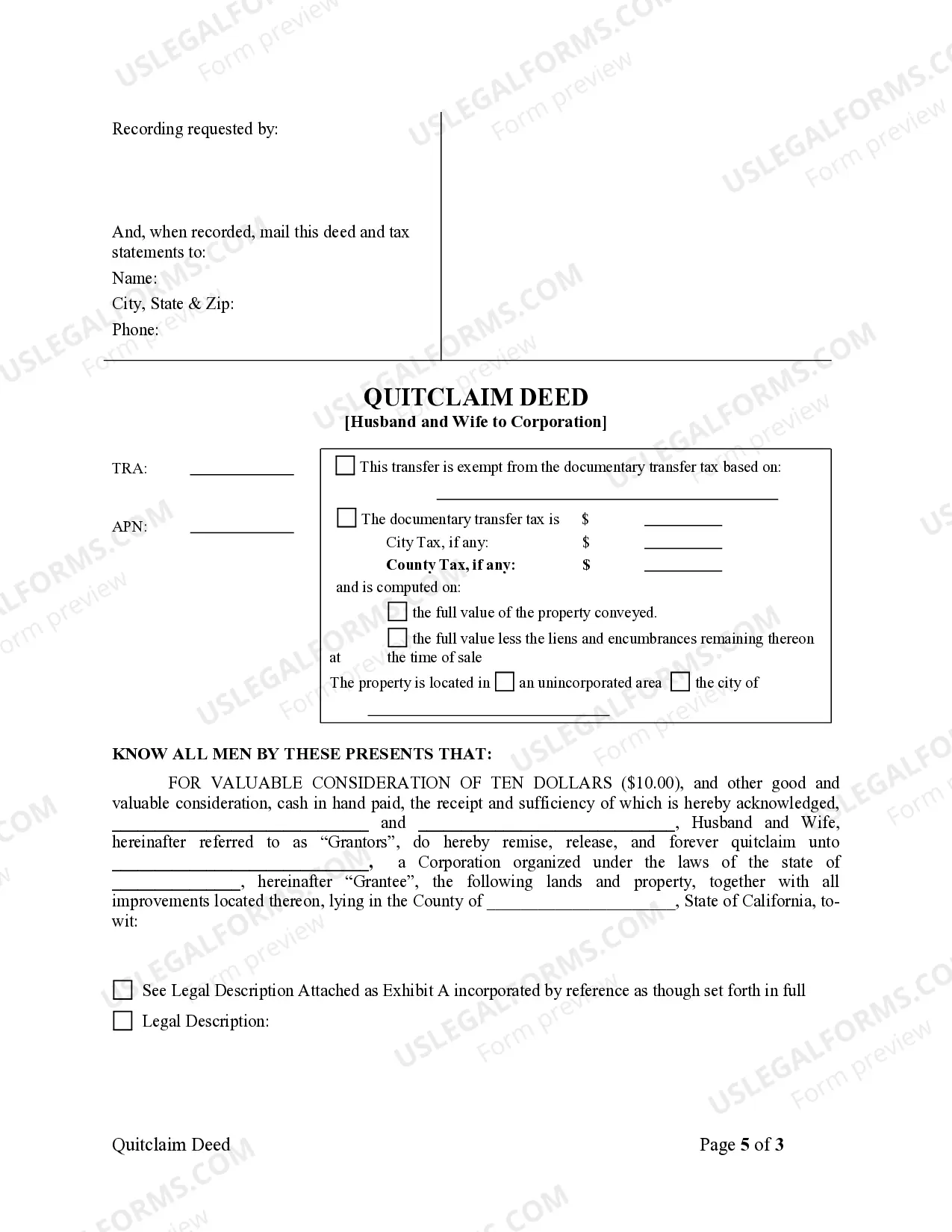

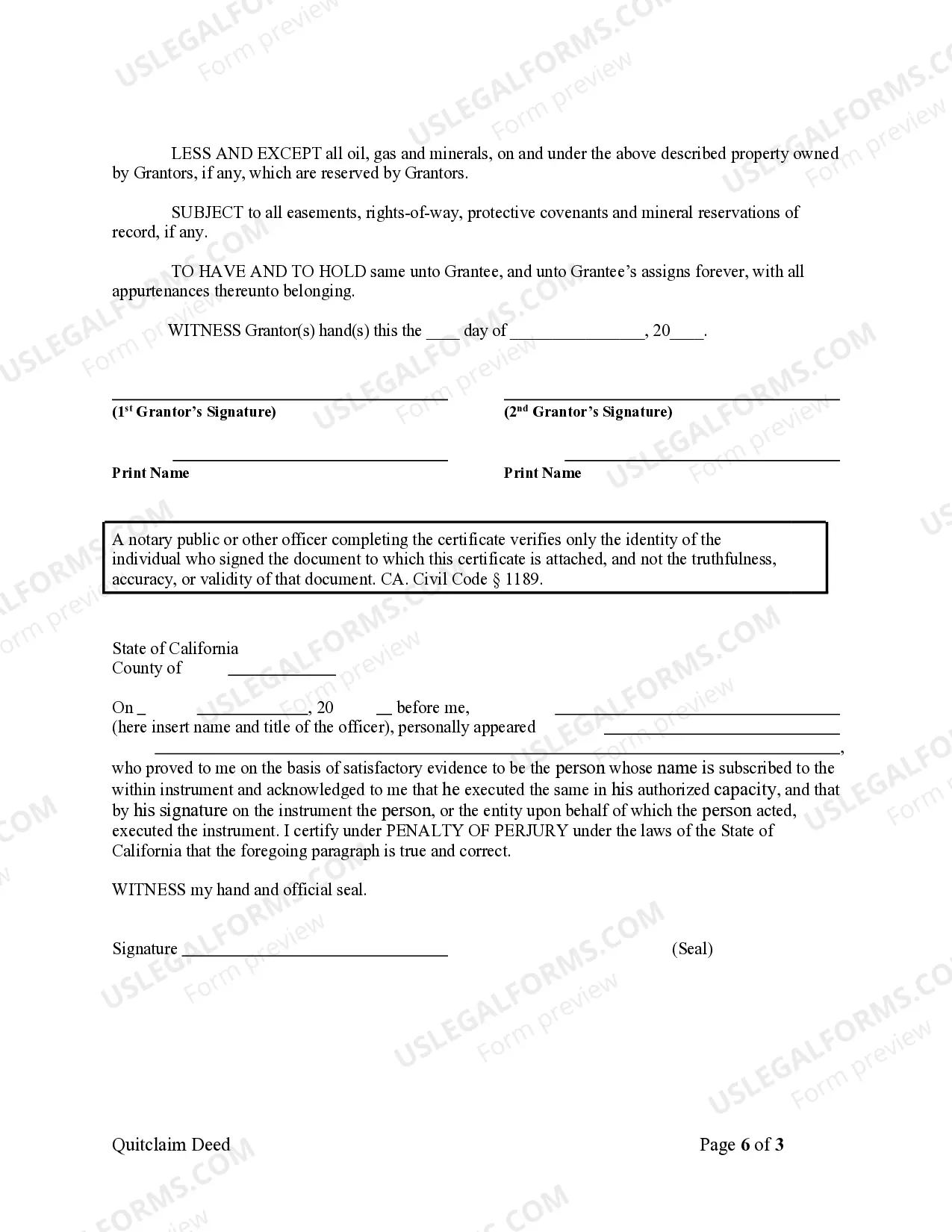

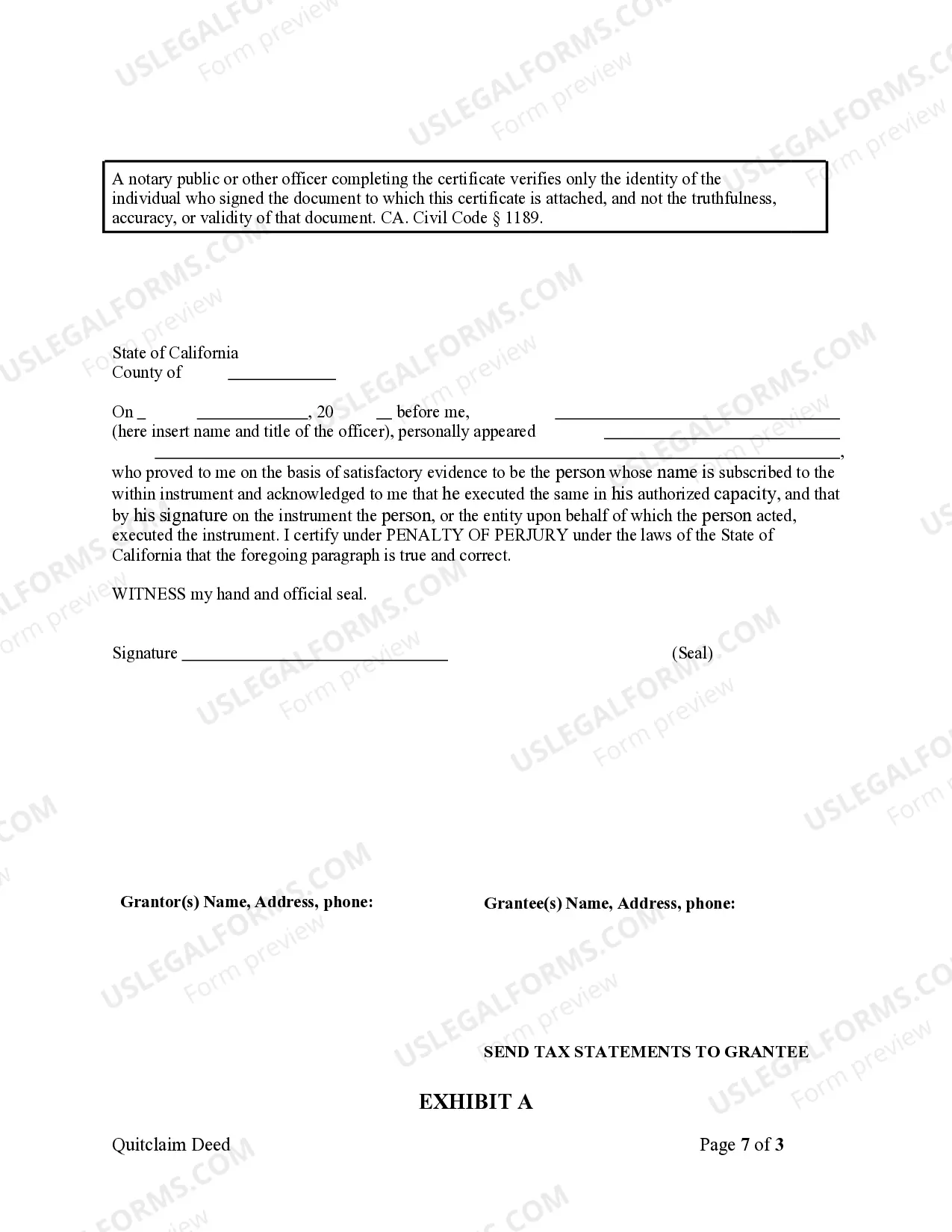

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A San Jose California Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership of a property from a married couple to a corporation through the use of a quitclaim deed. This type of transfer may occur when the couple wants to convert a jointly-held property into a corporate asset, potentially for business or tax purposes. Keywords: San Jose, California, Quitclaim Deed, Husband and Wife, Corporation, property ownership, transfer, legal document, jointly-held property, corporate asset, business, tax purposes. There may be different types of San Jose California Quitclaim Deeds from Husband and Wife to Corporation, depending on the specific circumstances. Some common variations include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used for transferring property. It transfers the ownership without any warranties or guarantees from the granters (the husband and wife) to the grantee (the corporation). 2. Special Purpose Quitclaim Deed: In certain cases, a specialized quitclaim deed may be required to fulfill particular legal or business requirements. For example, if the property has existing liens or encumbrances, a special purpose quitclaim deed can be used to transfer the property while specifically excluding responsibility for those existing issues. 3. Tax Advantageous Quitclaim Deed: Sometimes, a couple may choose to utilize a quitclaim deed as part of a tax planning strategy. This type of deed can help maximize tax benefits by transferring the property ownership from the individual couple to a corporation, potentially allowing for more advantageous tax treatment. 4. Conversion Quitclaim Deed: This type of quitclaim deed is specifically crafted to facilitate the conversion of a jointly-held property into a corporate asset. It ensures a smooth transition from personal ownership to corporate ownership, ensuring that all legal requirements are met. Regardless of the specific type, it is important to consult with a qualified attorney or real estate professional to draft and execute the San Jose California Quitclaim Deed from Husband and Wife to Corporation accurately and in compliance with local laws and regulations.A San Jose California Quitclaim Deed from Husband and Wife to Corporation is a legal document that transfers the ownership of a property from a married couple to a corporation through the use of a quitclaim deed. This type of transfer may occur when the couple wants to convert a jointly-held property into a corporate asset, potentially for business or tax purposes. Keywords: San Jose, California, Quitclaim Deed, Husband and Wife, Corporation, property ownership, transfer, legal document, jointly-held property, corporate asset, business, tax purposes. There may be different types of San Jose California Quitclaim Deeds from Husband and Wife to Corporation, depending on the specific circumstances. Some common variations include: 1. General Quitclaim Deed: This is the most common type of quitclaim deed used for transferring property. It transfers the ownership without any warranties or guarantees from the granters (the husband and wife) to the grantee (the corporation). 2. Special Purpose Quitclaim Deed: In certain cases, a specialized quitclaim deed may be required to fulfill particular legal or business requirements. For example, if the property has existing liens or encumbrances, a special purpose quitclaim deed can be used to transfer the property while specifically excluding responsibility for those existing issues. 3. Tax Advantageous Quitclaim Deed: Sometimes, a couple may choose to utilize a quitclaim deed as part of a tax planning strategy. This type of deed can help maximize tax benefits by transferring the property ownership from the individual couple to a corporation, potentially allowing for more advantageous tax treatment. 4. Conversion Quitclaim Deed: This type of quitclaim deed is specifically crafted to facilitate the conversion of a jointly-held property into a corporate asset. It ensures a smooth transition from personal ownership to corporate ownership, ensuring that all legal requirements are met. Regardless of the specific type, it is important to consult with a qualified attorney or real estate professional to draft and execute the San Jose California Quitclaim Deed from Husband and Wife to Corporation accurately and in compliance with local laws and regulations.