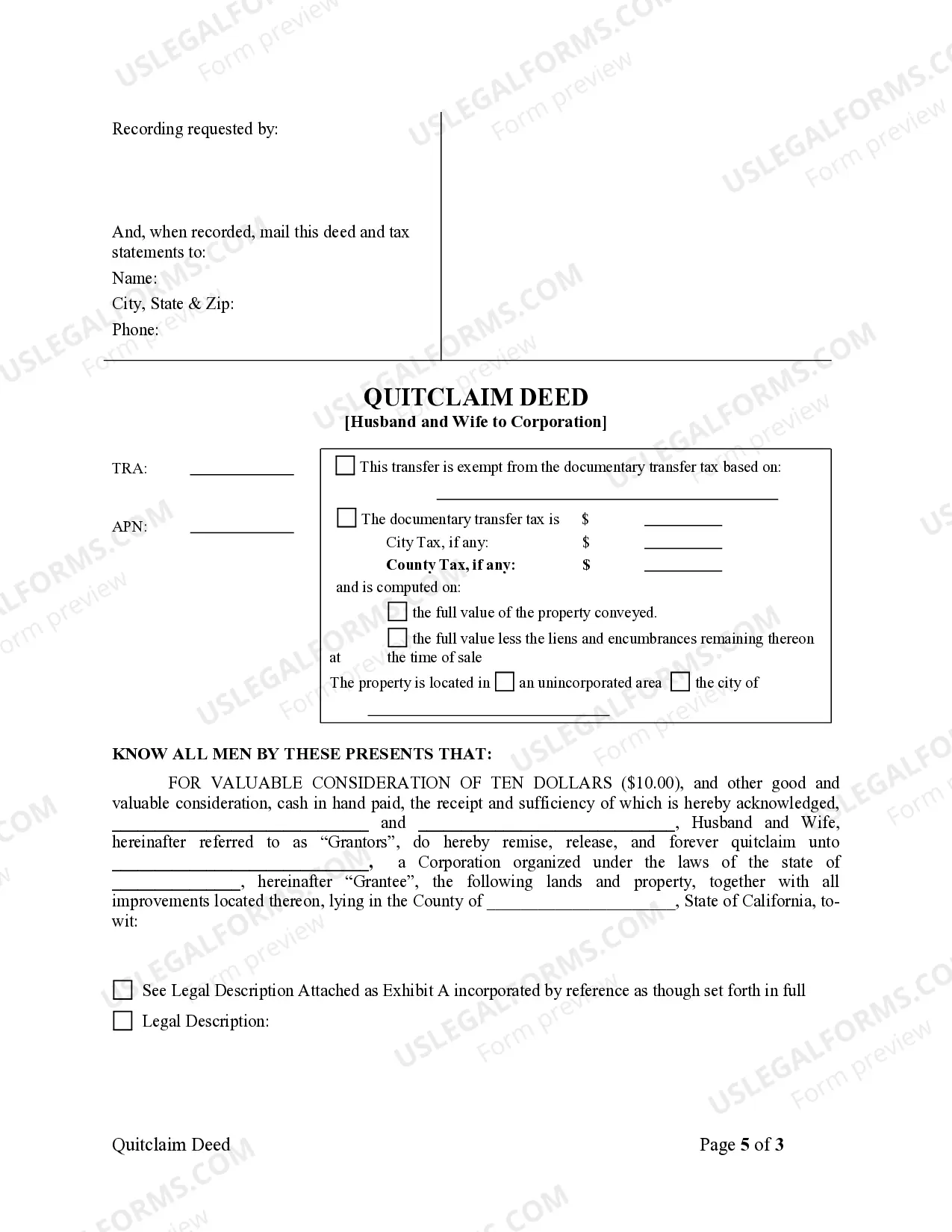

This Quitclaim Deed from Husband and Wife to Corporation form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a corporation. Grantors convey and quitclaim the described property to grantees less and except all oil, gas and minerals, on and under the property owned by Grantors, if any, which are reserved by Grantors.

A Quitclaim Deed is a legal document used to transfer the ownership or interest in a property from one party to another. In the case of a Vacaville California Quitclaim Deed from Husband and Wife to a Corporation, it involves transferring the property rights from a married couple to a corporate entity. This can be done for various reasons, such as asset protection, tax benefits, or business purposes. The Vacaville California Quitclaim Deed from Husband and Wife to Corporation ensures a smooth and legally binding transfer of property rights, providing protection and clarity to all parties involved. It is crucial to ensure that all necessary legal requirements are met when executing this type of deed to avoid any complications or disputes in the future. There are no specific different types of Vacaville California Quitclaim Deed from Husband and Wife to Corporation. However, it is essential to include relevant keywords for better understanding and search engine optimization. Some relevant keywords for this content could include: 1. Vacaville California Quitclaim Deed: Highlighting the specific location where the transfer is taking place, creating a sense of locality and relevance. 2. Husband and Wife: Indicates the joint ownership of the property and emphasizes the need for both spouses to be involved in the transfer. 3. Corporation: Refers to the legal entity that is assuming ownership, indicating that the property is being transferred for business or organizational purposes. 4. Asset protection: Highlights one of the potential reasons for transferring the property to a corporation, emphasizing the benefits of asset protection and separation. 5. Tax benefits: Indicates another potential motivation for the transfer, underscoring the potential tax advantages that can arise from transferring property to a corporation. 6. Business purposes: Demonstrates that the transfer is being made for commercial or organizational reasons, which may include using the property for business operations or as an investment. By incorporating these keywords and providing a detailed description, readers can gain a comprehensive understanding of the Vacaville California Quitclaim Deed from Husband and Wife to Corporation. It is important to consult with legal professionals regarding specific legal requirements and implications associated with such property transfers.