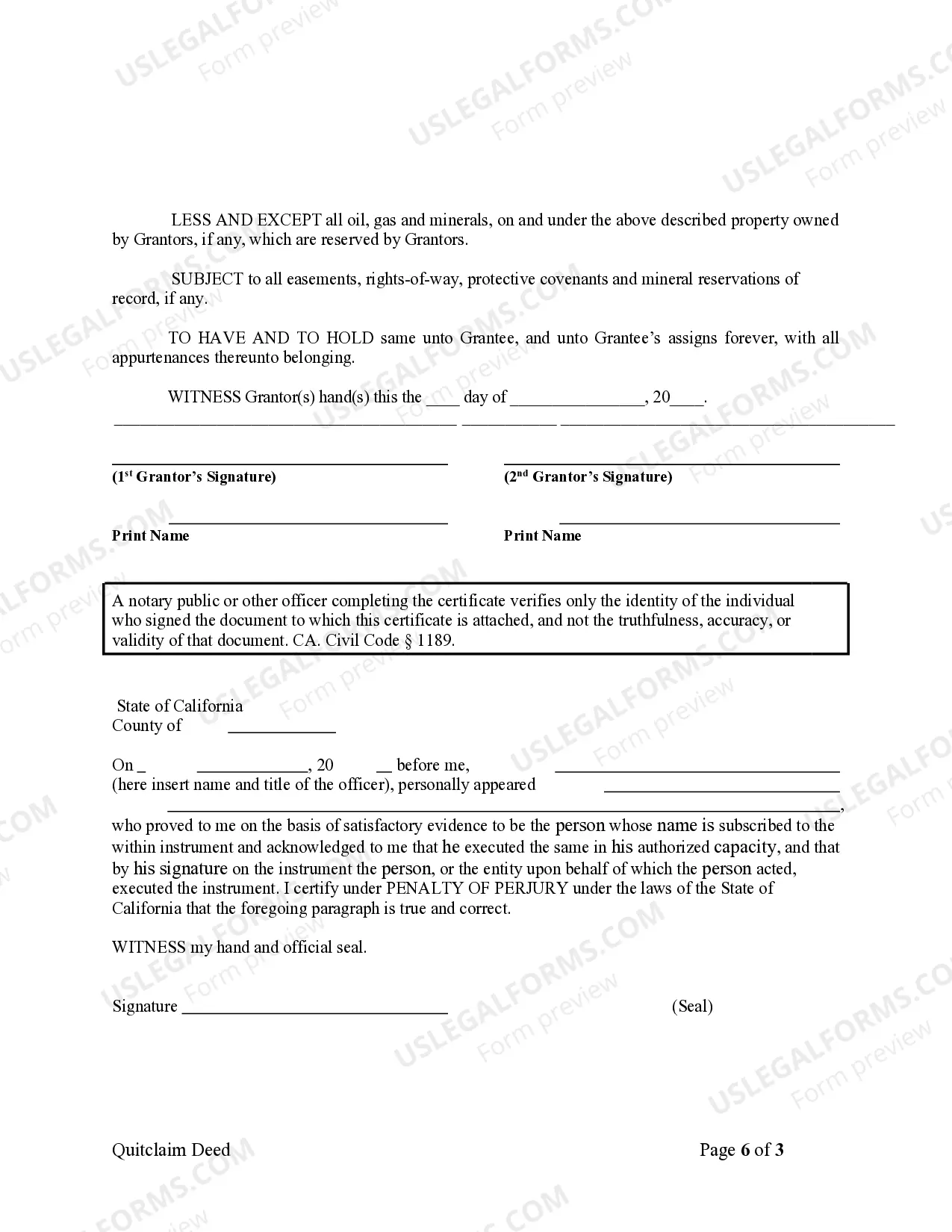

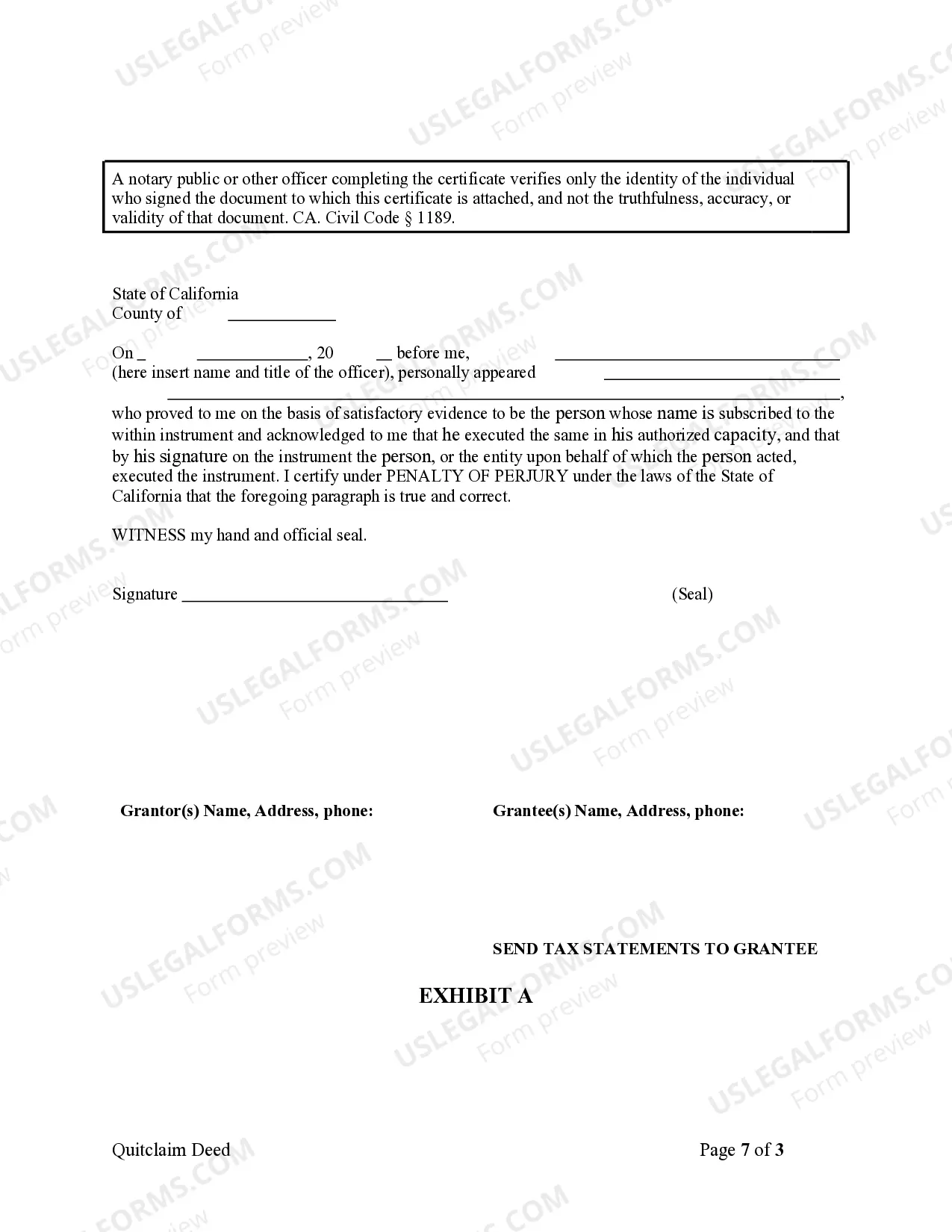

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Antioch California Quitclaim Deed from Husband and Wife to LLC — A Comprehensive Overview In Antioch, California, a Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership rights from a married couple to a Limited Liability Company (LLC). This transfer of ownership can be done for various reasons, such as asset protection, tax advantages, or to separate personal and business assets. The Antioch California Quitclaim Deed from Husband and Wife to LLC ensures a smooth and legally binding transfer of the property title. It is essential to understand the different types and variations of this deed to ensure the appropriate legal steps are followed. Here are a few variations that one should be aware of: 1. Husband and Wife Transfer as Members: This type of Quitclaim Deed is executed when both spouses are members of the LLC to which they are transferring the property. This allows the couple to transfer ownership while maintaining control and management rights within the LLC. 2. Husband and Wife Transfer as Non-Members: In this situation, the married couple transfers the property ownership to an LLC in which they do not hold membership. This type of transfer may occur if the couple wishes to have a separate entity manage and operate the property. 3. Husband and Wife Transfer to Newly Created LLC: This variation involves the creation of a new LLC specifically for the purpose of holding the property. The couple transfers ownership to the newly formed LLC, which enables them to separate personal assets from the LLC's liabilities and obligations. 4. Husband and Wife Transfer to Existing LLC: If the couple already has an existing LLC, they can use this variation to transfer ownership of the property to it. This method allows the LLC to benefit from the property's ownership without the need for the creation of a new entity. Regardless of the type of Quitclaim Deed used, it is crucial to adhere to the relevant legal procedures and requirements set forth by the state of California. This typically involves drafting the deed, ensuring it accurately describes the property being transferred, obtaining notarization, and recording the deed with the county recorder's office. It is highly recommended that individuals seek the assistance of a qualified real estate attorney or legal professional specializing in property transactions to ensure all legal obligations and documentation are correctly handled. This will help mitigate potential issues and ensure a harmonious transfer of property from Husband and Wife to LLC in Antioch, California.Antioch California Quitclaim Deed from Husband and Wife to LLC — A Comprehensive Overview In Antioch, California, a Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership rights from a married couple to a Limited Liability Company (LLC). This transfer of ownership can be done for various reasons, such as asset protection, tax advantages, or to separate personal and business assets. The Antioch California Quitclaim Deed from Husband and Wife to LLC ensures a smooth and legally binding transfer of the property title. It is essential to understand the different types and variations of this deed to ensure the appropriate legal steps are followed. Here are a few variations that one should be aware of: 1. Husband and Wife Transfer as Members: This type of Quitclaim Deed is executed when both spouses are members of the LLC to which they are transferring the property. This allows the couple to transfer ownership while maintaining control and management rights within the LLC. 2. Husband and Wife Transfer as Non-Members: In this situation, the married couple transfers the property ownership to an LLC in which they do not hold membership. This type of transfer may occur if the couple wishes to have a separate entity manage and operate the property. 3. Husband and Wife Transfer to Newly Created LLC: This variation involves the creation of a new LLC specifically for the purpose of holding the property. The couple transfers ownership to the newly formed LLC, which enables them to separate personal assets from the LLC's liabilities and obligations. 4. Husband and Wife Transfer to Existing LLC: If the couple already has an existing LLC, they can use this variation to transfer ownership of the property to it. This method allows the LLC to benefit from the property's ownership without the need for the creation of a new entity. Regardless of the type of Quitclaim Deed used, it is crucial to adhere to the relevant legal procedures and requirements set forth by the state of California. This typically involves drafting the deed, ensuring it accurately describes the property being transferred, obtaining notarization, and recording the deed with the county recorder's office. It is highly recommended that individuals seek the assistance of a qualified real estate attorney or legal professional specializing in property transactions to ensure all legal obligations and documentation are correctly handled. This will help mitigate potential issues and ensure a harmonious transfer of property from Husband and Wife to LLC in Antioch, California.