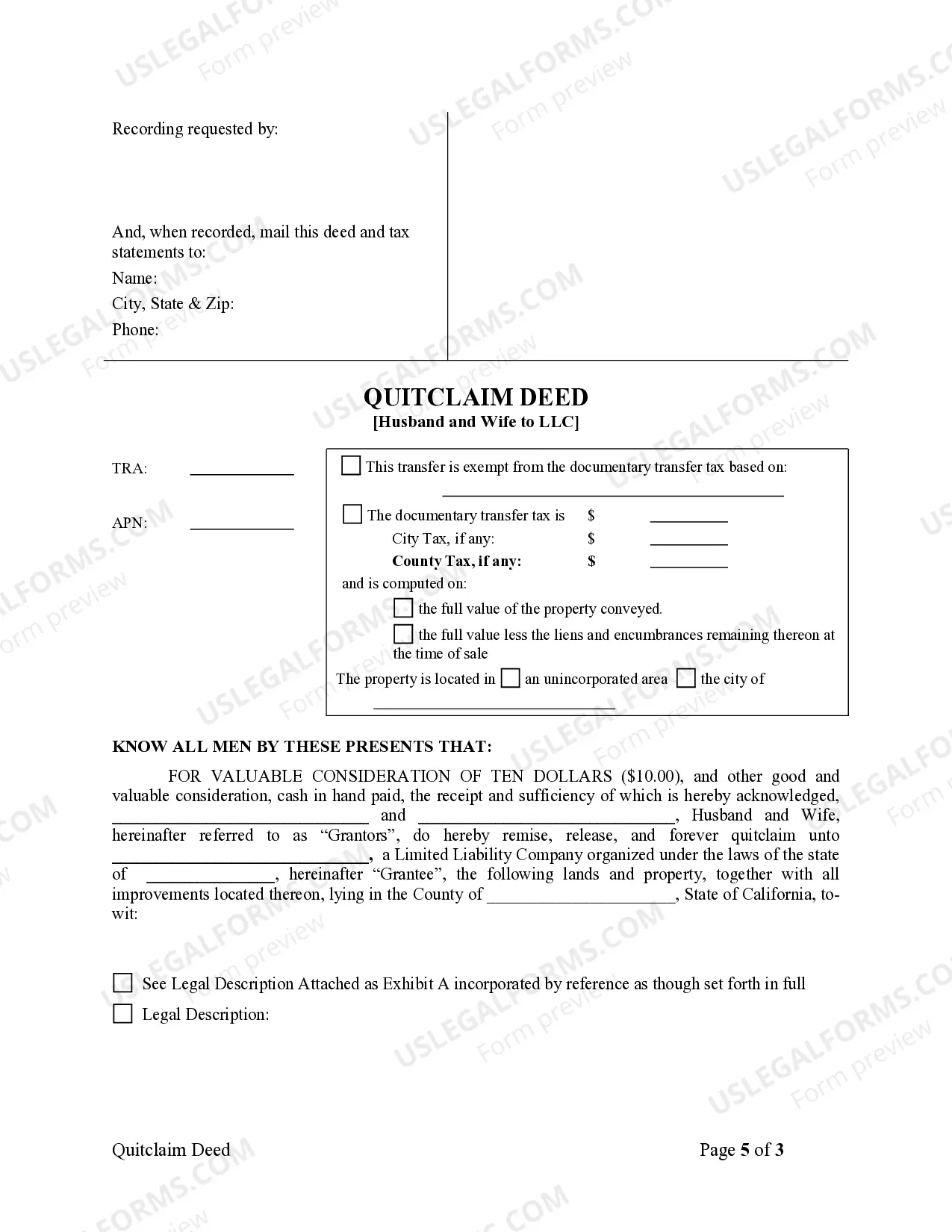

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Burbank California quitclaim deed is a legal document used to transfer ownership of a property from a husband and wife to a limited liability company (LLC). This type of deed is common when individuals want to transfer their property to an LLC for various reasons such as asset protection, estate planning, or business purposes. The quitclaim deed acts as a legal instrument that releases the husband and wife's interest in the property, effectively conveying it to the LLC. Unlike other types of deed transfers, a quitclaim deed does not guarantee or warrant the title's validity, but only transfers the ownership interest that the granter (husband and wife) possesses at the time of the transfer. By executing a quitclaim deed from a husband and wife to an LLC, the LLC assumes all rights, responsibilities, and liabilities associated with the property. This deed doesn't guarantee that the property is free of liens, encumbrances, or claims, and it's crucial for the LLC to conduct thorough due diligence and title search before accepting the transfer. Keywords: Burbank California, quitclaim deed, husband and wife, LLC, transfer of ownership, legal document, property transfer, asset protection, estate planning, business purposes, quitclaim deed types. Different types of Burbank California quitclaim deeds from husband and wife to LLC include: 1. General Quitclaim Deed: The most common type of quitclaim deed where the husband and wife transfer their entire interest in the property to the LLC. This deed is used when the husband and wife want to relinquish their ownership rights completely. 2. Partial Quitclaim Deed: This type of quitclaim deed involves the transfer of only a portion or percentage of the property's ownership from the husband and wife to the LLC. This can occur when the LLC intends to co-own the property with the husband and wife and share in the benefits and responsibilities. 3. Quitclaim Deed with Restrictions: In certain cases, the husband and wife may impose restrictions or conditions on the transfer of the property through the quitclaim deed. For example, they may restrict the LLC from using the property for specific purposes or impose limitations on future sales or transfers. 4. Quitclaim Deed with Affidavit of Title: Sometimes, the husband and wife may choose to provide additional assurance regarding the title's validity by attaching an affidavit of title to the quitclaim deed. This affidavit confirms that the property is free from any undisclosed claims or liens, providing an extra layer of security for the LLC. 5. Joint Tenants with Right of Survivorship Quitclaim Deed: In cases where the husband and wife hold the property as joint tenants with the right of survivorship, they can use this type of quitclaim deed to transfer their interest to the LLC. This deed ensures that if one spouse passes away, the other spouse automatically inherits the deceased spouse's share. It is important to consult with a qualified legal professional or real estate attorney when preparing and executing a Burbank California quitclaim deed from husband and wife to LLC to ensure compliance with local laws and to address specific circumstances and requirements.A Burbank California quitclaim deed is a legal document used to transfer ownership of a property from a husband and wife to a limited liability company (LLC). This type of deed is common when individuals want to transfer their property to an LLC for various reasons such as asset protection, estate planning, or business purposes. The quitclaim deed acts as a legal instrument that releases the husband and wife's interest in the property, effectively conveying it to the LLC. Unlike other types of deed transfers, a quitclaim deed does not guarantee or warrant the title's validity, but only transfers the ownership interest that the granter (husband and wife) possesses at the time of the transfer. By executing a quitclaim deed from a husband and wife to an LLC, the LLC assumes all rights, responsibilities, and liabilities associated with the property. This deed doesn't guarantee that the property is free of liens, encumbrances, or claims, and it's crucial for the LLC to conduct thorough due diligence and title search before accepting the transfer. Keywords: Burbank California, quitclaim deed, husband and wife, LLC, transfer of ownership, legal document, property transfer, asset protection, estate planning, business purposes, quitclaim deed types. Different types of Burbank California quitclaim deeds from husband and wife to LLC include: 1. General Quitclaim Deed: The most common type of quitclaim deed where the husband and wife transfer their entire interest in the property to the LLC. This deed is used when the husband and wife want to relinquish their ownership rights completely. 2. Partial Quitclaim Deed: This type of quitclaim deed involves the transfer of only a portion or percentage of the property's ownership from the husband and wife to the LLC. This can occur when the LLC intends to co-own the property with the husband and wife and share in the benefits and responsibilities. 3. Quitclaim Deed with Restrictions: In certain cases, the husband and wife may impose restrictions or conditions on the transfer of the property through the quitclaim deed. For example, they may restrict the LLC from using the property for specific purposes or impose limitations on future sales or transfers. 4. Quitclaim Deed with Affidavit of Title: Sometimes, the husband and wife may choose to provide additional assurance regarding the title's validity by attaching an affidavit of title to the quitclaim deed. This affidavit confirms that the property is free from any undisclosed claims or liens, providing an extra layer of security for the LLC. 5. Joint Tenants with Right of Survivorship Quitclaim Deed: In cases where the husband and wife hold the property as joint tenants with the right of survivorship, they can use this type of quitclaim deed to transfer their interest to the LLC. This deed ensures that if one spouse passes away, the other spouse automatically inherits the deceased spouse's share. It is important to consult with a qualified legal professional or real estate attorney when preparing and executing a Burbank California quitclaim deed from husband and wife to LLC to ensure compliance with local laws and to address specific circumstances and requirements.