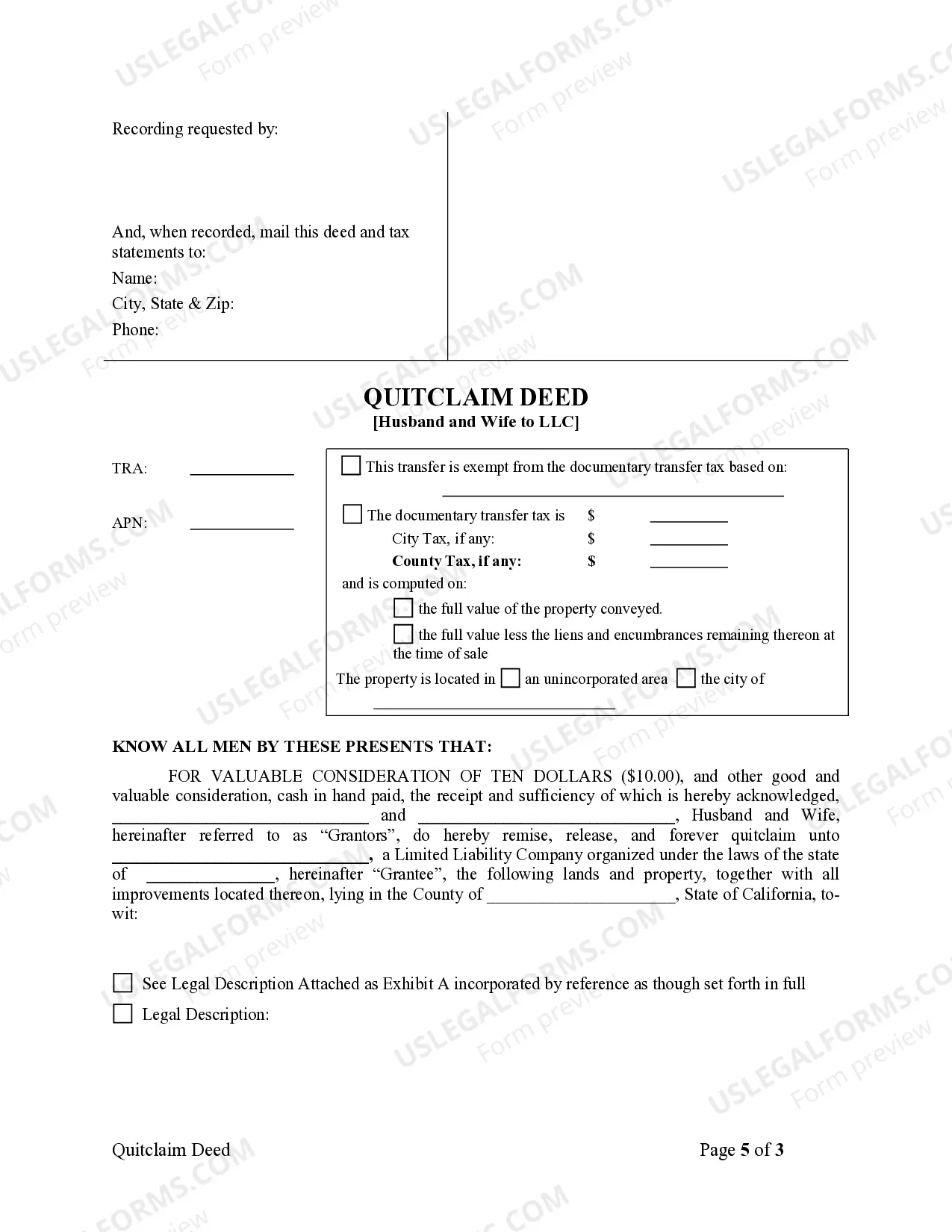

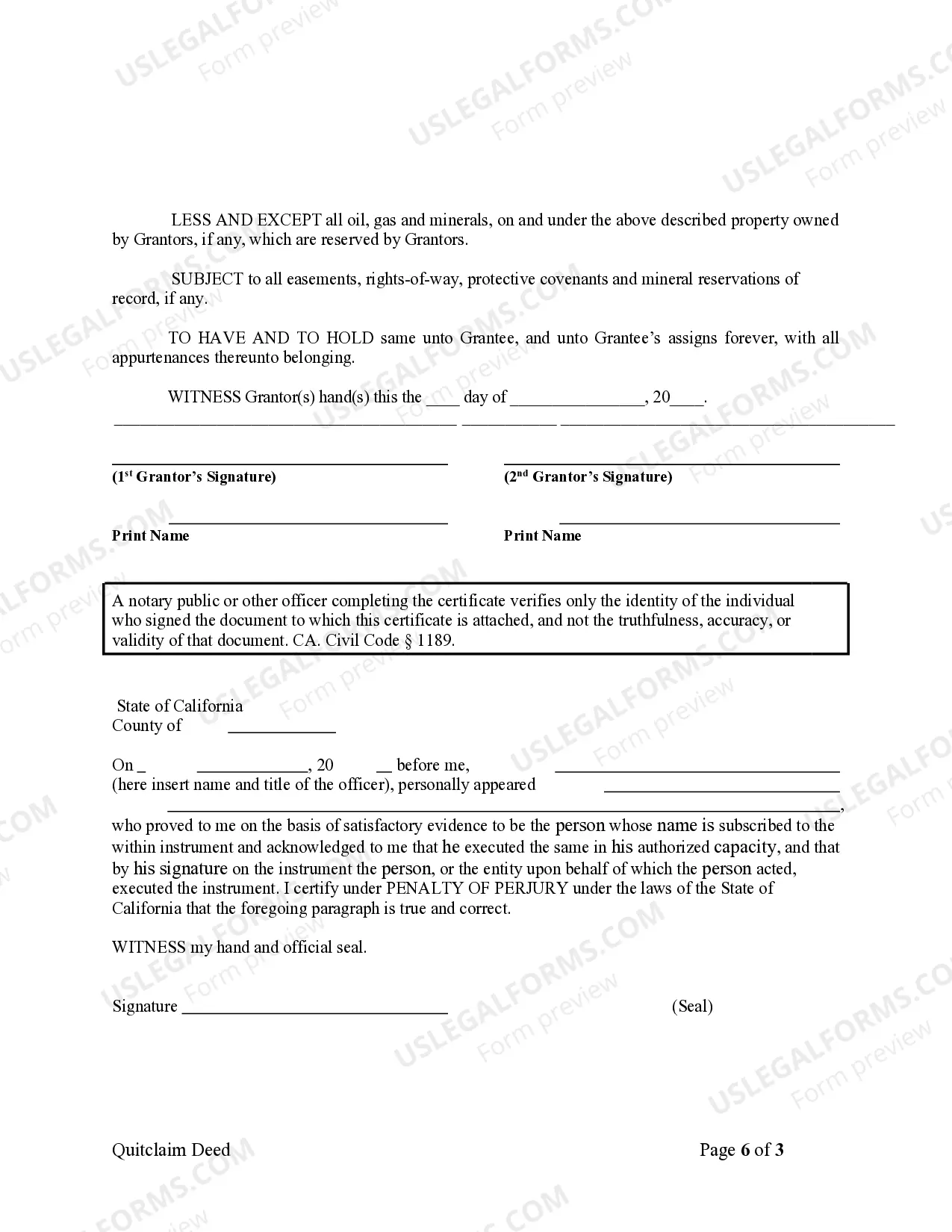

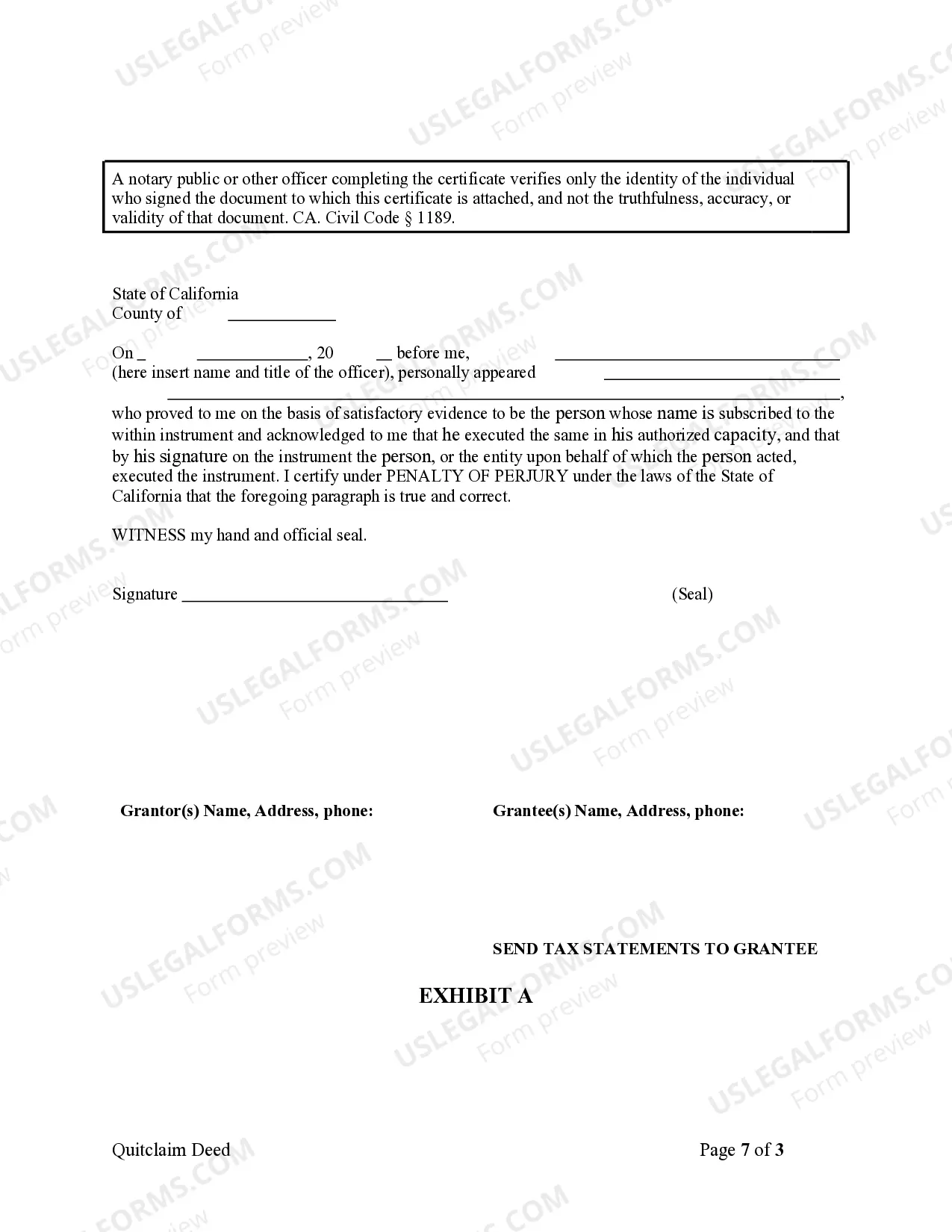

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Escondido California Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer their ownership interest in a property to a limited liability company (LLC) in Escondido, California. This type of quitclaim deed is commonly used when couples want to shift the legal ownership of their property from their personal names to their jointly owned LLC. By doing so, they can enjoy the liability protection and other benefits provided by an LLC, while maintaining control over the property. There are different variations of Escondido California Quitclaim Deed from Husband and Wife to LLC, including: 1. General Escondido California Quitclaim Deed: This is the most common type of quitclaim deed used in Escondido, California. It involves the transfer of all ownership interests in the property from the husband and wife to their LLC. 2. Partial Interest Escondido California Quitclaim Deed: In some cases, the husband and wife may choose to transfer only a portion of their ownership interest to the LLC. This can be useful if they want to retain some personal ownership while involving the LLC in property management or other ventures. 3. Tenants-in-Common Escondido California Quitclaim Deed: If the husband and wife own the property as tenants-in-common, they may opt to use this type of quitclaim deed. It allows them to transfer their respective shares to the LLC, while maintaining their individual ownership interests. 4. Joint Tenants with Right of Survivorship Escondido California Quitclaim Deed: For couples who hold the property as joint tenants with the right of survivorship, this type of quitclaim deed ensures that their ownership interests are transferred to the LLC while preserving the survivorship rights. The process of executing an Escondido California Quitclaim Deed from Husband and Wife to LLC typically involves drafting the deed, obtaining the signatures of both spouses, and recording it with the appropriate county recorder's office in Escondido. It is important to consult with an experienced real estate attorney or legal professional to ensure all necessary legal requirements and any tax implications are addressed properly. By using this specific type of quitclaim deed, couples can take advantage of the benefits provided by an LLC structure while maintaining control and ownership of their property in Escondido, California.Escondido California Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer their ownership interest in a property to a limited liability company (LLC) in Escondido, California. This type of quitclaim deed is commonly used when couples want to shift the legal ownership of their property from their personal names to their jointly owned LLC. By doing so, they can enjoy the liability protection and other benefits provided by an LLC, while maintaining control over the property. There are different variations of Escondido California Quitclaim Deed from Husband and Wife to LLC, including: 1. General Escondido California Quitclaim Deed: This is the most common type of quitclaim deed used in Escondido, California. It involves the transfer of all ownership interests in the property from the husband and wife to their LLC. 2. Partial Interest Escondido California Quitclaim Deed: In some cases, the husband and wife may choose to transfer only a portion of their ownership interest to the LLC. This can be useful if they want to retain some personal ownership while involving the LLC in property management or other ventures. 3. Tenants-in-Common Escondido California Quitclaim Deed: If the husband and wife own the property as tenants-in-common, they may opt to use this type of quitclaim deed. It allows them to transfer their respective shares to the LLC, while maintaining their individual ownership interests. 4. Joint Tenants with Right of Survivorship Escondido California Quitclaim Deed: For couples who hold the property as joint tenants with the right of survivorship, this type of quitclaim deed ensures that their ownership interests are transferred to the LLC while preserving the survivorship rights. The process of executing an Escondido California Quitclaim Deed from Husband and Wife to LLC typically involves drafting the deed, obtaining the signatures of both spouses, and recording it with the appropriate county recorder's office in Escondido. It is important to consult with an experienced real estate attorney or legal professional to ensure all necessary legal requirements and any tax implications are addressed properly. By using this specific type of quitclaim deed, couples can take advantage of the benefits provided by an LLC structure while maintaining control and ownership of their property in Escondido, California.