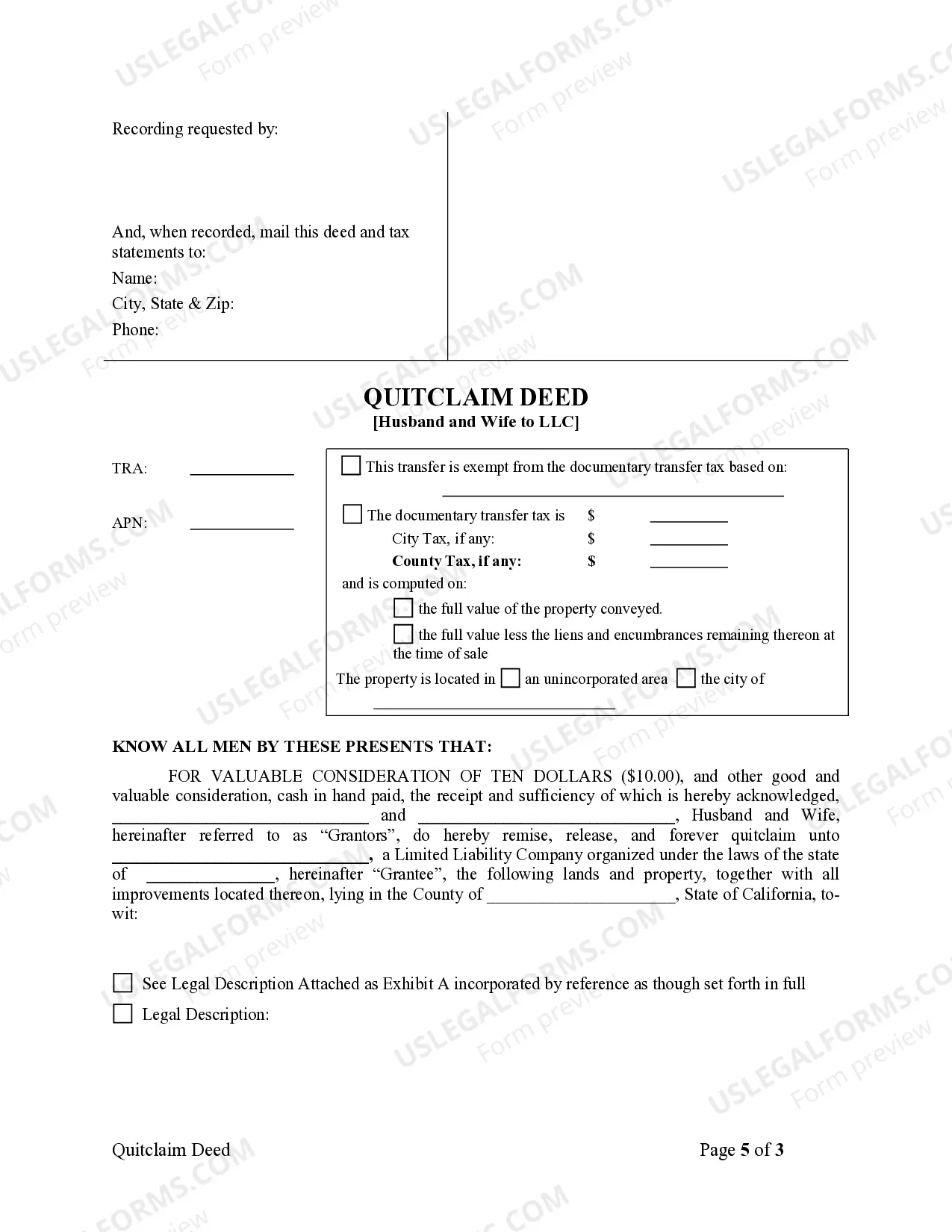

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A quitclaim deed is a legal document that allows property owners to transfer their interest in a property to another party. In the case of Garden Grove, California, a quitclaim deed from Husband and Wife to LLC refers to the transfer of property ownership from a married couple to a limited liability company (LLC) in the city of Garden Grove. This type of transaction involves a husband and wife, who jointly own a property, deciding to transfer their ownership rights to an LLC entity. The LLC then becomes the new legal owner of the property. This can be beneficial for a variety of reasons, such as asset protection, tax planning, or business purposes. In Garden Grove, California, there may be different types of quitclaim deeds from Husband and Wife to LLC, including: 1. General quitclaim deed: This is the most common type of quitclaim deed, where the husband and wife transfer their entire interest in the property to the LLC. It provides the broadest form of transfer, without any warranties or guarantees of the property's title. 2. Limited quitclaim deed: Sometimes, the transfer of ownership may be limited to a specific portion or percentage of the property. This type of quitclaim deed specifies the exact portion of the property that the husband and wife are transferring to the LLC. 3. Subject-to deed: In certain cases, the property may have an existing mortgage or lien. A subject-to deed allows the husband and wife to transfer the property to the LLC, while the LLC assumes responsibility for any existing debts or liabilities associated with the property. 4. Warranty deed: Although less common in a quitclaim deed scenario, a warranty deed provides guarantees to the LLC regarding the property's title. This type of deed assures the LLC that the husband and wife hold a clear title to the property and have the legal right to transfer it. When preparing a quitclaim deed from Husband and Wife to LLC in Garden Grove, California, it is crucial to consult with a qualified real estate attorney or title company. This ensures that all legal requirements are met, and the transfer of property ownership is properly executed. Additionally, it is recommended to conduct a thorough title search to verify the property's ownership history and any potential liens or encumbrances. Keywords: Garden Grove, California, quitclaim deed, Husband and Wife, LLC, property ownership, transfer, legal document, limited liability company, asset protection, tax planning, business purposes, general quitclaim deed, limited quitclaim deed, subject-to deed, warranty deed, title search, property ownership history.A quitclaim deed is a legal document that allows property owners to transfer their interest in a property to another party. In the case of Garden Grove, California, a quitclaim deed from Husband and Wife to LLC refers to the transfer of property ownership from a married couple to a limited liability company (LLC) in the city of Garden Grove. This type of transaction involves a husband and wife, who jointly own a property, deciding to transfer their ownership rights to an LLC entity. The LLC then becomes the new legal owner of the property. This can be beneficial for a variety of reasons, such as asset protection, tax planning, or business purposes. In Garden Grove, California, there may be different types of quitclaim deeds from Husband and Wife to LLC, including: 1. General quitclaim deed: This is the most common type of quitclaim deed, where the husband and wife transfer their entire interest in the property to the LLC. It provides the broadest form of transfer, without any warranties or guarantees of the property's title. 2. Limited quitclaim deed: Sometimes, the transfer of ownership may be limited to a specific portion or percentage of the property. This type of quitclaim deed specifies the exact portion of the property that the husband and wife are transferring to the LLC. 3. Subject-to deed: In certain cases, the property may have an existing mortgage or lien. A subject-to deed allows the husband and wife to transfer the property to the LLC, while the LLC assumes responsibility for any existing debts or liabilities associated with the property. 4. Warranty deed: Although less common in a quitclaim deed scenario, a warranty deed provides guarantees to the LLC regarding the property's title. This type of deed assures the LLC that the husband and wife hold a clear title to the property and have the legal right to transfer it. When preparing a quitclaim deed from Husband and Wife to LLC in Garden Grove, California, it is crucial to consult with a qualified real estate attorney or title company. This ensures that all legal requirements are met, and the transfer of property ownership is properly executed. Additionally, it is recommended to conduct a thorough title search to verify the property's ownership history and any potential liens or encumbrances. Keywords: Garden Grove, California, quitclaim deed, Husband and Wife, LLC, property ownership, transfer, legal document, limited liability company, asset protection, tax planning, business purposes, general quitclaim deed, limited quitclaim deed, subject-to deed, warranty deed, title search, property ownership history.