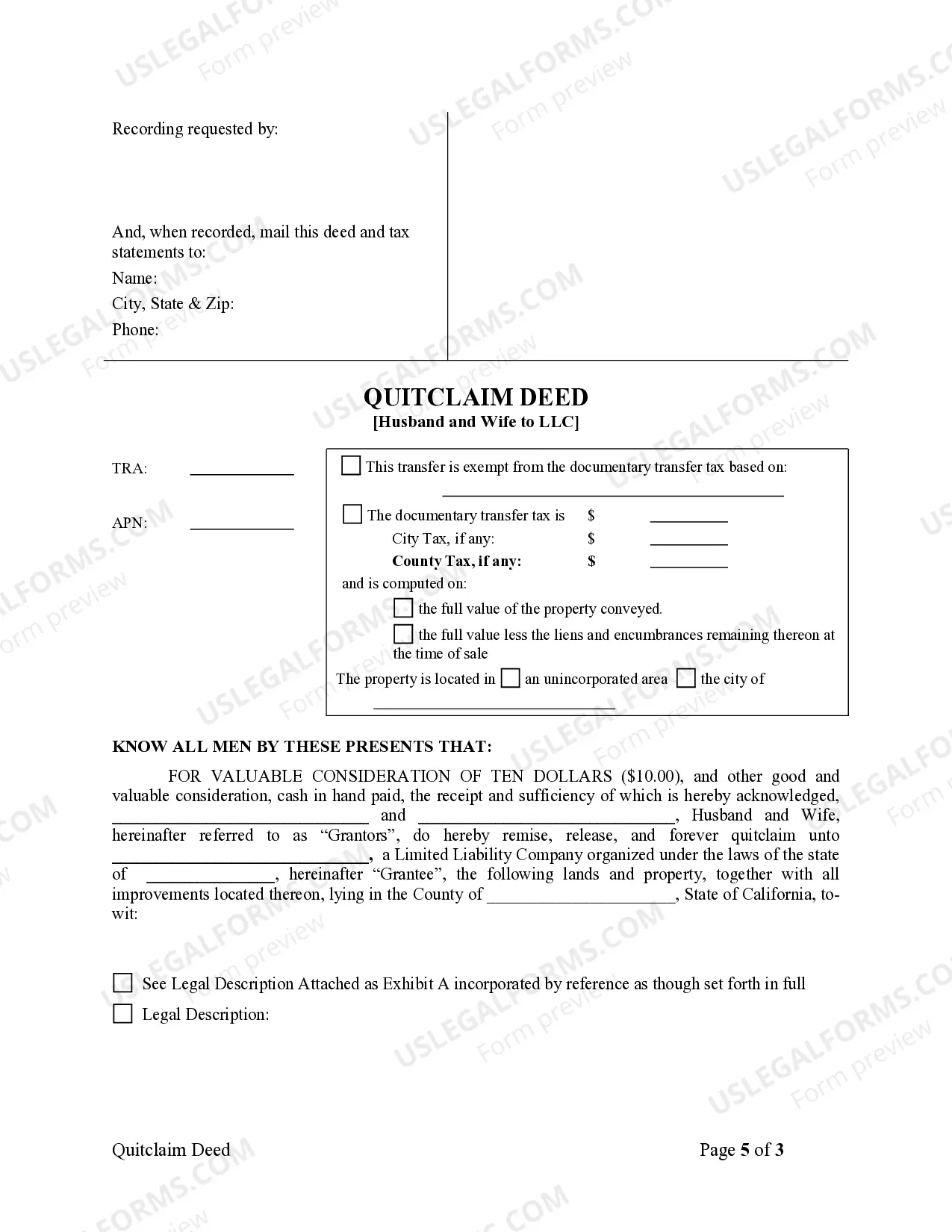

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Los Angeles California Quitclaim Deed from Husband and Wife to LLC refers to the legal transfer of property ownership from a married couple (husband and wife) to a Limited Liability Company (LLC) based in Los Angeles, California. This type of transaction commonly occurs when a married couple decides to transfer their property into a business entity, offering advantages such as liability protection, easier management, and potential tax benefits. In this process, the husband and wife acting as granters (sellers) voluntarily relinquish their claims, interests, and rights to the property, while the LLC acts as the grantee (buyer) and acquires full ownership. It's important to note that a quitclaim deed only transfers the ownership rights that the granters possess, without guaranteeing the absence of liens or encumbrances. Different types of Los Angeles California Quitclaim Deed from Husband and Wife to LLC may include variations based on specific circumstances, such as: 1. Single-member LLC Quitclaim Deed: When the LLC has only one member (husband or wife) while the other spouse is not a member of the business entity. 2. Joint-member LLC Quitclaim Deed: When both spouses are members of the LLC and jointly transfer ownership of the property to the LLC. 3. Equal ownership LLC Quitclaim Deed: When the husband and wife transfer the property into an LLC with equal ownership percentages, typically 50% each. 4. Unequal ownership LLC Quitclaim Deed: When the husband and wife transfer the property into an LLC with ownership percentages that are not equal, such as 70% and 30%. 5. Tenancy in Common LLC Quitclaim Deed: When the husband and wife wish to maintain their ownership shares as tenants in common within the LLC. This allows each spouse to specify their individual percentages of ownership. To execute a Los Angeles California Quitclaim Deed from Husband and Wife to LLC, certain steps must be followed. These steps often involve preparing the necessary legal documentation, signing the deed in the presence of a notary public, and recording the deed with the appropriate county office to ensure its validity and establish public ownership records. It is crucial to consult with a qualified real estate attorney or a specialized professional when considering this type of property transfer to ensure compliance with all legal requirements and to address any specific needs or concerns. By doing so, both the husband and wife and the LLC can navigate the process smoothly and safeguard their rights and interests.A Los Angeles California Quitclaim Deed from Husband and Wife to LLC refers to the legal transfer of property ownership from a married couple (husband and wife) to a Limited Liability Company (LLC) based in Los Angeles, California. This type of transaction commonly occurs when a married couple decides to transfer their property into a business entity, offering advantages such as liability protection, easier management, and potential tax benefits. In this process, the husband and wife acting as granters (sellers) voluntarily relinquish their claims, interests, and rights to the property, while the LLC acts as the grantee (buyer) and acquires full ownership. It's important to note that a quitclaim deed only transfers the ownership rights that the granters possess, without guaranteeing the absence of liens or encumbrances. Different types of Los Angeles California Quitclaim Deed from Husband and Wife to LLC may include variations based on specific circumstances, such as: 1. Single-member LLC Quitclaim Deed: When the LLC has only one member (husband or wife) while the other spouse is not a member of the business entity. 2. Joint-member LLC Quitclaim Deed: When both spouses are members of the LLC and jointly transfer ownership of the property to the LLC. 3. Equal ownership LLC Quitclaim Deed: When the husband and wife transfer the property into an LLC with equal ownership percentages, typically 50% each. 4. Unequal ownership LLC Quitclaim Deed: When the husband and wife transfer the property into an LLC with ownership percentages that are not equal, such as 70% and 30%. 5. Tenancy in Common LLC Quitclaim Deed: When the husband and wife wish to maintain their ownership shares as tenants in common within the LLC. This allows each spouse to specify their individual percentages of ownership. To execute a Los Angeles California Quitclaim Deed from Husband and Wife to LLC, certain steps must be followed. These steps often involve preparing the necessary legal documentation, signing the deed in the presence of a notary public, and recording the deed with the appropriate county office to ensure its validity and establish public ownership records. It is crucial to consult with a qualified real estate attorney or a specialized professional when considering this type of property transfer to ensure compliance with all legal requirements and to address any specific needs or concerns. By doing so, both the husband and wife and the LLC can navigate the process smoothly and safeguard their rights and interests.