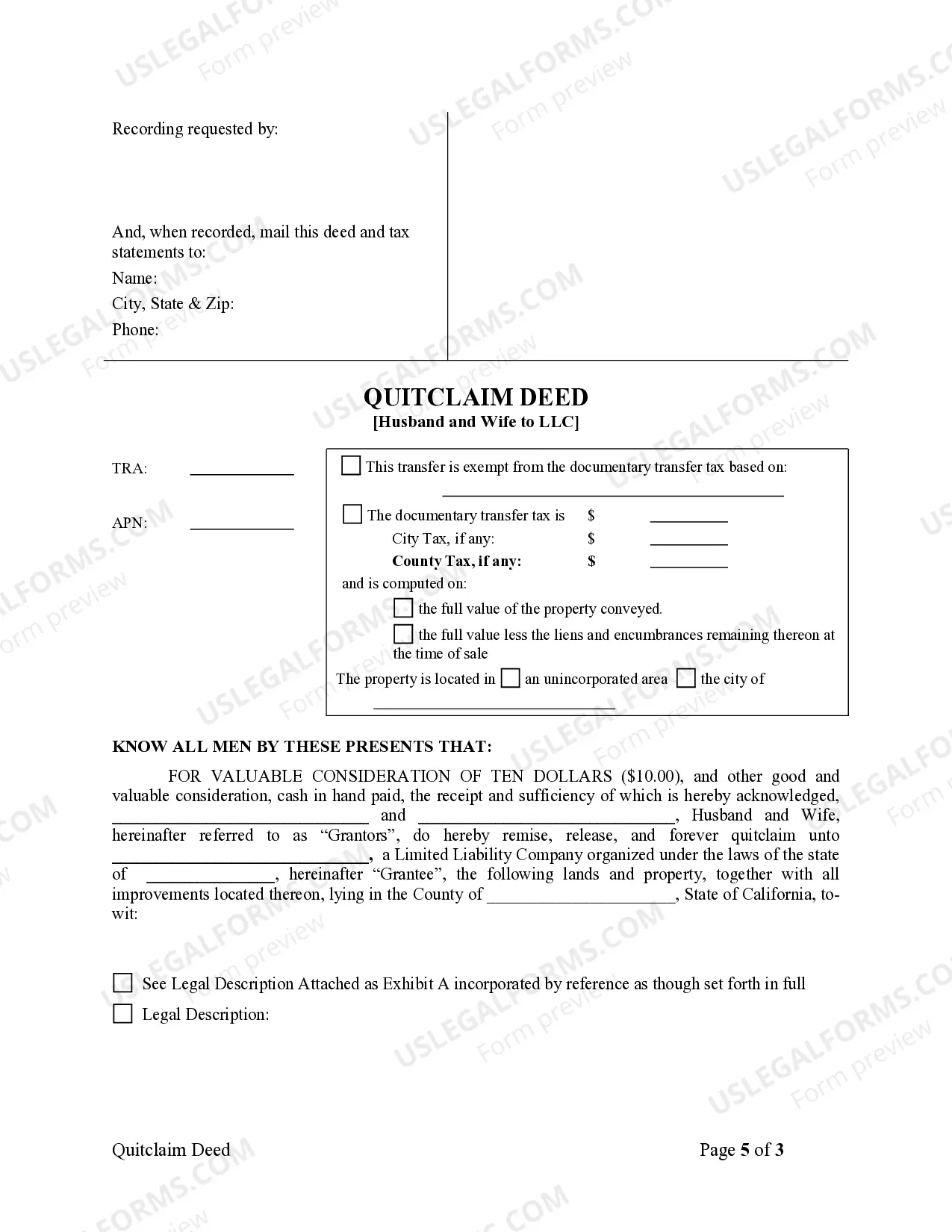

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Murrieta California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of a property from a married couple to a limited liability company (LLC) in the city of Murrieta, California. This type of transaction is commonly utilized when individuals want to protect their personal assets and limit liability by transferring ownership to an LLC, which provides a separate legal entity for the property. There are a few different types of Murrieta California Quitclaim Deeds that may be used in this specific scenario. They include: 1. Murrieta California Individual Quitclaim Deed from Husband to LLC: This type of quitclaim deed is used when only the husband is transferring his ownership interest in the property to the LLC, while the wife retains her ownership interest. 2. Murrieta California Individual Quitclaim Deed from Wife to LLC: In contrast to the previous type, this version is employed when only the wife is conveying her ownership interest in the property to the LLC, while the husband maintains his ownership. 3. Murrieta California Joint Quitclaim Deed from Husband and Wife to LLC: This is the most common type of quitclaim deed used in this scenario. Both the husband and wife transfer their respective ownership interests in the property to the LLC simultaneously. The Murrieta California Quitclaim Deed from Husband and Wife to LLC serves several purposes. Firstly, it allows the married couple to limit their personal liability by creating a legal separation between themselves and the property as owners. Secondly, it provides the LLC with control and management rights over the property, allowing the couple to conduct business or investment activities through the entity. Lastly, it helps with estate planning, since transferring the property to the LLC may facilitate the transfer of ownership upon the death of one or both spouses. When preparing a Murrieta California Quitclaim Deed from Husband and Wife to LLC, it is crucial to consult with a qualified attorney, as the process involves legal complexities and potential tax implications. The deed should clearly outline the names of the husband, wife, and LLC entity, the description of the property being transferred, and the terms of the transfer. Additionally, it should be notarized and recorded with the Riverside County Recorder's Office to ensure the transfer is legally binding and publicly documented. In conclusion, a Murrieta California Quitclaim Deed from Husband and Wife to LLC is a legal tool used for transferring property ownership from a married couple to an LLC in Murrieta, California. Several types of quitclaim deeds can be employed based on the specific ownership interests being transferred. Seeking professional assistance is vital to navigate the legal requirements and safeguard the interests of all parties involved.A Murrieta California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of a property from a married couple to a limited liability company (LLC) in the city of Murrieta, California. This type of transaction is commonly utilized when individuals want to protect their personal assets and limit liability by transferring ownership to an LLC, which provides a separate legal entity for the property. There are a few different types of Murrieta California Quitclaim Deeds that may be used in this specific scenario. They include: 1. Murrieta California Individual Quitclaim Deed from Husband to LLC: This type of quitclaim deed is used when only the husband is transferring his ownership interest in the property to the LLC, while the wife retains her ownership interest. 2. Murrieta California Individual Quitclaim Deed from Wife to LLC: In contrast to the previous type, this version is employed when only the wife is conveying her ownership interest in the property to the LLC, while the husband maintains his ownership. 3. Murrieta California Joint Quitclaim Deed from Husband and Wife to LLC: This is the most common type of quitclaim deed used in this scenario. Both the husband and wife transfer their respective ownership interests in the property to the LLC simultaneously. The Murrieta California Quitclaim Deed from Husband and Wife to LLC serves several purposes. Firstly, it allows the married couple to limit their personal liability by creating a legal separation between themselves and the property as owners. Secondly, it provides the LLC with control and management rights over the property, allowing the couple to conduct business or investment activities through the entity. Lastly, it helps with estate planning, since transferring the property to the LLC may facilitate the transfer of ownership upon the death of one or both spouses. When preparing a Murrieta California Quitclaim Deed from Husband and Wife to LLC, it is crucial to consult with a qualified attorney, as the process involves legal complexities and potential tax implications. The deed should clearly outline the names of the husband, wife, and LLC entity, the description of the property being transferred, and the terms of the transfer. Additionally, it should be notarized and recorded with the Riverside County Recorder's Office to ensure the transfer is legally binding and publicly documented. In conclusion, a Murrieta California Quitclaim Deed from Husband and Wife to LLC is a legal tool used for transferring property ownership from a married couple to an LLC in Murrieta, California. Several types of quitclaim deeds can be employed based on the specific ownership interests being transferred. Seeking professional assistance is vital to navigate the legal requirements and safeguard the interests of all parties involved.