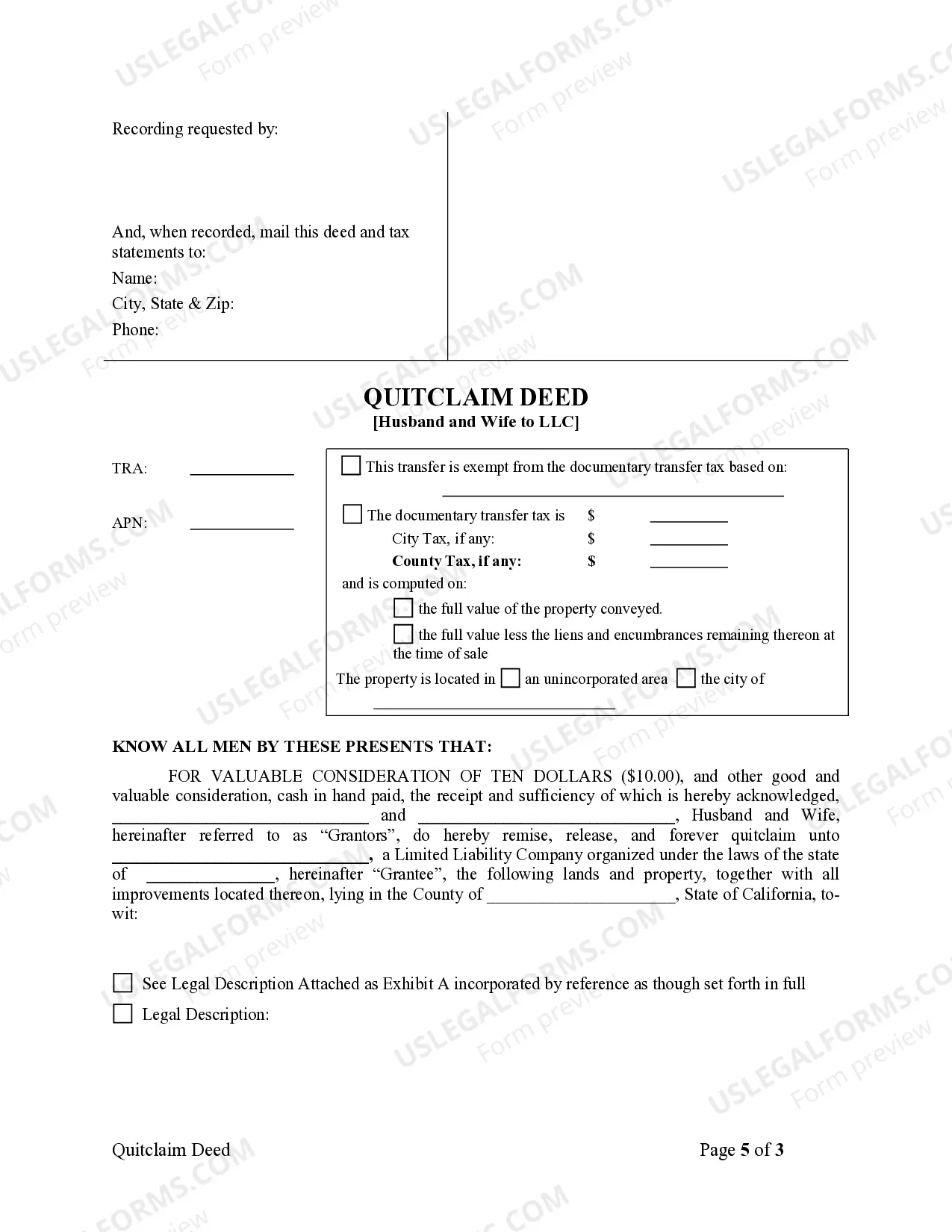

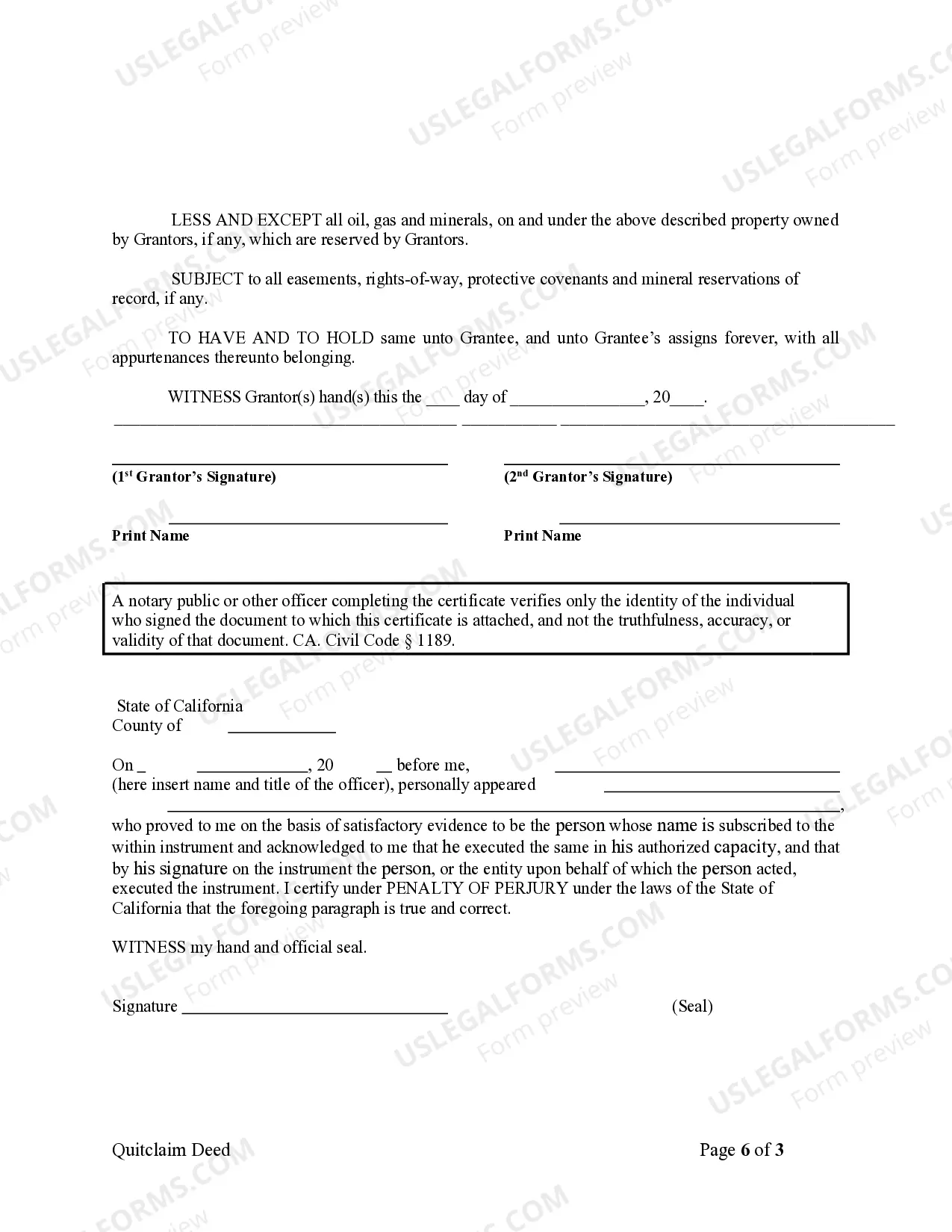

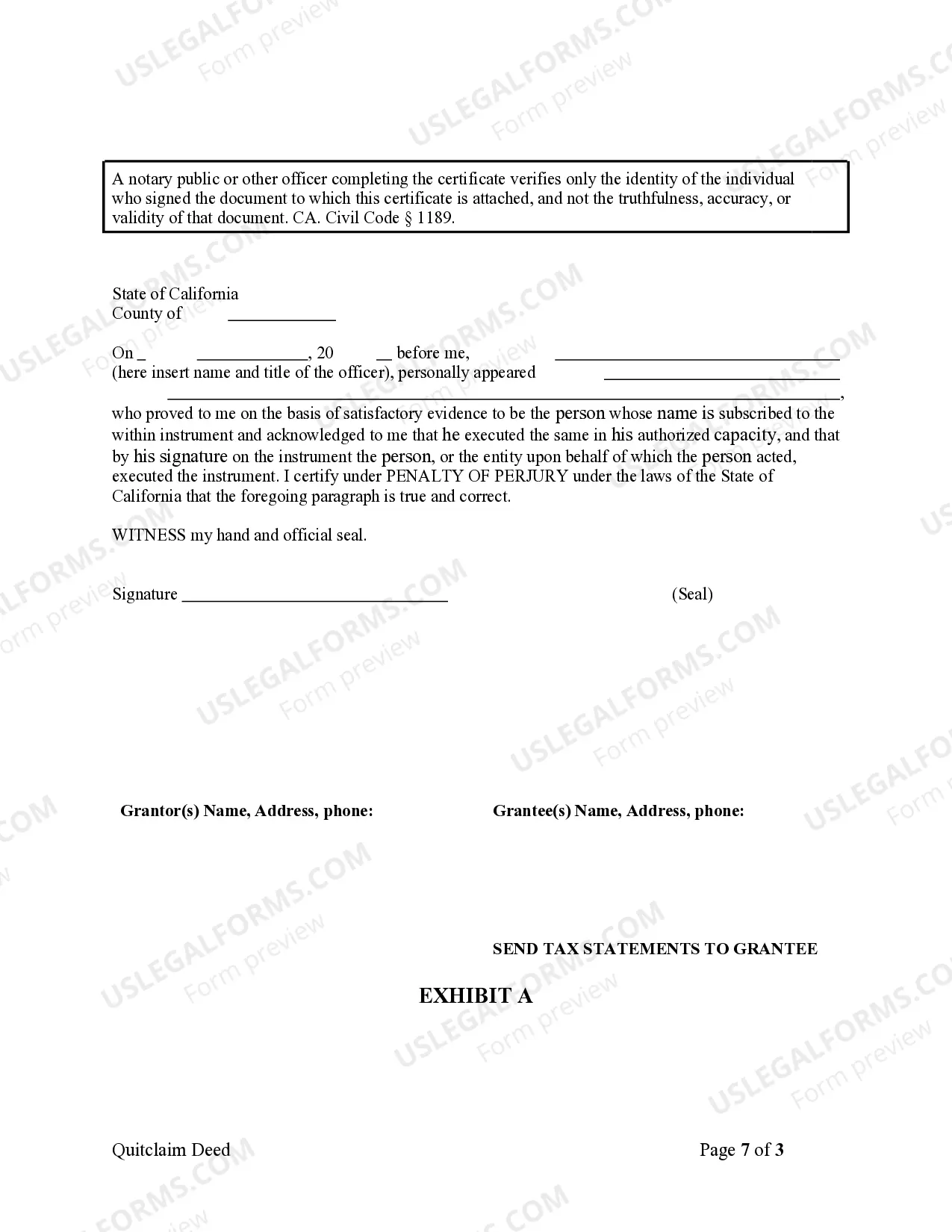

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Norwalk California Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to their limited liability company (LLC) through the use of a quitclaim deed. This type of deed is commonly used when a married couple wants to contribute their jointly owned property to their LLC, which can provide liability protection and tax benefits. The purpose of a quitclaim deed is to transfer the couple's ownership interest in the property to the LLC without making any warranties or guarantees regarding the title. It simply conveys whatever interest the couple has in the property, if any. It's important to note that a quitclaim deed does not guarantee that the property is free from liens or other encumbrances, and it doesn't address any potential claims or disputes over the property. There are several types of Norwalk California Quitclaim Deeds from Husband and Wife to LLC that may be used depending on the specific circumstances of the transfer: 1. Norwalk California Individual-to-LLC Quitclaim Deed: This type of deed is used when a married couple jointly owns a property and wants to transfer ownership to their LLC as individuals. 2. Norwalk California Joint Tenancy-to-LLC Quitclaim Deed: If the property is held in joint tenancy by the husband and wife, this type of quitclaim deed is used to transfer their joint tenancy interest to the LLC. 3. Norwalk California Tenants in Common-to-LLC Quitclaim Deed: When the husband and wife own the property as tenants in common, this quitclaim deed is utilized to transfer their respective shares to the LLC. 4. Norwalk California Community Property-to-LLC Quitclaim Deed: In California, married couples can own property as community property. This type of quitclaim deed is used to transfer the community property interest to the LLC. When drafting a Norwalk California Quitclaim Deed from Husband and Wife to LLC, it is crucial to include important information like the property's legal description, the names of the husband and wife transferring the property, the name of the LLC receiving the property, and the consideration exchanged (if any). Overall, this type of quitclaim deed facilitates the transfer of property ownership from a married couple to their LLC, offering the benefits of limited liability protection and potentially more advantageous tax treatment. It is advisable to consult with a qualified real estate attorney or legal professional to ensure the appropriate deed type is chosen and all necessary legal requirements are met during the transfer process.A Norwalk California Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a married couple to their limited liability company (LLC) through the use of a quitclaim deed. This type of deed is commonly used when a married couple wants to contribute their jointly owned property to their LLC, which can provide liability protection and tax benefits. The purpose of a quitclaim deed is to transfer the couple's ownership interest in the property to the LLC without making any warranties or guarantees regarding the title. It simply conveys whatever interest the couple has in the property, if any. It's important to note that a quitclaim deed does not guarantee that the property is free from liens or other encumbrances, and it doesn't address any potential claims or disputes over the property. There are several types of Norwalk California Quitclaim Deeds from Husband and Wife to LLC that may be used depending on the specific circumstances of the transfer: 1. Norwalk California Individual-to-LLC Quitclaim Deed: This type of deed is used when a married couple jointly owns a property and wants to transfer ownership to their LLC as individuals. 2. Norwalk California Joint Tenancy-to-LLC Quitclaim Deed: If the property is held in joint tenancy by the husband and wife, this type of quitclaim deed is used to transfer their joint tenancy interest to the LLC. 3. Norwalk California Tenants in Common-to-LLC Quitclaim Deed: When the husband and wife own the property as tenants in common, this quitclaim deed is utilized to transfer their respective shares to the LLC. 4. Norwalk California Community Property-to-LLC Quitclaim Deed: In California, married couples can own property as community property. This type of quitclaim deed is used to transfer the community property interest to the LLC. When drafting a Norwalk California Quitclaim Deed from Husband and Wife to LLC, it is crucial to include important information like the property's legal description, the names of the husband and wife transferring the property, the name of the LLC receiving the property, and the consideration exchanged (if any). Overall, this type of quitclaim deed facilitates the transfer of property ownership from a married couple to their LLC, offering the benefits of limited liability protection and potentially more advantageous tax treatment. It is advisable to consult with a qualified real estate attorney or legal professional to ensure the appropriate deed type is chosen and all necessary legal requirements are met during the transfer process.