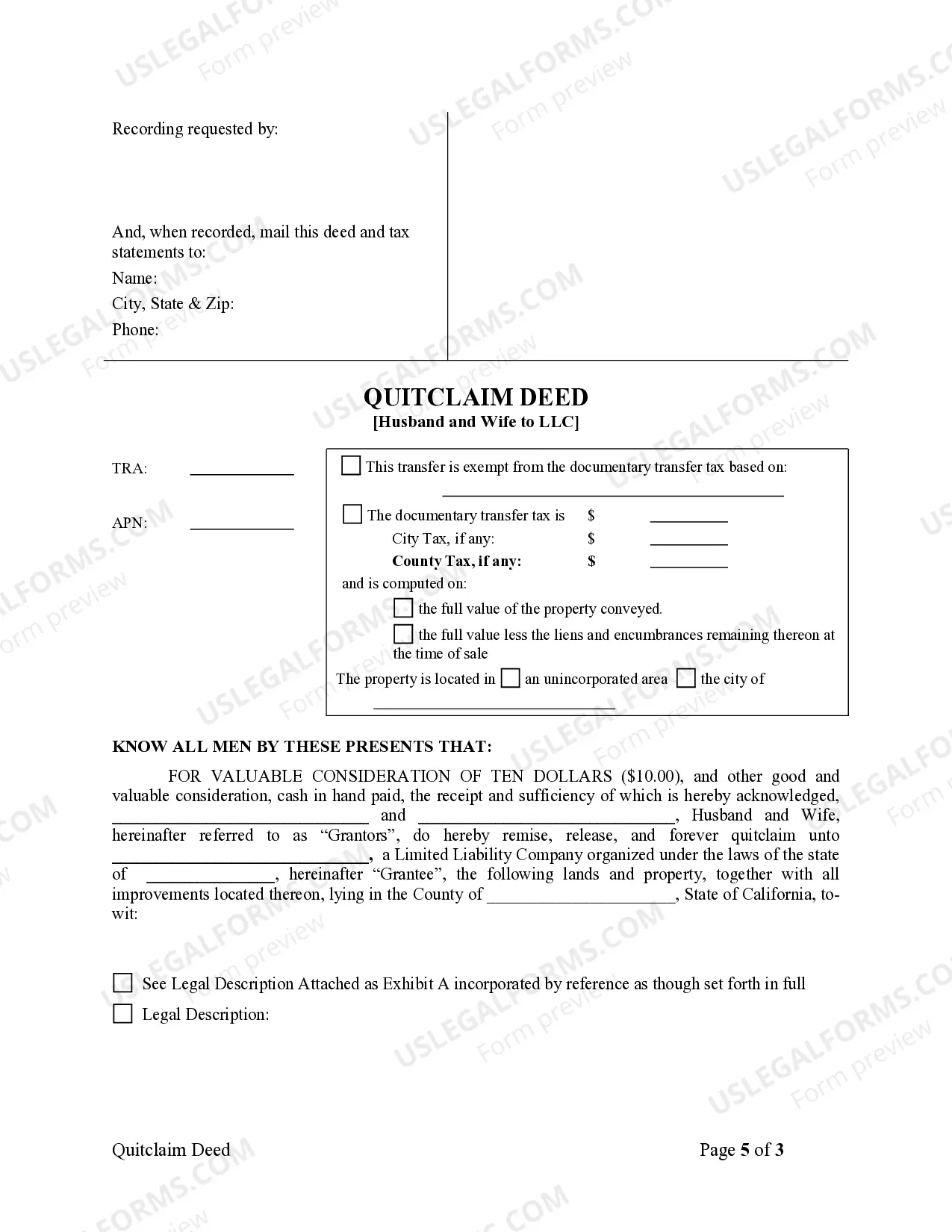

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of a property located in Orange, California from a married couple to a limited liability company (LLC). This type of deed is commonly used when a couple wishes to transfer property to an LLC, typically for business or asset protection purposes. The deed ensures a smooth and legally binding transfer of ownership rights from the individuals to the LLC, protecting both parties involved. There are several variations or types of Orange California Quitclaim Deed from Husband and Wife to LLC, each serving different purposes. Some common types include: 1. General Quitclaim Deed: This is the most basic type of quitclaim deed, transferring the couple's ownership interest in the property to the LLC, without any warranties or guarantees. It simply conveys whatever interest the couple holds in the property to the LLC. 2. Special Purpose Quitclaim Deed: This type of quitclaim deed is used when the transfer is done for a specific purpose, such as transferring the property to an LLC established for rental or investment purposes. It may include specific obligations or restrictions related to the LLC's use of the property. 3. Asset Protection Quitclaim Deed: This deed is often used to transfer ownership to an LLC as a way to protect personal assets from potential liabilities, such as business debts or lawsuits. It provides a layer of separation between personal and business assets, reducing the risk of losing the property in case of legal claims against the LLC. 4. Estate Planning Quitclaim Deed: This type of quitclaim deed is used when the couple wants to transfer the property to an LLC as part of their estate planning strategy. It may involve the creation of a trust, ensuring a smooth transfer of the property to heirs or beneficiaries in the future. Regardless of the specific type, an Orange California Quitclaim Deed from Husband and Wife to LLC must include essential details such as the names and addresses of the granters (the husband and wife), the name and address of the LLC being transferred to, a legal property description, and the date of the transfer. It is crucial to consult with a real estate attorney or an experienced professional to ensure the deed is correctly prepared, executed, and recorded according to California's legal requirements.