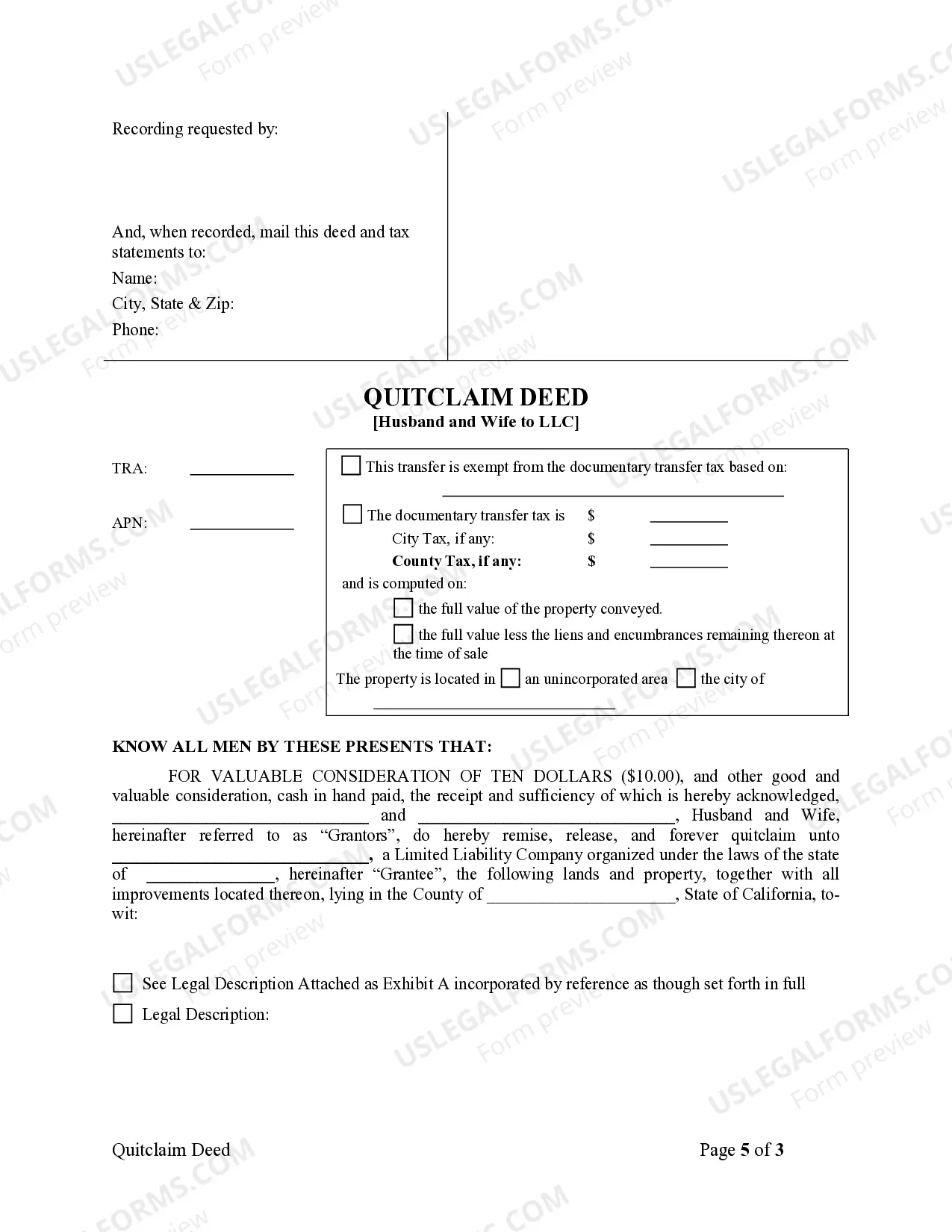

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Riverside California Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a husband and wife to a limited liability company (LLC) located in Riverside, California. This type of deed is commonly used when a married couple jointly owns property and decides to transfer ownership to their LLC, often for the purpose of asset protection, tax benefits, or business purposes. There are different types of Riverside California Quitclaim Deeds from Husband and Wife to LLC, including: 1. Single Member LLC Transfer: This type of quitclaim deed is used when the husband and wife are the sole members of their LLC. It allows them to transfer the property from their names to the LLC as a single member entity. 2. Multi-Member LLC Transfer: If the LLC has multiple members, such as additional partners or investors, a quitclaim deed can be used to transfer the property ownership to the LLC with clear terms and conditions for each member's ownership percentage. 3. Operating Agreement Incorporation: In some cases, the incorporation process of the LLC in Riverside, California may require the husband and wife to transfer the property ownership through a quitclaim deed as part of the LLC's operating agreement. This type of transfer ensures compliance with state laws and internal regulations of the LLC. 4. Asset Protection Transfer: When the husband and wife want to protect their personal assets from potential liabilities related to the property, they may choose to transfer ownership to their LLC using a quitclaim deed. This type of transfer helps limit personal liability, as any legal claims or debts related to the property would be directed towards the LLC rather than their personal assets. It is important to note that while a quitclaim deed transfers the ownership rights to the LLC, it does not guarantee clear title or resolve any existing liens or encumbrances on the property. Therefore, it is advisable to consult an attorney or professional real estate agent specializing in LLC transfers to ensure a smooth transfer process and to address any legal concerns or potential issues.A Riverside California Quitclaim Deed from Husband and Wife to LLC is a legal document that transfers ownership of a property from a husband and wife to a limited liability company (LLC) located in Riverside, California. This type of deed is commonly used when a married couple jointly owns property and decides to transfer ownership to their LLC, often for the purpose of asset protection, tax benefits, or business purposes. There are different types of Riverside California Quitclaim Deeds from Husband and Wife to LLC, including: 1. Single Member LLC Transfer: This type of quitclaim deed is used when the husband and wife are the sole members of their LLC. It allows them to transfer the property from their names to the LLC as a single member entity. 2. Multi-Member LLC Transfer: If the LLC has multiple members, such as additional partners or investors, a quitclaim deed can be used to transfer the property ownership to the LLC with clear terms and conditions for each member's ownership percentage. 3. Operating Agreement Incorporation: In some cases, the incorporation process of the LLC in Riverside, California may require the husband and wife to transfer the property ownership through a quitclaim deed as part of the LLC's operating agreement. This type of transfer ensures compliance with state laws and internal regulations of the LLC. 4. Asset Protection Transfer: When the husband and wife want to protect their personal assets from potential liabilities related to the property, they may choose to transfer ownership to their LLC using a quitclaim deed. This type of transfer helps limit personal liability, as any legal claims or debts related to the property would be directed towards the LLC rather than their personal assets. It is important to note that while a quitclaim deed transfers the ownership rights to the LLC, it does not guarantee clear title or resolve any existing liens or encumbrances on the property. Therefore, it is advisable to consult an attorney or professional real estate agent specializing in LLC transfers to ensure a smooth transfer process and to address any legal concerns or potential issues.