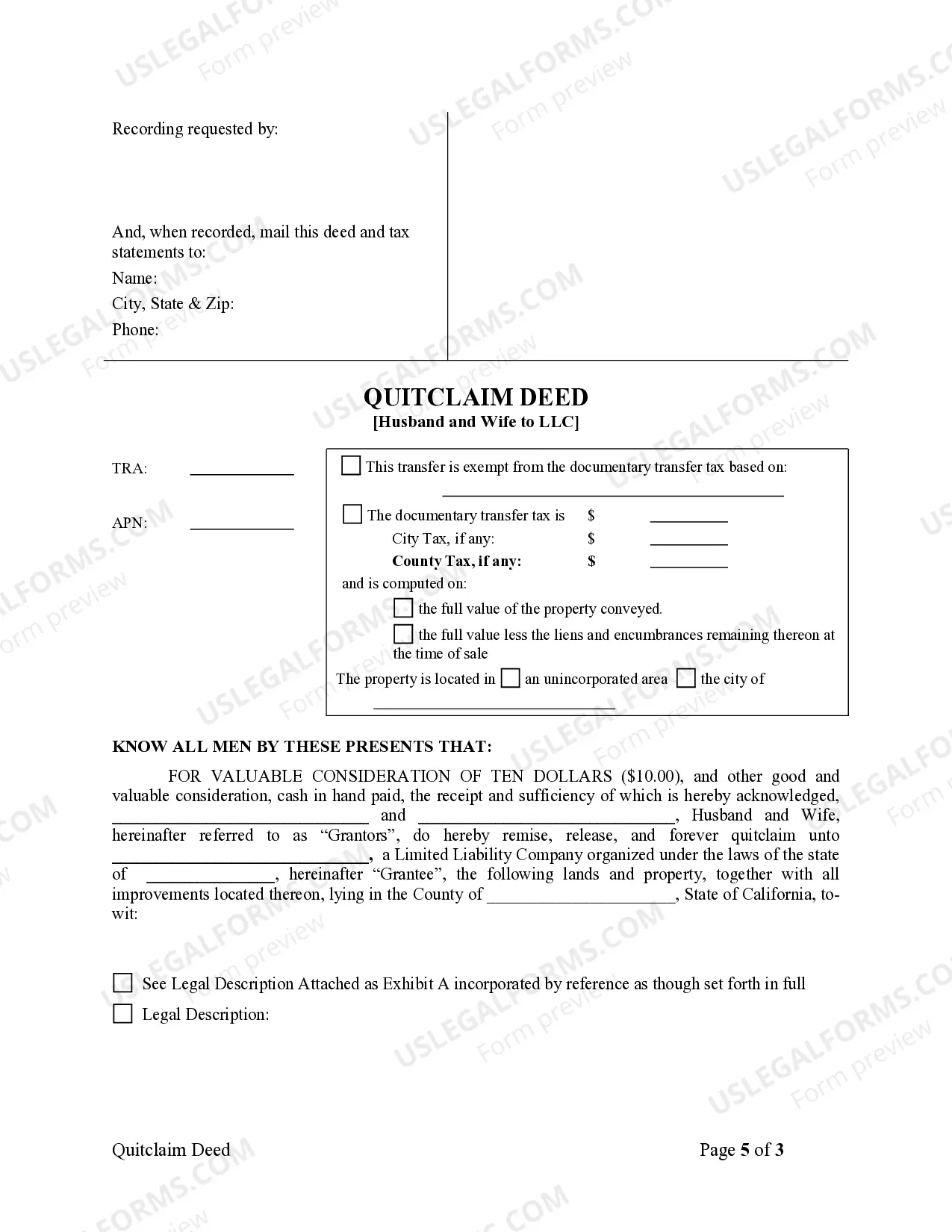

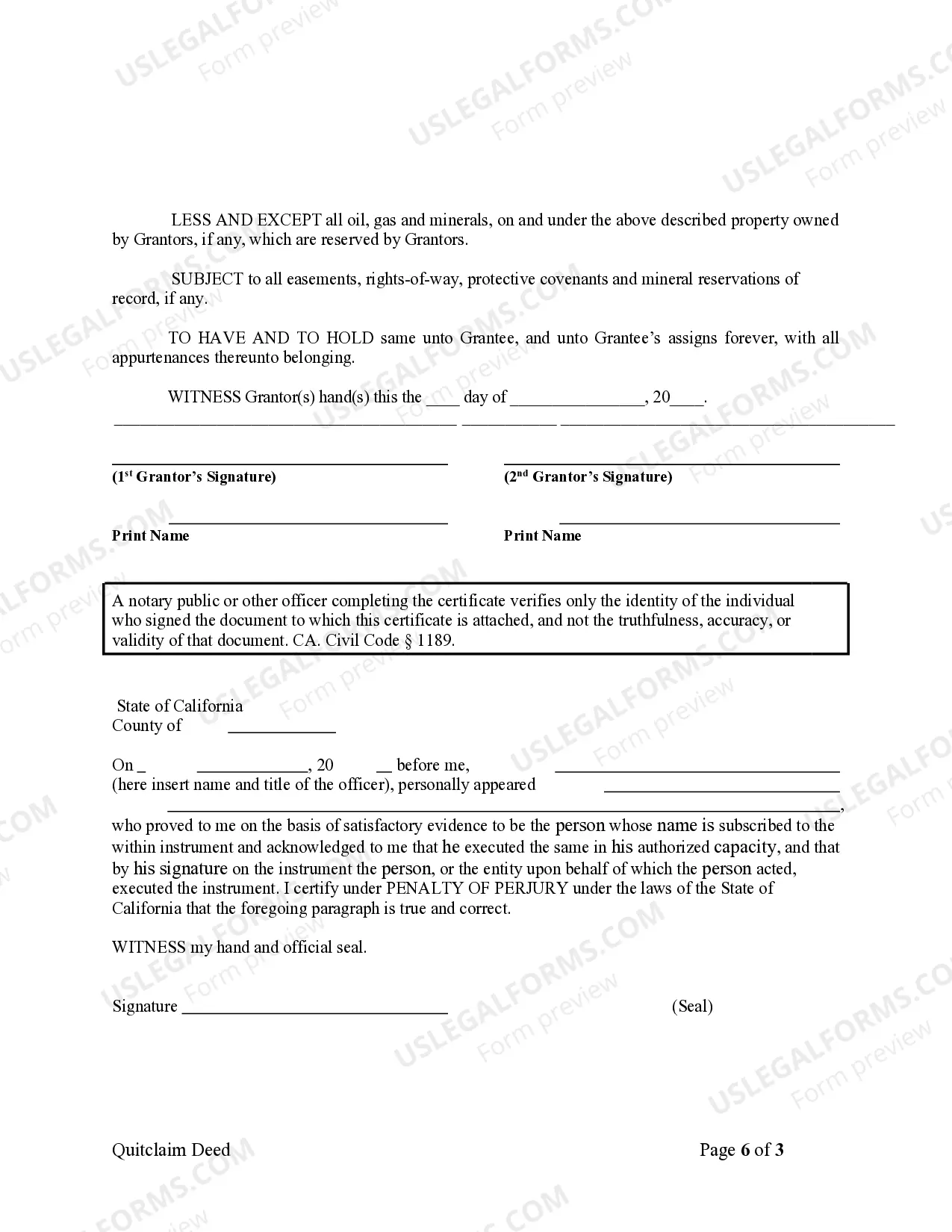

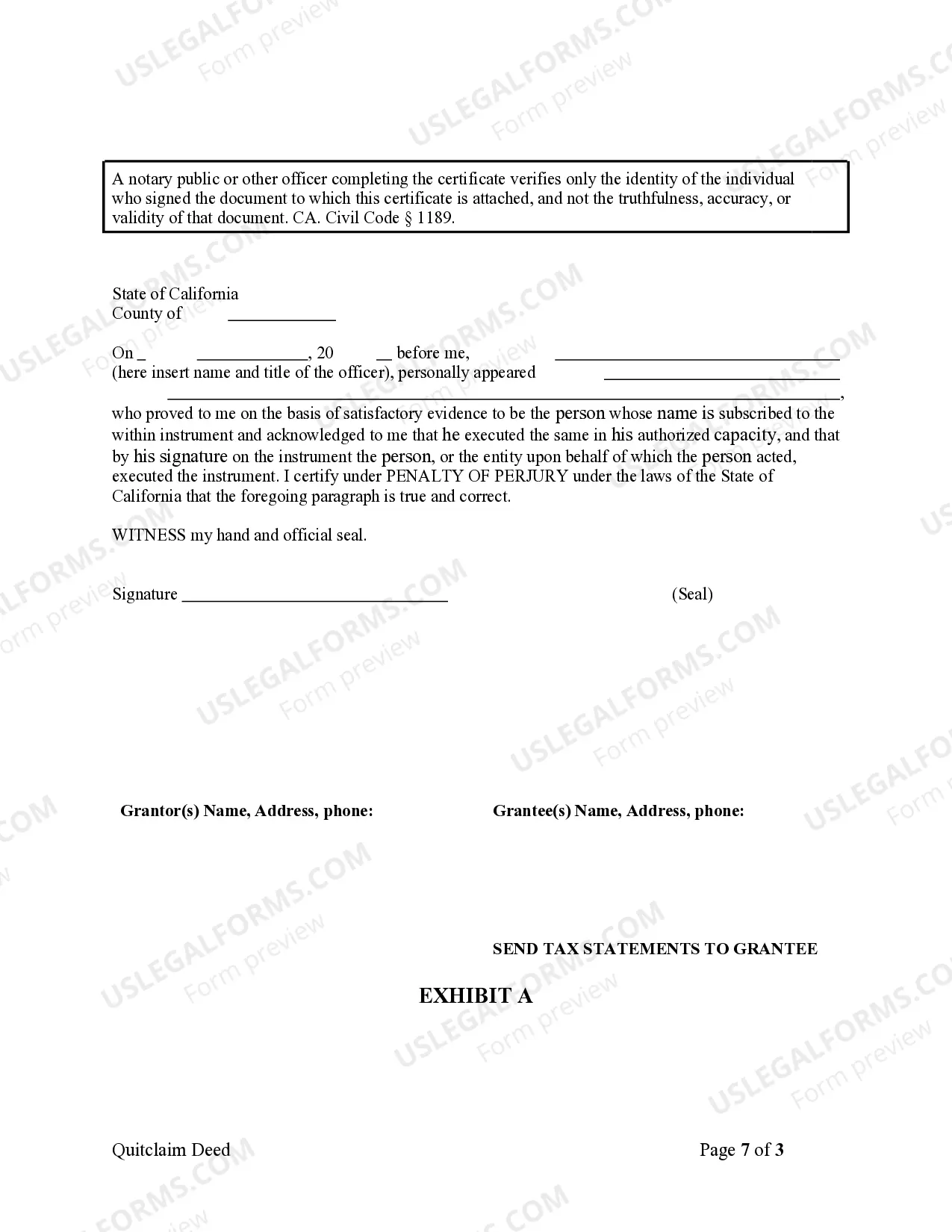

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Title: Understanding the Roseville California Quitclaim Deed from Husband and Wife to LLC: Types and Detailed Explanation Introduction: In the fast-paced world of real estate transactions, it is important to grasp the concept and significance of a Quitclaim Deed. This article will provide a comprehensive understanding of the Roseville California Quitclaim Deed from Husband and Wife to LLC. We will explore its definition, purpose, variations, and key considerations. What is a Quitclaim Deed? A Quitclaim Deed is a legal document commonly utilized in real estate transfers. It allows individuals, in this case, a husband and wife, to transfer their interest in a property to an LLC, effectively relinquishing any claim or ownership they might have had over the property. Types of Roseville California Quitclaim Deeds from Husband and Wife to LLC: 1. Traditional Roseville California Quitclaim Deed from Husband and Wife to LLC: — This type of quitclaim deed involves the transfer of property from both spouses to an LLC. — It can be used for various purposes, such as asset protection, estate planning, or business restructuring. 2. Roseville California Quitclaim Deed with Rights of Survivorship from Husband and Wife to LLC: — A unique variation, this deed ensures that if one spouse passes away, the surviving spouse retains full ownership rights over the property, ultimately transferring their interest to the LLC. — It offers a seamless transfer of property rights and avoids potential complications upon the death of a spouse. 3. Roseville California Quitclaim Deed with Reserved Rights from Husband and Wife to LLC: — This type of deed involves transferring ownership to an LLC while reserving certain rights for the husband and wife. — Reserved rights can include a life estate for the transferring parties, allowing them to continue residing in the property until death or relocation. 4. Roseville California Partial Quitclaim Deed from Husband and Wife to LLC: — In situations where the husband and wife wish to retain partial ownership of the property while transferring the majority to the LLC, a partial quitclaim deed is utilized. — This can be beneficial for tax purposes, liability protection, or estate planning purposes. Key Considerations for Roseville California Quitclaim Deeds from Husband and Wife to LLC: 1. Consult with a legal professional: It is crucial to seek advice from a qualified attorney knowledgeable in California real estate and LLC regulations to ensure compliance and avoid potential legal pitfalls. 2. Ownership structure and tax implications: Understanding the tax consequences associated with the transfer of property from individuals to an LLC is important for strategic planning and minimizing tax liabilities. 3. LLC formation and documentation: Properly forming an LLC and obtaining the necessary legal documentation, such as an Operating Agreement, is instrumental in establishing the rights and responsibilities of all parties involved. Conclusion: The Roseville California Quitclaim Deed from Husband and Wife to LLC is a powerful legal tool used in various real estate scenarios. By transferring ownership from the spouses to an LLC, individuals can effectively protect assets, plan their estates, and achieve business restructuring goals. It is crucial to consider the different types of quitclaim deeds based on specific needs, consult a professional, and properly document the transfer to ensure a smooth and legally binding transaction.Title: Understanding the Roseville California Quitclaim Deed from Husband and Wife to LLC: Types and Detailed Explanation Introduction: In the fast-paced world of real estate transactions, it is important to grasp the concept and significance of a Quitclaim Deed. This article will provide a comprehensive understanding of the Roseville California Quitclaim Deed from Husband and Wife to LLC. We will explore its definition, purpose, variations, and key considerations. What is a Quitclaim Deed? A Quitclaim Deed is a legal document commonly utilized in real estate transfers. It allows individuals, in this case, a husband and wife, to transfer their interest in a property to an LLC, effectively relinquishing any claim or ownership they might have had over the property. Types of Roseville California Quitclaim Deeds from Husband and Wife to LLC: 1. Traditional Roseville California Quitclaim Deed from Husband and Wife to LLC: — This type of quitclaim deed involves the transfer of property from both spouses to an LLC. — It can be used for various purposes, such as asset protection, estate planning, or business restructuring. 2. Roseville California Quitclaim Deed with Rights of Survivorship from Husband and Wife to LLC: — A unique variation, this deed ensures that if one spouse passes away, the surviving spouse retains full ownership rights over the property, ultimately transferring their interest to the LLC. — It offers a seamless transfer of property rights and avoids potential complications upon the death of a spouse. 3. Roseville California Quitclaim Deed with Reserved Rights from Husband and Wife to LLC: — This type of deed involves transferring ownership to an LLC while reserving certain rights for the husband and wife. — Reserved rights can include a life estate for the transferring parties, allowing them to continue residing in the property until death or relocation. 4. Roseville California Partial Quitclaim Deed from Husband and Wife to LLC: — In situations where the husband and wife wish to retain partial ownership of the property while transferring the majority to the LLC, a partial quitclaim deed is utilized. — This can be beneficial for tax purposes, liability protection, or estate planning purposes. Key Considerations for Roseville California Quitclaim Deeds from Husband and Wife to LLC: 1. Consult with a legal professional: It is crucial to seek advice from a qualified attorney knowledgeable in California real estate and LLC regulations to ensure compliance and avoid potential legal pitfalls. 2. Ownership structure and tax implications: Understanding the tax consequences associated with the transfer of property from individuals to an LLC is important for strategic planning and minimizing tax liabilities. 3. LLC formation and documentation: Properly forming an LLC and obtaining the necessary legal documentation, such as an Operating Agreement, is instrumental in establishing the rights and responsibilities of all parties involved. Conclusion: The Roseville California Quitclaim Deed from Husband and Wife to LLC is a powerful legal tool used in various real estate scenarios. By transferring ownership from the spouses to an LLC, individuals can effectively protect assets, plan their estates, and achieve business restructuring goals. It is crucial to consider the different types of quitclaim deeds based on specific needs, consult a professional, and properly document the transfer to ensure a smooth and legally binding transaction.