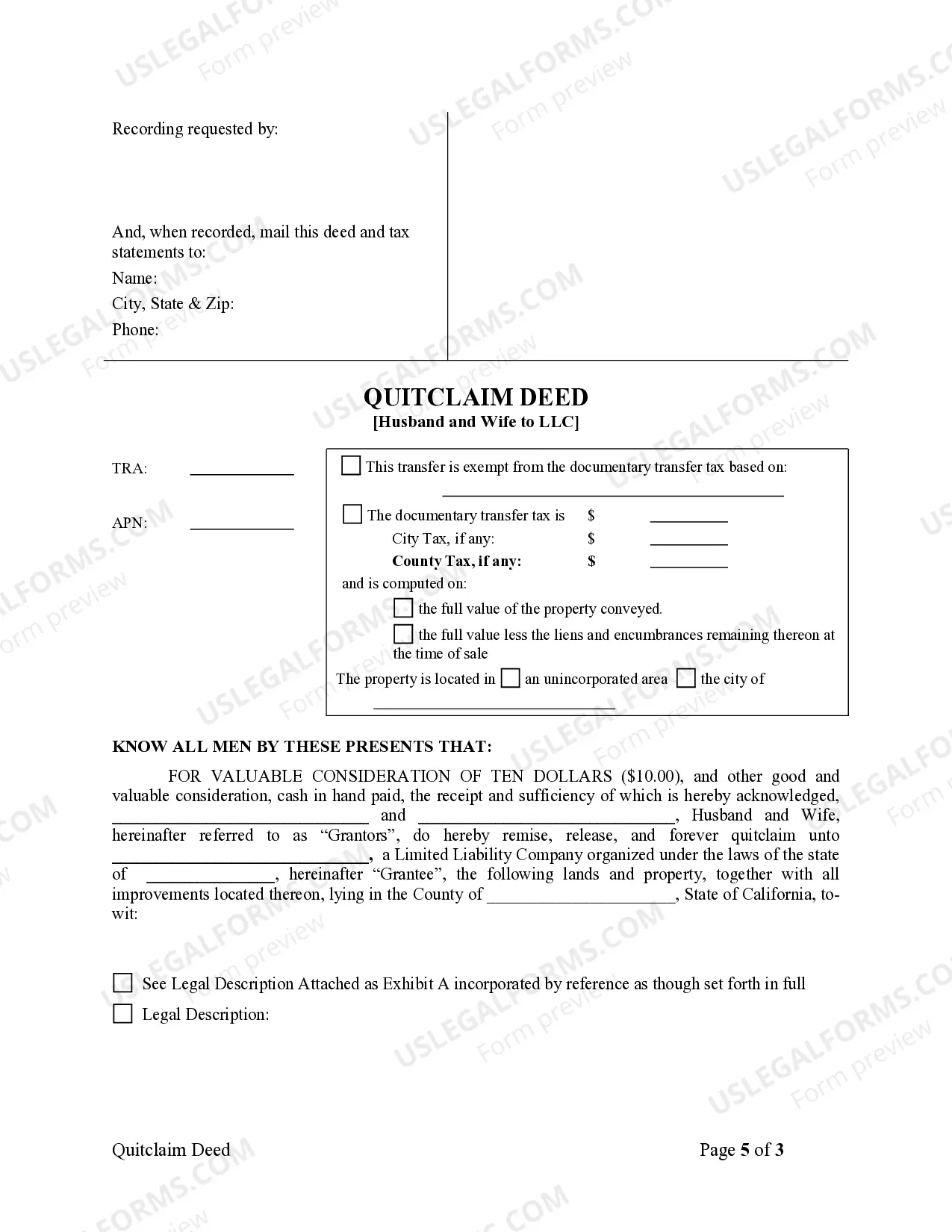

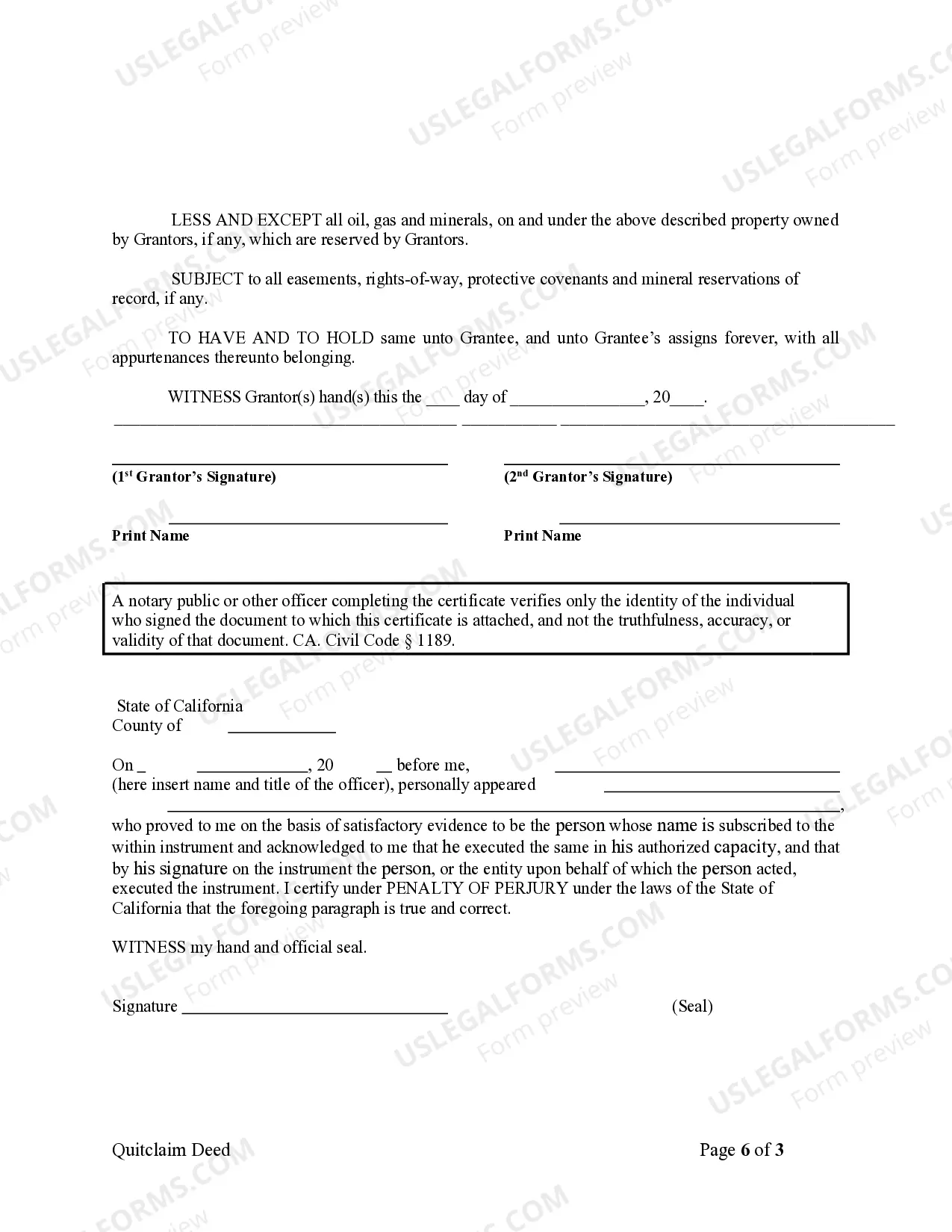

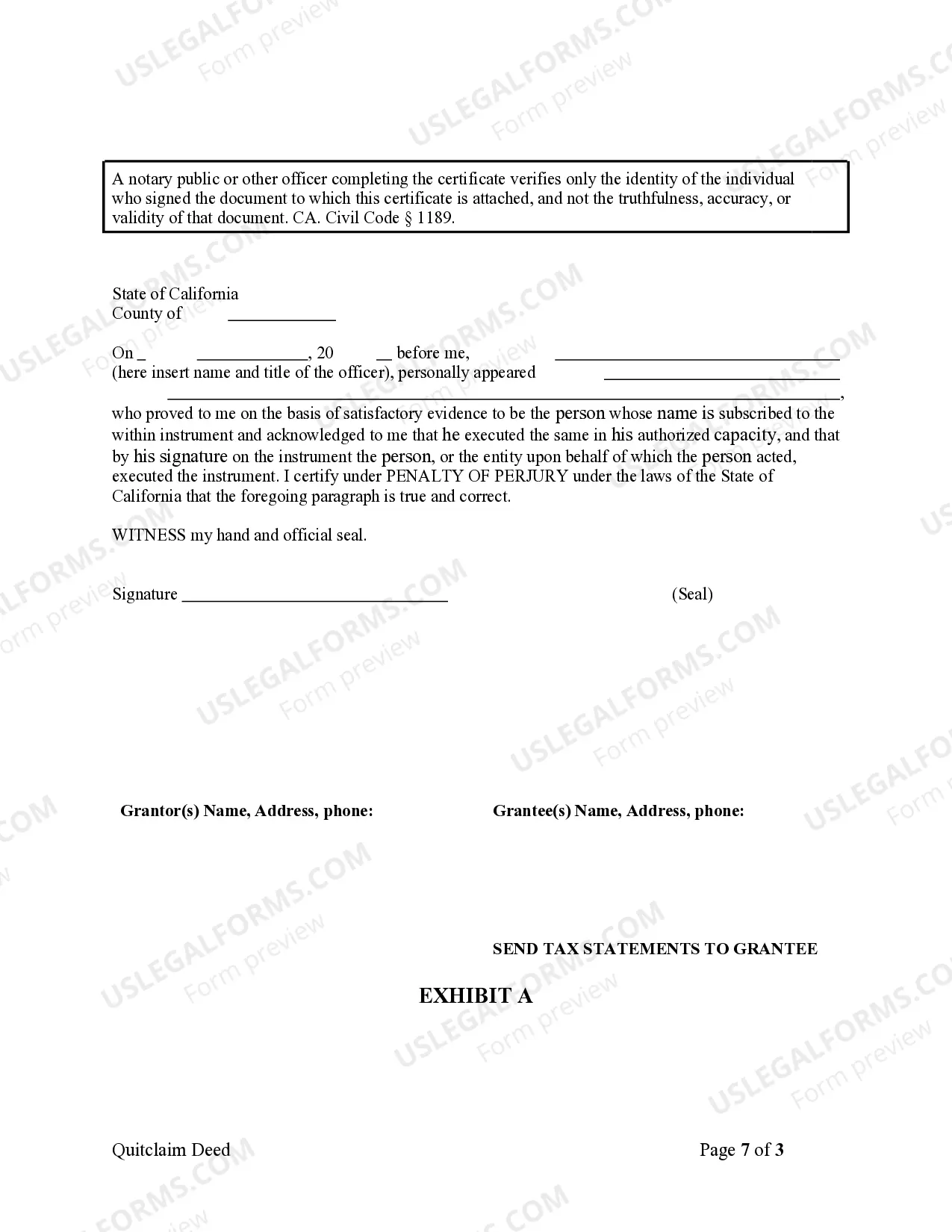

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

The Salinas California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer the ownership of real property from a married couple to a limited liability company (LLC). This type of deed is often utilized when a married couple wishes to transfer their property to an LLC that they have established for various reasons, like business purposes or asset protection. The Salinas California Quitclaim Deed from Husband and Wife to LLC is remarkable for its simplicity and straightforwardness. It allows the couple, referred to as the granters, to convey all their interests and rights in the property to the LLC, known as the grantee, without providing any warranties or guarantees regarding title issues or liens on the property. The primary purpose of this deed is to release any claims the granters might have on the property and facilitate a smooth transfer to the grantee. There are no specific variations or different types of Salinas California Quitclaim Deed from Husband and Wife to LLC based on legal definitions. However, different versions or templates of the deed may exist, depending on the nuances required by the parties involved or specific circumstances related to the property transfer. These variations may include additional provisions or modifications to the standard deed language to address particular considerations such as tax implications, liabilities, or restrictions. It is always advisable to consult with a qualified attorney or legal professional experienced in real estate law to ensure the suitability and accuracy of the deed for a specific situation. Keywords: Salinas California, Quitclaim Deed, Husband and Wife, LLC, real property, transfer ownership, limited liability company, legal document, business purposes, asset protection, straightforward, release claims, smooth transfer, warranties, title issues, liens, variations, templates, specific circumstances, tax implications, liabilities, restrictions, legal professional, real estate law.The Salinas California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer the ownership of real property from a married couple to a limited liability company (LLC). This type of deed is often utilized when a married couple wishes to transfer their property to an LLC that they have established for various reasons, like business purposes or asset protection. The Salinas California Quitclaim Deed from Husband and Wife to LLC is remarkable for its simplicity and straightforwardness. It allows the couple, referred to as the granters, to convey all their interests and rights in the property to the LLC, known as the grantee, without providing any warranties or guarantees regarding title issues or liens on the property. The primary purpose of this deed is to release any claims the granters might have on the property and facilitate a smooth transfer to the grantee. There are no specific variations or different types of Salinas California Quitclaim Deed from Husband and Wife to LLC based on legal definitions. However, different versions or templates of the deed may exist, depending on the nuances required by the parties involved or specific circumstances related to the property transfer. These variations may include additional provisions or modifications to the standard deed language to address particular considerations such as tax implications, liabilities, or restrictions. It is always advisable to consult with a qualified attorney or legal professional experienced in real estate law to ensure the suitability and accuracy of the deed for a specific situation. Keywords: Salinas California, Quitclaim Deed, Husband and Wife, LLC, real property, transfer ownership, limited liability company, legal document, business purposes, asset protection, straightforward, release claims, smooth transfer, warranties, title issues, liens, variations, templates, specific circumstances, tax implications, liabilities, restrictions, legal professional, real estate law.