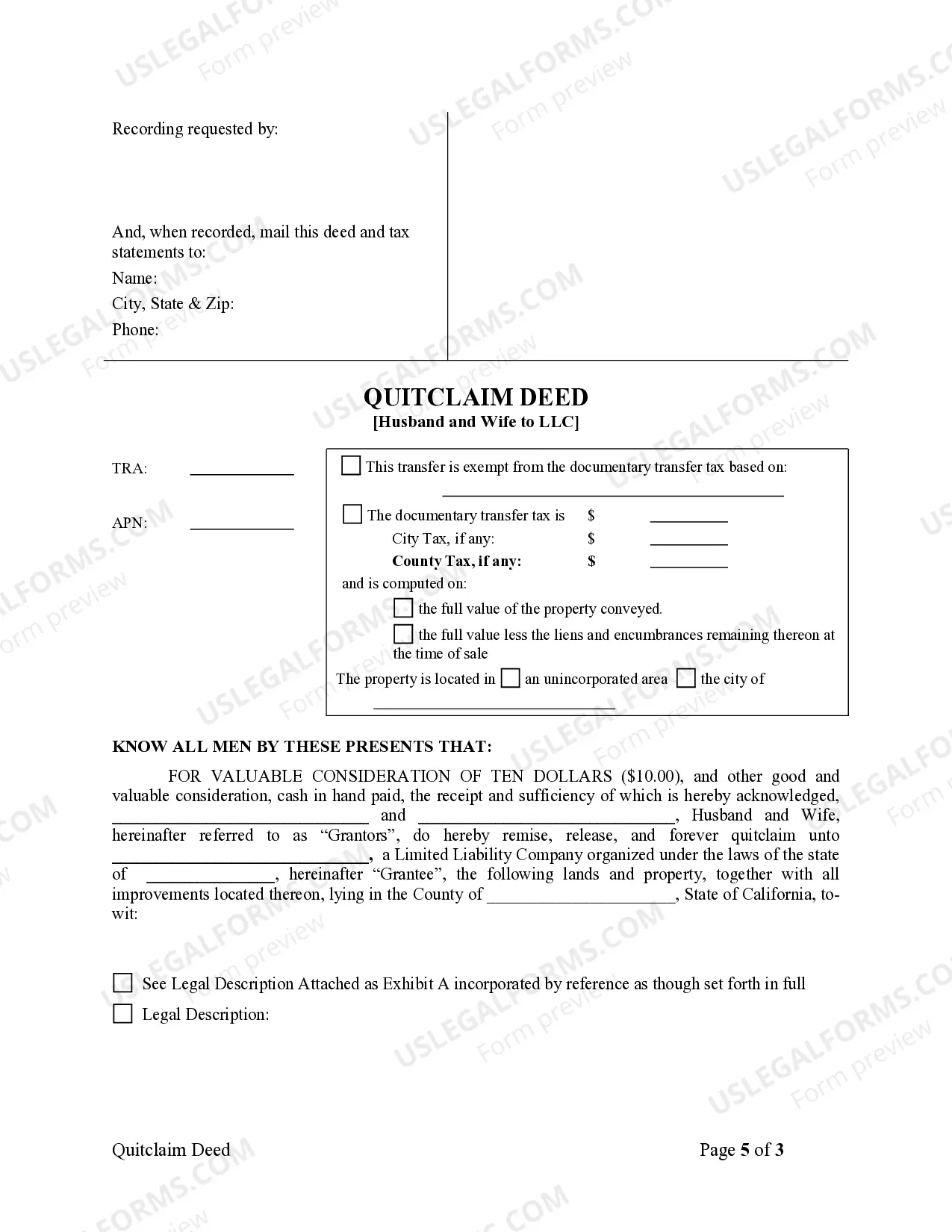

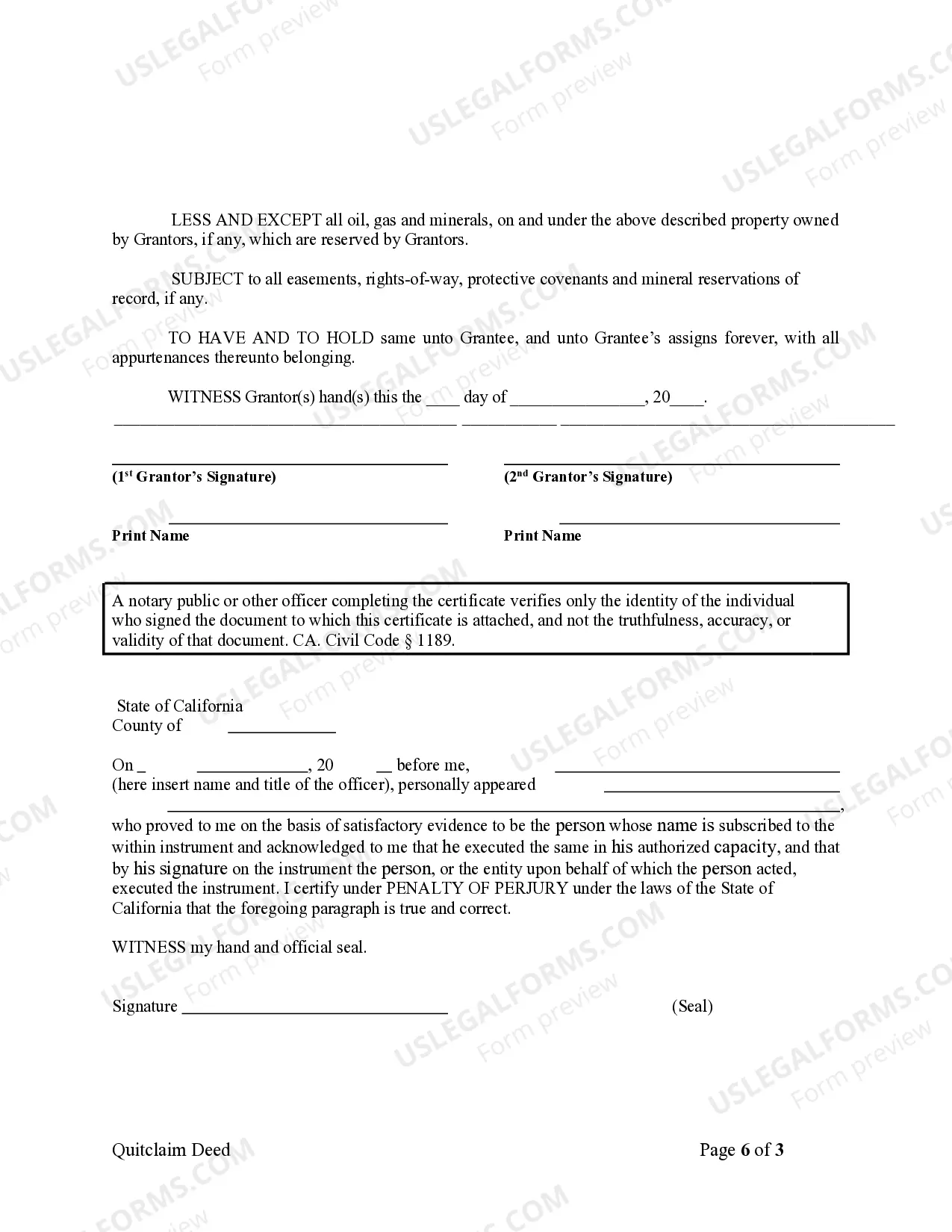

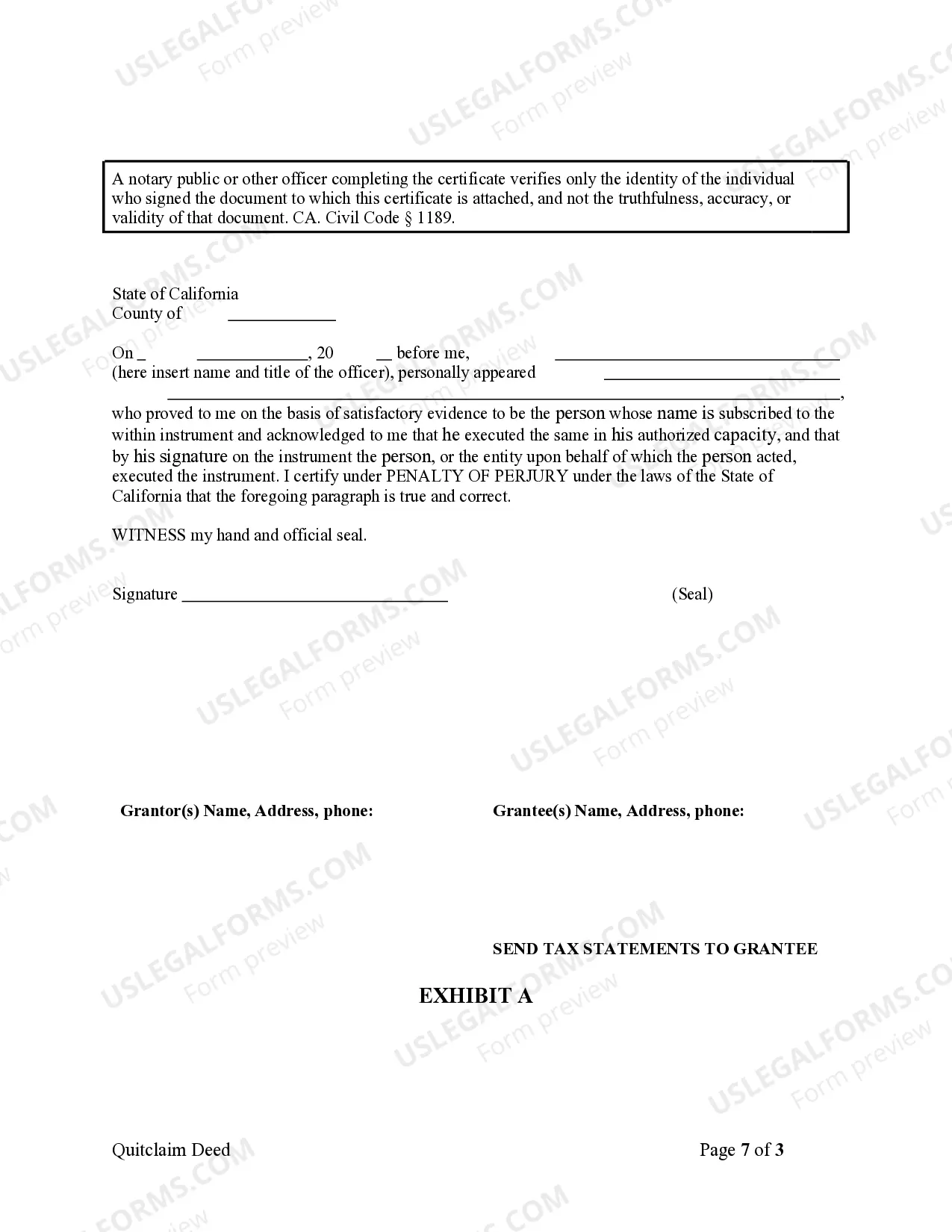

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A San Diego California Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer ownership of real estate property to a limited liability company (LLC) without any warranties or guarantees about the ownership rights or title of the property. This type of deed is commonly used when a husband and wife wish to transfer their property into an LLC for various reasons such as asset protection, tax benefits, or to separate personal and business interests. Keywords: San Diego California, Quitclaim Deed, Husband and Wife, LLC, property transfer, ownership rights, real estate, limited liability company, warranties, guarantees, title, asset protection, tax benefits, personal and business interests. There are a few different types of San Diego California Quitclaim Deed from Husband and Wife to LLC that could be named: 1. San Diego California Joint Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when both spouses have equal ownership rights and agree to transfer the property into an LLC jointly. It requires the signatures of both the husband and wife. 2. San Diego California Separate Quitclaim Deed from Husband and Wife to LLC: In certain situations, spouses may hold separate ownership rights to a property. If they both wish to transfer their respective interests to an LLC separately, they would use this type of deed. 3. San Diego California Partial Quitclaim Deed from Husband and Wife to LLC: Sometimes, a husband and wife may decide to transfer only a portion of their property ownership to an LLC while retaining the remaining portion. This can be useful when they want to maintain personal ownership while still benefiting from the advantages of an LLC structure. These different types of deeds provide flexibility for married couples in San Diego, California, to protect their assets, manage taxes efficiently, and align their property ownership with their business structures through the use of an LLC.A San Diego California Quitclaim Deed from Husband and Wife to LLC is a legal document that allows a married couple to transfer ownership of real estate property to a limited liability company (LLC) without any warranties or guarantees about the ownership rights or title of the property. This type of deed is commonly used when a husband and wife wish to transfer their property into an LLC for various reasons such as asset protection, tax benefits, or to separate personal and business interests. Keywords: San Diego California, Quitclaim Deed, Husband and Wife, LLC, property transfer, ownership rights, real estate, limited liability company, warranties, guarantees, title, asset protection, tax benefits, personal and business interests. There are a few different types of San Diego California Quitclaim Deed from Husband and Wife to LLC that could be named: 1. San Diego California Joint Quitclaim Deed from Husband and Wife to LLC: This type of deed is used when both spouses have equal ownership rights and agree to transfer the property into an LLC jointly. It requires the signatures of both the husband and wife. 2. San Diego California Separate Quitclaim Deed from Husband and Wife to LLC: In certain situations, spouses may hold separate ownership rights to a property. If they both wish to transfer their respective interests to an LLC separately, they would use this type of deed. 3. San Diego California Partial Quitclaim Deed from Husband and Wife to LLC: Sometimes, a husband and wife may decide to transfer only a portion of their property ownership to an LLC while retaining the remaining portion. This can be useful when they want to maintain personal ownership while still benefiting from the advantages of an LLC structure. These different types of deeds provide flexibility for married couples in San Diego, California, to protect their assets, manage taxes efficiently, and align their property ownership with their business structures through the use of an LLC.