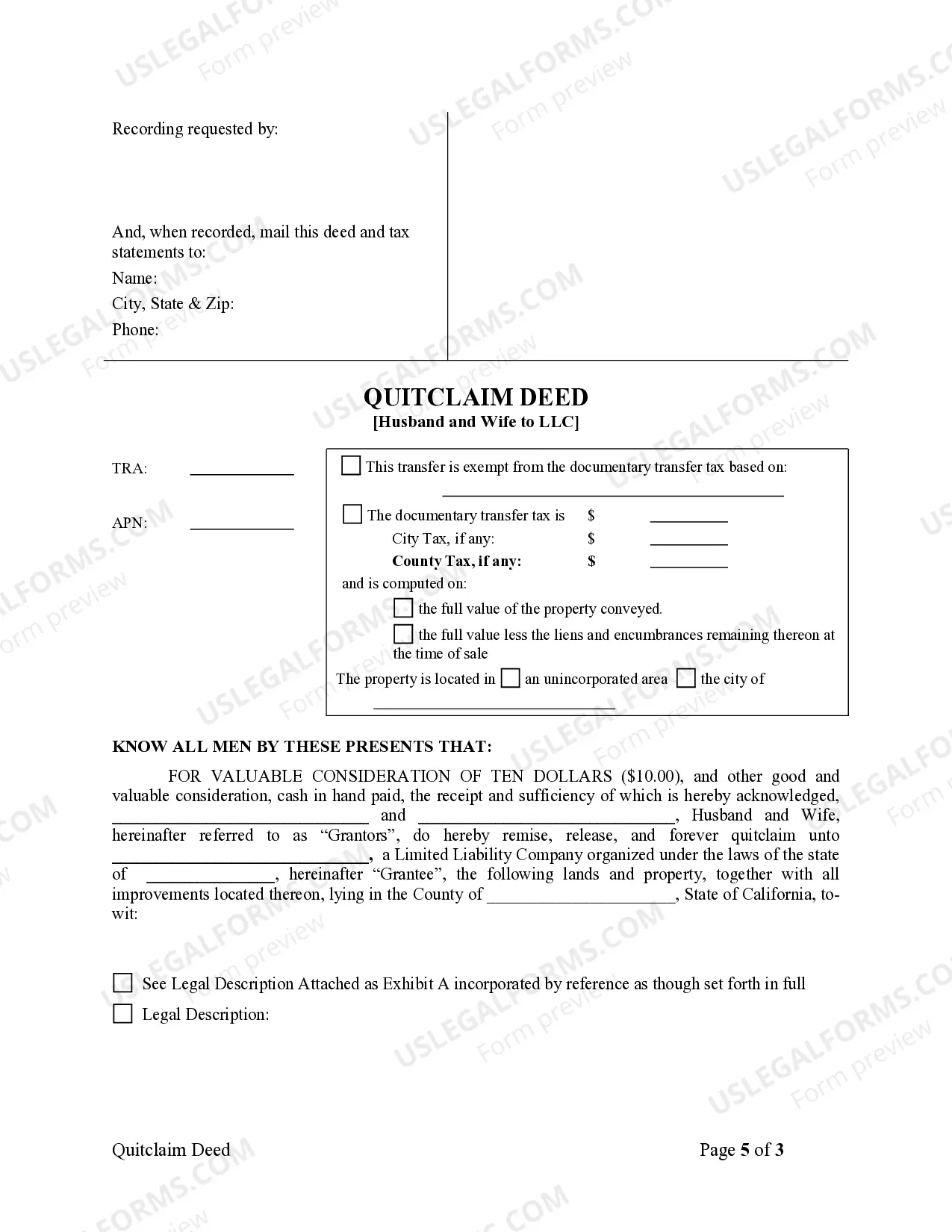

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

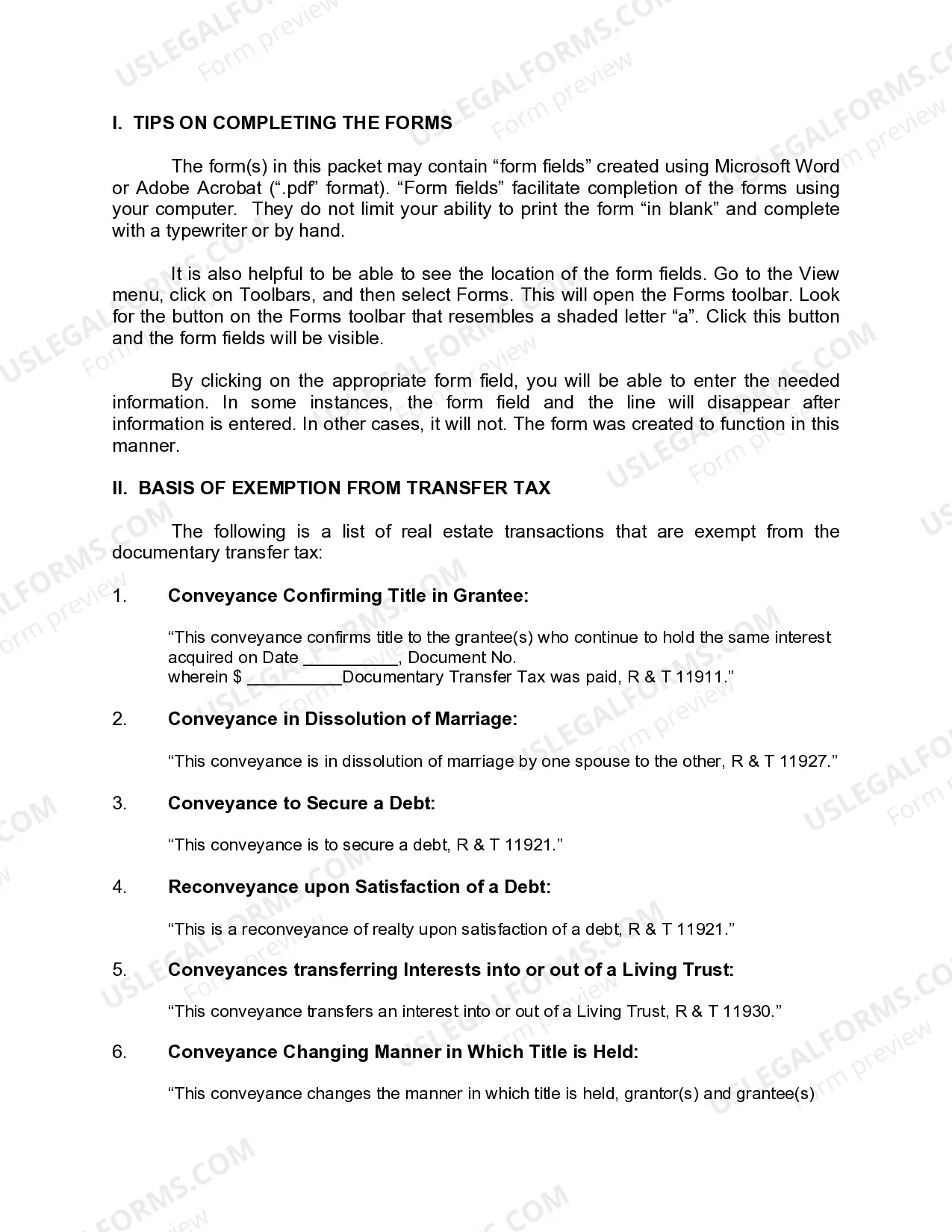

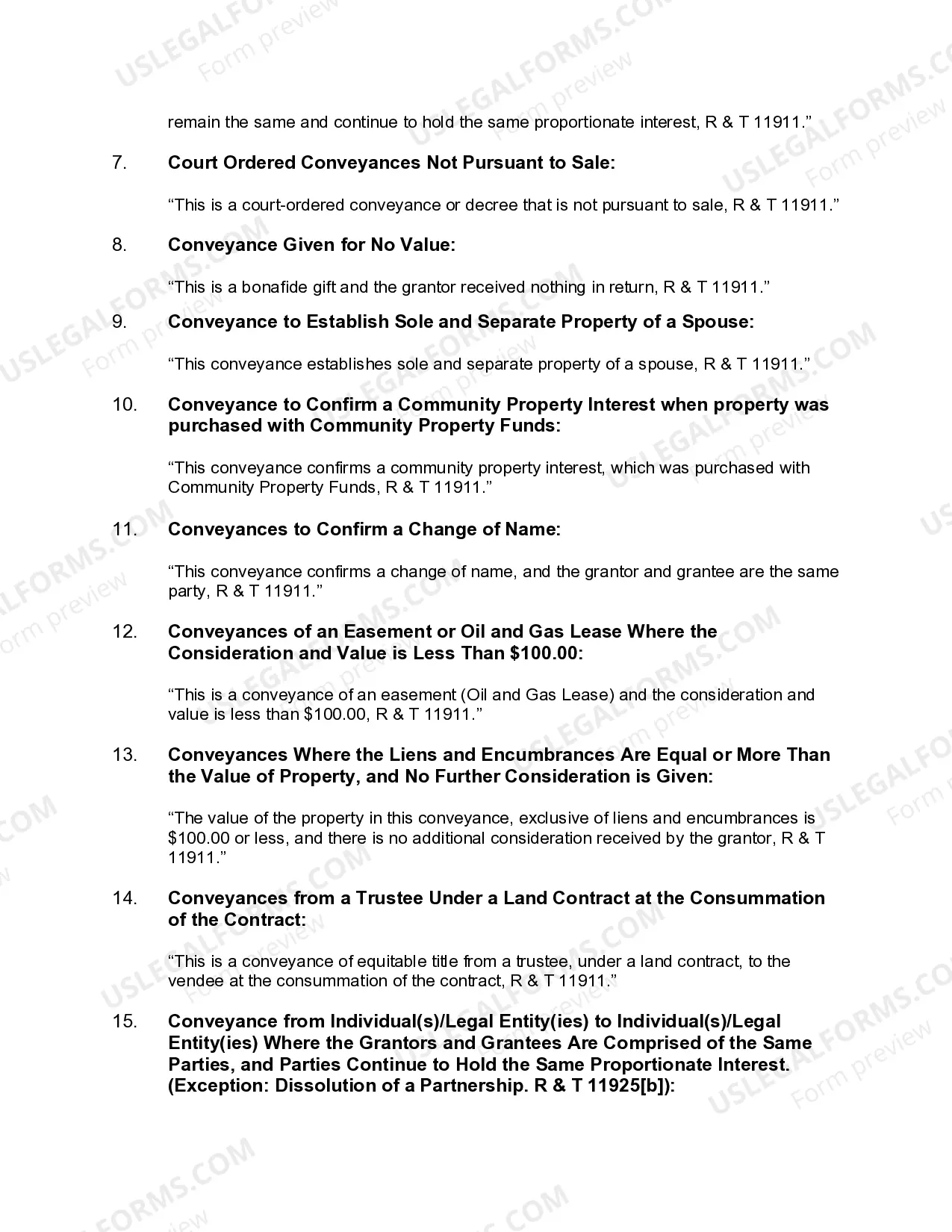

A San Jose California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to a limited liability company (LLC) in San Jose, California. This type of deed is commonly used when the couple wishes to transfer their jointly owned property into an LLC, providing certain benefits such as liability protection and potential tax advantages. The Quitclaim Deed is a legal instrument that ensures the transfer of property rights, without any warranties or guarantees of the property's condition or ownership status. It basically conveys any interest the couple has in the property to the LLC, if any. This means that if there are any claims or encumbrances on the property, they will be transferred to the LLC as well. The process of completing a San Jose California Quitclaim Deed from Husband and Wife to LLC involves several steps. First, the deed must be drafted, outlining the names of the granters (the husband and wife), the grantee (the LLC), and a clear legal description of the property being transferred. The deed then needs to be notarized to ensure its validity. It is important to note that there may be different types of San Jose California Quitclaim Deeds from Husband and Wife to LLC, depending on the specific circumstances or requirements of the parties involved. For example, there may be variations such as a "San Jose California Special Warranty Quitclaim Deed from Husband and Wife to LLC" which includes limited warranties or guarantees about the property's condition or ownership. It is highly recommended for parties considering this type of transfer to seek legal advice from a qualified attorney. This ensures that all legal requirements are met, mitigating the risks and potential complications that may arise during the transfer process. Additionally, consulting with a tax professional can provide guidance on any potential tax implications that may arise from the property transfer to an LLC. In summary, a San Jose California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to an LLC. It provides the couple with the ability to protect their personal assets through the LLC while potentially enjoying tax advantages. However, it is essential to seek professional guidance to ensure a smooth and legally sound transfer process.A San Jose California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to a limited liability company (LLC) in San Jose, California. This type of deed is commonly used when the couple wishes to transfer their jointly owned property into an LLC, providing certain benefits such as liability protection and potential tax advantages. The Quitclaim Deed is a legal instrument that ensures the transfer of property rights, without any warranties or guarantees of the property's condition or ownership status. It basically conveys any interest the couple has in the property to the LLC, if any. This means that if there are any claims or encumbrances on the property, they will be transferred to the LLC as well. The process of completing a San Jose California Quitclaim Deed from Husband and Wife to LLC involves several steps. First, the deed must be drafted, outlining the names of the granters (the husband and wife), the grantee (the LLC), and a clear legal description of the property being transferred. The deed then needs to be notarized to ensure its validity. It is important to note that there may be different types of San Jose California Quitclaim Deeds from Husband and Wife to LLC, depending on the specific circumstances or requirements of the parties involved. For example, there may be variations such as a "San Jose California Special Warranty Quitclaim Deed from Husband and Wife to LLC" which includes limited warranties or guarantees about the property's condition or ownership. It is highly recommended for parties considering this type of transfer to seek legal advice from a qualified attorney. This ensures that all legal requirements are met, mitigating the risks and potential complications that may arise during the transfer process. Additionally, consulting with a tax professional can provide guidance on any potential tax implications that may arise from the property transfer to an LLC. In summary, a San Jose California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to an LLC. It provides the couple with the ability to protect their personal assets through the LLC while potentially enjoying tax advantages. However, it is essential to seek professional guidance to ensure a smooth and legally sound transfer process.