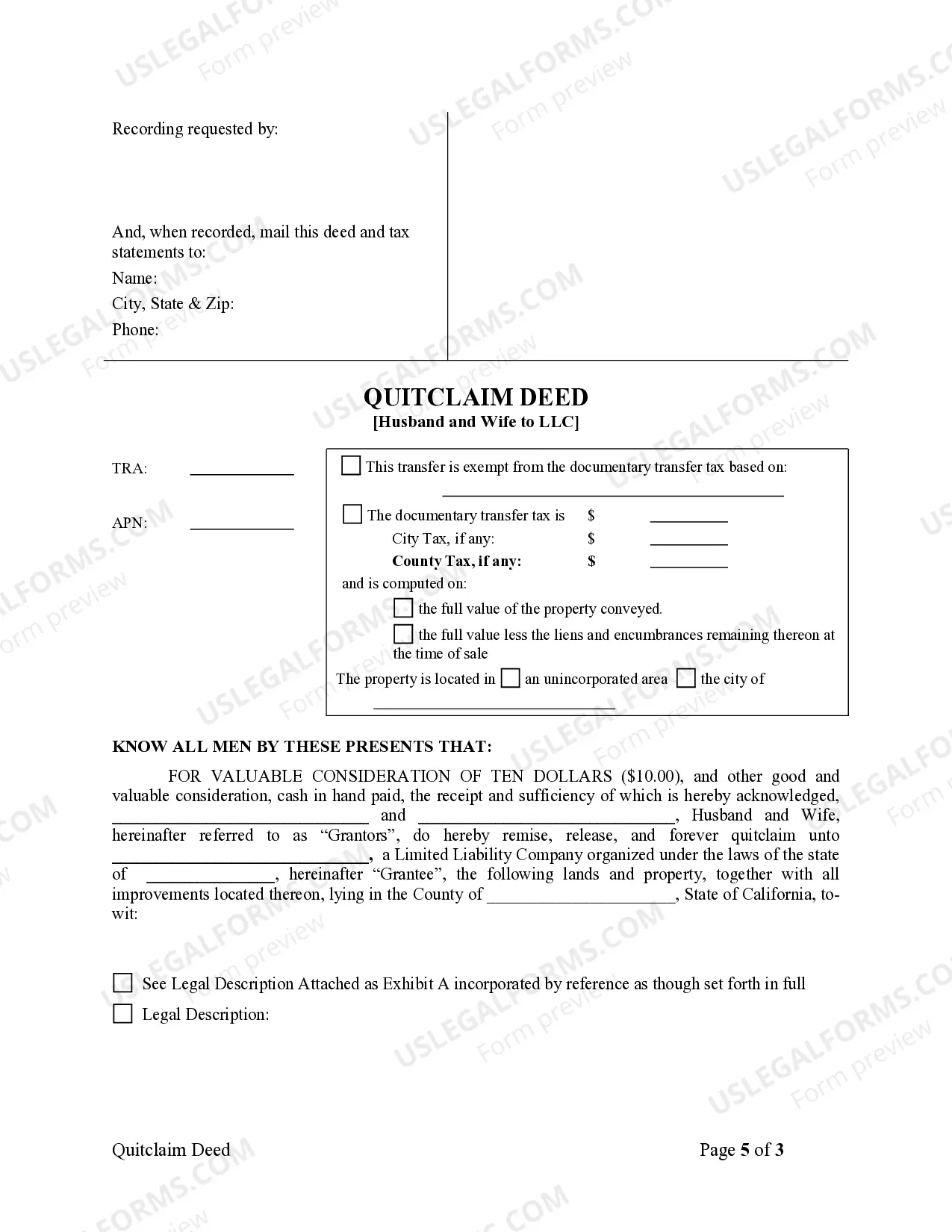

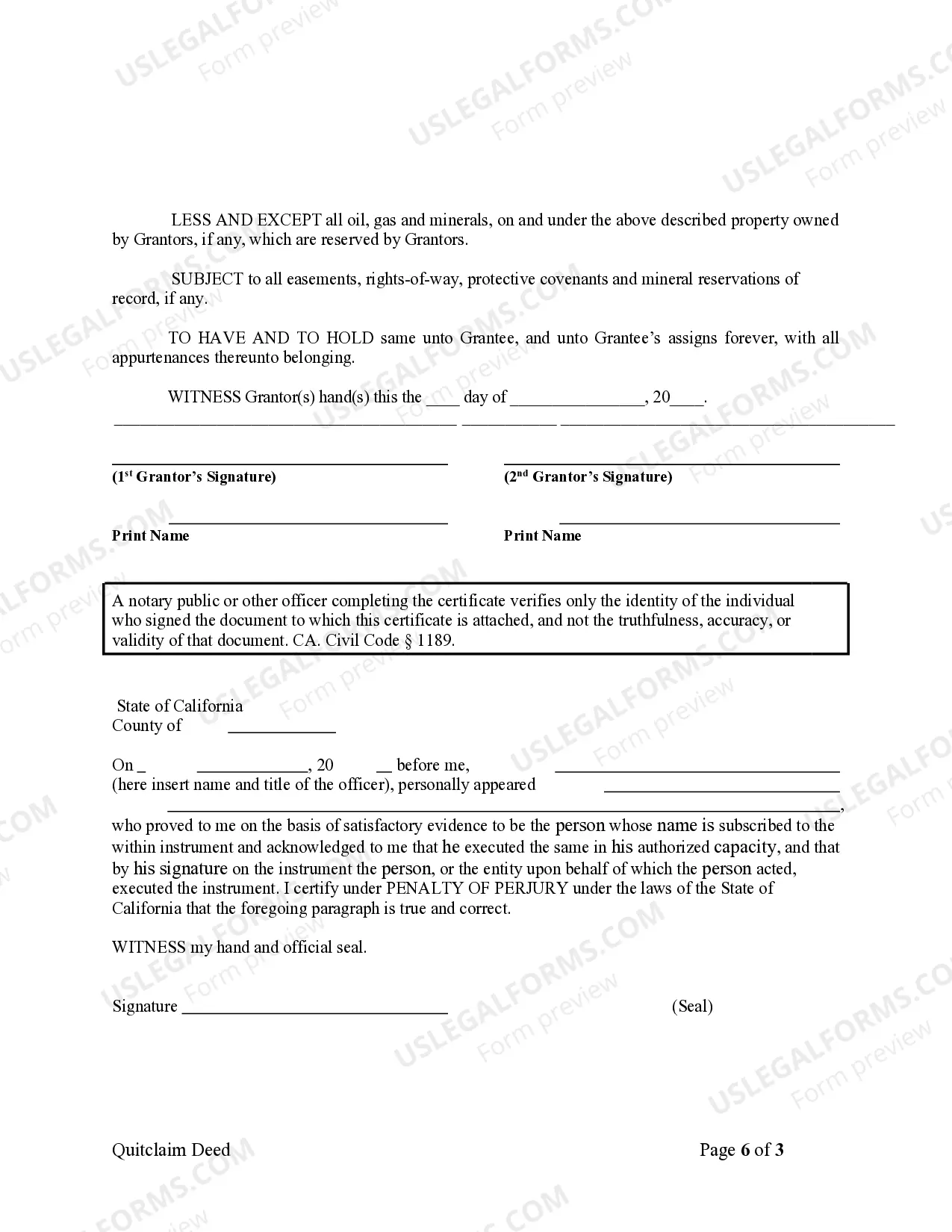

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

Santa Clara California Quitclaim Deed from Husband and Wife to LLC: A Detailed Description A Santa Clara California Quitclaim Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of property ownership rights from a married couple to a limited liability company (LLC) located in Santa Clara, California. This type of deed ensures that the property's title is transferred from the spouses to the LLC without any guarantees about the existence of liens or encumbrances on the property. Executing a quitclaim deed offers a simple and straightforward method for transferring property interests. Through this document, the couple relinquishes all rights, interests, and claims they may have had on the property, providing the LLC with legal ownership and control over the real estate asset. Relevant keywords for understanding this process include: 1. Quitclaim Deed: A legal document used to transfer property interest from one party to another without any warranties or guarantees. 2. Husband and Wife: Refers to a married couple who share property ownership rights as spouses. 3. LLC: Abbreviation for Limited Liability Company, a business structure offering limited liability protection to its owners while maintaining flexibility in terms of taxation. 4. Santa Clara, California: The specific location where the property is situated, in this case, the city of Santa Clara within the state of California. 5. Property Ownership Transfer: The process of changing the legal ownership of a property from one entity to another. 6. Encumbrance: Any claim, lien, or legal liability that may exist on the property, which may affect its value or restrict its use. 7. Real Estate Asset: The property being transferred, which could be residential, commercial, or industrial in nature. Different types of Santa Clara California Quitclaim Deed from Husband and Wife to LLC typically include: 1. Individual to Separate LLC: In this scenario, only one spouse transfers their ownership interest in the property to a separate LLC, while the other spouse retains their share. 2. Joint Transfer to LLC: Both spouses jointly transfer their ownership rights in the property to the LLC, ensuring that the LLC becomes the sole owner. 3. Tenancy by the Entirety Transfer to LLC: This type of transfer involves a specific form of joint ownership between spouses where both individuals have an equal, undivided interest in the property. The LLC then assumes ownership of the entire property. It is crucial for all parties involved to consult with legal professionals specializing in real estate law and familiarize themselves with the specific legal requirements, regulations, and tax implications associated with this type of property transfer in Santa Clara, California.Santa Clara California Quitclaim Deed from Husband and Wife to LLC: A Detailed Description A Santa Clara California Quitclaim Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of property ownership rights from a married couple to a limited liability company (LLC) located in Santa Clara, California. This type of deed ensures that the property's title is transferred from the spouses to the LLC without any guarantees about the existence of liens or encumbrances on the property. Executing a quitclaim deed offers a simple and straightforward method for transferring property interests. Through this document, the couple relinquishes all rights, interests, and claims they may have had on the property, providing the LLC with legal ownership and control over the real estate asset. Relevant keywords for understanding this process include: 1. Quitclaim Deed: A legal document used to transfer property interest from one party to another without any warranties or guarantees. 2. Husband and Wife: Refers to a married couple who share property ownership rights as spouses. 3. LLC: Abbreviation for Limited Liability Company, a business structure offering limited liability protection to its owners while maintaining flexibility in terms of taxation. 4. Santa Clara, California: The specific location where the property is situated, in this case, the city of Santa Clara within the state of California. 5. Property Ownership Transfer: The process of changing the legal ownership of a property from one entity to another. 6. Encumbrance: Any claim, lien, or legal liability that may exist on the property, which may affect its value or restrict its use. 7. Real Estate Asset: The property being transferred, which could be residential, commercial, or industrial in nature. Different types of Santa Clara California Quitclaim Deed from Husband and Wife to LLC typically include: 1. Individual to Separate LLC: In this scenario, only one spouse transfers their ownership interest in the property to a separate LLC, while the other spouse retains their share. 2. Joint Transfer to LLC: Both spouses jointly transfer their ownership rights in the property to the LLC, ensuring that the LLC becomes the sole owner. 3. Tenancy by the Entirety Transfer to LLC: This type of transfer involves a specific form of joint ownership between spouses where both individuals have an equal, undivided interest in the property. The LLC then assumes ownership of the entire property. It is crucial for all parties involved to consult with legal professionals specializing in real estate law and familiarize themselves with the specific legal requirements, regulations, and tax implications associated with this type of property transfer in Santa Clara, California.