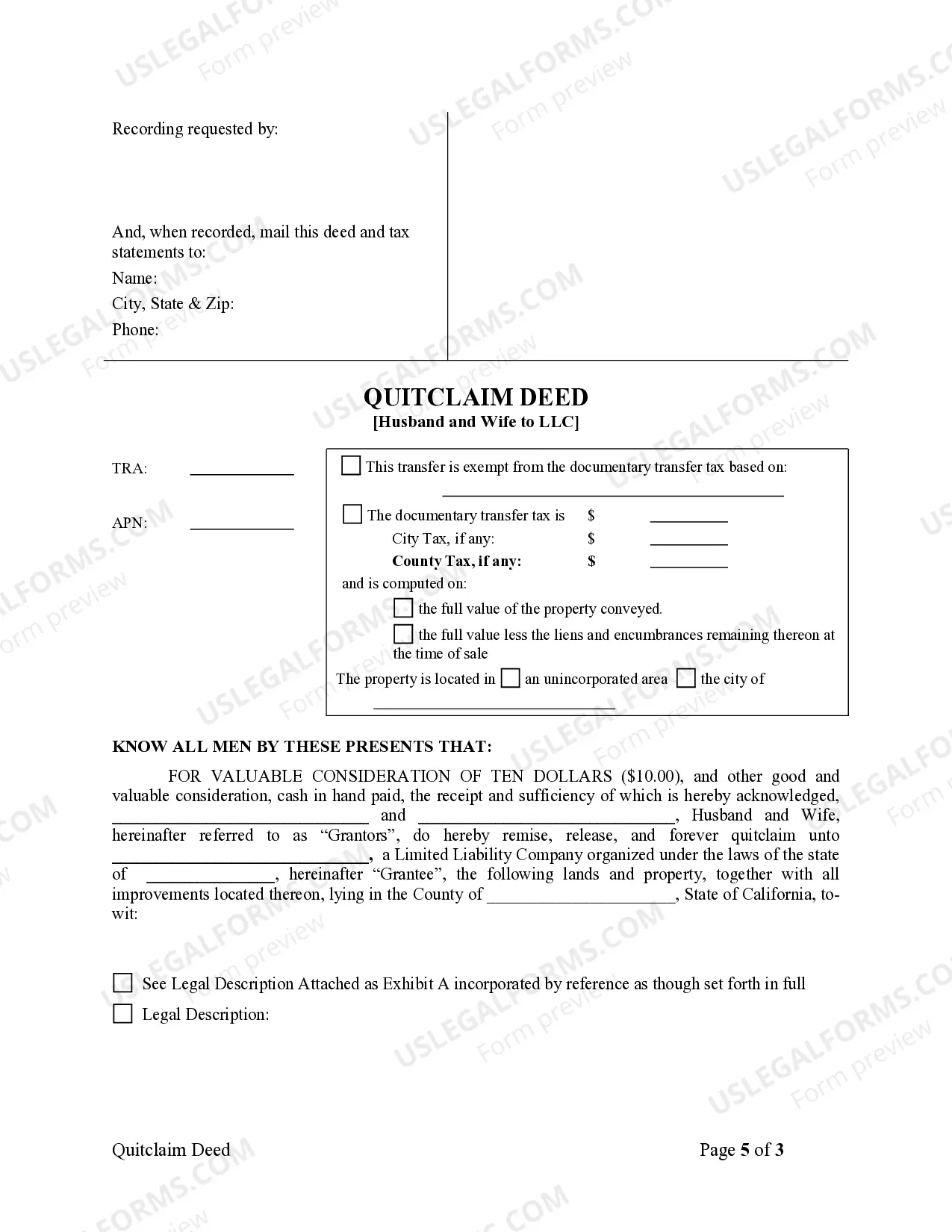

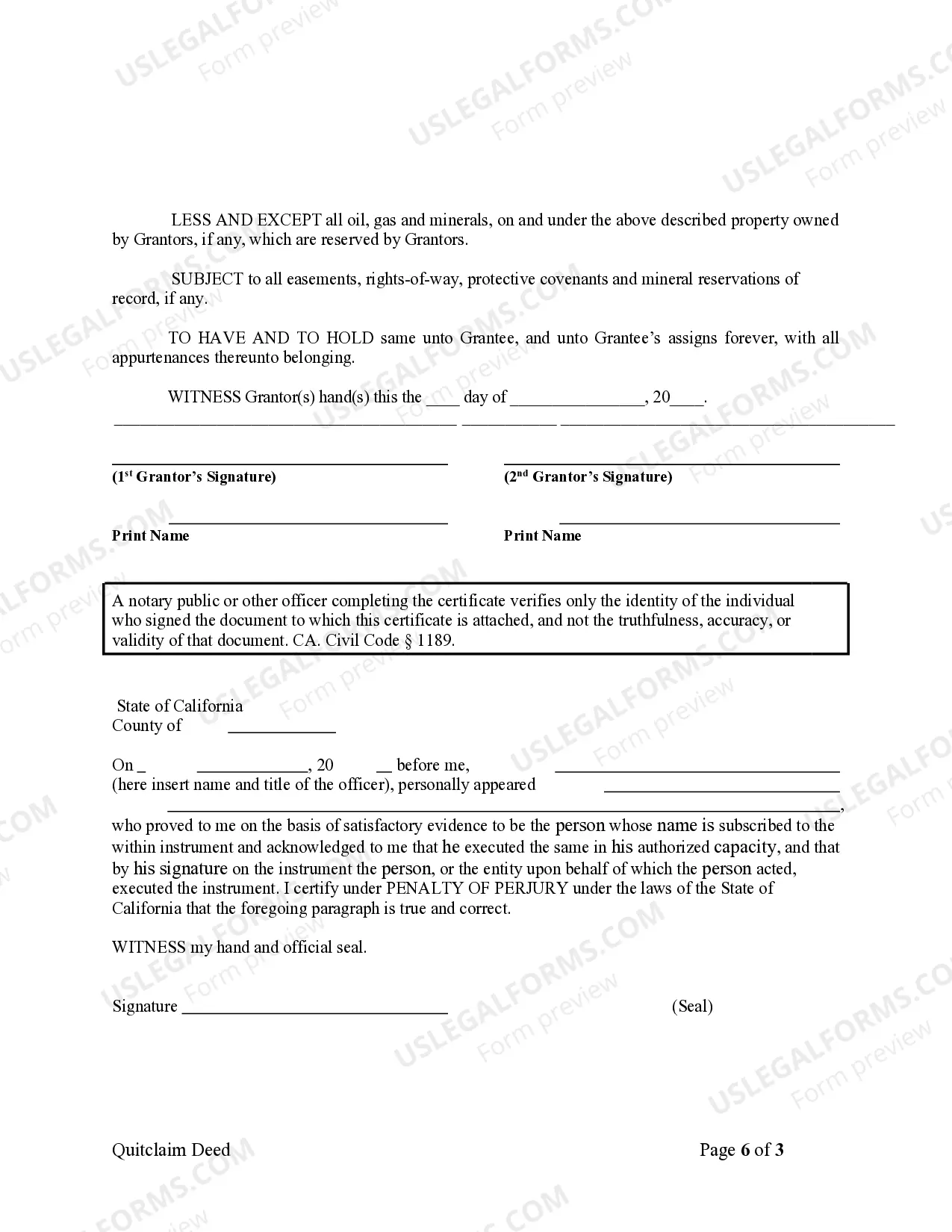

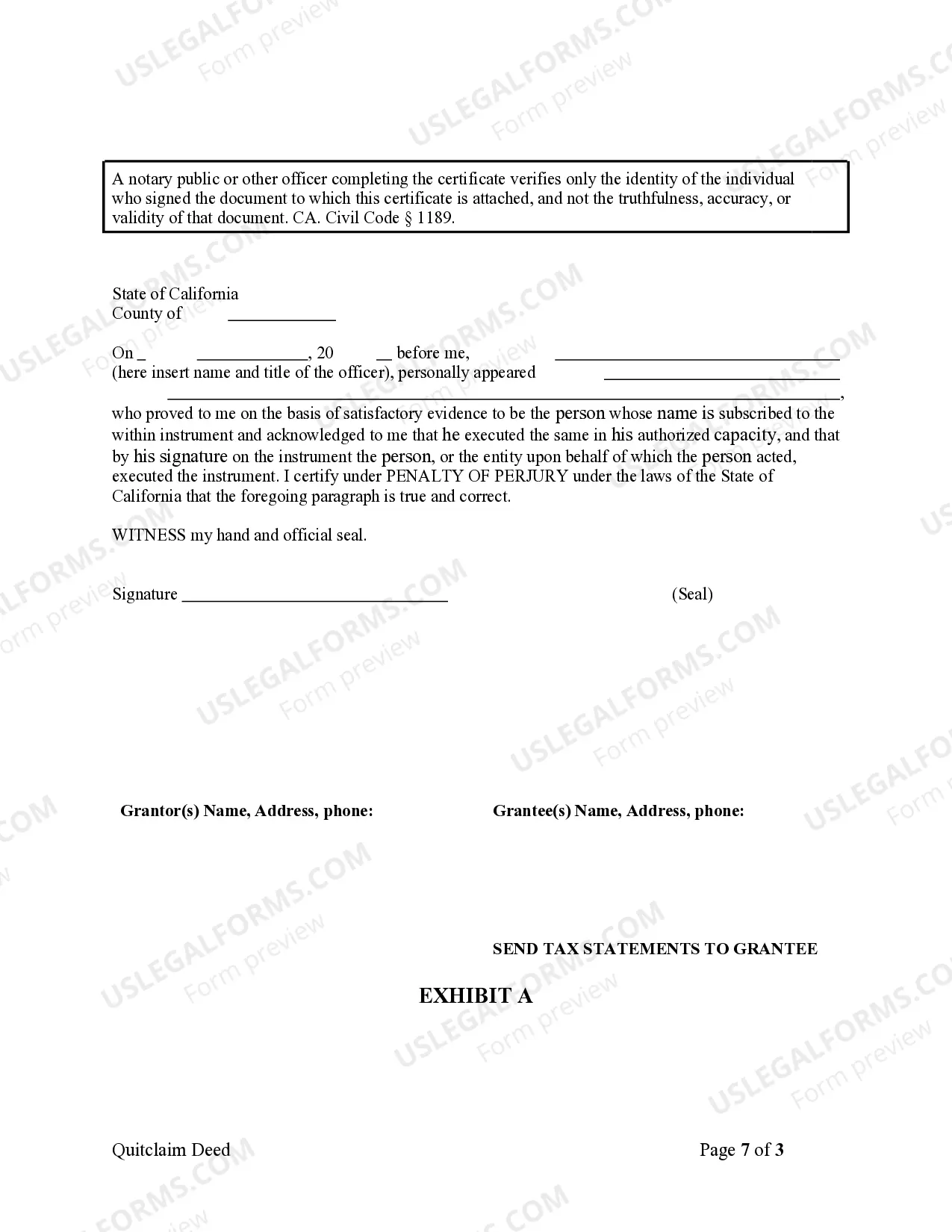

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A Temecula California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real estate property from a married couple to a Limited Liability Company (LLC) based in Temecula, California. This type of deed is commonly utilized when spouses wish to convey property they jointly own to their LLC, often for asset protection or business-related purposes. The Quitclaim Deed essentially serves as a legal instrument that confirms the couple's intention to relinquish their ownership interests in the property, transferring them to the LLC. Unlike traditional warranty deeds, Quitclaim Deeds offer no warranties or guarantees of the property's title or condition. Instead, they primarily rely on the couple's interest in transferring their rights. It's essential for both parties to understand the implications and potential risks associated with this type of deed. Several variations of the Temecula California Quitclaim Deed from Husband and Wife to LLC may exist, primarily differing in their specific purposes or conditions accompanying the transfer. Here are a few examples: 1. Standard Quitclaim Deed: The standard Temecula California Quitclaim Deed from Husband and Wife to LLC, without any additional conditions or agreements, is commonly used for straightforward transfers of property ownership. It provides a clear record of the couple's intent to convey their property rights to the LLC. 2. Asset Protection Quitclaim Deed: This type of Quitclaim Deed is often employed by married couples seeking to protect their property from potential personal liability. By transferring ownership to an LLC, the property becomes an asset of the business entity rather than the individuals, potentially safeguarding it from individual lawsuits or creditors. 3. Business Entity Formation Quitclaim Deed: When spouses decide to establish an LLC for business ventures and wish to include a specific property as part of the LLC's assets, a Business Entity Formation Quitclaim Deed is typically utilized. This deed explicitly states the intention to establish the LLC and simultaneously transfer ownership of the property to it. 4. Tax Planning Quitclaim Deed: For tax planning purposes, spouses may utilize a Quitclaim Deed to transfer property ownership to an LLC. This can enable them to take advantage of tax benefits or deductions associated with business ownership, real estate investments, or rental properties. In summary, the Temecula California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to an LLC based in Temecula, California. This conveyance serves various purposes, including asset protection, business formation, and tax planning. Understanding the specific type and purpose of the quitclaim deed is crucial when engaging in real estate transactions and seeking legal advice is highly recommended ensuring compliance with local laws and regulations.A Temecula California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer ownership of real estate property from a married couple to a Limited Liability Company (LLC) based in Temecula, California. This type of deed is commonly utilized when spouses wish to convey property they jointly own to their LLC, often for asset protection or business-related purposes. The Quitclaim Deed essentially serves as a legal instrument that confirms the couple's intention to relinquish their ownership interests in the property, transferring them to the LLC. Unlike traditional warranty deeds, Quitclaim Deeds offer no warranties or guarantees of the property's title or condition. Instead, they primarily rely on the couple's interest in transferring their rights. It's essential for both parties to understand the implications and potential risks associated with this type of deed. Several variations of the Temecula California Quitclaim Deed from Husband and Wife to LLC may exist, primarily differing in their specific purposes or conditions accompanying the transfer. Here are a few examples: 1. Standard Quitclaim Deed: The standard Temecula California Quitclaim Deed from Husband and Wife to LLC, without any additional conditions or agreements, is commonly used for straightforward transfers of property ownership. It provides a clear record of the couple's intent to convey their property rights to the LLC. 2. Asset Protection Quitclaim Deed: This type of Quitclaim Deed is often employed by married couples seeking to protect their property from potential personal liability. By transferring ownership to an LLC, the property becomes an asset of the business entity rather than the individuals, potentially safeguarding it from individual lawsuits or creditors. 3. Business Entity Formation Quitclaim Deed: When spouses decide to establish an LLC for business ventures and wish to include a specific property as part of the LLC's assets, a Business Entity Formation Quitclaim Deed is typically utilized. This deed explicitly states the intention to establish the LLC and simultaneously transfer ownership of the property to it. 4. Tax Planning Quitclaim Deed: For tax planning purposes, spouses may utilize a Quitclaim Deed to transfer property ownership to an LLC. This can enable them to take advantage of tax benefits or deductions associated with business ownership, real estate investments, or rental properties. In summary, the Temecula California Quitclaim Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to an LLC based in Temecula, California. This conveyance serves various purposes, including asset protection, business formation, and tax planning. Understanding the specific type and purpose of the quitclaim deed is crucial when engaging in real estate transactions and seeking legal advice is highly recommended ensuring compliance with local laws and regulations.