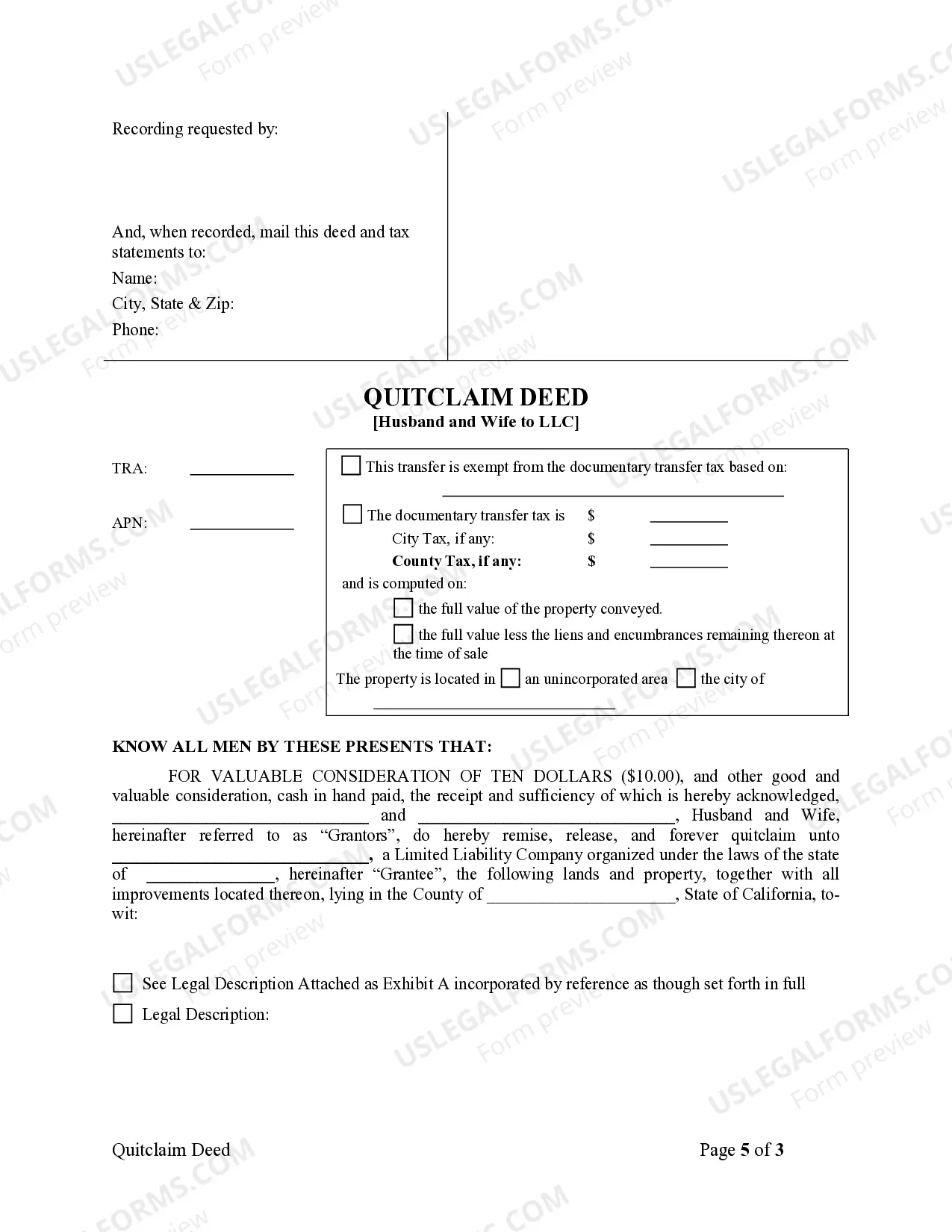

This Quitclaim Deed from Husband and Wife to LLC form is a Quitclaim Deed where the grantors are husband and wife and the grantee is a limited liability company. This deed conforms to all state statutory laws and reserves the right of grantors to reenter in light of any oil, gas, or minerals that are found on the described property.

A quitclaim deed is a legal document used to transfer the ownership interest of real property from one party to another, without providing any warranty or guarantee of the property's title. In the case of Thousand Oaks, California, a quitclaim deed is commonly used when a husband and wife wish to transfer the ownership of their property to a limited liability company (LLC) they have established. This type of transfer can have various purposes, including asset protection, estate planning, and taxation considerations. Thousand Oaks, California, offers several types of quitclaim deeds that can be utilized for the transfer of property ownership from a husband and wife to an LLC, depending on specific circumstances and requirements. Some notable types are: 1. Standard Thousand Oaks California Quitclaim Deed from Husband and Wife to LLC: This is the most common type of quitclaim deed used to transfer ownership of real property from a married couple to their LLC. It acts as a legal agreement that relinquishes the couple's interest in the property and effectively transfers it to the LLC. 2. Thousand Oaks California Quitclaim Deed with Consideration from Husband and Wife to LLC: In certain cases, a quitclaim deed may involve a consideration or monetary exchange between the parties involved. This variation includes a financial transaction, such as the LLC providing compensation to the husband and wife for their interest in the property being transferred. 3. Thousand Oaks California Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: Joint tenancy is a form of property ownership in which both spouses have an equal and undivided interest in the property. In this variant, a quitclaim deed is used to transfer the entire joint tenancy interest held by the couple to their LLC as a single entity. 4. Thousand Oaks California Community Property Quitclaim Deed from Husband and Wife to LLC: California is a community property state, meaning that assets acquired during marriage are generally considered joint property. This type of quitclaim deed is specific to community property, allowing the husband and wife to transfer their community property interest in the real estate to their LLC. It is important to note that the specific terminology, requirements, and regulations related to quitclaim deeds can vary from state to state, so it is crucial to consult with legal professionals or title companies specializing in Thousand Oaks, California, real estate transactions to ensure adherence to all legal procedures and regulations. Seeking professional advice will guarantee a smooth transfer of property ownership and mitigate any potential complications that may arise in the process.A quitclaim deed is a legal document used to transfer the ownership interest of real property from one party to another, without providing any warranty or guarantee of the property's title. In the case of Thousand Oaks, California, a quitclaim deed is commonly used when a husband and wife wish to transfer the ownership of their property to a limited liability company (LLC) they have established. This type of transfer can have various purposes, including asset protection, estate planning, and taxation considerations. Thousand Oaks, California, offers several types of quitclaim deeds that can be utilized for the transfer of property ownership from a husband and wife to an LLC, depending on specific circumstances and requirements. Some notable types are: 1. Standard Thousand Oaks California Quitclaim Deed from Husband and Wife to LLC: This is the most common type of quitclaim deed used to transfer ownership of real property from a married couple to their LLC. It acts as a legal agreement that relinquishes the couple's interest in the property and effectively transfers it to the LLC. 2. Thousand Oaks California Quitclaim Deed with Consideration from Husband and Wife to LLC: In certain cases, a quitclaim deed may involve a consideration or monetary exchange between the parties involved. This variation includes a financial transaction, such as the LLC providing compensation to the husband and wife for their interest in the property being transferred. 3. Thousand Oaks California Joint Tenancy Quitclaim Deed from Husband and Wife to LLC: Joint tenancy is a form of property ownership in which both spouses have an equal and undivided interest in the property. In this variant, a quitclaim deed is used to transfer the entire joint tenancy interest held by the couple to their LLC as a single entity. 4. Thousand Oaks California Community Property Quitclaim Deed from Husband and Wife to LLC: California is a community property state, meaning that assets acquired during marriage are generally considered joint property. This type of quitclaim deed is specific to community property, allowing the husband and wife to transfer their community property interest in the real estate to their LLC. It is important to note that the specific terminology, requirements, and regulations related to quitclaim deeds can vary from state to state, so it is crucial to consult with legal professionals or title companies specializing in Thousand Oaks, California, real estate transactions to ensure adherence to all legal procedures and regulations. Seeking professional advice will guarantee a smooth transfer of property ownership and mitigate any potential complications that may arise in the process.