This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

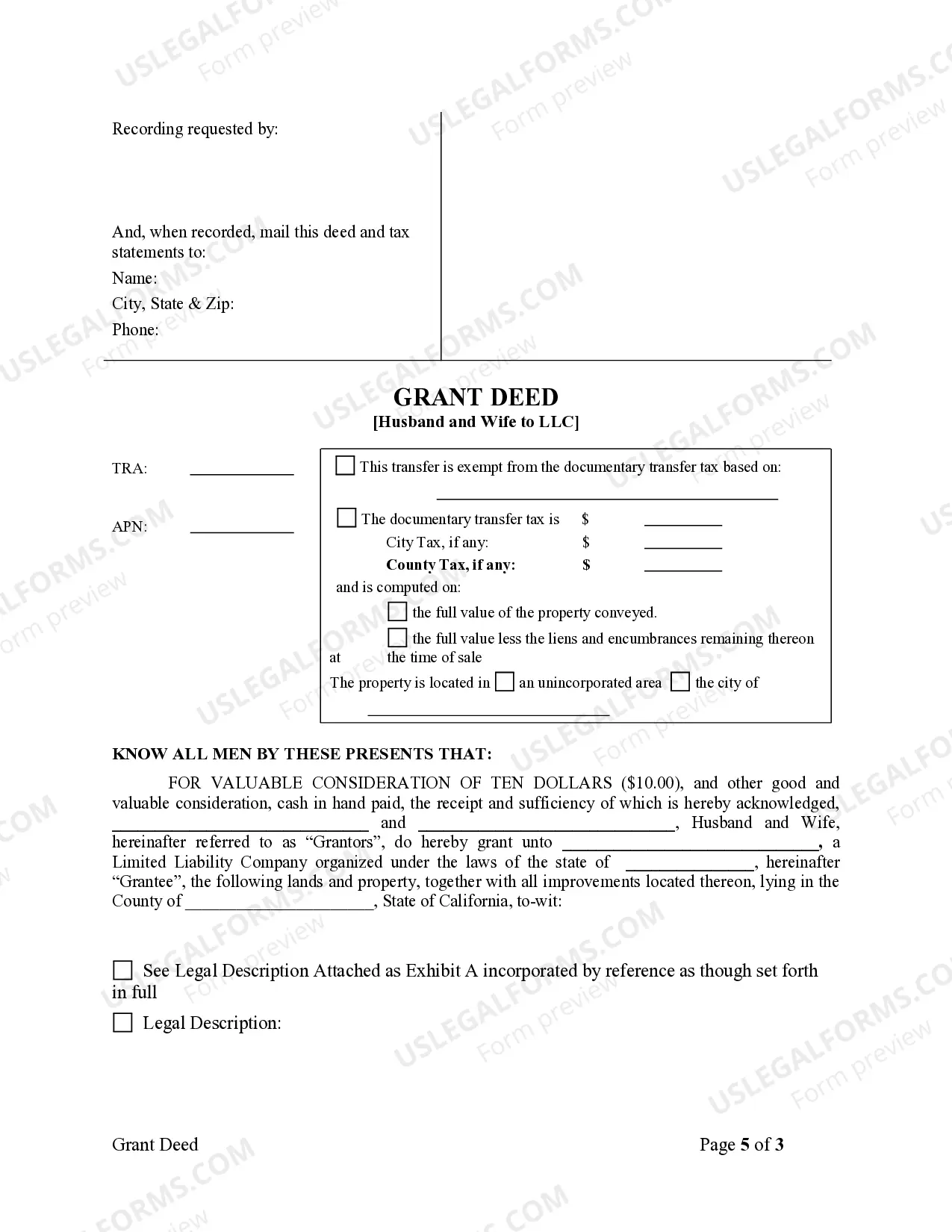

Title: Chico California Grant Deed from Husband and Wife to LLC — A Comprehensive Overview Keywords: Chico California, Grant Deed, Husband and Wife, LLC, Types Introduction: A Chico California Grant Deed from Husband and Wife to LLC is a legally binding document that transfers ownership of real property from a married couple to a Limited Liability Company (LLC). This comprehensive description will explore the various aspects of this process, including its purpose, key requirements, and potential benefits. Additionally, we will highlight any different types of Chico California Grant Deeds associated with this transaction. What is a Chico California Grant Deed from Husband and Wife to LLC? A Chico California Grant Deed from Husband and Wife to LLC is a legal instrument used to convey or transfer real property ownership rights from a married couple (granters) to an LLC (grantee). The granter's interest in the property is transferred to the grantee, ensuring a clear and official transfer of ownership. Key Elements: 1. Granter: The married couple who currently owns the property and intends to transfer ownership rights to an LLC. 2. Grantee: The LLC that will acquire the property's ownership rights. 3. Property Description: The physical details of the property, including the legal description, address, and parcel number. 4. Consideration: The amount or value exchanged for transferring the property ownership rights. 5. Signatures: Both the husband and wife must sign the deed in the presence of a notary public or other authorized official. Different Types of Chico California Grant Deeds from Husband and Wife to LLC: 1. General Grant Deed: This is the most common and straightforward type of Chico California Grant Deed, where the granter's interest in the property is transferred to the LLC without any specific warranties or guarantees. 2. Special Warranty Deed: This type of Grant Deed guarantees that the granter has not done anything to impair or restrict the property title while they owned it. However, it does not protect against any claims or issues arising before the granter's ownership. 3. Quitclaim Deed: Although less commonly used, a Quitclaim Deed transfers the granter's rights and interests in the property but does not provide any warranties or guarantees regarding the property's title. Benefits and Considerations: 1. Asset Protection: Transferring property ownership to an LLC can shield personal assets from potential liabilities associated with the property. 2. Business Structure: Conveying real estate to an LLC allows for better management and separation of personal and business assets. 3. Tax Planning: Properly structuring the transfer can provide tax benefits and deductions for the LLC, ultimately optimizing financial outcomes. 4. Seek Professional Guidance: Due to the legal complexities involved, it is highly recommended consulting an attorney or real estate professional to ensure compliance with California laws. Conclusion: A Chico California Grant Deed from Husband and Wife to LLC enables the transfer of real property ownership from a married couple to an LLC. By understanding the process, types, and potential benefits of such a transaction, individuals can make informed decisions about their property holdings. However, it is crucial to consult legal professionals or experts for personalized guidance tailored to individual circumstances.Title: Chico California Grant Deed from Husband and Wife to LLC — A Comprehensive Overview Keywords: Chico California, Grant Deed, Husband and Wife, LLC, Types Introduction: A Chico California Grant Deed from Husband and Wife to LLC is a legally binding document that transfers ownership of real property from a married couple to a Limited Liability Company (LLC). This comprehensive description will explore the various aspects of this process, including its purpose, key requirements, and potential benefits. Additionally, we will highlight any different types of Chico California Grant Deeds associated with this transaction. What is a Chico California Grant Deed from Husband and Wife to LLC? A Chico California Grant Deed from Husband and Wife to LLC is a legal instrument used to convey or transfer real property ownership rights from a married couple (granters) to an LLC (grantee). The granter's interest in the property is transferred to the grantee, ensuring a clear and official transfer of ownership. Key Elements: 1. Granter: The married couple who currently owns the property and intends to transfer ownership rights to an LLC. 2. Grantee: The LLC that will acquire the property's ownership rights. 3. Property Description: The physical details of the property, including the legal description, address, and parcel number. 4. Consideration: The amount or value exchanged for transferring the property ownership rights. 5. Signatures: Both the husband and wife must sign the deed in the presence of a notary public or other authorized official. Different Types of Chico California Grant Deeds from Husband and Wife to LLC: 1. General Grant Deed: This is the most common and straightforward type of Chico California Grant Deed, where the granter's interest in the property is transferred to the LLC without any specific warranties or guarantees. 2. Special Warranty Deed: This type of Grant Deed guarantees that the granter has not done anything to impair or restrict the property title while they owned it. However, it does not protect against any claims or issues arising before the granter's ownership. 3. Quitclaim Deed: Although less commonly used, a Quitclaim Deed transfers the granter's rights and interests in the property but does not provide any warranties or guarantees regarding the property's title. Benefits and Considerations: 1. Asset Protection: Transferring property ownership to an LLC can shield personal assets from potential liabilities associated with the property. 2. Business Structure: Conveying real estate to an LLC allows for better management and separation of personal and business assets. 3. Tax Planning: Properly structuring the transfer can provide tax benefits and deductions for the LLC, ultimately optimizing financial outcomes. 4. Seek Professional Guidance: Due to the legal complexities involved, it is highly recommended consulting an attorney or real estate professional to ensure compliance with California laws. Conclusion: A Chico California Grant Deed from Husband and Wife to LLC enables the transfer of real property ownership from a married couple to an LLC. By understanding the process, types, and potential benefits of such a transaction, individuals can make informed decisions about their property holdings. However, it is crucial to consult legal professionals or experts for personalized guidance tailored to individual circumstances.