This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

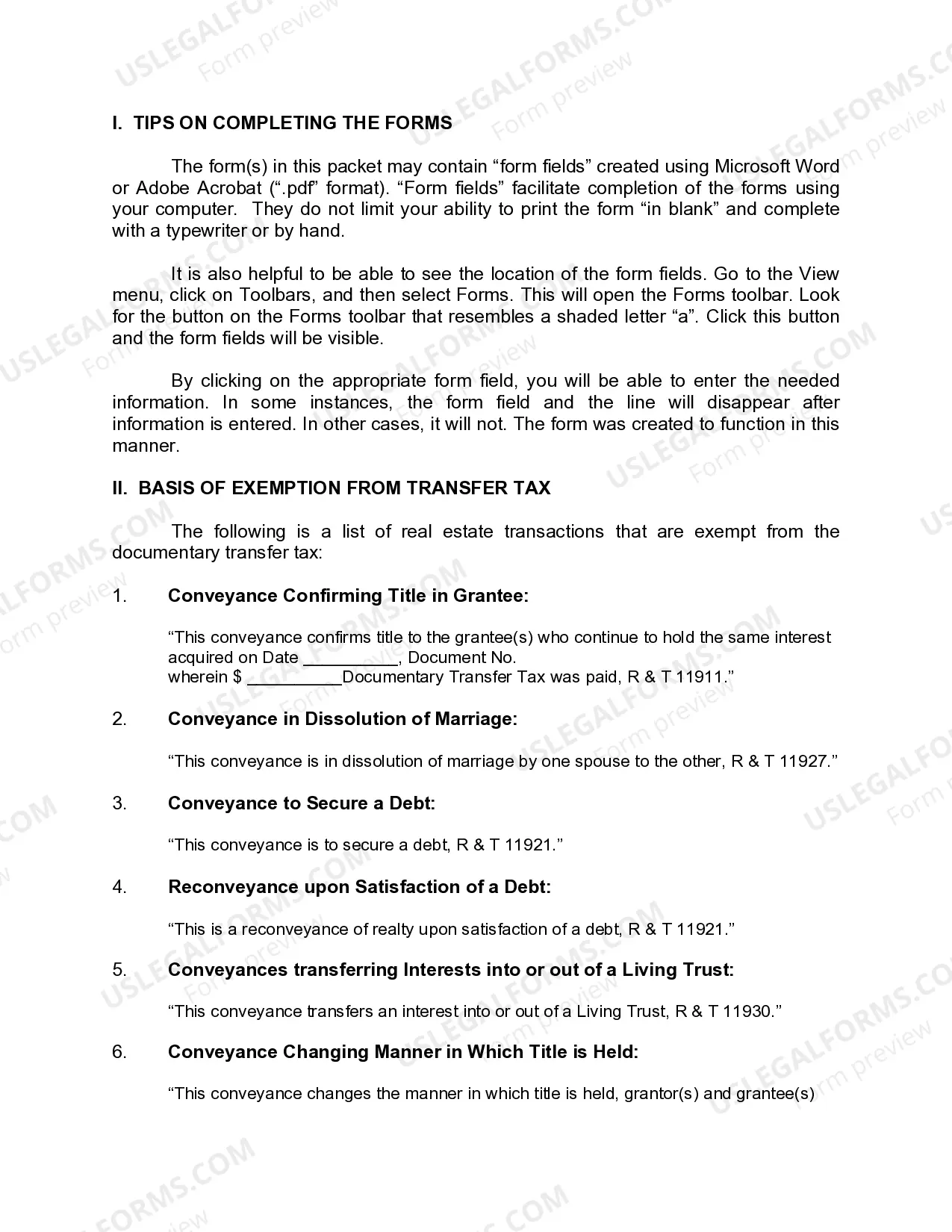

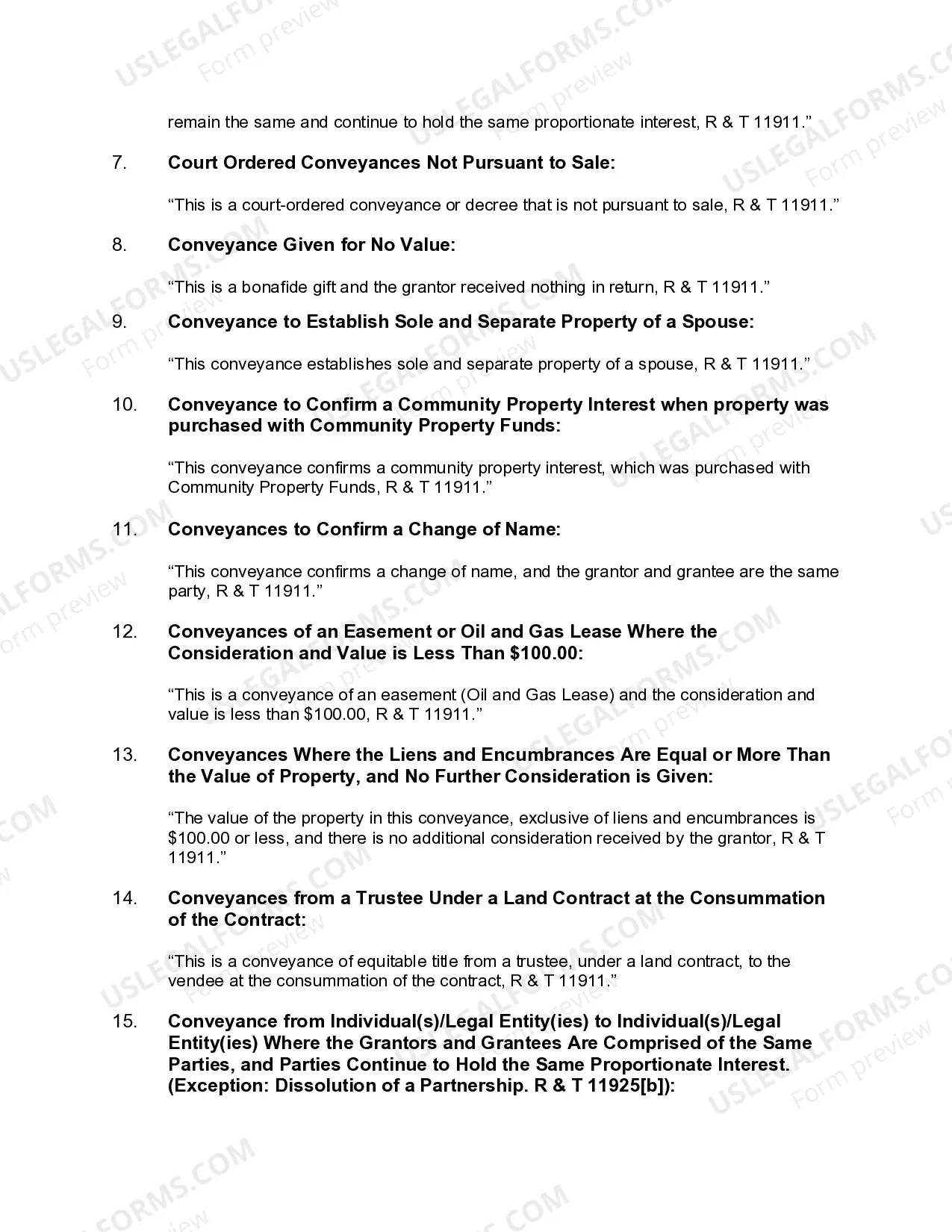

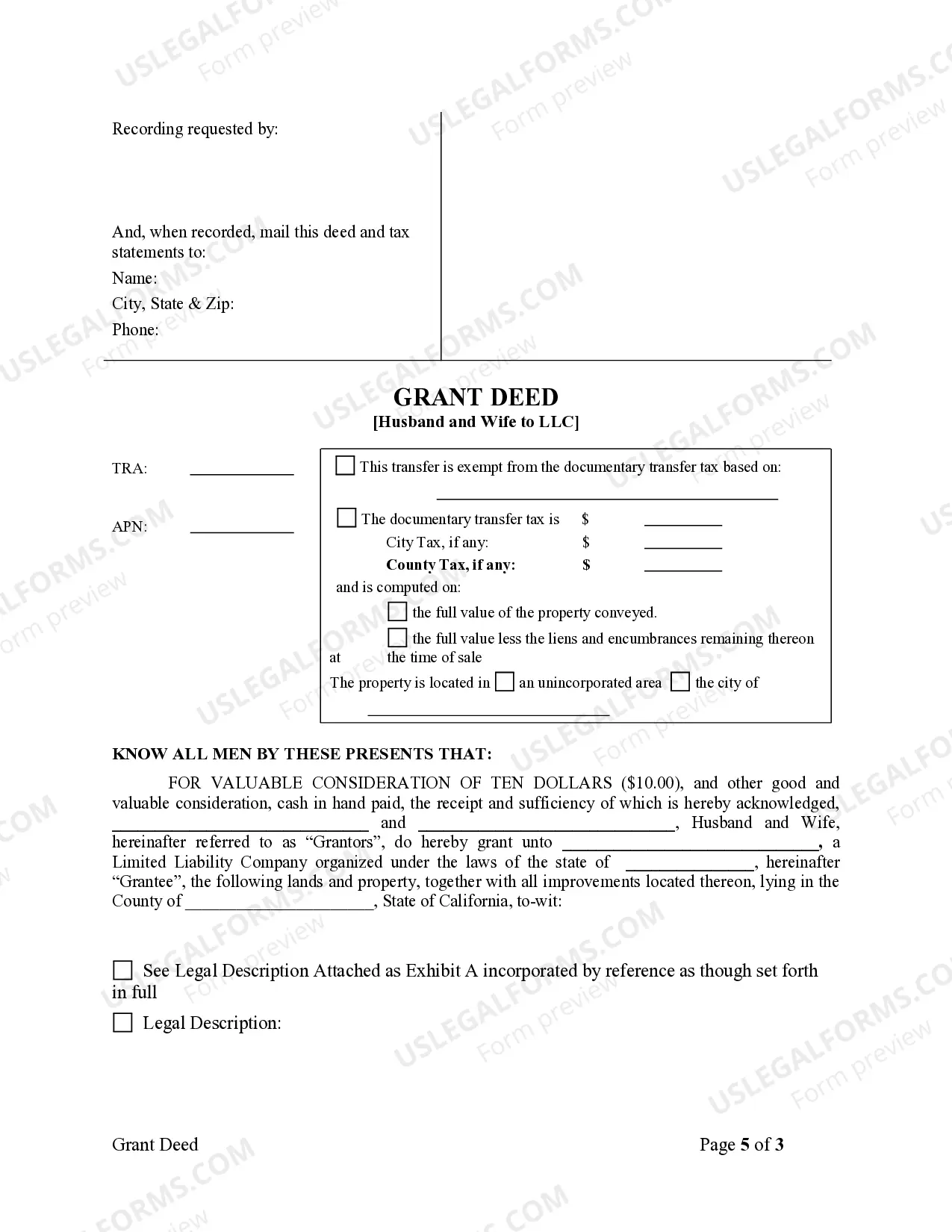

El Cajon, California Grant Deed from Husband and Wife to LLC is a legal document that transfers ownership of real estate property from a married couple to a Limited Liability Company (LLC) in El Cajon, California. This type of deed is commonly used when spouses decide to transfer property into a business entity they own, such as an LLC, for asset protection or tax purposes. The El Cajon California Grant Deed from Husband and Wife to LLC provides a formal record of the property transfer and ensures clear and clean ownership for the LLC, protecting both parties involved. This document outlines the marital status of the granters (husband and wife) and clearly describes the property being transferred, including its legal description, such as the lot of number, block number, and any accompanying documents such as a detailed metes and bounds survey. The grant deed typically includes specific language referring to the husband and wife, acknowledging their intent to transfer ownership to the LLC. It also includes the name of the LLC as the grantee, along with its legal address and other relevant details. Different types of El Cajon California Grant Deed from Husband and Wife to LLC can include variations based on specific circumstances. For example: 1. General Grant Deed: This is the standard form of the grant deed, representing the transfer of property ownership from spouses to their LLC without any additional conditions or restrictions. 2. Special Warranty Grant Deed: This type of grant deed provides a limited warranty from the husband and wife to the LLC, assuring that they have not done anything to negatively affect the title to the property during their ownership. 3. Quitclaim Deed: Although not technically considered a grant deed, a quitclaim deed can also be used for transferring property from a husband and wife to their LLC. However, it does not provide any warranty or guarantee of the title's status. Whether using a general grant deed, special warranty grant deed, or quitclaim deed, it is crucial to consult with a real estate attorney or legal professional familiar with California real estate law to ensure the deed accurately reflects the intentions of the spouses and complies with all relevant legal requirements. In conclusion, El Cajon, California Grant Deed from Husband and Wife to LLC is a legal instrument that facilitates the transfer of property ownership from a married couple to their LLC. It establishes a clear record of the transfer, provides protection for both parties, and ensures proper ownership of the property by the LLC.El Cajon, California Grant Deed from Husband and Wife to LLC is a legal document that transfers ownership of real estate property from a married couple to a Limited Liability Company (LLC) in El Cajon, California. This type of deed is commonly used when spouses decide to transfer property into a business entity they own, such as an LLC, for asset protection or tax purposes. The El Cajon California Grant Deed from Husband and Wife to LLC provides a formal record of the property transfer and ensures clear and clean ownership for the LLC, protecting both parties involved. This document outlines the marital status of the granters (husband and wife) and clearly describes the property being transferred, including its legal description, such as the lot of number, block number, and any accompanying documents such as a detailed metes and bounds survey. The grant deed typically includes specific language referring to the husband and wife, acknowledging their intent to transfer ownership to the LLC. It also includes the name of the LLC as the grantee, along with its legal address and other relevant details. Different types of El Cajon California Grant Deed from Husband and Wife to LLC can include variations based on specific circumstances. For example: 1. General Grant Deed: This is the standard form of the grant deed, representing the transfer of property ownership from spouses to their LLC without any additional conditions or restrictions. 2. Special Warranty Grant Deed: This type of grant deed provides a limited warranty from the husband and wife to the LLC, assuring that they have not done anything to negatively affect the title to the property during their ownership. 3. Quitclaim Deed: Although not technically considered a grant deed, a quitclaim deed can also be used for transferring property from a husband and wife to their LLC. However, it does not provide any warranty or guarantee of the title's status. Whether using a general grant deed, special warranty grant deed, or quitclaim deed, it is crucial to consult with a real estate attorney or legal professional familiar with California real estate law to ensure the deed accurately reflects the intentions of the spouses and complies with all relevant legal requirements. In conclusion, El Cajon, California Grant Deed from Husband and Wife to LLC is a legal instrument that facilitates the transfer of property ownership from a married couple to their LLC. It establishes a clear record of the transfer, provides protection for both parties, and ensures proper ownership of the property by the LLC.