This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

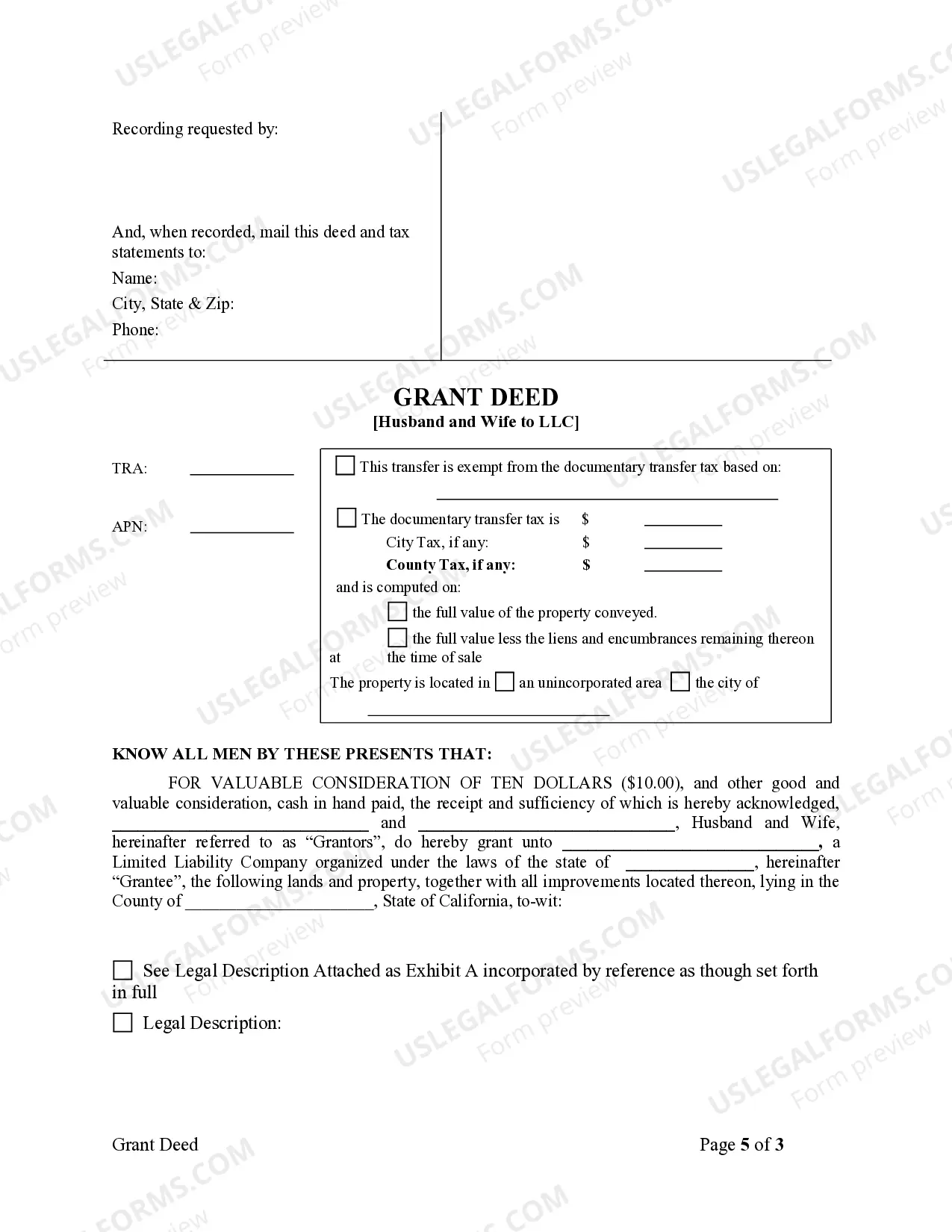

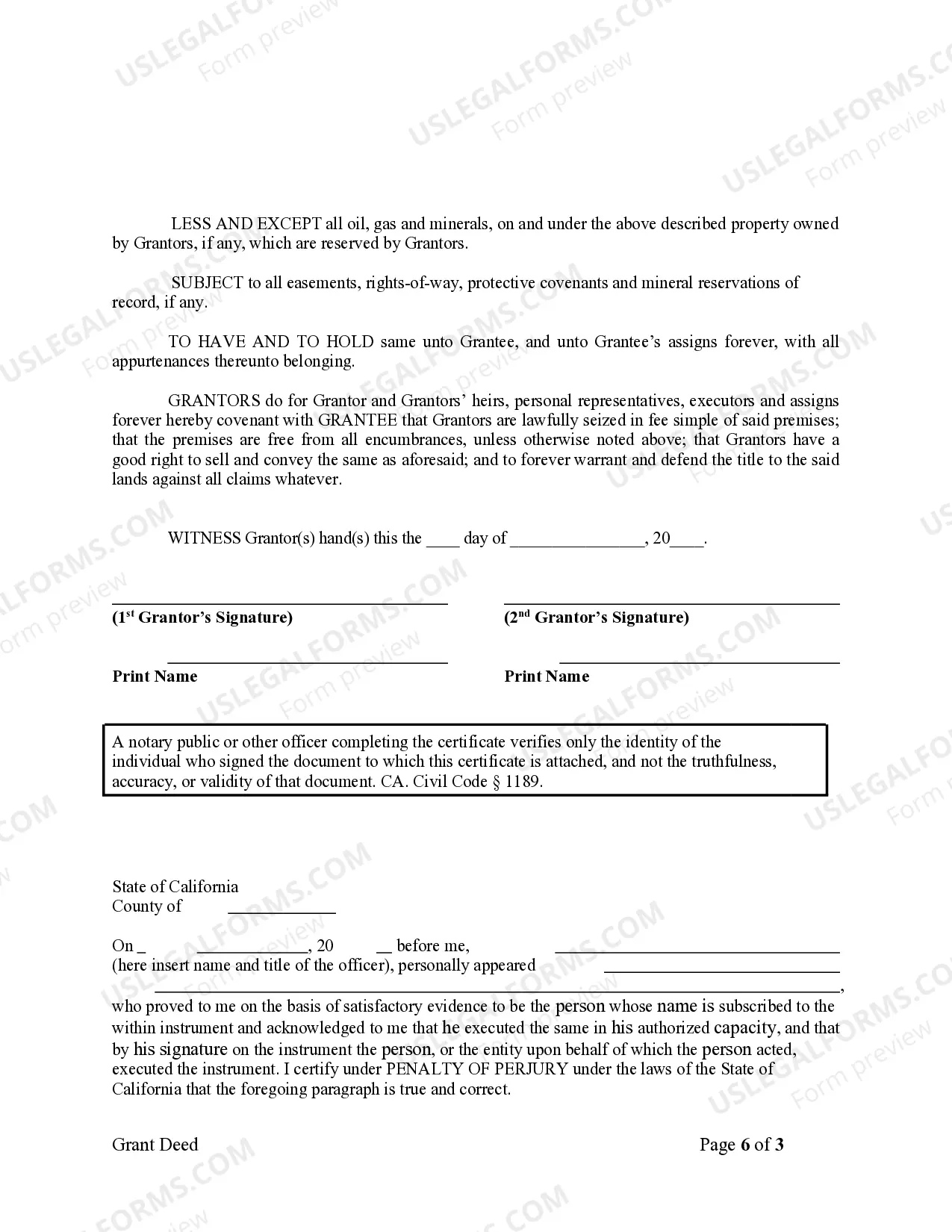

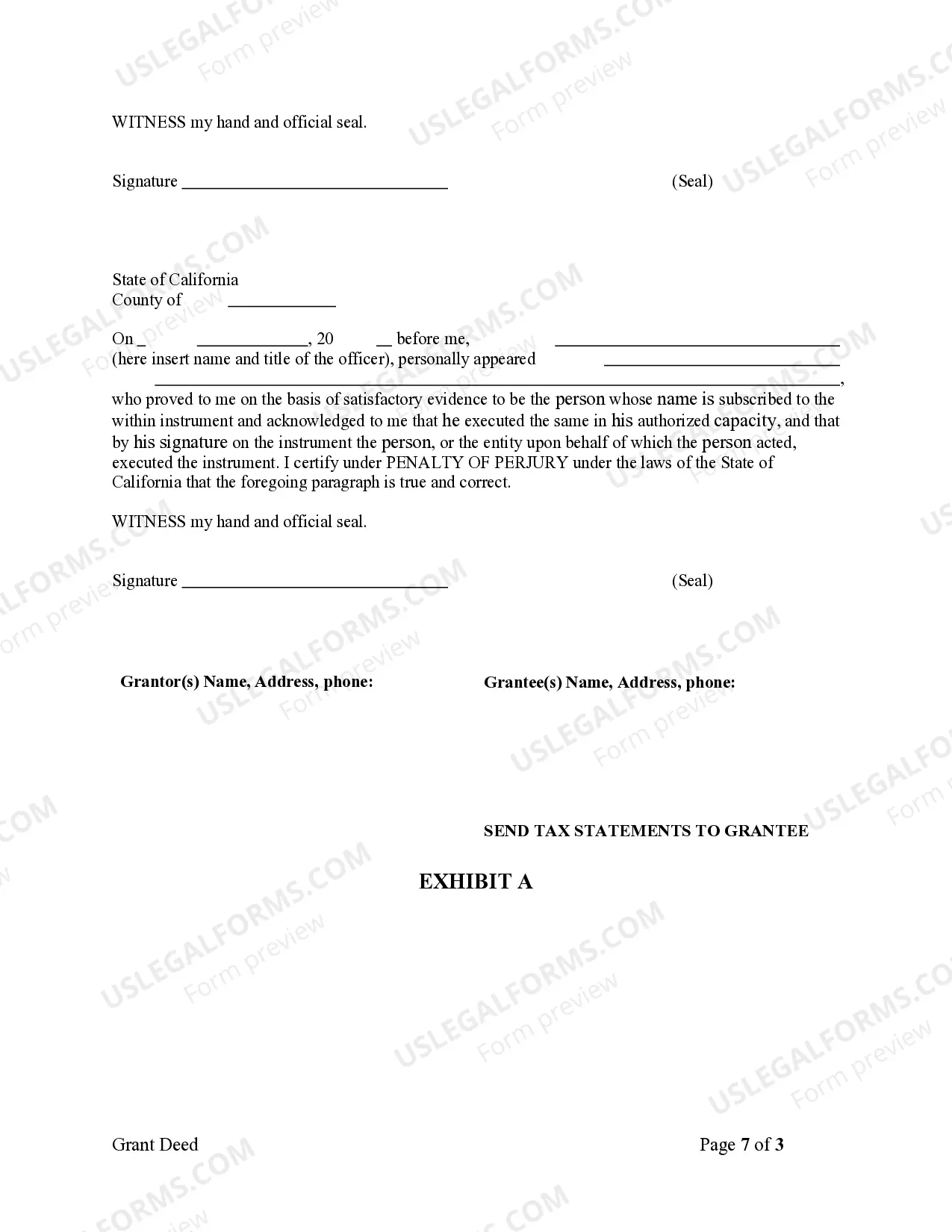

Escondido California Grant Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of ownership of real property from a married couple to a limited liability company (LLC) in the city of Escondido, California. This type of deed is commonly used when spouses wish to transfer their jointly owned property to an LLC, which offers various benefits such as liability protection and easier management of the property. When drafting an Escondido California Grant Deed from Husband and Wife to LLC, it is crucial to include specific information to ensure its validity and accuracy. Some key details typically included in this document are: 1. Parties Involved: Clearly identify the names and roles of the transferring parties (husband and wife) and the receiving party (LLC). Include their full legal names, addresses, and their respective roles, such as "granters" and "grantees." 2. Property Description: Provide a detailed description of the property being transferred, including the complete address, parcel number, and legal description. It is essential to accurately identify the property boundaries to eliminate any confusion or future disputes. 3. Consideration: State the consideration or payment being exchanged between the parties, which is typically the value of the property being transferred. It can be a sum of money, shares in the LLC, or other agreed-upon terms. 4. Terms and Conditions: Include any specific terms and conditions agreed upon by the parties involved. This may involve restrictions, limitations, or conditions associated with the property or the transfer process. 5. Signatures and Notarization: Each party involved should sign the grant deed. It is advisable to have the deed notarized by a licensed notary public for its legal validity. Different types of Escondido California Grant Deed from Husband and Wife to LLC may vary based on specific circumstances, such as the purpose of the transfer or additional arrangements made between the parties. Some examples of these variations are: 1. Interspousal Transfer Grant Deed (TGD) from Husband and Wife to LLC: This type of grant deed may be used when the property transfer occurs solely between the spouses, without involving any external parties. 2. Joint Tenancy Grant Deed from Husband and Wife to LLC: This form of grant deed may be utilized when the property is owned under joint tenancy by the husband and wife, and they wish to transfer their joint ownership to an LLC. It is important to consult with a legal professional or a real estate attorney to determine the appropriate type of grant deed that suits your specific circumstances and ensures compliance with Escondido, California, and state laws.