This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

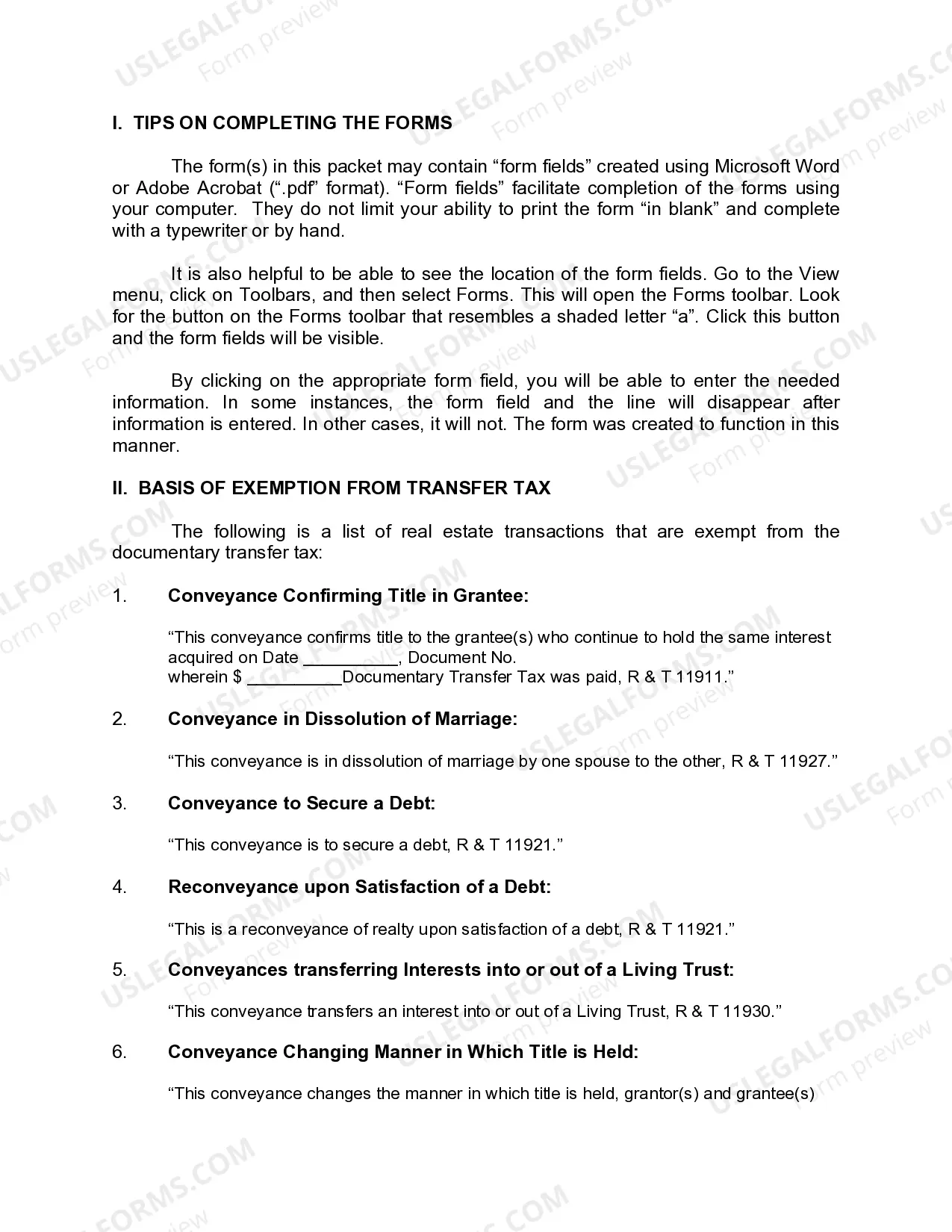

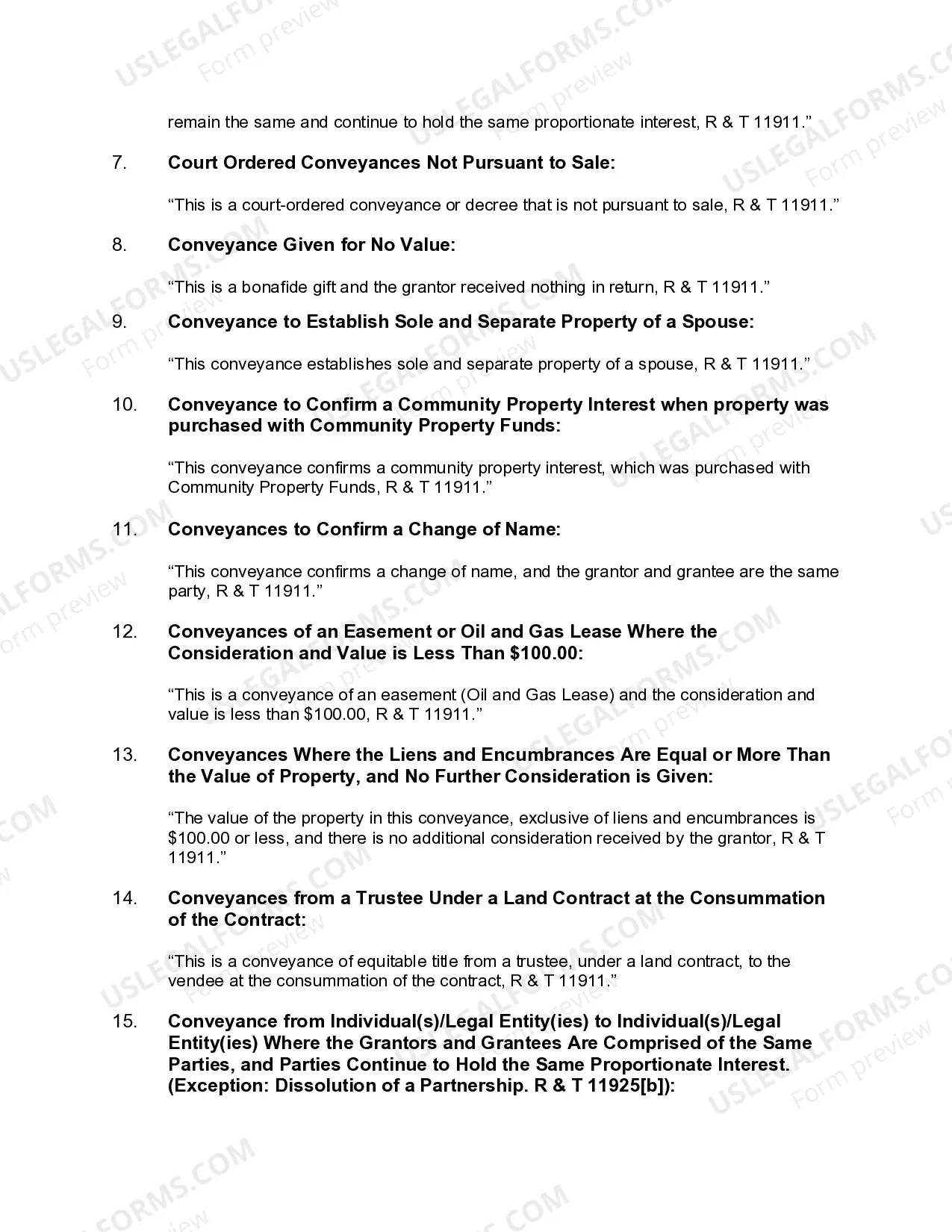

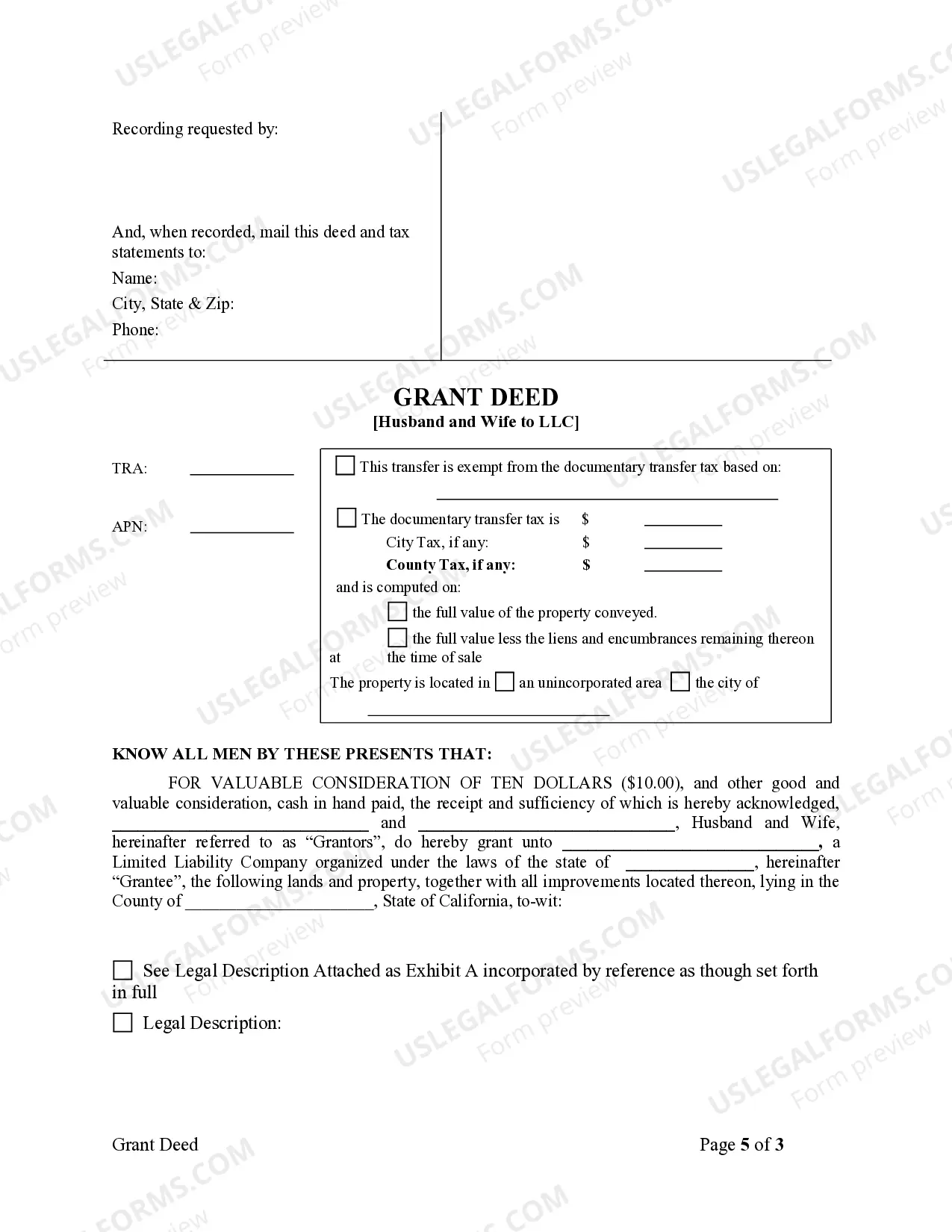

A Palmdale California Grant Deed from Husband and Wife to LLC is a legal document that signifies the transfer of ownership of a property from a married couple to a limited liability company (LLC) in Palmdale, California. This type of deed is commonly used when a married couple wants to transfer property ownership to their LLC, which offers liability protection and other benefits. The Grant Deed is a legal instrument used to transfer real property rights and interests. In this case, it is specifically designed to transfer the property rights from the husband and wife to their own LLC. By using a Grant Deed, the couple conveys all rights and title to the LLC, ensuring legal clarity and protection for both parties involved. This transfer of ownership provides several advantages, such as asset protection, tax benefits, and facilitating business operations. By transferring the property to an LLC, the couple can limit personal liability, consolidate their real estate holdings, and potentially gain tax advantages. Different types of Palmdale California Grant Deeds from Husband and Wife to LLC may include: 1. Traditional Grant Deed: This is the most common type of Grant Deed used for property transfers. It guarantees that the granter (the husband and wife) hold clear title to the property and have the legal authority to transfer it to the LLC. This type of deed is typically used when there are no specific limitations or conditions on the transfer. 2. Special Warranty Deed: In this type of Grant Deed, the granter guarantees that they have not done anything to diminish or encumber the property during their ownership, except as specifically stated in the deed. This means that the granter assures the LLC that they have not created any liens, mortgages, or other claims that may affect the property title. 3. Quitclaim Deed: A Quitclaim Deed is a type of Palmdale California Grant Deed that transfers the ownership interest from the husband and wife to the LLC without making any warranties. Unlike a traditional Grant Deed, it does not guarantee that the granter holds clear title or has the legal authority to transfer the property. Instead, it simply transfers whatever interest the granter has in the property, if any. It is important to note that consulting with a real estate attorney or legal professional is highly recommended when dealing with property transfers and drafting Grant Deeds. They can provide guidance on the specific requirements in Palmdale, California, and ensure the process is legally compliant and appropriately executed.A Palmdale California Grant Deed from Husband and Wife to LLC is a legal document that signifies the transfer of ownership of a property from a married couple to a limited liability company (LLC) in Palmdale, California. This type of deed is commonly used when a married couple wants to transfer property ownership to their LLC, which offers liability protection and other benefits. The Grant Deed is a legal instrument used to transfer real property rights and interests. In this case, it is specifically designed to transfer the property rights from the husband and wife to their own LLC. By using a Grant Deed, the couple conveys all rights and title to the LLC, ensuring legal clarity and protection for both parties involved. This transfer of ownership provides several advantages, such as asset protection, tax benefits, and facilitating business operations. By transferring the property to an LLC, the couple can limit personal liability, consolidate their real estate holdings, and potentially gain tax advantages. Different types of Palmdale California Grant Deeds from Husband and Wife to LLC may include: 1. Traditional Grant Deed: This is the most common type of Grant Deed used for property transfers. It guarantees that the granter (the husband and wife) hold clear title to the property and have the legal authority to transfer it to the LLC. This type of deed is typically used when there are no specific limitations or conditions on the transfer. 2. Special Warranty Deed: In this type of Grant Deed, the granter guarantees that they have not done anything to diminish or encumber the property during their ownership, except as specifically stated in the deed. This means that the granter assures the LLC that they have not created any liens, mortgages, or other claims that may affect the property title. 3. Quitclaim Deed: A Quitclaim Deed is a type of Palmdale California Grant Deed that transfers the ownership interest from the husband and wife to the LLC without making any warranties. Unlike a traditional Grant Deed, it does not guarantee that the granter holds clear title or has the legal authority to transfer the property. Instead, it simply transfers whatever interest the granter has in the property, if any. It is important to note that consulting with a real estate attorney or legal professional is highly recommended when dealing with property transfers and drafting Grant Deeds. They can provide guidance on the specific requirements in Palmdale, California, and ensure the process is legally compliant and appropriately executed.