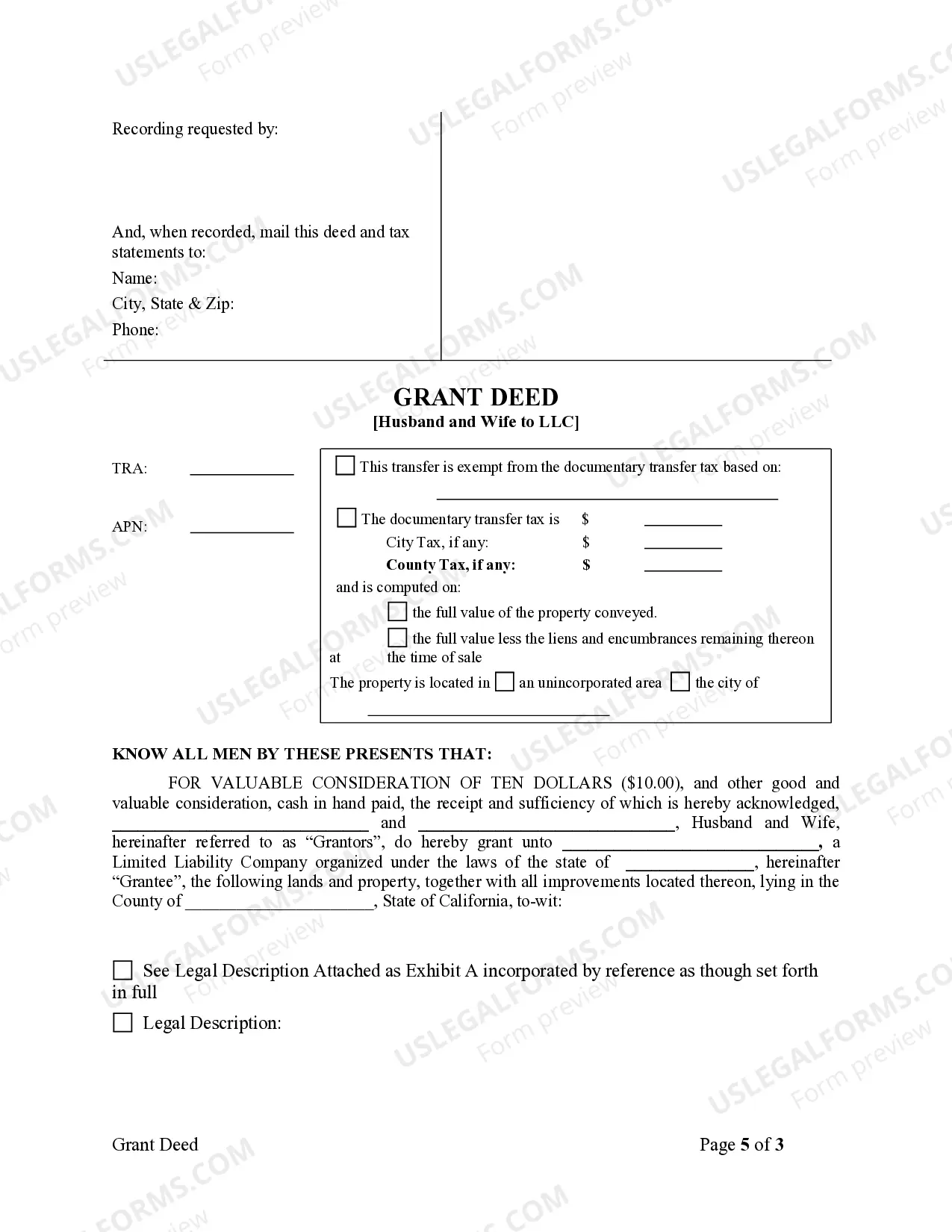

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

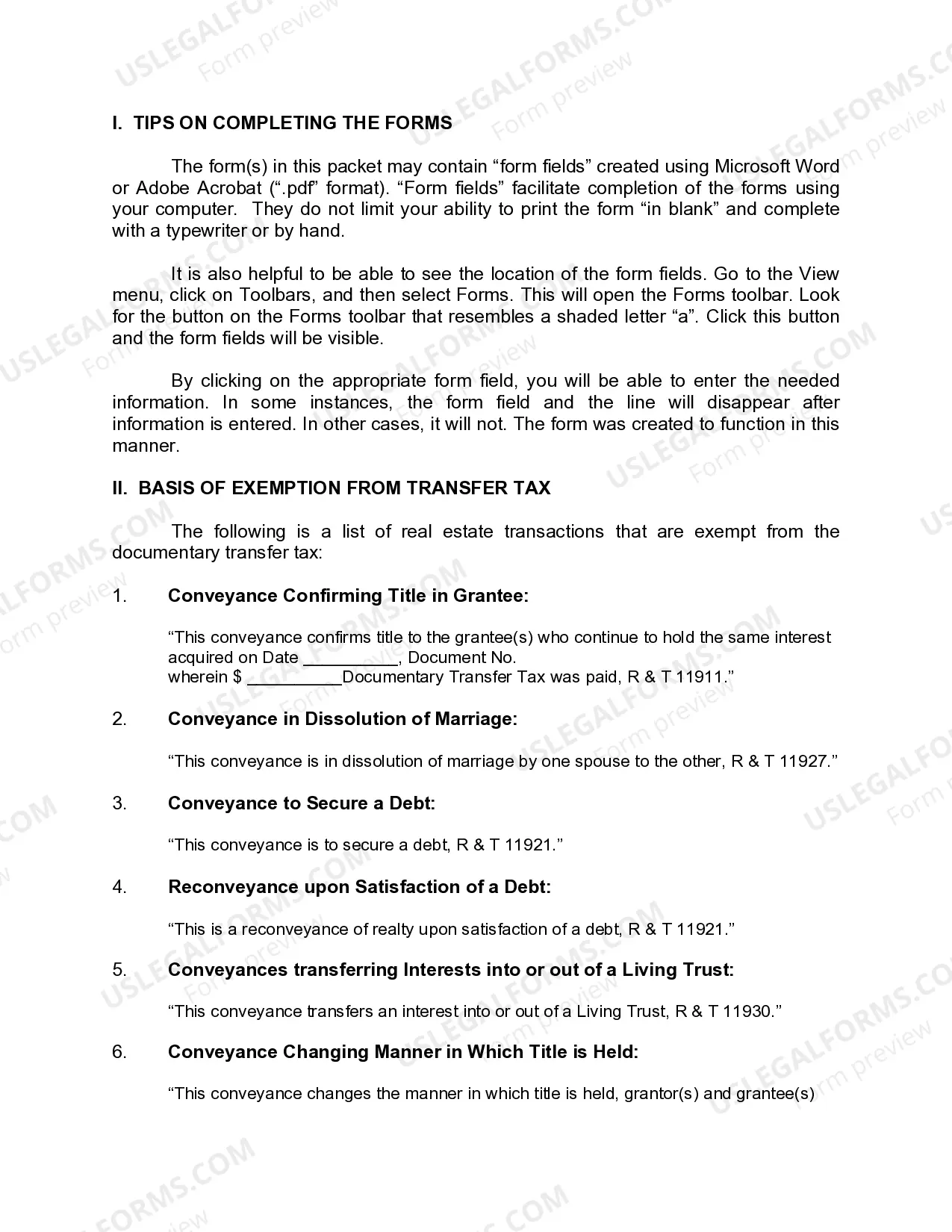

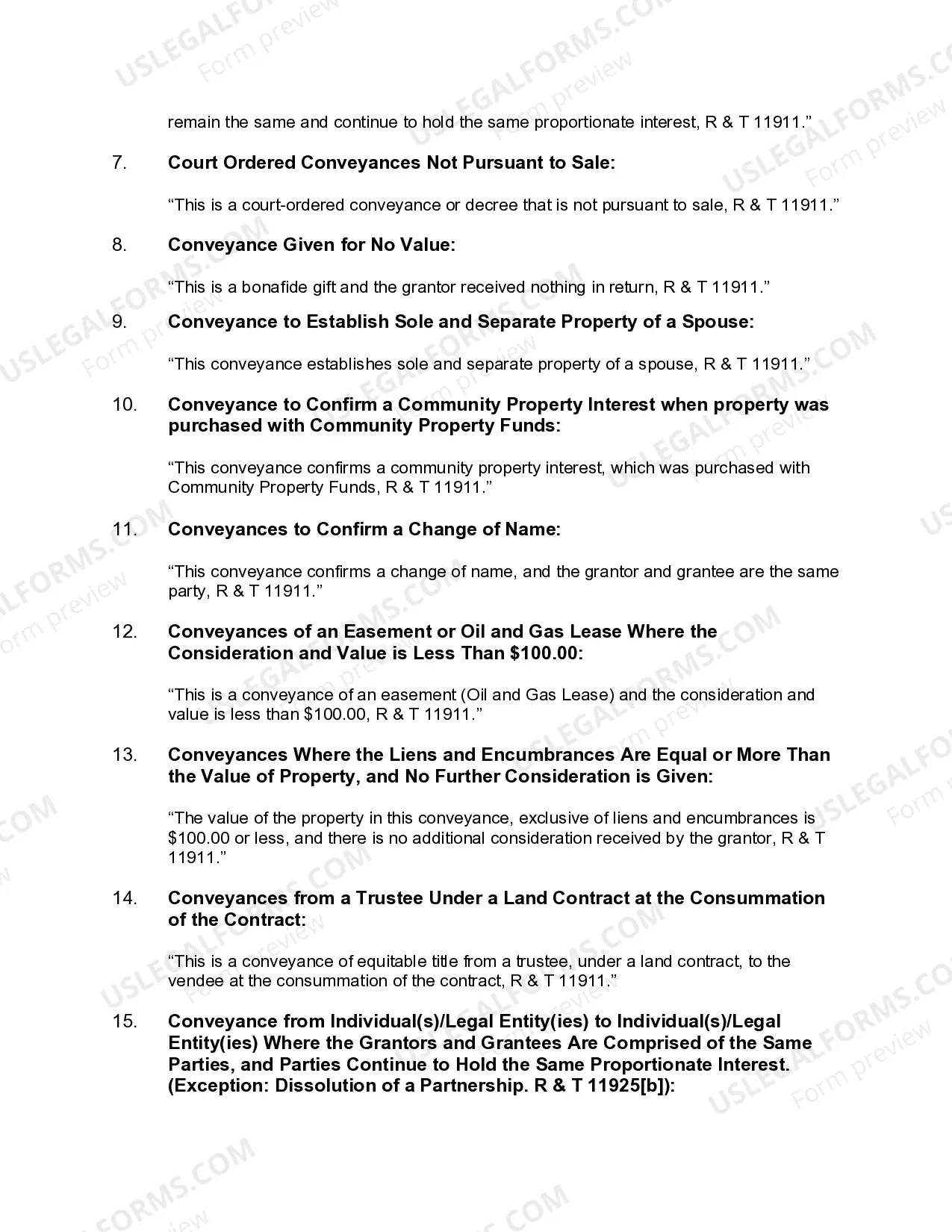

A Rancho Cucamonga California Grant Deed from Husband and Wife to LLC is a legal document that transfers ownership of real estate from a married couple to a limited liability company (LLC) in the city of Rancho Cucamonga, California. This type of deed is commonly used when a couple wishes to move their property into an LLC for various reasons including asset protection, tax advantages, or business purposes. The Rancho Cucamonga California Grant Deed from Husband and Wife to LLC is a straightforward process that involves the transfer of ownership rights in a property. It establishes the LLC as the new owner with legal rights and responsibilities regarding the property in question. This transfer ensures that the property is now owned, managed, and controlled by the LLC entity, rather than the individuals. There are several variations of the Rancho Cucamonga California Grant Deed from Husband and Wife to LLC, each serving specific purposes depending on the situation and goals of the property owners. Some common types of these deeds include: 1. General Grant Deed: This is the most common form of a grant deed and typically transfers ownership of the property from the husband and wife to the LLC. It provides a clean transfer of ownership with no warranties or guarantees, except that the husband and wife have not already transferred the property to someone else. 2. Special Warranty Deed: This type of grant deed guarantees that the husband and wife (granters) have not done anything to impair the title during their ownership of the property. It protects the grantee (the LLC) against any claims or encumbrances that may have occurred prior to their ownership. 3. Quitclaim Deed: Although less common for this specific transaction, a quitclaim deed may also be used to transfer ownership. However, it provides the least amount of protection to the grantee, as it conveys whatever interest the husband and wife have in the property without any warranties or guarantees. Regardless of the specific type of grant deed used, it is crucial to follow the legal requirements outlined by the state of California to ensure a valid and enforceable transfer of ownership. It is recommended to consult with a knowledgeable attorney or real estate professional when preparing and executing a Rancho Cucamonga California Grant Deed from Husband and Wife to LLC to ensure compliance with all relevant laws and regulations. This content provides a detailed description of what a Rancho Cucamonga California Grant Deed from Husband and Wife to LLC is and includes relevant keywords such as Rancho Cucamonga, California Grant Deed, Husband and Wife, LLC, transfer of ownership, asset protection, tax advantages, business purposes, General Grant Deed, Special Warranty Deed, Quitclaim Deed, and legal requirements.A Rancho Cucamonga California Grant Deed from Husband and Wife to LLC is a legal document that transfers ownership of real estate from a married couple to a limited liability company (LLC) in the city of Rancho Cucamonga, California. This type of deed is commonly used when a couple wishes to move their property into an LLC for various reasons including asset protection, tax advantages, or business purposes. The Rancho Cucamonga California Grant Deed from Husband and Wife to LLC is a straightforward process that involves the transfer of ownership rights in a property. It establishes the LLC as the new owner with legal rights and responsibilities regarding the property in question. This transfer ensures that the property is now owned, managed, and controlled by the LLC entity, rather than the individuals. There are several variations of the Rancho Cucamonga California Grant Deed from Husband and Wife to LLC, each serving specific purposes depending on the situation and goals of the property owners. Some common types of these deeds include: 1. General Grant Deed: This is the most common form of a grant deed and typically transfers ownership of the property from the husband and wife to the LLC. It provides a clean transfer of ownership with no warranties or guarantees, except that the husband and wife have not already transferred the property to someone else. 2. Special Warranty Deed: This type of grant deed guarantees that the husband and wife (granters) have not done anything to impair the title during their ownership of the property. It protects the grantee (the LLC) against any claims or encumbrances that may have occurred prior to their ownership. 3. Quitclaim Deed: Although less common for this specific transaction, a quitclaim deed may also be used to transfer ownership. However, it provides the least amount of protection to the grantee, as it conveys whatever interest the husband and wife have in the property without any warranties or guarantees. Regardless of the specific type of grant deed used, it is crucial to follow the legal requirements outlined by the state of California to ensure a valid and enforceable transfer of ownership. It is recommended to consult with a knowledgeable attorney or real estate professional when preparing and executing a Rancho Cucamonga California Grant Deed from Husband and Wife to LLC to ensure compliance with all relevant laws and regulations. This content provides a detailed description of what a Rancho Cucamonga California Grant Deed from Husband and Wife to LLC is and includes relevant keywords such as Rancho Cucamonga, California Grant Deed, Husband and Wife, LLC, transfer of ownership, asset protection, tax advantages, business purposes, General Grant Deed, Special Warranty Deed, Quitclaim Deed, and legal requirements.