This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

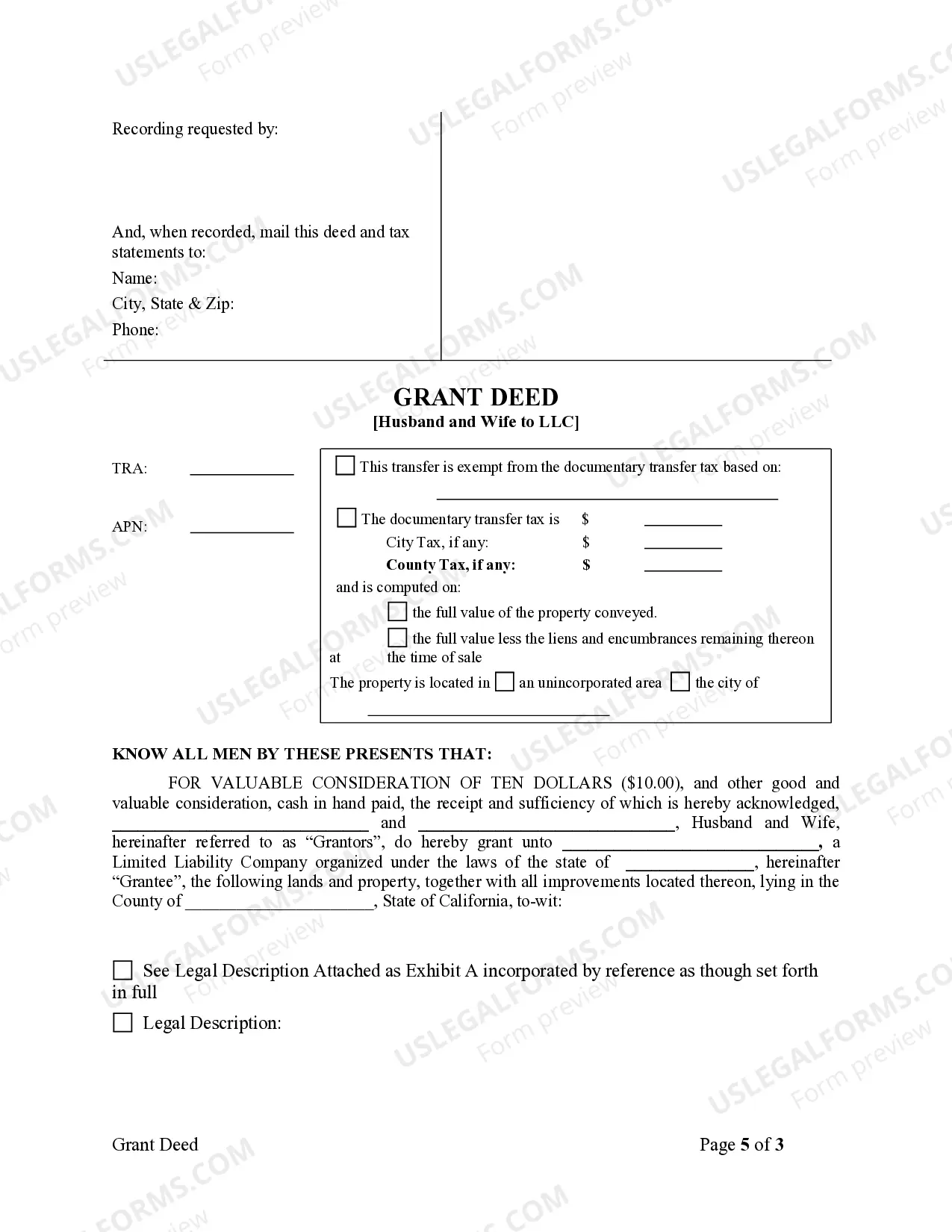

Title: Understanding the Rialto California Grant Deed from Husband and Wife to LLC Introduction: A Grant Deed is a legal document used to transfer ownership of real property from one party to another. In the context of Rialto, California, a specific type of Grant Deed is significant — the Grant Deed from Husband and Wife to LLC. This article will provide a detailed description of this type of Grant Deed, its purpose, process, and potential variations. 1. Purpose and Overview: The Grant Deed from Husband and Wife to LLC is commonly utilized when a married couple wishes to transfer ownership of a property they jointly own to an LLC (Limited Liability Company) in Rialto, California. This type of deed ensures the property's title is legally transferred from the individuals to the LLC, thereby protecting the couple's personal assets and providing liability protection. 2. Form and Stipulations: The Grant Deed from Husband and Wife to LLC follows a specific legal format in Rialto, California. It comprises essential information such as: — Names and addresses of the husband and wife, as granters (transferring parties). — Name and address of the LLC, as the grantee (recipient). — The property's legal description, including its boundaries and unique identifying factors. — Consideration (usually a nominal sum or mutual agreement). — Thgrantersrs' affirmation that they are the legal owners of the property, guaranteeing they have the right to transfer it. — Thgrantersrs' intention of granting the property, warranting that it is free from any undisclosed encumbrances. 3. Process and Execution: To initiate the Grant Deed from Husband and Wife to LLC in Rialto, California, the following steps are typically involved: — Research: The husband and wife should determine the requirements and restrictions set forth by the county recorder's office in Rialto, California. — Drafting: Engage a qualified attorney or legal professional to draft the Grant Deed. Accuracy and adherence to legal language and format are crucial. — Notarization: Both the husband and wife must sign the deed in the presence of a notary public, who will acknowledge their signatures. — Recording: The executed Grant Deed must be recorded at the San Bernardino County Recorder's Office to make the transfer officially recognized and permanently documented. Variations of the Rialto California Grant Deed from Husband and Wife to LLC: While the concept of the Grant Deed from Husband and Wife to LLC remains constant, there may be variations based on specific circumstances or preferences, such as: 1. Joint Tenancy with Right of Survivorship to LLC: This variation grants ownership of the property to the LLC, with the right of survivorship, ensuring that if one spouse passes away, the LLC automatically inherits their share. 2. Community Property to Domestic LLC: In this case, the property is considered community property, jointly owned by the married couple. Upon transfer to an LLC, it retains its community property status. This type of deed provides additional protection and tax benefits. 3. Separate Property to LLC: When a property held separately by one spouse is transferred to an LLC, this variation ensures that the separate property's distinction is maintained within the LLC. Conclusion: Understanding the intricacies of the Rialto California Grant Deed from Husband and Wife to LLC is crucial for couples seeking to transfer property to a limited liability company. Engaging legal professionals and following the proper procedural steps will ensure a smooth and legally binding transfer, protecting the parties involved while facilitating their business goals effectively.