This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

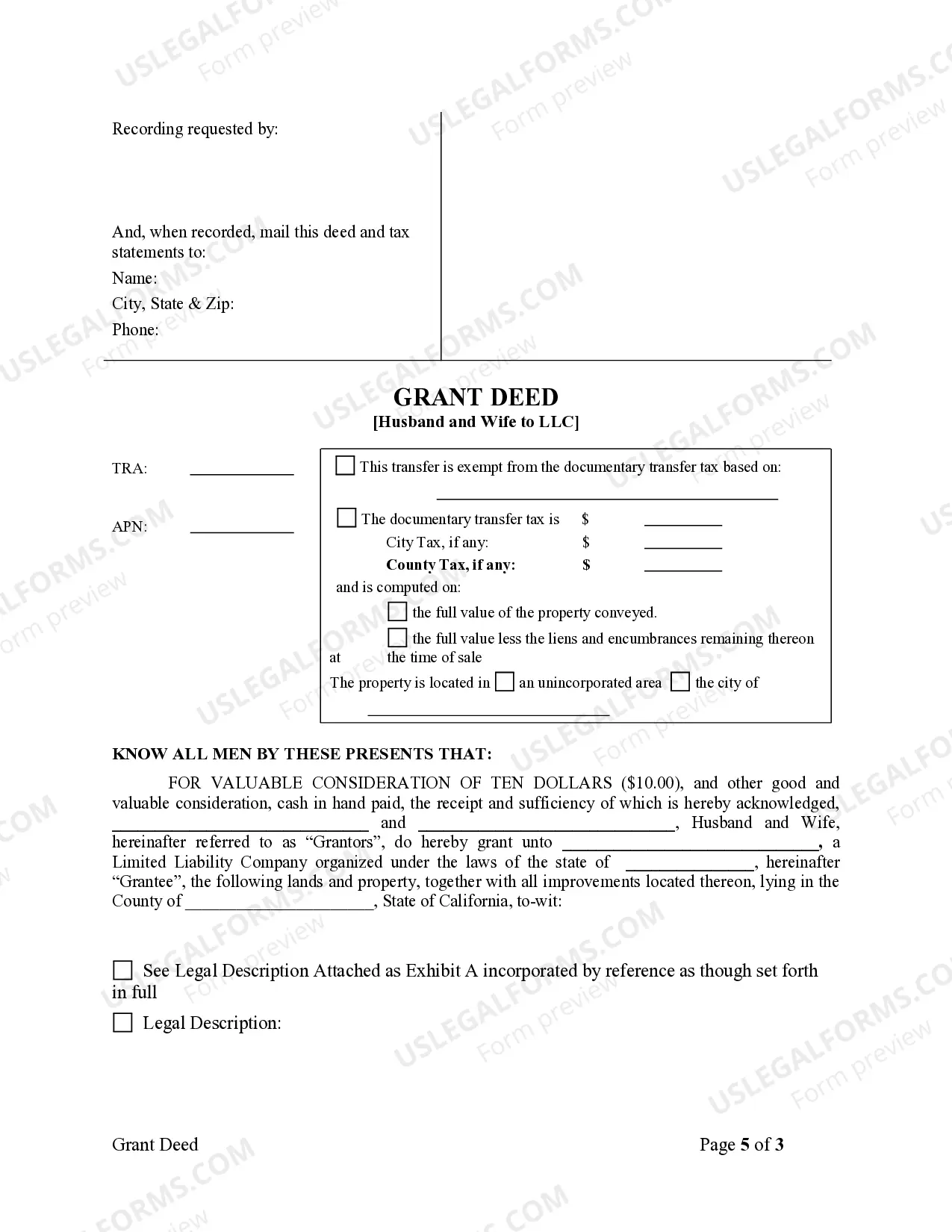

A Grant Deed from Husband and Wife to LLC in Roseville, California is a legal document used to transfer ownership of real property from a married couple to a limited liability company (LLC). This type of transaction is common when couples decide to convert the ownership of their property into an LLC for various reasons, such as asset protection or tax benefits. There are different variations of the Roseville California Grant Deed from Husband and Wife to LLC, including: 1. Traditional Grant Deed: This is the most common type of Grant Deed used in Roseville, California. It transfers the property ownership from the husband and wife to the LLC without any additional conditions or warranties. 2. Warranty Grant Deed: In this variation, the husband and wife provide warranties to the LLC, guaranteeing that they have full ownership rights and that the property is free from any hidden liens or encumbrances. 3. Special Warranty Grant Deed: Similar to the Warranty Grant Deed, the husband and wife provide warranties, but these warranties only cover the period during which they owned the property. 4. Quitclaim Deed: Although not technically a Grant Deed, a Quitclaim Deed can also be used to transfer ownership from husband and wife to an LLC. However, it does not provide any warranties or guarantees about the ownership status or condition of the property. When executing a Grant Deed from Husband and Wife to LLC in Roseville, California, several essential elements should be included in the document: 1. Date and parties: The Grant Deed should clearly state the date of the transfer and identify the husband and wife as granters and the LLC as the grantee. 2. Legal description: A detailed legal description of the property should be provided to ensure accuracy and avoid any disputes in the future. 3. Consideration: The consideration or payment made for the transfer should be stated, even if it is a nominal amount or the transfer is done without any monetary exchange. 4. Granter's signature: Both the husband and wife should sign the Grant Deed in the presence of a notary public. Their signatures signify their voluntary consent to transfer the property to the LLC. 5. Witness or notary acknowledgment: The Grant Deed should include an acknowledgment section where a notary public or witnesses can verify the authenticity of the signatures. It is important to consult an experienced real estate attorney or a professional in Roseville, California to ensure that the Grant Deed is correctly prepared and executed according to the state's laws and regulations. Keywords: Roseville California, Grant Deed, Husband and Wife, LLC, ownership, real property, legal document, limited liability company, variations, traditional grant deed, warranty grant deed, special warranty grant deed, quitclaim deed, date, parties, legal description, consideration, granter's signature, witness, notary acknowledgment.A Grant Deed from Husband and Wife to LLC in Roseville, California is a legal document used to transfer ownership of real property from a married couple to a limited liability company (LLC). This type of transaction is common when couples decide to convert the ownership of their property into an LLC for various reasons, such as asset protection or tax benefits. There are different variations of the Roseville California Grant Deed from Husband and Wife to LLC, including: 1. Traditional Grant Deed: This is the most common type of Grant Deed used in Roseville, California. It transfers the property ownership from the husband and wife to the LLC without any additional conditions or warranties. 2. Warranty Grant Deed: In this variation, the husband and wife provide warranties to the LLC, guaranteeing that they have full ownership rights and that the property is free from any hidden liens or encumbrances. 3. Special Warranty Grant Deed: Similar to the Warranty Grant Deed, the husband and wife provide warranties, but these warranties only cover the period during which they owned the property. 4. Quitclaim Deed: Although not technically a Grant Deed, a Quitclaim Deed can also be used to transfer ownership from husband and wife to an LLC. However, it does not provide any warranties or guarantees about the ownership status or condition of the property. When executing a Grant Deed from Husband and Wife to LLC in Roseville, California, several essential elements should be included in the document: 1. Date and parties: The Grant Deed should clearly state the date of the transfer and identify the husband and wife as granters and the LLC as the grantee. 2. Legal description: A detailed legal description of the property should be provided to ensure accuracy and avoid any disputes in the future. 3. Consideration: The consideration or payment made for the transfer should be stated, even if it is a nominal amount or the transfer is done without any monetary exchange. 4. Granter's signature: Both the husband and wife should sign the Grant Deed in the presence of a notary public. Their signatures signify their voluntary consent to transfer the property to the LLC. 5. Witness or notary acknowledgment: The Grant Deed should include an acknowledgment section where a notary public or witnesses can verify the authenticity of the signatures. It is important to consult an experienced real estate attorney or a professional in Roseville, California to ensure that the Grant Deed is correctly prepared and executed according to the state's laws and regulations. Keywords: Roseville California, Grant Deed, Husband and Wife, LLC, ownership, real property, legal document, limited liability company, variations, traditional grant deed, warranty grant deed, special warranty grant deed, quitclaim deed, date, parties, legal description, consideration, granter's signature, witness, notary acknowledgment.