This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

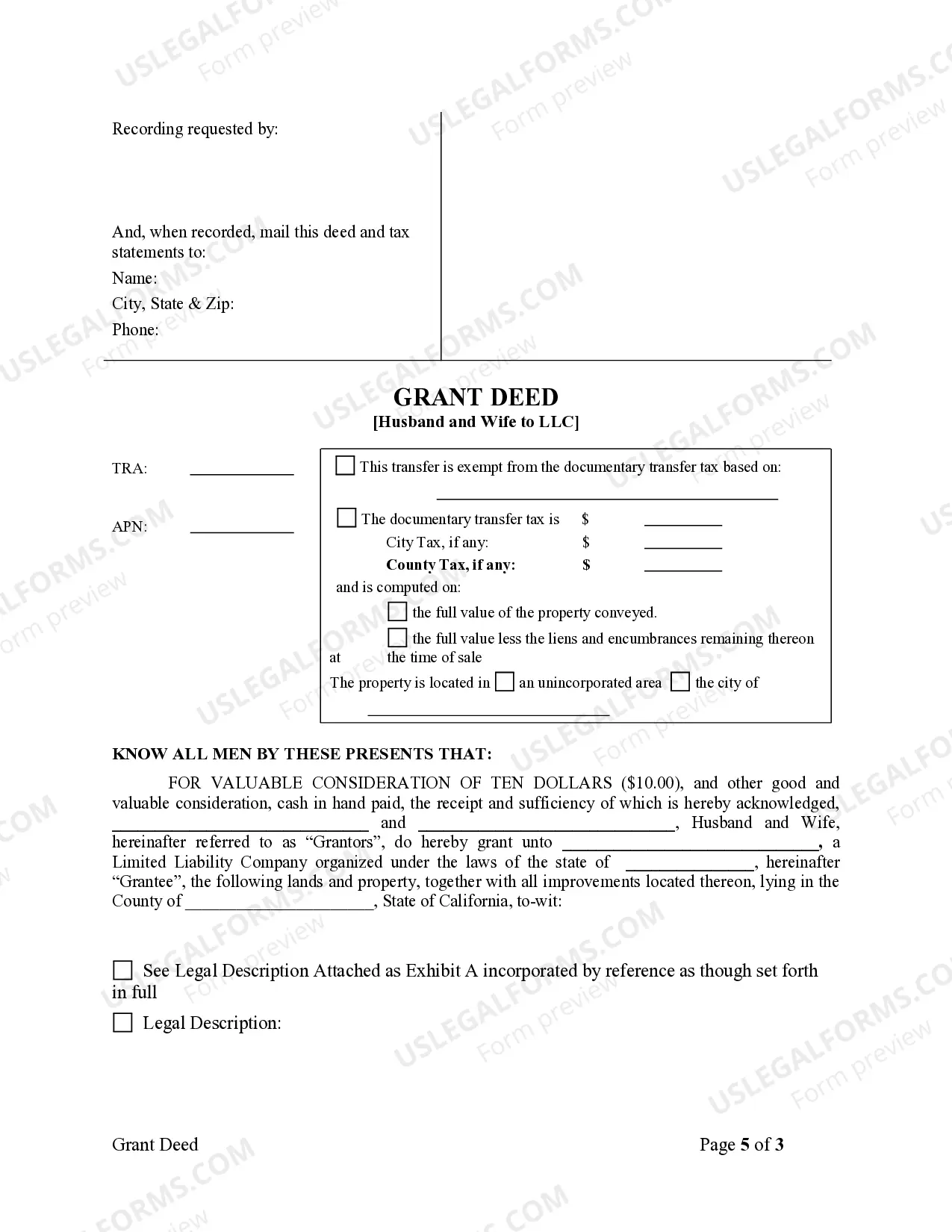

A Sacramento California Grant Deed from Husband and Wife to LLC is a legally binding document that transfers real property ownership from a married couple to a limited liability company (LLC) in the Sacramento area. This type of deed is commonly used when a couple wants to transfer property to their LLC for business or asset protection purposes. The Sacramento California Grant Deed from Husband and Wife to LLC includes relevant information such as the names of the husband and wife, their marital status, the LLC's name and address, and the specific details of the property being transferred. The deed also contains a legal description of the property, which typically includes the address, lot number, parcel number, and any other relevant identifying information. This type of grant deed in Sacramento has a few variations, including: 1. Sacramento California Grant Deed from Husband and Wife to LLC — Community Property: This type of grant deed is used when the property being transferred is considered community property, which means that it is jointly owned by the husband and wife. The deed will specify the ownership interest each spouse has in the property and how it will be transferred to the LLC. 2. Sacramento California Grant Deed from Husband and Wife to LLC — Separate Property: This variation is used when the property being transferred is considered separate property, meaning it is owned individually by either the husband or wife. The deed will outline the separate ownership interests and the process of transferring the property to the LLC. 3. Sacramento California Grant Deed from Husband and Wife to LLC — Tenancy in Common: This type of grant deed is used when the property being transferred is owned as tenants in common, meaning each spouse has a divided ownership interest in the property. The deed will reflect the respective ownership percentages and how they will be transferred to the LLC. It is essential to consult with a qualified attorney or title company when preparing a Sacramento California Grant Deed from Husband and Wife to LLC to ensure all legal requirements are met, and the deed accurately reflects the desired property transfer. Additionally, appropriate county-specific keywords may include "Sacramento County Grant Deed," "California real estate transfer," "deed recording in Sacramento," and "property ownership transfer Sacramento LLC." Remember, the information provided here is for general informational purposes only and should not be considered legal advice. It is advisable to seek professional assistance when dealing with legal documents and property transfers.A Sacramento California Grant Deed from Husband and Wife to LLC is a legally binding document that transfers real property ownership from a married couple to a limited liability company (LLC) in the Sacramento area. This type of deed is commonly used when a couple wants to transfer property to their LLC for business or asset protection purposes. The Sacramento California Grant Deed from Husband and Wife to LLC includes relevant information such as the names of the husband and wife, their marital status, the LLC's name and address, and the specific details of the property being transferred. The deed also contains a legal description of the property, which typically includes the address, lot number, parcel number, and any other relevant identifying information. This type of grant deed in Sacramento has a few variations, including: 1. Sacramento California Grant Deed from Husband and Wife to LLC — Community Property: This type of grant deed is used when the property being transferred is considered community property, which means that it is jointly owned by the husband and wife. The deed will specify the ownership interest each spouse has in the property and how it will be transferred to the LLC. 2. Sacramento California Grant Deed from Husband and Wife to LLC — Separate Property: This variation is used when the property being transferred is considered separate property, meaning it is owned individually by either the husband or wife. The deed will outline the separate ownership interests and the process of transferring the property to the LLC. 3. Sacramento California Grant Deed from Husband and Wife to LLC — Tenancy in Common: This type of grant deed is used when the property being transferred is owned as tenants in common, meaning each spouse has a divided ownership interest in the property. The deed will reflect the respective ownership percentages and how they will be transferred to the LLC. It is essential to consult with a qualified attorney or title company when preparing a Sacramento California Grant Deed from Husband and Wife to LLC to ensure all legal requirements are met, and the deed accurately reflects the desired property transfer. Additionally, appropriate county-specific keywords may include "Sacramento County Grant Deed," "California real estate transfer," "deed recording in Sacramento," and "property ownership transfer Sacramento LLC." Remember, the information provided here is for general informational purposes only and should not be considered legal advice. It is advisable to seek professional assistance when dealing with legal documents and property transfers.