This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

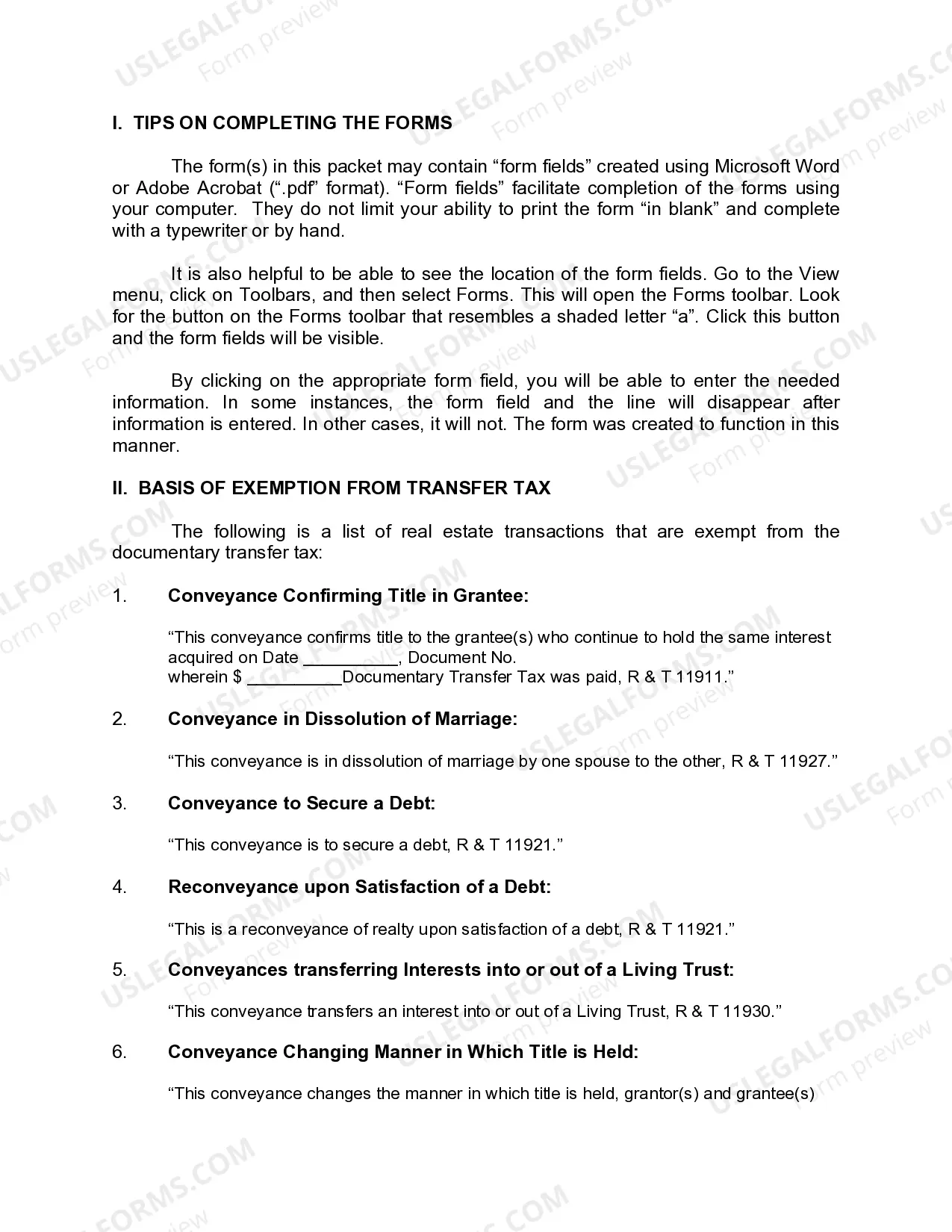

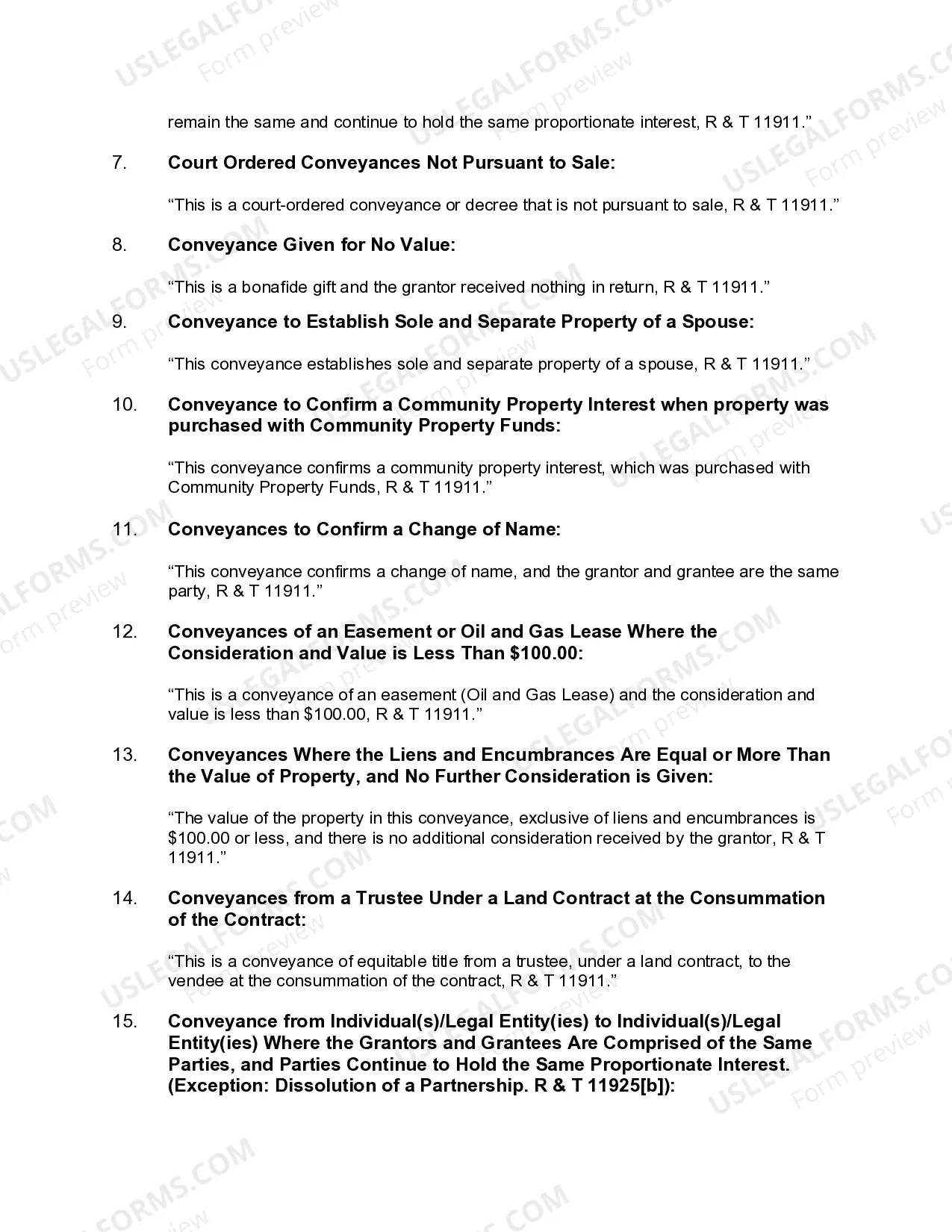

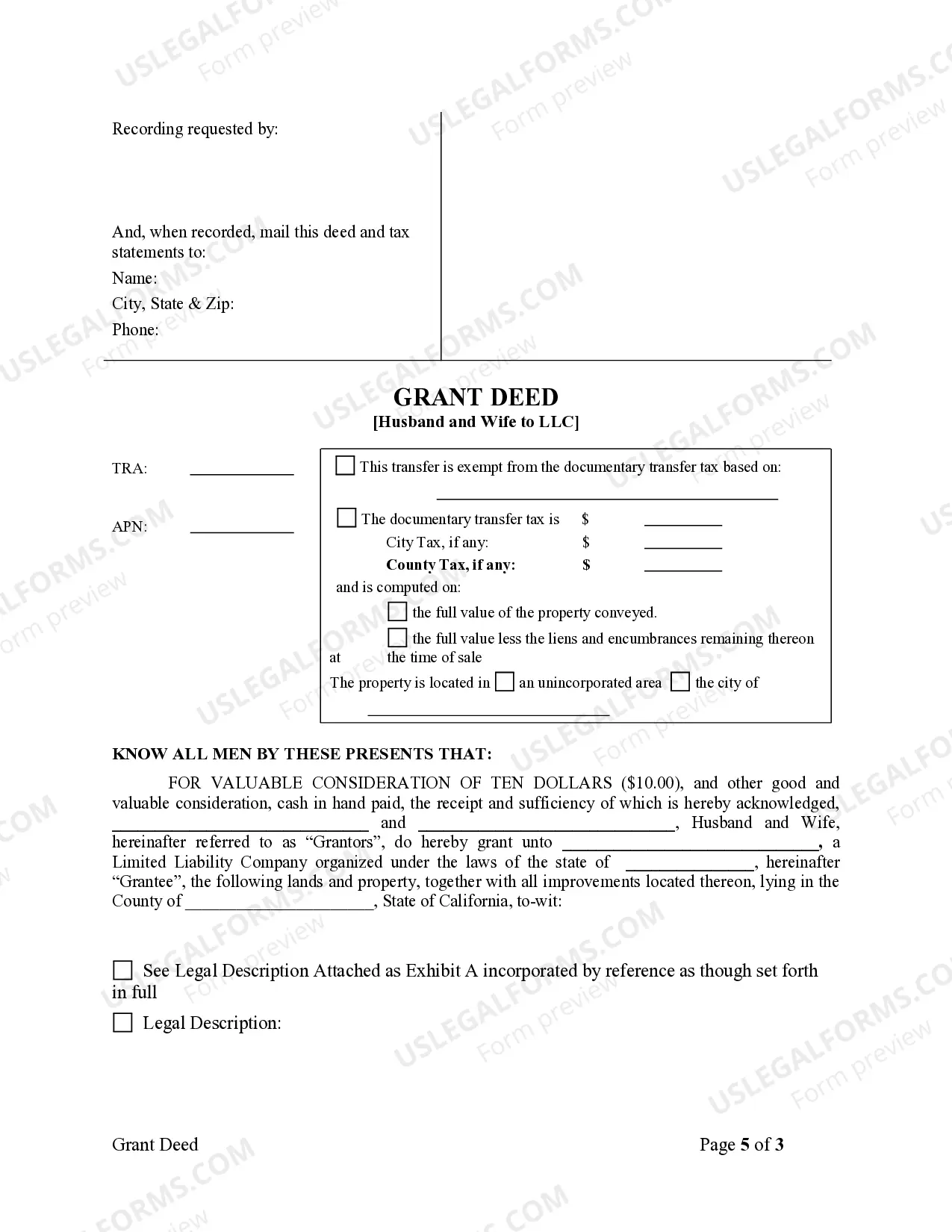

Salinas California Grant Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to a Limited Liability Company (LLC) based in Salinas, California. This deed provides a secure method for transferring property to an LLC, which offers liability protection and potential tax advantages. In a Salinas California Grant Deed from Husband and Wife to LLC, the husband and wife, referred to as the granters, transfer their interest in the property to the LLC, known as the grantee. The property being transferred can be residential, commercial, or vacant land. The grant deed serves as proof that the transfer is legally binding and ensures a clear title for the property. There are various types of Salinas California Grant Deeds from Husband and Wife to LLC, including: 1. General Warranty Grant Deed: This type of grant deed provides the highest level of protection for the grantee. It guarantees that the granters have full ownership rights and there are no undisclosed claims or encumbrances on the property. 2. Special Warranty Grant Deed: In a special warranty grant deed, the granters only warrant against claims or encumbrances that occurred during their ownership. This means that any issues before their ownership will not be covered. 3. Quitclaim Deed: A quitclaim deed is the simplest and most commonly used type of grant deed. It transfers the granters' interest in the property without any warranties. This means that the granters make no guarantees regarding the property's title, and the grantee accepts any potential risks or claims. It is essential to consult with a qualified real estate attorney or an experienced title company when preparing a Salinas California Grant Deed from Husband and Wife to LLC. They will ensure that the appropriate type of deed is used and that all legal requirements and provisions are met. Additionally, thorough research and due diligence should be conducted to ensure there are no unknown liens, claims, or other issues that may affect the property's title.Salinas California Grant Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to a Limited Liability Company (LLC) based in Salinas, California. This deed provides a secure method for transferring property to an LLC, which offers liability protection and potential tax advantages. In a Salinas California Grant Deed from Husband and Wife to LLC, the husband and wife, referred to as the granters, transfer their interest in the property to the LLC, known as the grantee. The property being transferred can be residential, commercial, or vacant land. The grant deed serves as proof that the transfer is legally binding and ensures a clear title for the property. There are various types of Salinas California Grant Deeds from Husband and Wife to LLC, including: 1. General Warranty Grant Deed: This type of grant deed provides the highest level of protection for the grantee. It guarantees that the granters have full ownership rights and there are no undisclosed claims or encumbrances on the property. 2. Special Warranty Grant Deed: In a special warranty grant deed, the granters only warrant against claims or encumbrances that occurred during their ownership. This means that any issues before their ownership will not be covered. 3. Quitclaim Deed: A quitclaim deed is the simplest and most commonly used type of grant deed. It transfers the granters' interest in the property without any warranties. This means that the granters make no guarantees regarding the property's title, and the grantee accepts any potential risks or claims. It is essential to consult with a qualified real estate attorney or an experienced title company when preparing a Salinas California Grant Deed from Husband and Wife to LLC. They will ensure that the appropriate type of deed is used and that all legal requirements and provisions are met. Additionally, thorough research and due diligence should be conducted to ensure there are no unknown liens, claims, or other issues that may affect the property's title.