This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

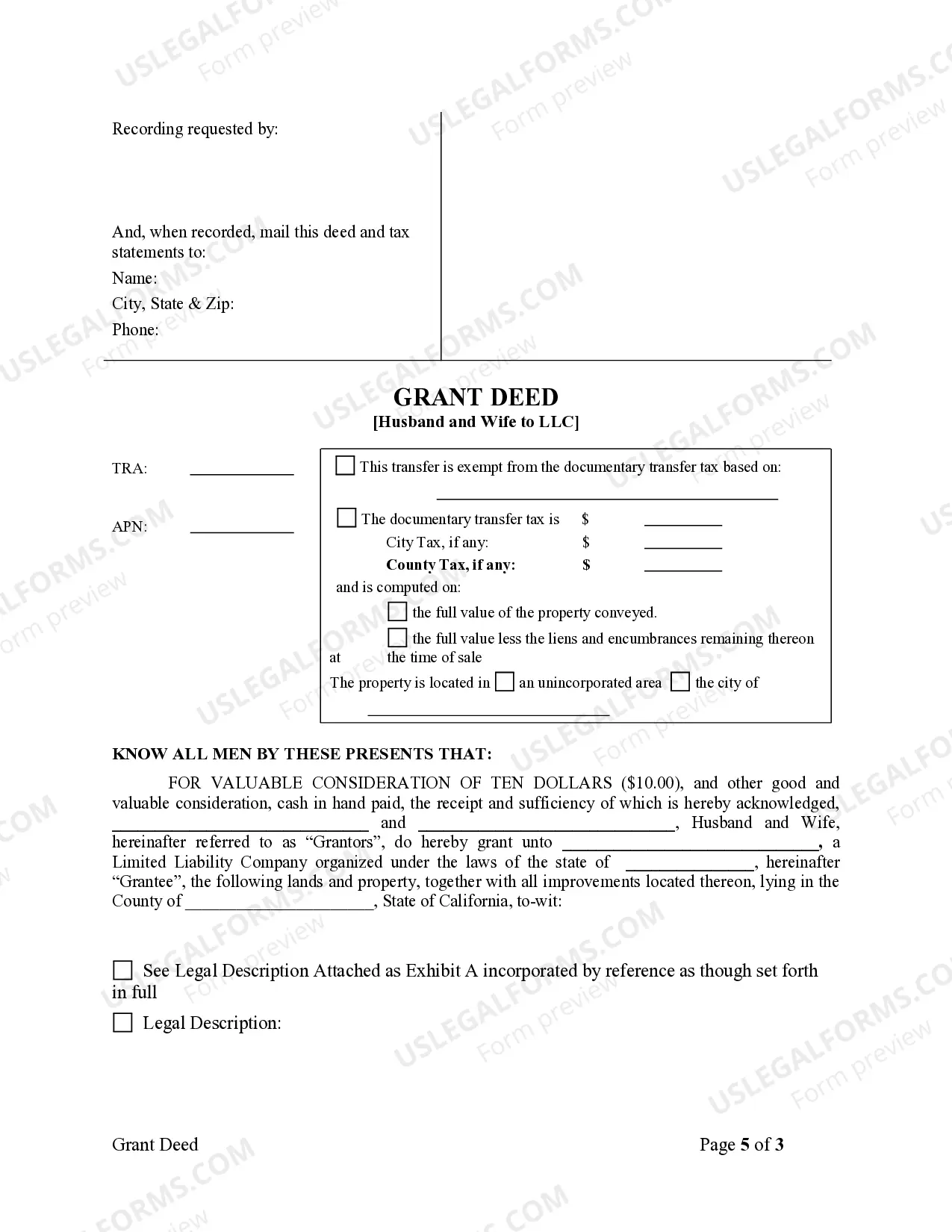

When transferring property ownership from a husband and wife to a limited liability company (LLC) in San Diego, California, a Grant Deed is commonly used. This legal document facilitates the transfer of real estate and ensures the new ownership is recorded accurately. Let's explore the details of a San Diego California Grant Deed from Husband and Wife to LLC, along with its variations. A Grant Deed is a written instrument indicating the intent of the property owners, in this case, a husband and wife, to convey their property rights to an LLC. It guarantees that the property is free from encumbrances, except any mentioned in the deed. This type of transfer is beneficial for individuals seeking to protect their personal assets by holding their property under the umbrella of an LLC. Key elements typically included in a San Diego California Grant Deed from Husband and Wife to LLC are: 1. Identification: The Grant Deed should start with proper identification of the transferring owners (husband and wife) and the LLC. This includes their full names, residential addresses, and the LLC's legal name. 2. Description of Property: The deed should contain a clear and accurate legal description of the property being transferred. This includes details like the address, lot number, subdivision, and any other relevant information required to identify the property. 3. Granting Clause: This clause states the intention of the husband and wife to convey the property to the LLC. It usually begins with phrases like "This Grant Deed", followed by the names of the granters (husband and wife), and explicitly specifies that they grant, sell, and convey the property rights. 4. Consideration: The deed should mention the value or consideration for the transfer, even if it is nominal or unquantifiable. Typically, this amount is stated as "for and in consideration of one dollar and other valuable considerations." 5. Warranties and Covenants: The Grant Deed may include various warranties from the husband and wife, assuring that the property is free from liens, encumbrances, or claims, except those explicitly mentioned in the deed. Different types of San Diego California Grant Deeds from Husband and Wife to LLC might be categorized based on additional clauses or provisions that are tailored to specific circumstances: 1. Due-On-Sale Clause Grant Deed: This type of deed might include a provision allowing the lender to demand full payment of the outstanding loan upon the transfer of ownership from the husband and wife to the LLC. It ensures that the mortgage or loan associated with the property becomes due immediately. 2. Trust Grant Deed to LLC: If the husband and wife owned the property within a trust before transferring it to the LLC, a Trust Grant Deed may be utilized. This deed involves changing the trustee from the trust to the LLC, enabling seamless transition and ownership continuity. 3. Joint Tenancy Grant Deed to LLC: If the husband and wife held the property as joint tenants, they could transfer their interests to an LLC using a Joint Tenancy Grant Deed. This type of deed accounts for survivorship rights and ensures seamless transfer without disrupting the joint tenancy structure. It's essential to consult with a qualified attorney or legal professional specializing in real estate transactions to prepare and execute the applicable Grant Deed accurately. This ensures compliance with San Diego County's specific requirements and guarantees a smooth transfer of ownership from a husband and wife to an LLC.When transferring property ownership from a husband and wife to a limited liability company (LLC) in San Diego, California, a Grant Deed is commonly used. This legal document facilitates the transfer of real estate and ensures the new ownership is recorded accurately. Let's explore the details of a San Diego California Grant Deed from Husband and Wife to LLC, along with its variations. A Grant Deed is a written instrument indicating the intent of the property owners, in this case, a husband and wife, to convey their property rights to an LLC. It guarantees that the property is free from encumbrances, except any mentioned in the deed. This type of transfer is beneficial for individuals seeking to protect their personal assets by holding their property under the umbrella of an LLC. Key elements typically included in a San Diego California Grant Deed from Husband and Wife to LLC are: 1. Identification: The Grant Deed should start with proper identification of the transferring owners (husband and wife) and the LLC. This includes their full names, residential addresses, and the LLC's legal name. 2. Description of Property: The deed should contain a clear and accurate legal description of the property being transferred. This includes details like the address, lot number, subdivision, and any other relevant information required to identify the property. 3. Granting Clause: This clause states the intention of the husband and wife to convey the property to the LLC. It usually begins with phrases like "This Grant Deed", followed by the names of the granters (husband and wife), and explicitly specifies that they grant, sell, and convey the property rights. 4. Consideration: The deed should mention the value or consideration for the transfer, even if it is nominal or unquantifiable. Typically, this amount is stated as "for and in consideration of one dollar and other valuable considerations." 5. Warranties and Covenants: The Grant Deed may include various warranties from the husband and wife, assuring that the property is free from liens, encumbrances, or claims, except those explicitly mentioned in the deed. Different types of San Diego California Grant Deeds from Husband and Wife to LLC might be categorized based on additional clauses or provisions that are tailored to specific circumstances: 1. Due-On-Sale Clause Grant Deed: This type of deed might include a provision allowing the lender to demand full payment of the outstanding loan upon the transfer of ownership from the husband and wife to the LLC. It ensures that the mortgage or loan associated with the property becomes due immediately. 2. Trust Grant Deed to LLC: If the husband and wife owned the property within a trust before transferring it to the LLC, a Trust Grant Deed may be utilized. This deed involves changing the trustee from the trust to the LLC, enabling seamless transition and ownership continuity. 3. Joint Tenancy Grant Deed to LLC: If the husband and wife held the property as joint tenants, they could transfer their interests to an LLC using a Joint Tenancy Grant Deed. This type of deed accounts for survivorship rights and ensures seamless transfer without disrupting the joint tenancy structure. It's essential to consult with a qualified attorney or legal professional specializing in real estate transactions to prepare and execute the applicable Grant Deed accurately. This ensures compliance with San Diego County's specific requirements and guarantees a smooth transfer of ownership from a husband and wife to an LLC.