This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

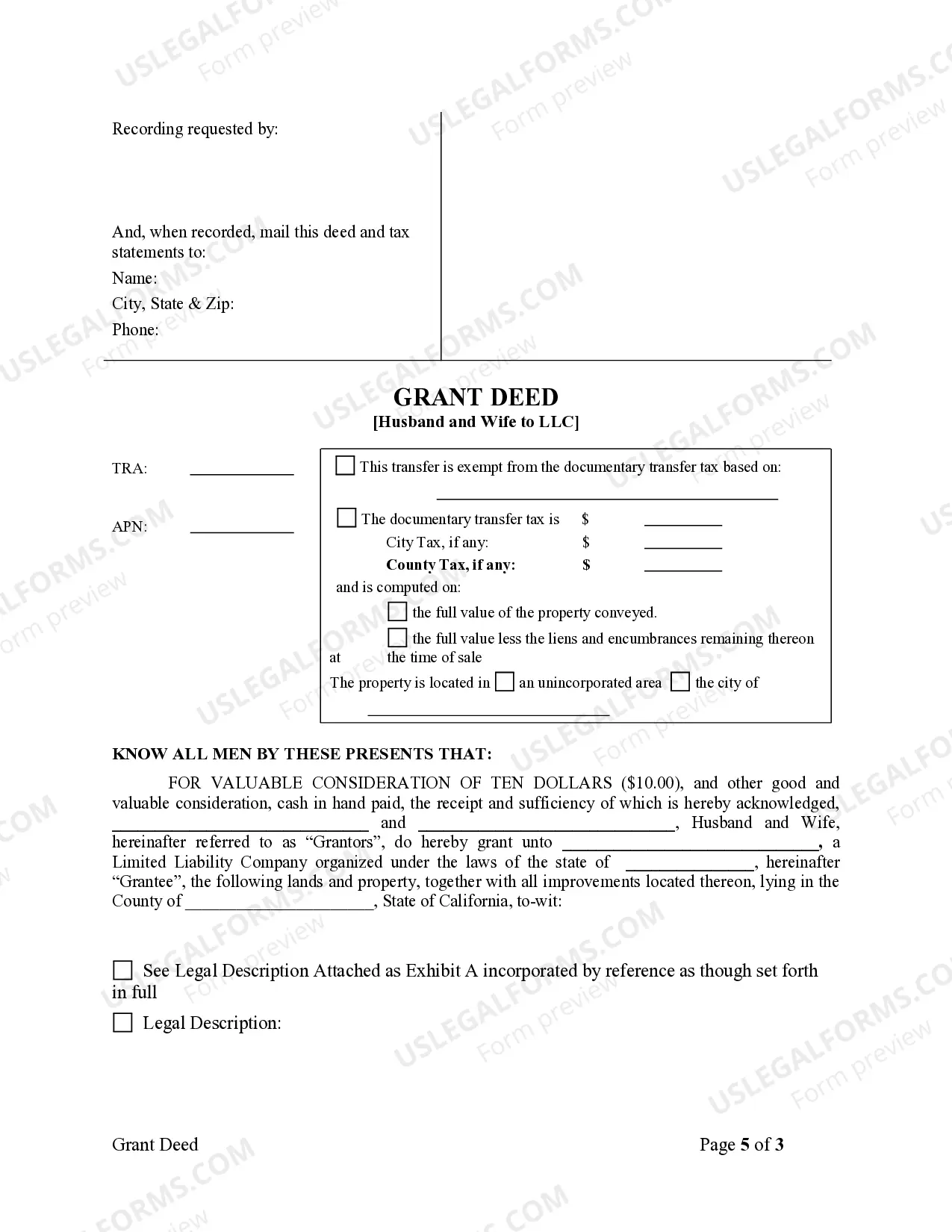

Simi Valley California Grant Deed from Husband and Wife to LLC is a legal document used to transfer property ownership from a married couple to a limited liability company. This type of grant deed ensures a seamless and efficient transfer of real estate assets while providing legal protection and tax advantages to the individuals involved. In Simi Valley, California, there are two main types of Grant Deeds commonly used when transferring property from Husband and Wife to an LLC: General Grant Deed and Special Grant Deed. 1. General Grant Deed: A General Grant Deed is commonly used when the couple intends to transfer the property to their LLC without any warranties or guarantees. It implies that the couple is conveying their ownership rights and interests in the property, but does not warrant or guarantee against any title defects or encumbrances that may exist. 2. Special Grant Deed: A Special Grant Deed, on the other hand, is used when the couple wants to transfer the property with specific warranties and guarantees. By using a Special Grant Deed, the couple ensures that they will defend the title against any potential claims or encumbrances that may arise in the future. When drafting a Simi Valley California Grant Deed from Husband and Wife to LLC, certain key elements must be included: 1. Description of the Property: The deed should provide a detailed legal description of the property being transferred, ensuring accuracy and avoiding any confusion. 2. Granter and Grantee Information: The names of the husband and wife, acting as the granters, and the LLC, identified as the grantee, should be clearly stated, including their legal addresses. 3. Statement of Consideration: The deed should state the consideration or payment exchanged for the property transfer, even if it is non-monetary or nominal. 4. Legal Acknowledgment: The granters must acknowledge their signatures in the presence of a notary public, who will authenticate the document. 5. Compliance with State Laws: The grant deed must comply with Simi Valley and California state laws regarding property transfers, including recording requirements and regulations. It is essential to consult with a knowledgeable attorney or a real estate professional when preparing and executing a Grant Deed in Simi Valley, California. Their expertise will ensure that the document is legally valid and meets all necessary requirements for a smooth transfer of property ownership from a Husband and Wife to an LLC.