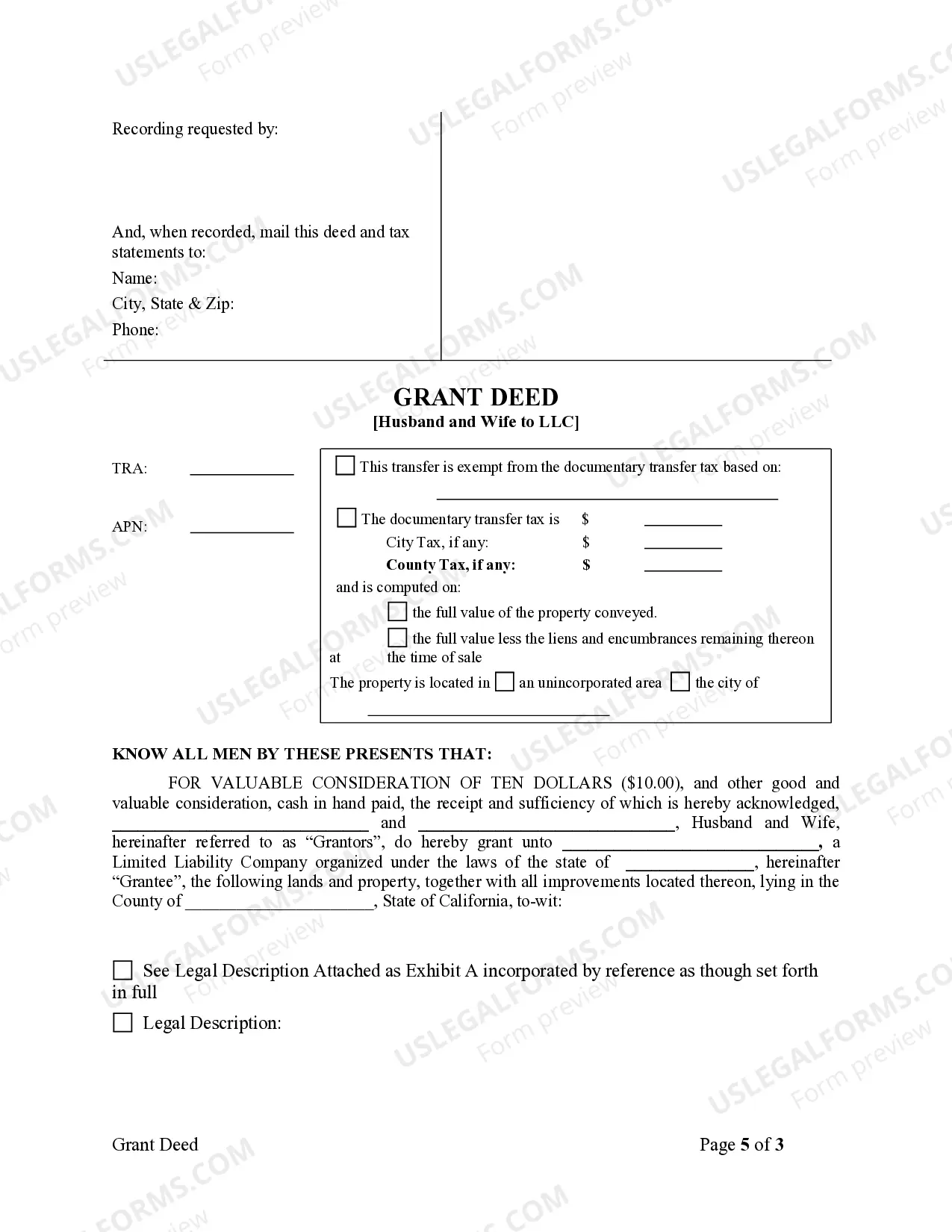

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

A Sunnyvale California Grant Deed from Husband and Wife to LLC is a legal document that transfers ownership of real estate from a married couple to a Limited Liability Company (LLC) based in Sunnyvale, California. This type of deed is commonly used when a couple wishes to place their property under the ownership and protection of an LLC for various reasons. Although there might not be different variations of this grant deed specific to Sunnyvale, California, it is essential to understand the key elements involved. Keywords: 1. Grant deed: A legal instrument used to transfer ownership of real property from one party (granter) to another (grantee). The granter is typically the husband and wife, while the LLC becomes the grantee. 2. Sunnyvale, California: Refers to the geographical location where the property is situated and where this Grant Deed is relevant. 3. Husband and wife: The individuals who jointly own the property and are transferring it to the LLC. 4. Limited Liability Company (LLC): A business structure that provides limited liability to its owners (members) while offering flexibility and certain tax benefits. 5. Real estate: The property being transferred, which could be a house, land, or any other form of immovable asset. Description: A Sunnyvale California Grant Deed from Husband and Wife to LLC is a legal process that enables a married couple to transfer their ownership rights in a property to an LLC they either own or establish for the purpose. This deed ensures that the LLC becomes the legal owner of the property, offering protection, flexibility, and potential tax advantages. The grant deed is a written agreement between the husband and wife as the granters and the LLC as the grantee. It contains important information such as the names of the granters and the grantee, the property's legal description, and the consideration exchanged for the transfer. By executing this grant deed, the husband and wife effectively relinquish their rights of ownership in favor of the LLC. The LLC assumes all responsibilities and benefits associated with owning the property, including payment of taxes, maintenance, and potential financial appreciation. This type of grant deed is commonly used in situations where the husband and wife wish to protect their personal assets from potential liabilities associated with the property. By placing the property under the ownership of an LLC, they can limit their personal liability in case of legal disputes or financial claims. It is important to consult with a qualified attorney or a real estate professional when executing a Sunnyvale California Grant Deed from Husband and Wife to LLC to ensure all legal requirements are met and the process is properly executed. Overall, a Sunnyvale California Grant Deed from Husband and Wife to LLC provides a legally recognized means for a married couple to transfer ownership of their property to an LLC, granting the LLC specific legal rights and protections while maintaining limited personal liability for the couple.