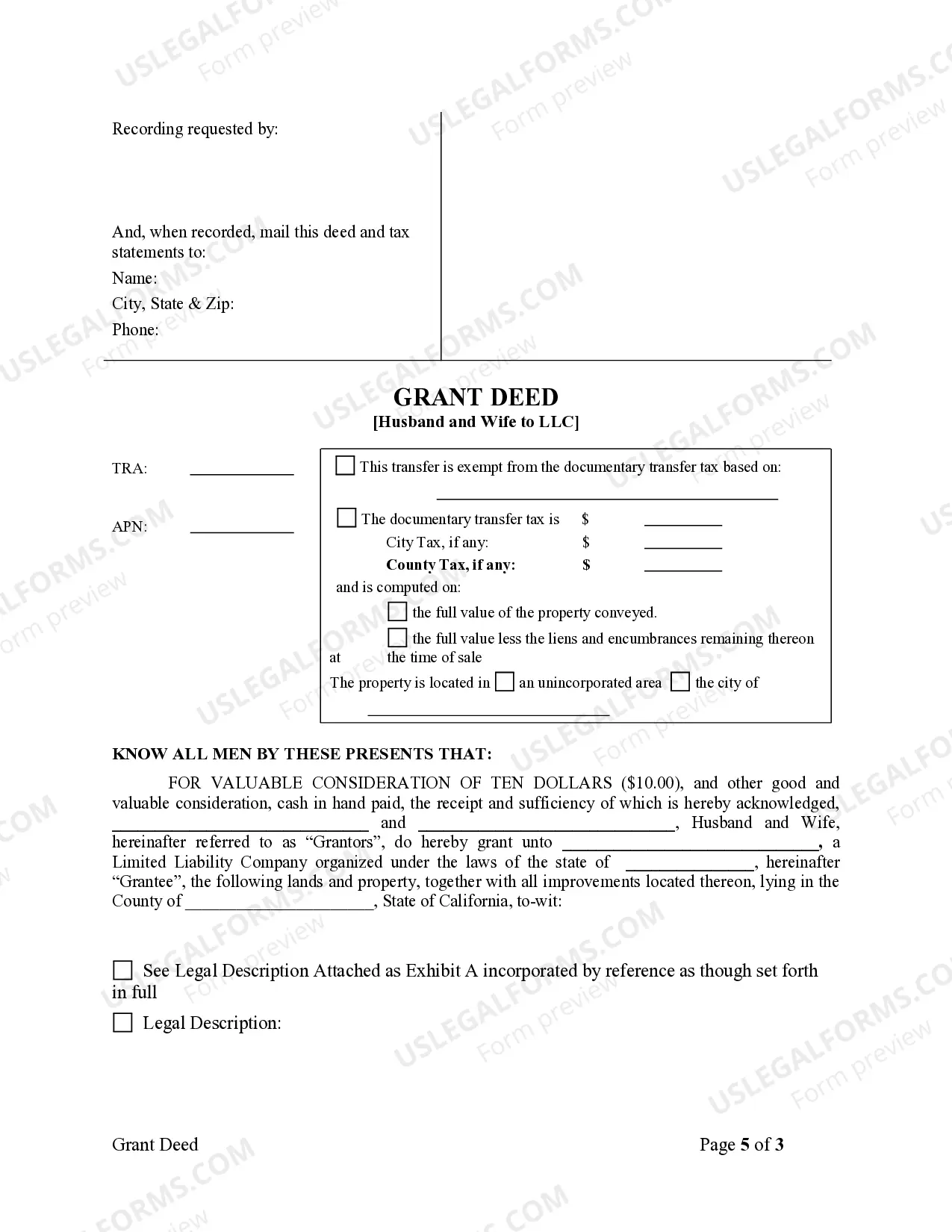

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

A grant deed is a legal document used to transfer real property ownership from one party to another. In the case of Thousand Oaks, California, a specific type of grant deed can be used when transferring property from a husband and wife to an LLC. Thousand Oaks, located in Ventura County, is a beautiful city known for its picturesque landscapes, safe neighborhoods, and strong sense of community. Within this city, individuals and families may decide to transfer the ownership of their property from themselves as a married couple to a Limited Liability Company (LLC). This process is typically accomplished through the use of a Thousand Oaks California Grant Deed from Husband and Wife to LLC. Such a grant deed is a legal document that outlines the transfer of real property, including land, structures, and any associated rights, from a husband and wife to an LLC. This type of transaction is usually conducted when individuals want to restructure their property ownership for business purposes, liability protection, or estate planning reasons in Thousand Oaks, California. It is important to note that there can be different variations or types of Thousand Oaks California Grant Deed from Husband and Wife to LLC, each serving a specific purpose. These variations can include: 1. General Grant Deed: This is a type of grant deed that transfers the property from the husband and wife to the LLC without any warranties or guarantees. It simply means that the couple is transferring any interest they may have in the property to the LLC, without making any claims about the property's condition or title. 2. Special Warranty Grant Deed: In this type of grant deed, the husband and wife transferring the property to the LLC are providing a limited warranty. They warrant that they haven't done anything during their ownership to negatively impact the property's title, but they don't provide any guarantees for issues that occurred before their ownership. 3. Quitclaim Deed: Although not technically a grant deed, some individuals may opt to use a quitclaim deed when transferring property from a husband and wife to an LLC. This type of deed transfers whatever interest the couple has in the property to the LLC, without any warranties or guarantees. Each of these variations of the Thousand Oaks California Grant Deed from Husband and Wife to LLC has its own legal implications, and it would be advisable for parties involved in the transfer to consult with a qualified real estate attorney or professional familiar with California real estate laws to ensure all legal requirements are met and to determine which type of deed best suits their specific situation. Overall, the Thousand Oaks California Grant Deed from Husband and Wife to LLC is an essential legal document used to facilitate property transfers between married couples and LCS, helping individuals achieve their business goals, enhance liability protection, or streamline estate planning strategies within the beautiful city of Thousand Oaks, California.A grant deed is a legal document used to transfer real property ownership from one party to another. In the case of Thousand Oaks, California, a specific type of grant deed can be used when transferring property from a husband and wife to an LLC. Thousand Oaks, located in Ventura County, is a beautiful city known for its picturesque landscapes, safe neighborhoods, and strong sense of community. Within this city, individuals and families may decide to transfer the ownership of their property from themselves as a married couple to a Limited Liability Company (LLC). This process is typically accomplished through the use of a Thousand Oaks California Grant Deed from Husband and Wife to LLC. Such a grant deed is a legal document that outlines the transfer of real property, including land, structures, and any associated rights, from a husband and wife to an LLC. This type of transaction is usually conducted when individuals want to restructure their property ownership for business purposes, liability protection, or estate planning reasons in Thousand Oaks, California. It is important to note that there can be different variations or types of Thousand Oaks California Grant Deed from Husband and Wife to LLC, each serving a specific purpose. These variations can include: 1. General Grant Deed: This is a type of grant deed that transfers the property from the husband and wife to the LLC without any warranties or guarantees. It simply means that the couple is transferring any interest they may have in the property to the LLC, without making any claims about the property's condition or title. 2. Special Warranty Grant Deed: In this type of grant deed, the husband and wife transferring the property to the LLC are providing a limited warranty. They warrant that they haven't done anything during their ownership to negatively impact the property's title, but they don't provide any guarantees for issues that occurred before their ownership. 3. Quitclaim Deed: Although not technically a grant deed, some individuals may opt to use a quitclaim deed when transferring property from a husband and wife to an LLC. This type of deed transfers whatever interest the couple has in the property to the LLC, without any warranties or guarantees. Each of these variations of the Thousand Oaks California Grant Deed from Husband and Wife to LLC has its own legal implications, and it would be advisable for parties involved in the transfer to consult with a qualified real estate attorney or professional familiar with California real estate laws to ensure all legal requirements are met and to determine which type of deed best suits their specific situation. Overall, the Thousand Oaks California Grant Deed from Husband and Wife to LLC is an essential legal document used to facilitate property transfers between married couples and LCS, helping individuals achieve their business goals, enhance liability protection, or streamline estate planning strategies within the beautiful city of Thousand Oaks, California.