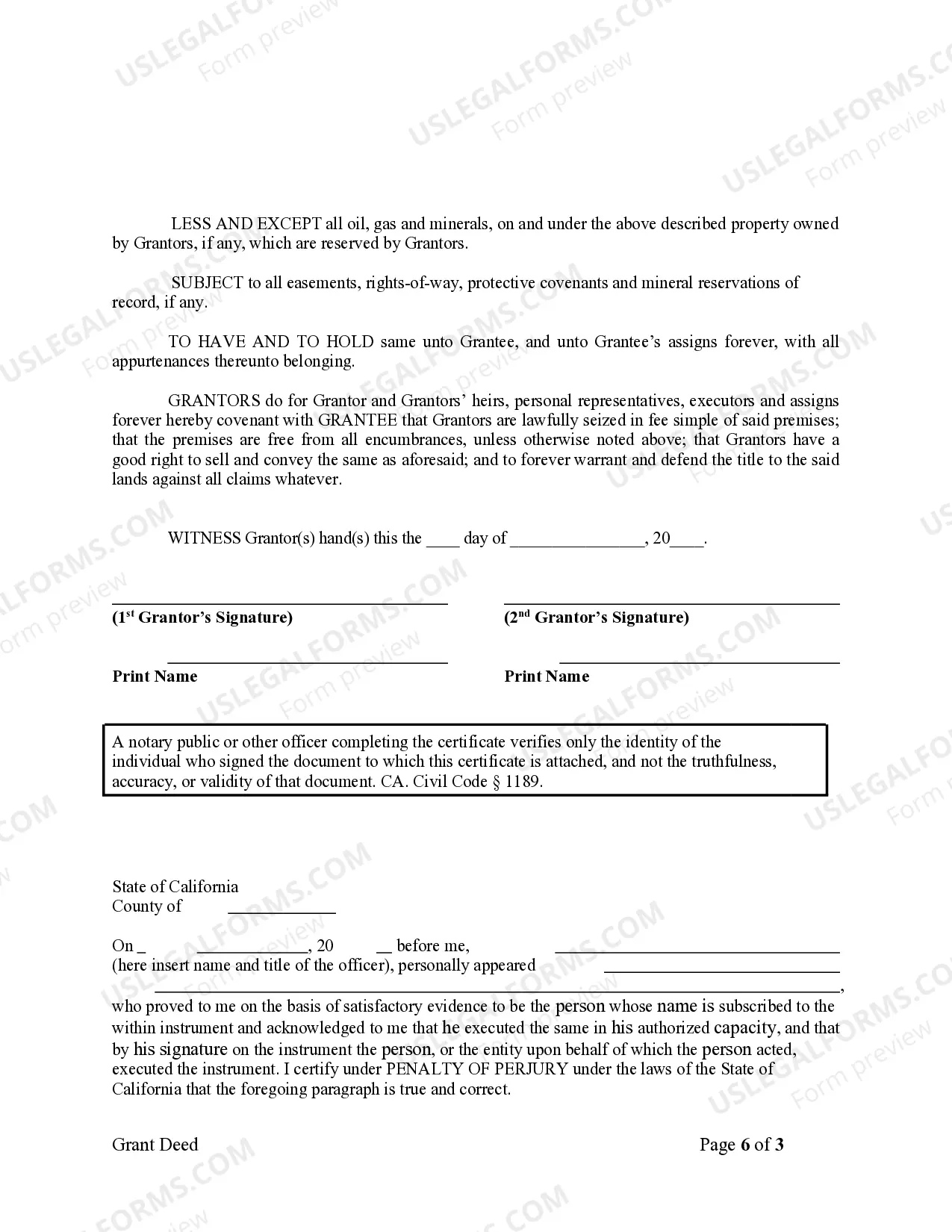

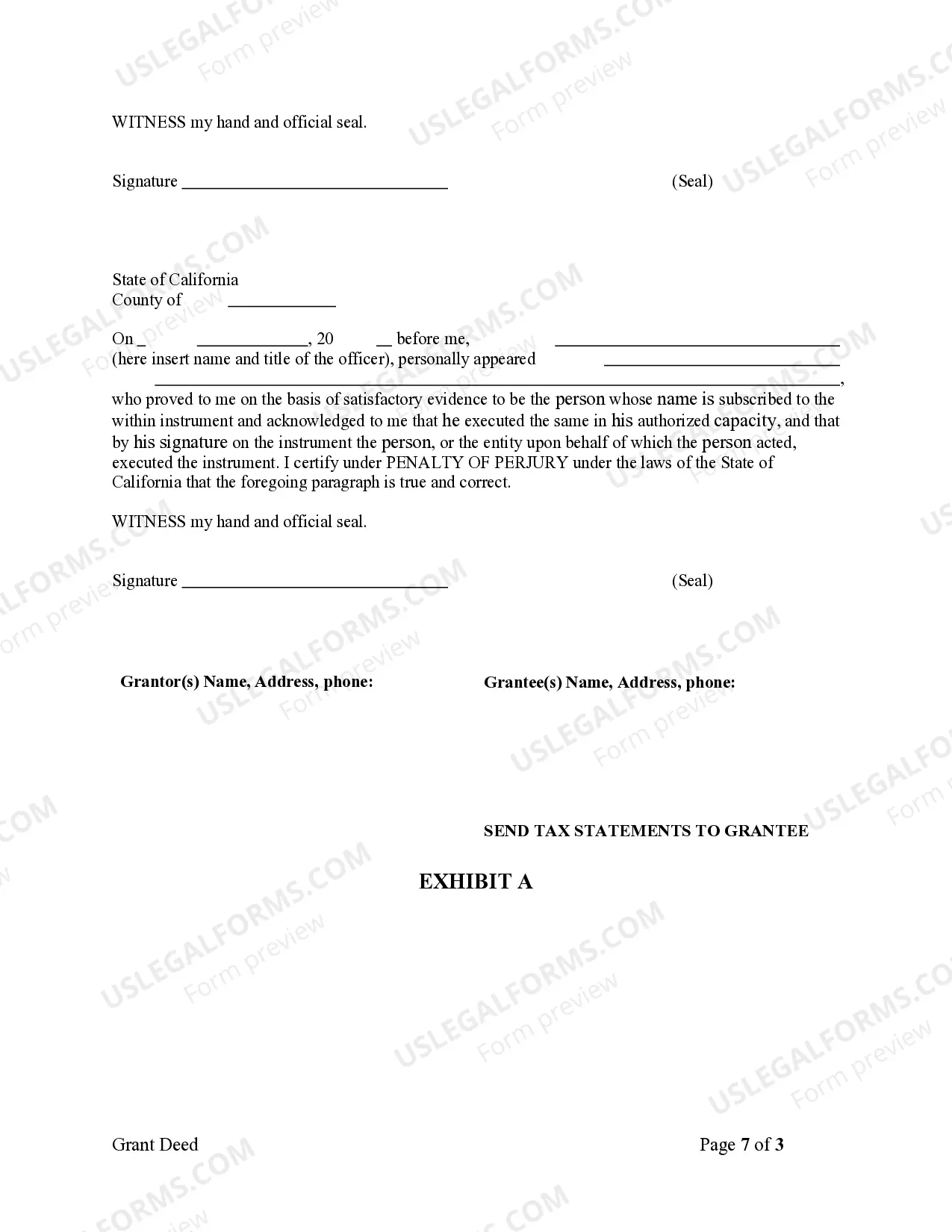

This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

A Victorville California Grant Deed from Husband and Wife to LLC is a legal document that facilitates the transfer of real estate ownership from a married couple to a limited liability company (LLC). This type of deed is commonly executed when the couple wants to transfer their property to an LLC that they own or are affiliated with, allowing for better asset protection or management purposes. This article will outline the process and significance of a Victorville California Grant Deed from Husband and Wife to LLC, highlighting different types for specific scenarios. 1. Importance of a Victorville California Grant Deed: A Victorville California Grant Deed from Husband and Wife to LLC is an essential legal tool facilitating the transfer of real property ownership rights. By executing this document, the couple effectively transfers ownership from themselves to their LLC, ensuring the property is legally vested in the company's name. 2. The Process of Transferring Ownership: To initiate the transfer, the husband and wife must draft and sign a grant deed in accordance with the California laws and regulations pertaining to property transactions. The deed should accurately describe the property being transferred and meet the specific requirements of the Victorville jurisdiction. It is recommended to consult with legal professionals or real estate experts to ensure compliance with all legal formalities. 3. Types of Victorville California Grant Deeds: a) Traditional Grant Deed: This is the standard type of grant deed used in Victorville, California, where ownership rights are transferred from a husband and wife to their LLC. It includes all essential elements such as the names of the granters (husband and wife), the name of the grantee (LLC), a legal description of the property, and the granters' signatures. b) Joint Tenancy Grant Deed: In cases where the married couple holds the property as joint tenants, they may choose to execute a Joint Tenancy Grant Deed to transfer the ownership interest from themselves as joint tenants to the LLC. This deed ensures that the property is transferred while maintaining the same joint tenancy rights under the LLC. c) Tenancy in Common Grant Deed: If the husband and wife own the property as tenants in common, they can opt for a Tenancy in Common Grant Deed to achieve the transfer to their LLC. The deed would allocate specific percentage interests in the property to the LLC corresponding to their ownership shares as tenants in common. d) Community Property Grant Deed: In situations where the property is classified as community property, the husband and wife may utilize a Community Property Grant Deed to transfer the ownership from themselves to their LLC. This deed specifically reflects the community property interest held by both spouses in the LLC. In summary, a Victorville California Grant Deed from Husband and Wife to LLC is an important legal instrument for transferring real estate ownership to an LLC. It offers benefits such as asset protection and management flexibility. Various types of grant deeds, including Traditional Grant Deeds, Joint Tenancy Grant Deeds, Tenancy in Common Grant Deeds, and Community Property Grant Deeds, allow for tailored transfers based on the couple's ownership arrangement. To ensure a successful transfer process, it is advised to consult legal professionals experienced in California real estate law and Victorville's specific requirements.