This Warranty Deed from Husband and Wife to LLC form is a Warranty Deed where the grantors are husband and wife and the grantee is a limited liability company. Grantors convey and warrant the described property to grantee less oil, gas and minerals to which grantors reserve the right.

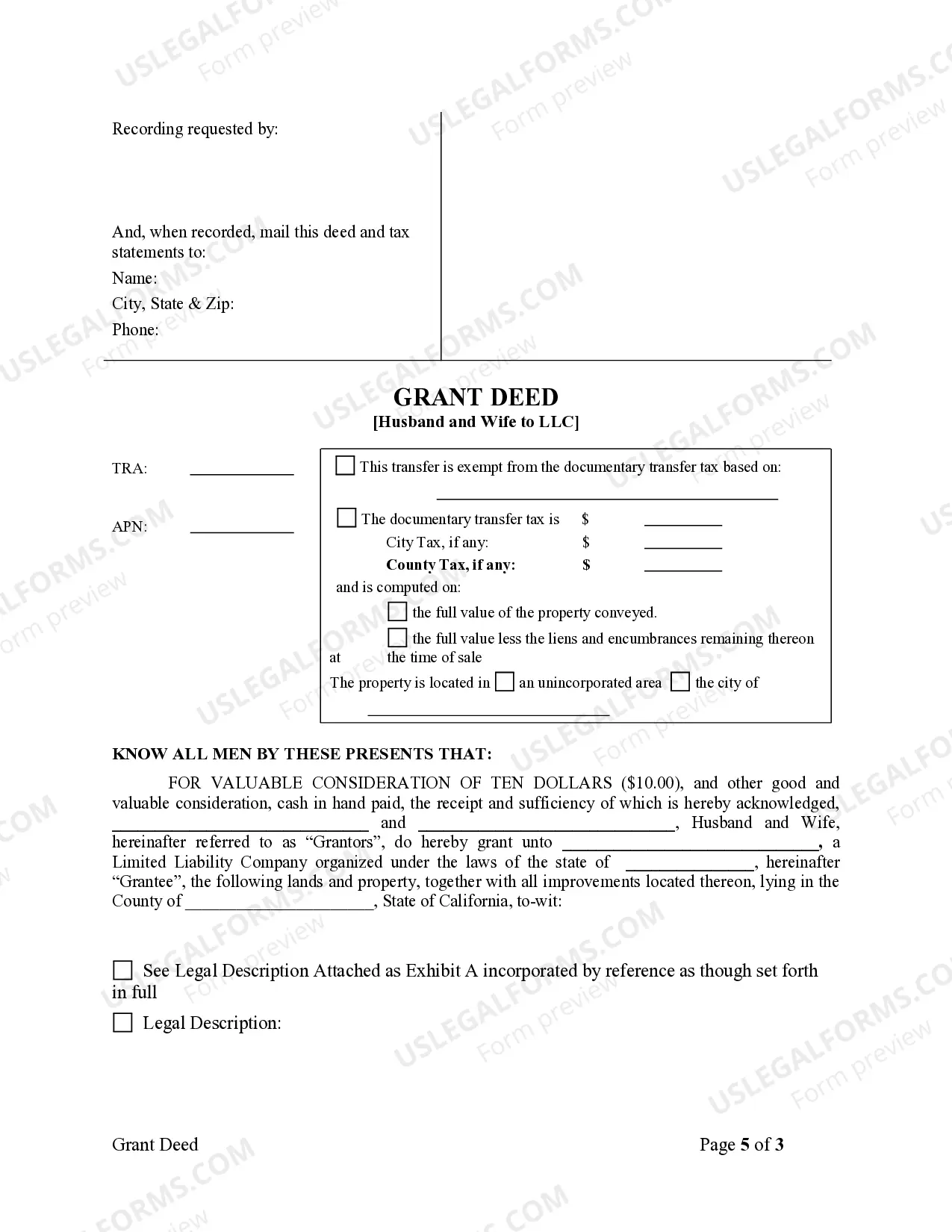

A Vista California Grant Deed from Husband and Wife to LLC is a legally binding document that allows a married couple to transfer ownership of real estate property to a limited liability company (LLC) in Vista, California. This type of transfer is commonly used when individuals want to protect their personal assets and limit liability by holding the property under an LLC. The grant deed is a legal instrument used to convey the title of the property from the granter (husband and wife) to the grantee (the LLC). It is recorded in the San Diego County Recorder's Office to provide public notice of the change in ownership. By transferring the property to an LLC, the husband and wife are effectively separating their personal assets from the property, which can provide liability protection in case of lawsuits or debt. Some variations or types of Vista California Grant Deed from Husband and Wife to LLC include: 1. General Grant Deed: This type of grant deed is the most common and transfers the ownership of the property from the husband and wife to the LLC without any warranties or guarantees. The LLC receives the property as-is, with no assurance from the granters regarding the property's title or condition. 2. Special Warranty Deed: This grant deed offers limited warranties from the husband and wife. It guarantees that they have not encumbered the property during their ownership, except as stated in the deed. However, it does not provide any guarantees or warranties for issues that existed before the couple acquired the property. 3. Quitclaim Deed: A quitclaim deed is another option for transferring ownership from the husband and wife to the LLC. However, it provides the least amount of protection. It simply transfers whatever interest or title the couple has in the property to the LLC. There are no warranties, guarantees, or assurances regarding the property's title or condition. When executing a Vista California Grant Deed from Husband and Wife to LLC, it is crucial to ensure all legal requirements are met, including proper notarization, accurate property descriptions, and compliance with state laws. It is advisable to consult a real estate attorney or legal professional experienced in California real estate transactions to oversee and assist with the process to ensure a smooth and valid transfer of property.A Vista California Grant Deed from Husband and Wife to LLC is a legally binding document that allows a married couple to transfer ownership of real estate property to a limited liability company (LLC) in Vista, California. This type of transfer is commonly used when individuals want to protect their personal assets and limit liability by holding the property under an LLC. The grant deed is a legal instrument used to convey the title of the property from the granter (husband and wife) to the grantee (the LLC). It is recorded in the San Diego County Recorder's Office to provide public notice of the change in ownership. By transferring the property to an LLC, the husband and wife are effectively separating their personal assets from the property, which can provide liability protection in case of lawsuits or debt. Some variations or types of Vista California Grant Deed from Husband and Wife to LLC include: 1. General Grant Deed: This type of grant deed is the most common and transfers the ownership of the property from the husband and wife to the LLC without any warranties or guarantees. The LLC receives the property as-is, with no assurance from the granters regarding the property's title or condition. 2. Special Warranty Deed: This grant deed offers limited warranties from the husband and wife. It guarantees that they have not encumbered the property during their ownership, except as stated in the deed. However, it does not provide any guarantees or warranties for issues that existed before the couple acquired the property. 3. Quitclaim Deed: A quitclaim deed is another option for transferring ownership from the husband and wife to the LLC. However, it provides the least amount of protection. It simply transfers whatever interest or title the couple has in the property to the LLC. There are no warranties, guarantees, or assurances regarding the property's title or condition. When executing a Vista California Grant Deed from Husband and Wife to LLC, it is crucial to ensure all legal requirements are met, including proper notarization, accurate property descriptions, and compliance with state laws. It is advisable to consult a real estate attorney or legal professional experienced in California real estate transactions to oversee and assist with the process to ensure a smooth and valid transfer of property.