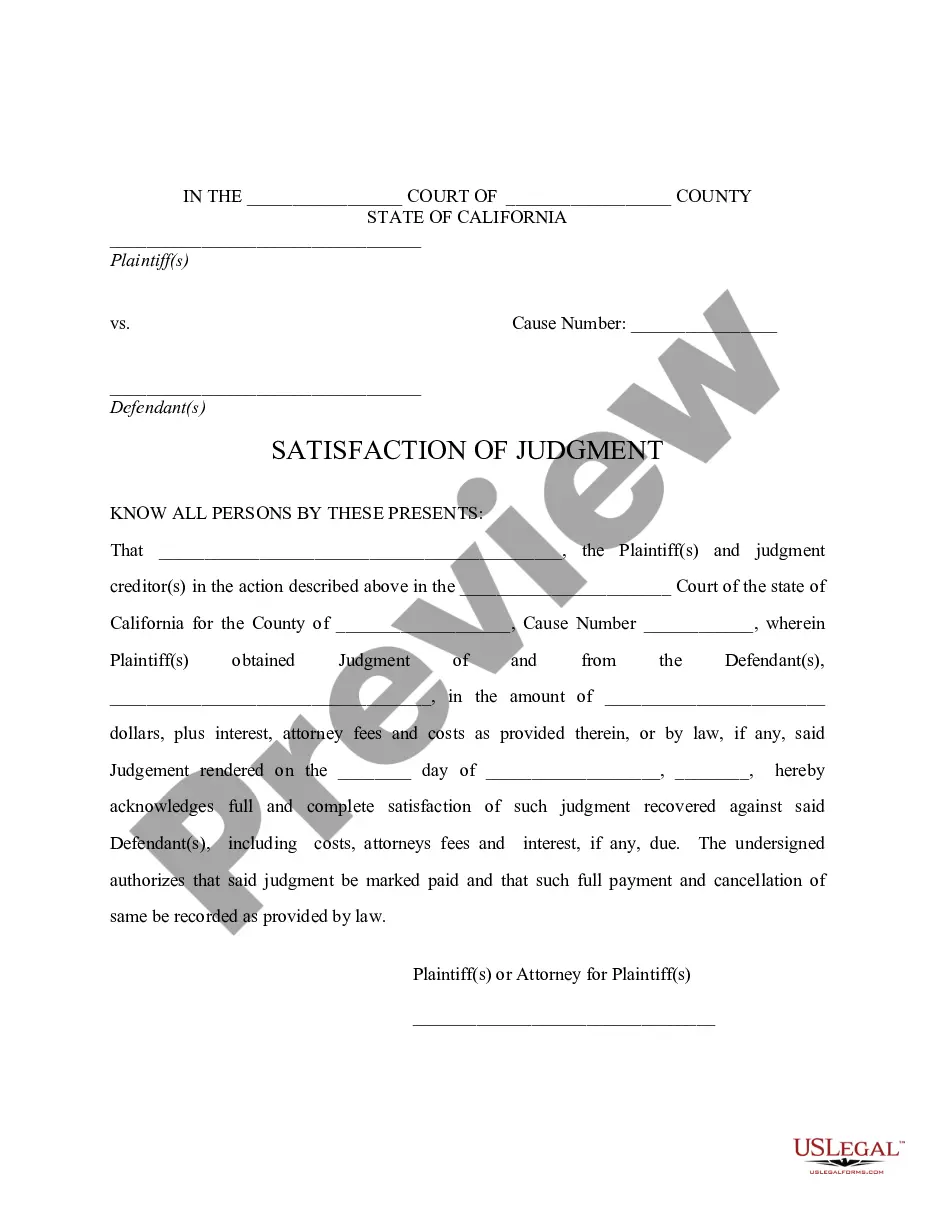

This is a satisfaction of judgment which indicates that a judgment has been paid in full, including all fees, costs and interest. It acknowledges full and complete satisfaction of the judgment and directs that the judgment be marked as paid in full.

Los Angeles California Satisfaction of Judgment

Description

How to fill out California Satisfaction Of Judgment?

Regardless of one's social or professional standing, completing legal forms is a regrettable requirement in today's society.

Frequently, it is nearly impossible for someone without any legal education to draft such documents from the ground up, primarily due to the complex language and legal intricacies they involve.

This is where US Legal Forms provides assistance.

Verify that the form you have located is appropriate for your jurisdiction, as the laws of one state or county may not apply to another.

Review the form and skim through a brief summary (if available) of situations for which the document can be utilized.

- Our platform features an extensive array of over 85,000 ready-to-use state-specific documents suitable for nearly every legal situation.

- US Legal Forms is also an excellent tool for associates or attorneys looking to enhance their efficiency using our DIY forms.

- Whether you need the Los Angeles California Satisfaction of Judgment or any other document applicable in your region or county, US Legal Forms has everything you need readily available.

- Here’s the quick process to obtain the Los Angeles California Satisfaction of Judgment using our reliable platform.

- If you are already a registered user, simply Log In to your account to access the necessary form.

- If you are new to our library, follow these steps before downloading the Los Angeles California Satisfaction of Judgment.

Form popularity

FAQ

You can verify if a judgment has been satisfied by checking public court records or obtaining a copy of the Acknowledgement of Satisfaction from the creditor. It's important to ensure that all documents are properly filed and up-to-date. Utilizing services like US Legal Forms can facilitate this verification and provide peace of mind regarding your legal standing.

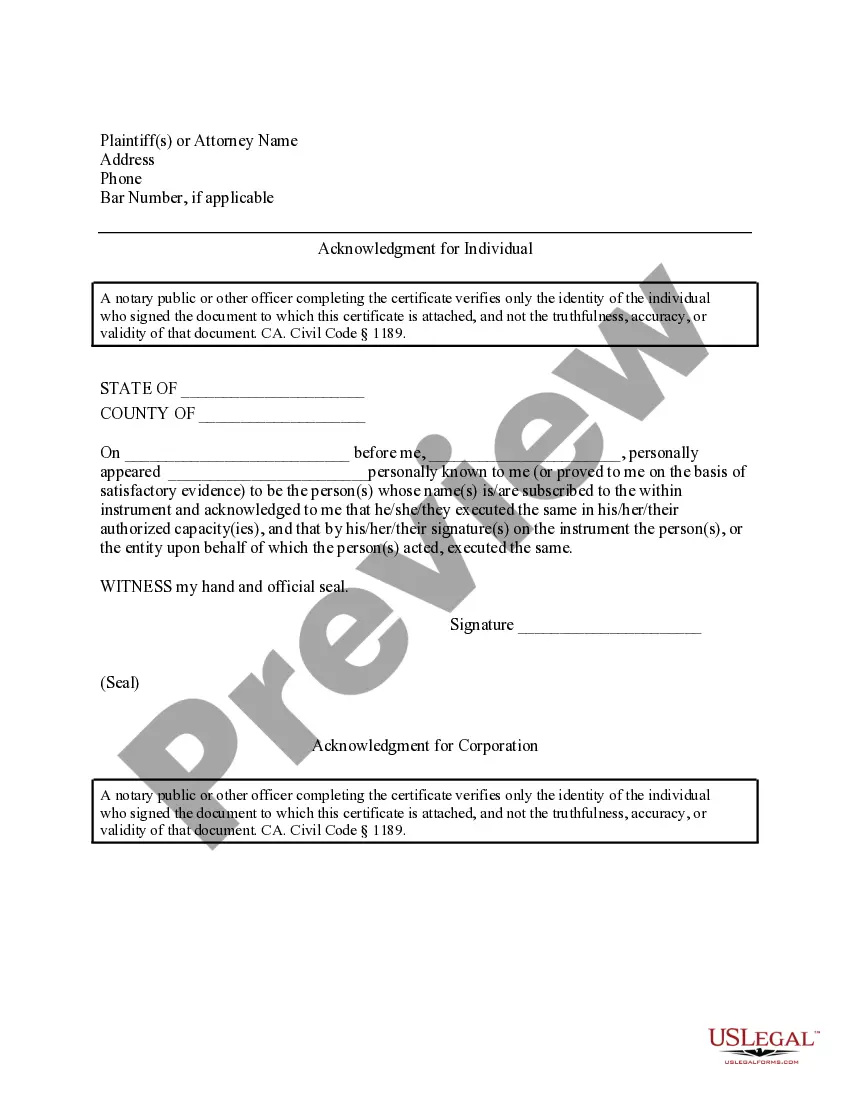

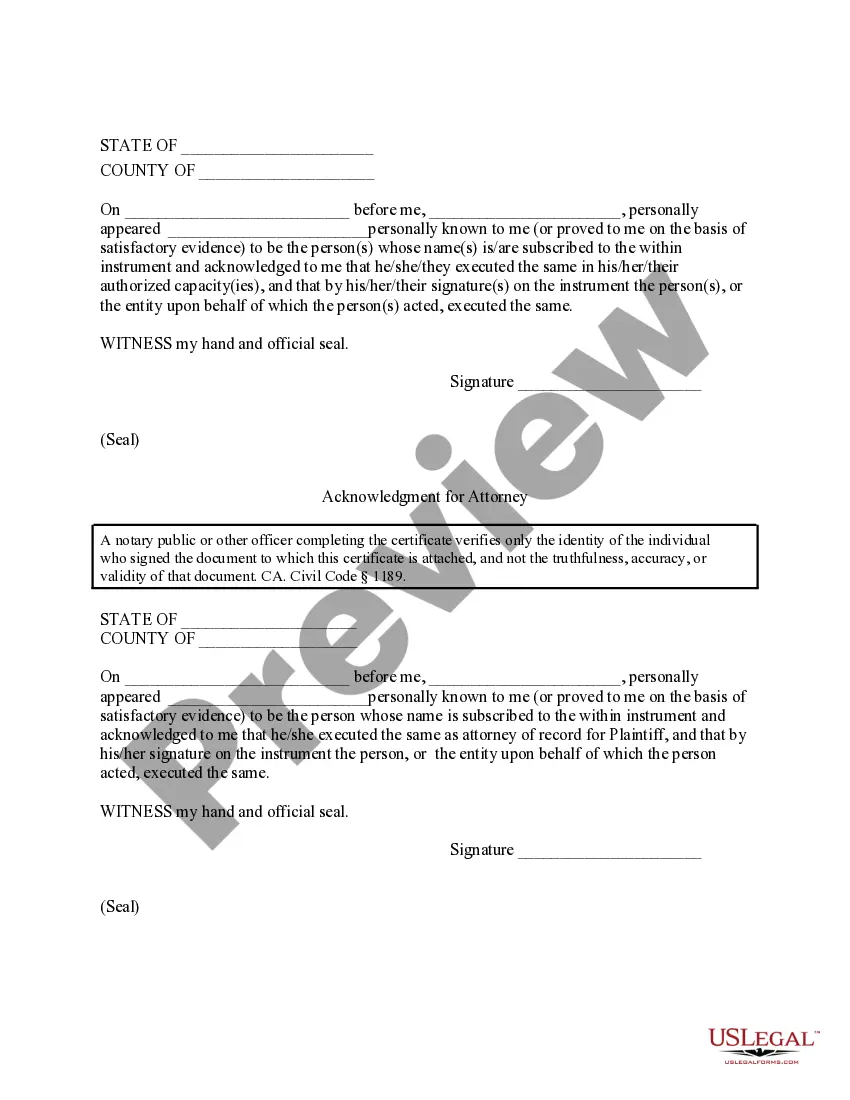

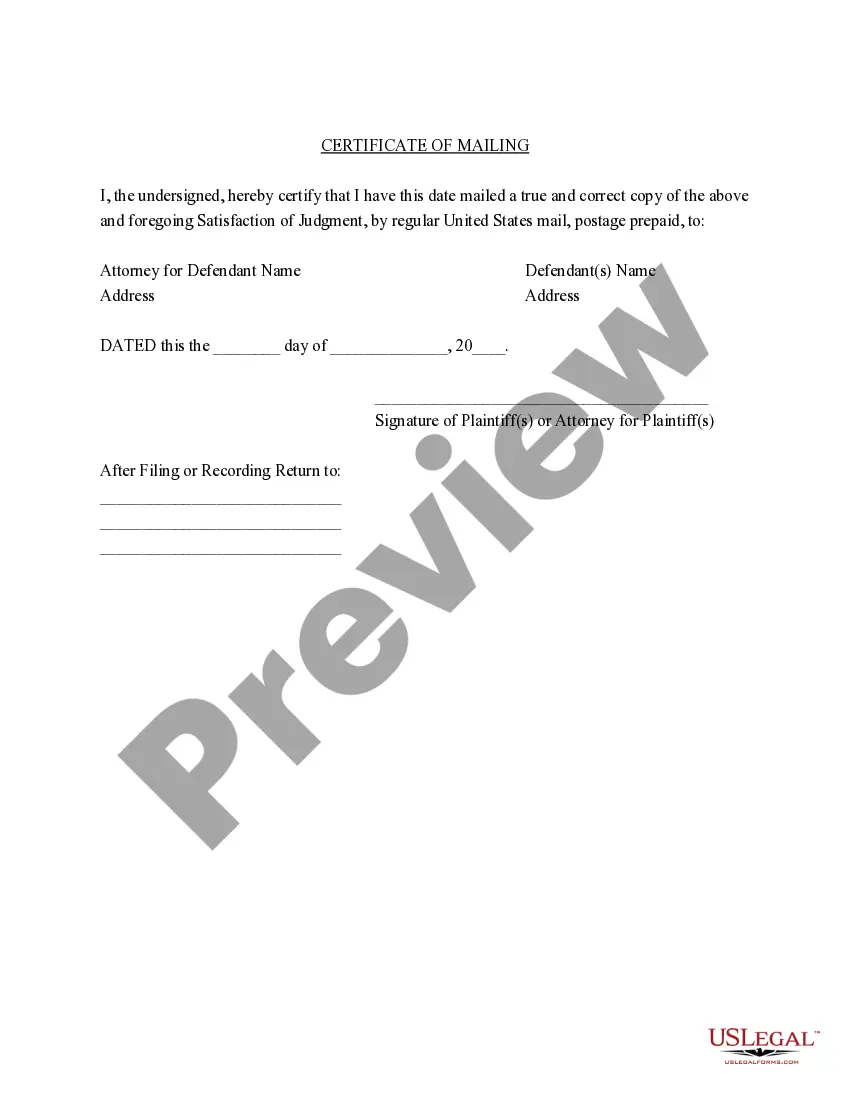

To record a satisfaction of judgment in California, you must file the Acknowledgement of Satisfaction with the court where the judgment was originally filed. After obtaining this document, ensure that it is completed correctly and submitted timely. Platforms like US Legal Forms can simplify this process, providing templates and guidance for successful filing.

To fix poor judgment, it is important to first analyze the situation and identify the root causes. You should consider seeking legal advice or using services like US Legal Forms for guidance in navigating complexities. Ultimately, making informed decisions and learning from past experiences can aid in preventing similar issues in the future.

An unsatisfied judgment is one where the debtor has not fulfilled their obligations as ordered by the court. In Los Angeles, California, this means that the debt remains unpaid, and the creditor retains the legal right to collect on it. Unsatisfied judgments can have significant impacts on credit scores and financial standings, making resolution a priority for many.

You can verify a judgment in Los Angeles, California, by searching public court records through the county's website or visiting the courthouse directly. These records will provide details about the judgment, including its status and any associated filings. Verifying a judgment is a crucial step for individuals or businesses that want to ensure they are dealing with accurate and up-to-date information.

Typically, the creditor or the party that obtained the judgment signs the satisfaction of judgment. This signing signifies their acknowledgment that the judgment has been fulfilled. In Los Angeles, California, it is crucial to ensure this document is properly executed and filed with the court to officially close the judgment.

Yes, judgments can be renewed in Los Angeles, California, before they expire, often for an additional 10 years. The renewal process requires filing specific documents in court, signifying that the debt remains unpaid and the creditor still seeks it. Understanding this process ensures that creditors can maintain their rights to collect, even after a judgment's initial validity period has passed.

A satisfaction of judgment refers to the formal acknowledgment that a debt or obligation resulting from a court judgment has been fulfilled. In Los Angeles, California, when a judgment is satisfied, it indicates that the winning party has received the payment or resolution they sought. This important step not only clears the debtor's legal obligations but also updates public records to reflect the change.

Filing a Satisfaction of Judgment in Los Angeles, California, involves a few simple steps. First, complete the EJ-130 form accurately, ensuring all required information is included. After filling out the form, you should file it with the court where the original judgment was issued. Utilizing our platform can provide you with step-by-step instructions, making the filing process clear and efficient.

The EJ-130 form, also known as the Satisfaction of Judgment form, is a legal document used in Los Angeles, California, to declare that a judgment has been satisfied. Completing this form is essential for clearing your record and showing that the debt has been resolved. Filing this form with the appropriate court helps to prevent future disputes regarding the judgment. Our platform can guide you through the completion and filing of the EJ-130 form seamlessly.