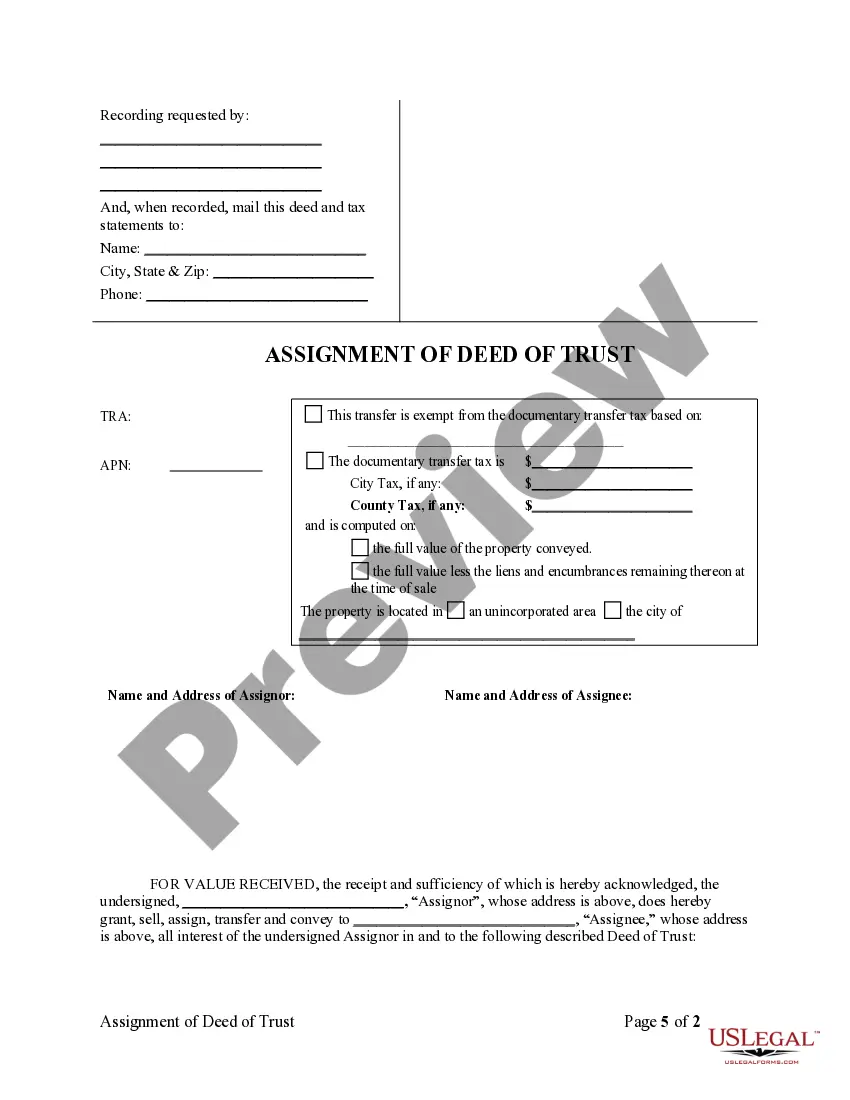

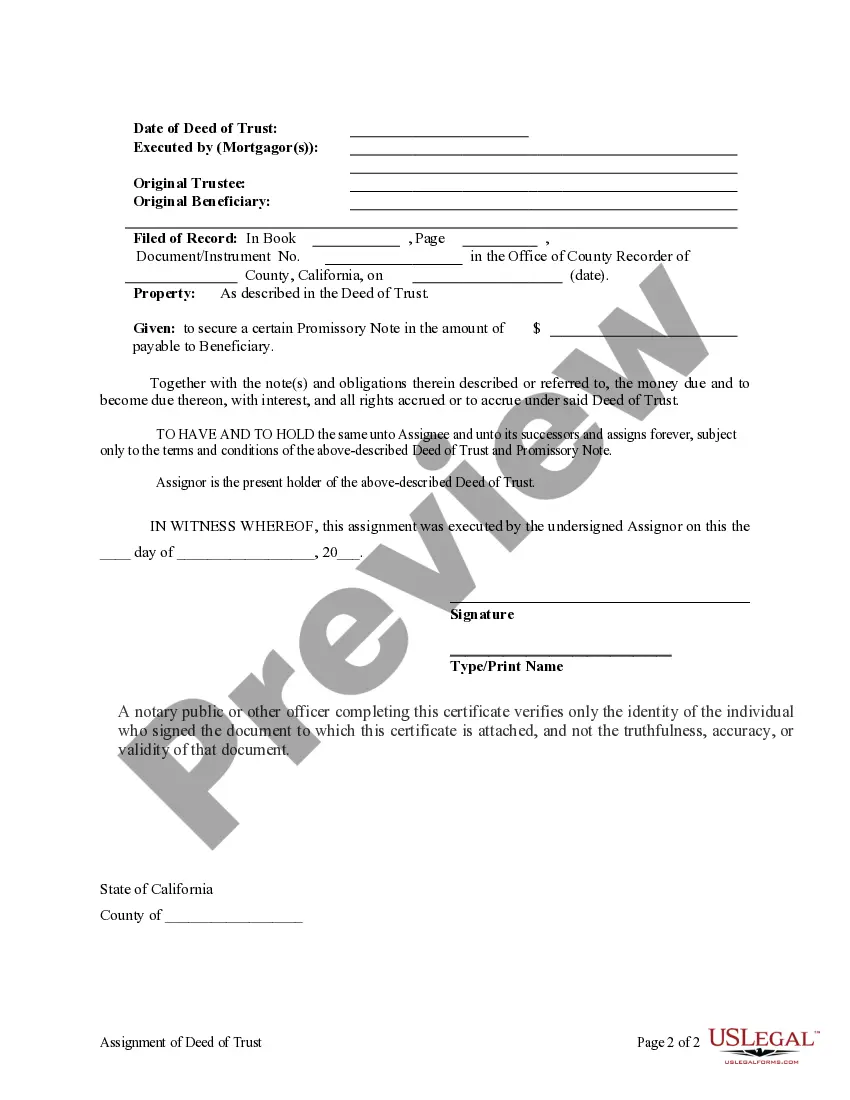

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is an individual(s).

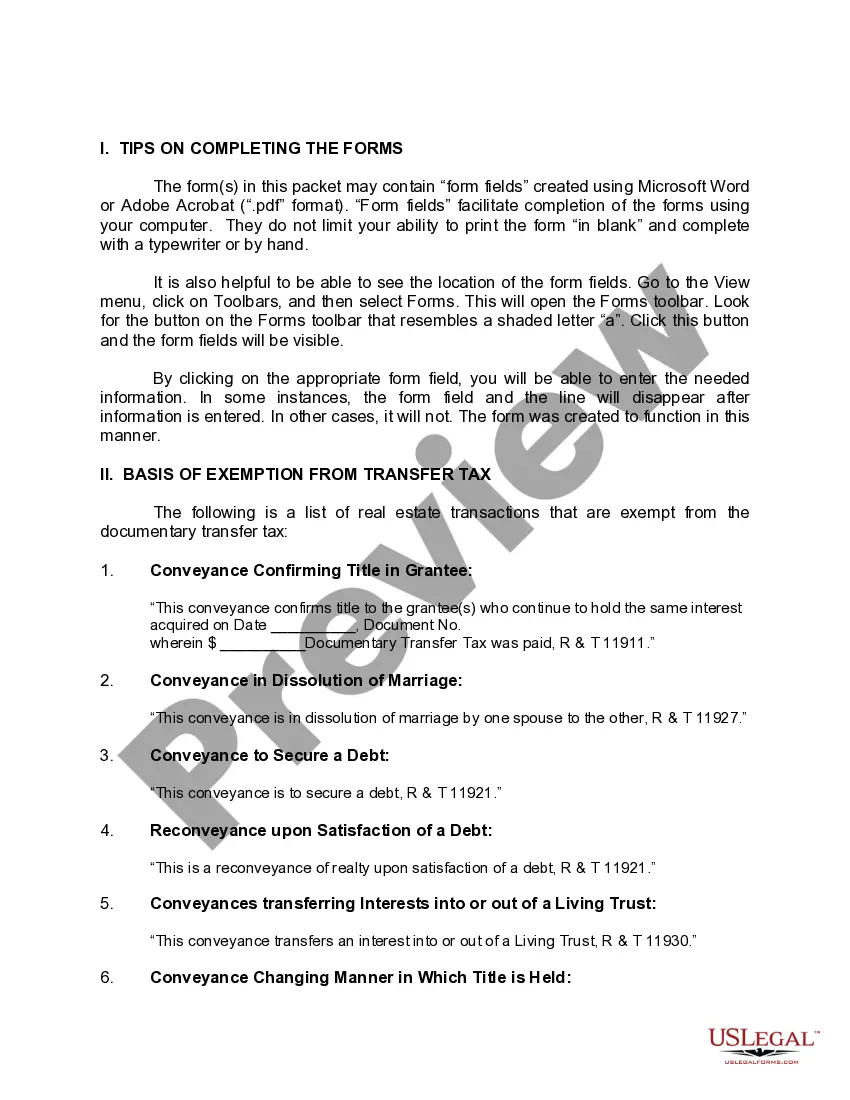

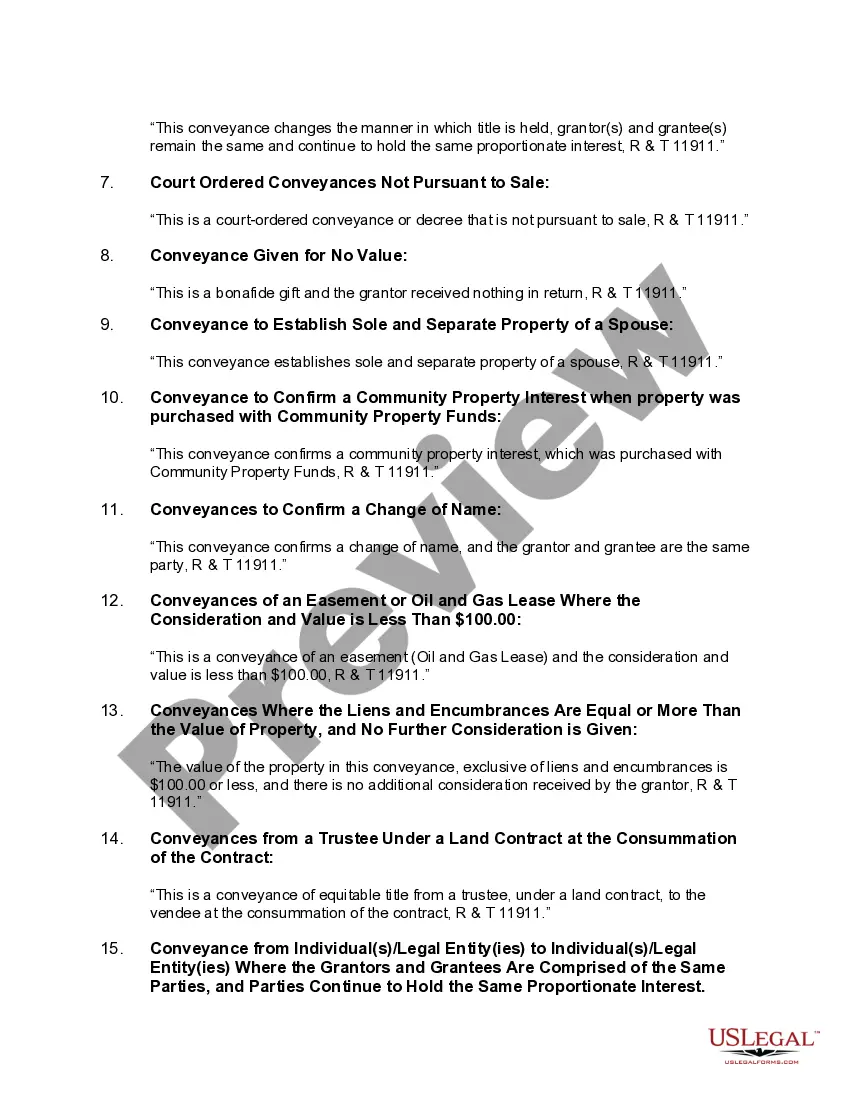

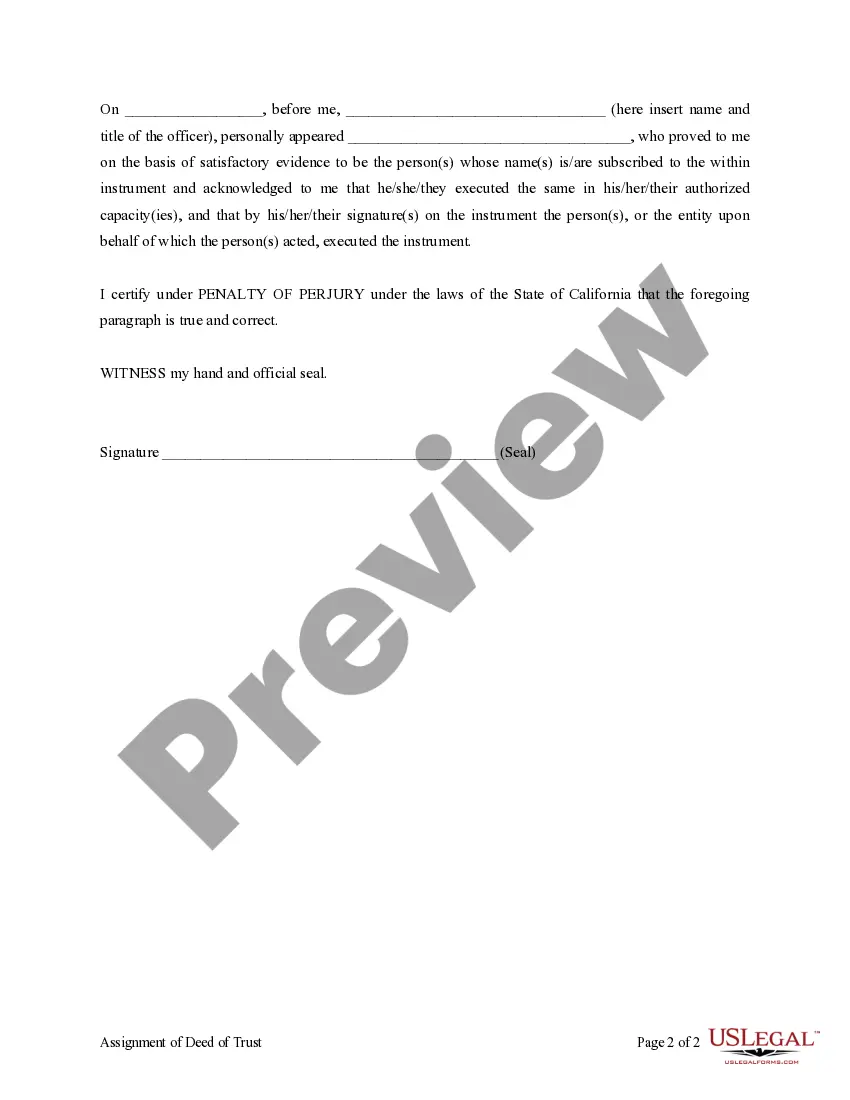

Fullerton, California Assignment of Deed of Trust by Individual Mortgage Holder: A Comprehensive Guide Introduction: In Fullerton, California, an Assignment of Deed of Trust by an Individual Mortgage Holder is a legal document that serves as evidence of the transfer of a mortgage from one party to another. This assignment allows the new mortgage holder to be recognized as the legal owner of the property's mortgage and rights associated with it. It is essential to understand the different types and nuances of Fullerton California Assignment of Deed of Trust by Individual Mortgage Holder to ensure a smooth transition and protect the interests of all parties involved. Types of Assignments: 1. Voluntary Assignment: A voluntary assignment refers to situations where the individual mortgage holder willingly transfers their rights and interest in a deed of trust to another party. This could occur due to various reasons, such as selling the note or mortgage, transferring ownership due to divorce or inheritance, or simply choosing to proceed with a different financial arrangement. 2. Involuntary Assignment: Involuntary assignments happen when the transfer of a mortgage is not voluntary but rather forced by a legal process or judgment. This could occur in cases of foreclosure, bankruptcy, or when the court orders the assignment of the deed of trust to settle a debt or dispute. Important Considerations: 1. Legal Requirements: To ensure the Assignment of Deed of Trust is valid and enforceable in Fullerton, California, it must adhere to specific legal requirements. These include proper execution by all involved parties, correctly identifying the subject property, clear identification of the assignee, and compliance with state and local regulations. 2. Recording the Assignment: To provide notice to all interested parties, it is crucial to record the Assignment of Deed of Trust with the County Recorder's Office in the county where the property is located. This recording helps establish the order of priorities in case of multiple assignments or claims against the property. 3. Potential Liabilities and Protections: Individual mortgage holders must carefully consider any potential liabilities that may arise from the assignment. Proper legal counsel should be sought to ensure protection against adverse claims, potential breaches, or further obligations related to the assignment. 4. Consultation with Professionals: Navigating the complexities of an Assignment of Deed of Trust by an Individual Mortgage Holder can be challenging. Engaging the services of experienced real estate attorneys, mortgage brokers, or title companies in Fullerton, California, is highly recommended ensuring compliance with all legal requirements and to safeguard one's interests during the assignment process. Conclusion: In Fullerton, California, an Assignment of Deed of Trust by an Individual Mortgage Holder is a crucial legal document that facilitates the transfer of the rights and interests associated with a mortgage. Understanding the various types of assignments, legal requirements, and potential liabilities is essential to ensure a smooth and legally sound transaction. Seeking professional assistance and staying informed about relevant regulations can help individuals navigate this process successfully.Fullerton, California Assignment of Deed of Trust by Individual Mortgage Holder: A Comprehensive Guide Introduction: In Fullerton, California, an Assignment of Deed of Trust by an Individual Mortgage Holder is a legal document that serves as evidence of the transfer of a mortgage from one party to another. This assignment allows the new mortgage holder to be recognized as the legal owner of the property's mortgage and rights associated with it. It is essential to understand the different types and nuances of Fullerton California Assignment of Deed of Trust by Individual Mortgage Holder to ensure a smooth transition and protect the interests of all parties involved. Types of Assignments: 1. Voluntary Assignment: A voluntary assignment refers to situations where the individual mortgage holder willingly transfers their rights and interest in a deed of trust to another party. This could occur due to various reasons, such as selling the note or mortgage, transferring ownership due to divorce or inheritance, or simply choosing to proceed with a different financial arrangement. 2. Involuntary Assignment: Involuntary assignments happen when the transfer of a mortgage is not voluntary but rather forced by a legal process or judgment. This could occur in cases of foreclosure, bankruptcy, or when the court orders the assignment of the deed of trust to settle a debt or dispute. Important Considerations: 1. Legal Requirements: To ensure the Assignment of Deed of Trust is valid and enforceable in Fullerton, California, it must adhere to specific legal requirements. These include proper execution by all involved parties, correctly identifying the subject property, clear identification of the assignee, and compliance with state and local regulations. 2. Recording the Assignment: To provide notice to all interested parties, it is crucial to record the Assignment of Deed of Trust with the County Recorder's Office in the county where the property is located. This recording helps establish the order of priorities in case of multiple assignments or claims against the property. 3. Potential Liabilities and Protections: Individual mortgage holders must carefully consider any potential liabilities that may arise from the assignment. Proper legal counsel should be sought to ensure protection against adverse claims, potential breaches, or further obligations related to the assignment. 4. Consultation with Professionals: Navigating the complexities of an Assignment of Deed of Trust by an Individual Mortgage Holder can be challenging. Engaging the services of experienced real estate attorneys, mortgage brokers, or title companies in Fullerton, California, is highly recommended ensuring compliance with all legal requirements and to safeguard one's interests during the assignment process. Conclusion: In Fullerton, California, an Assignment of Deed of Trust by an Individual Mortgage Holder is a crucial legal document that facilitates the transfer of the rights and interests associated with a mortgage. Understanding the various types of assignments, legal requirements, and potential liabilities is essential to ensure a smooth and legally sound transaction. Seeking professional assistance and staying informed about relevant regulations can help individuals navigate this process successfully.