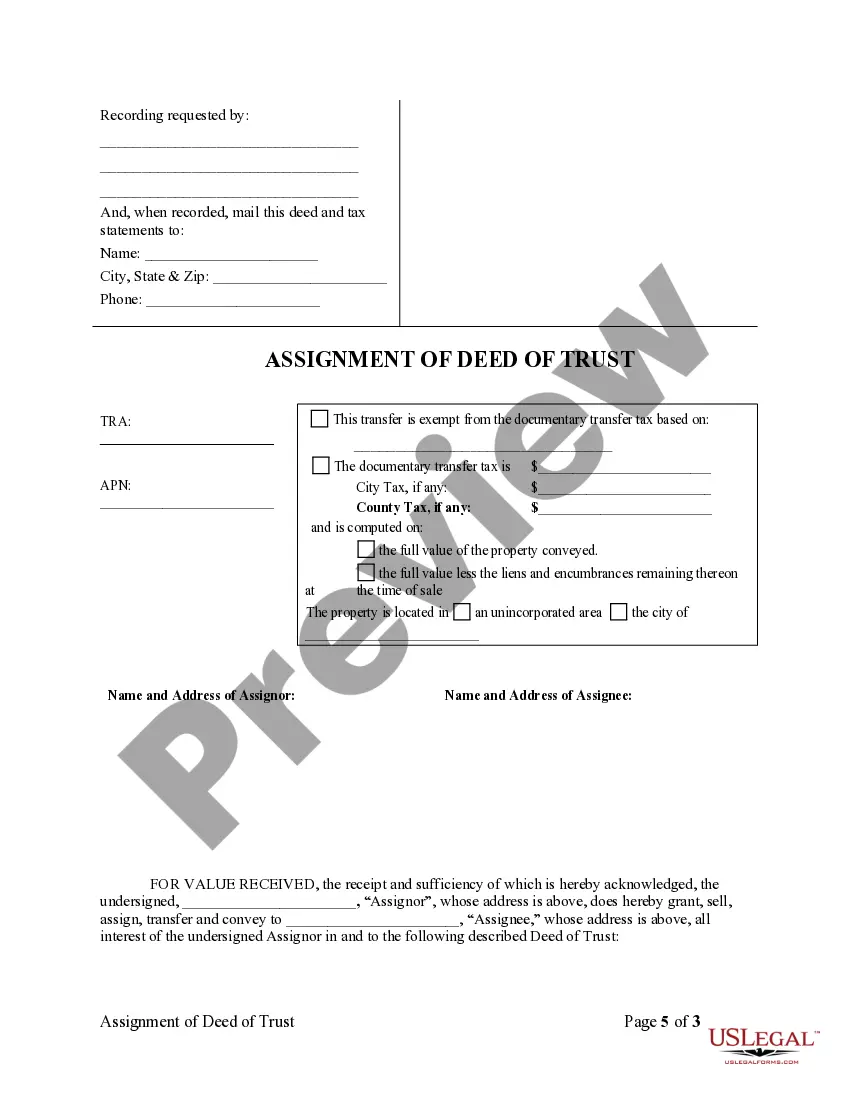

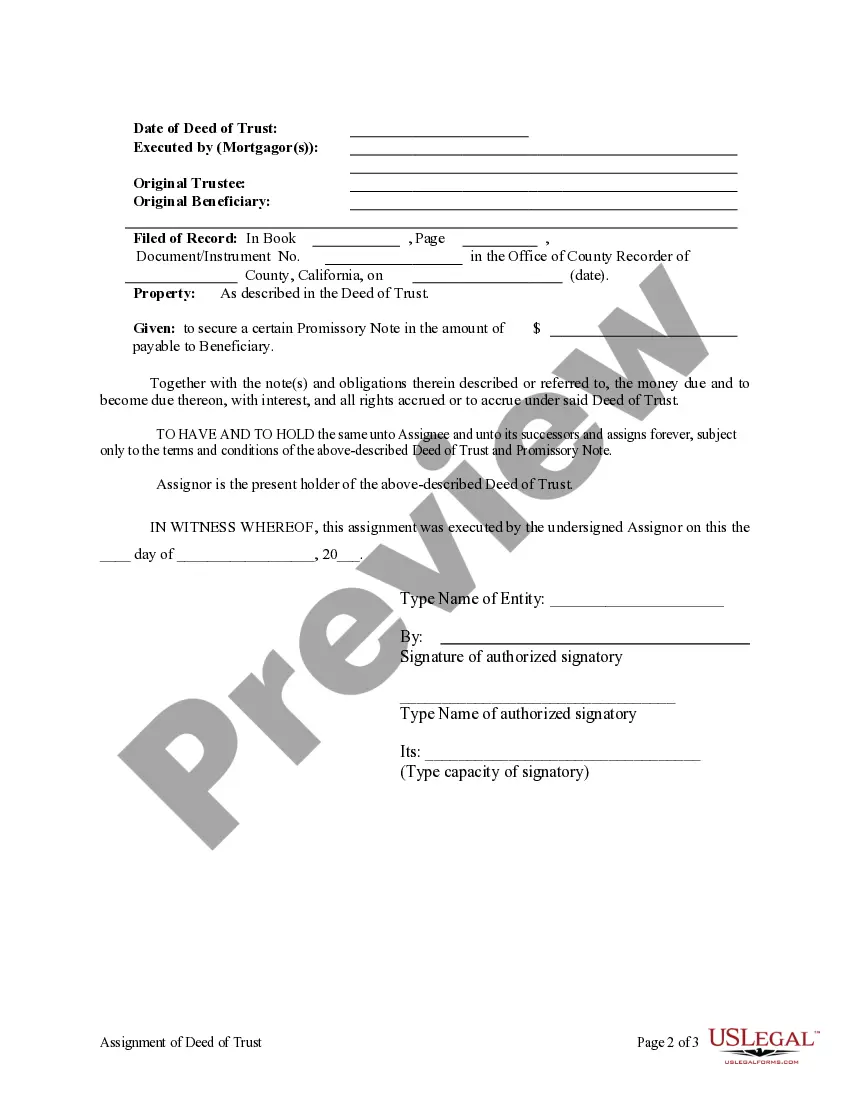

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

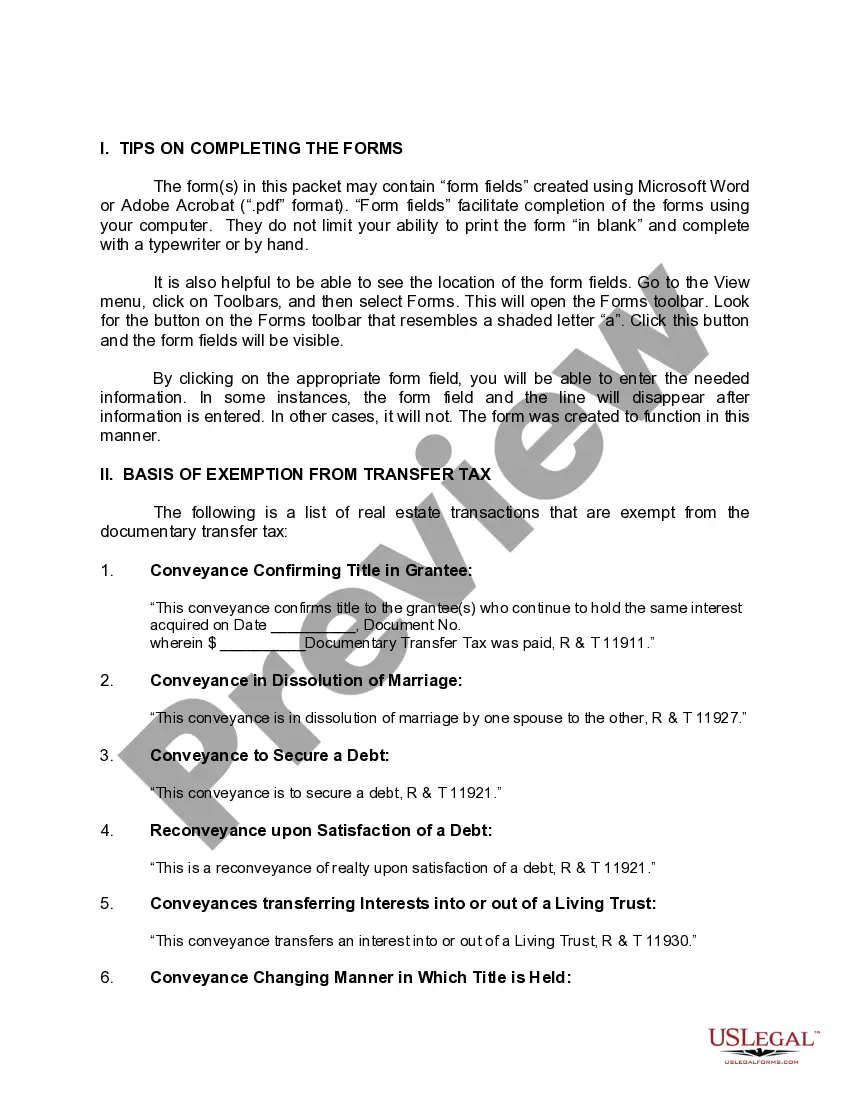

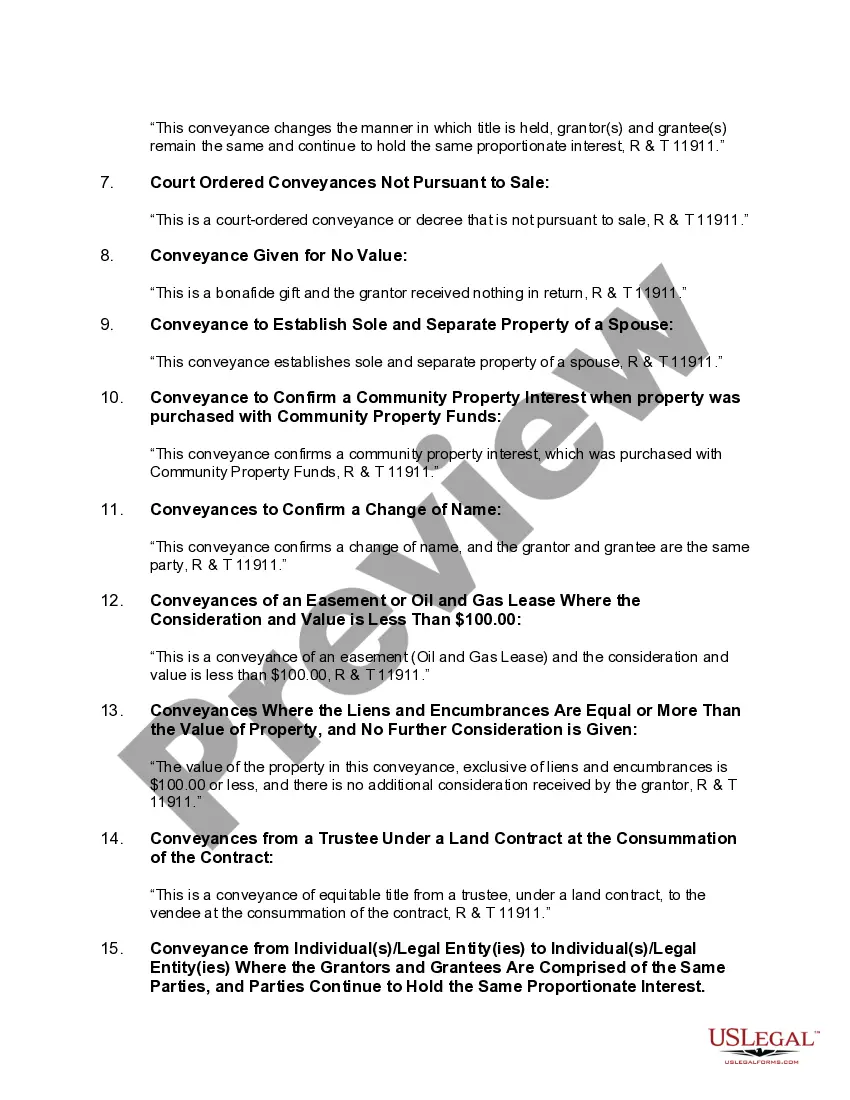

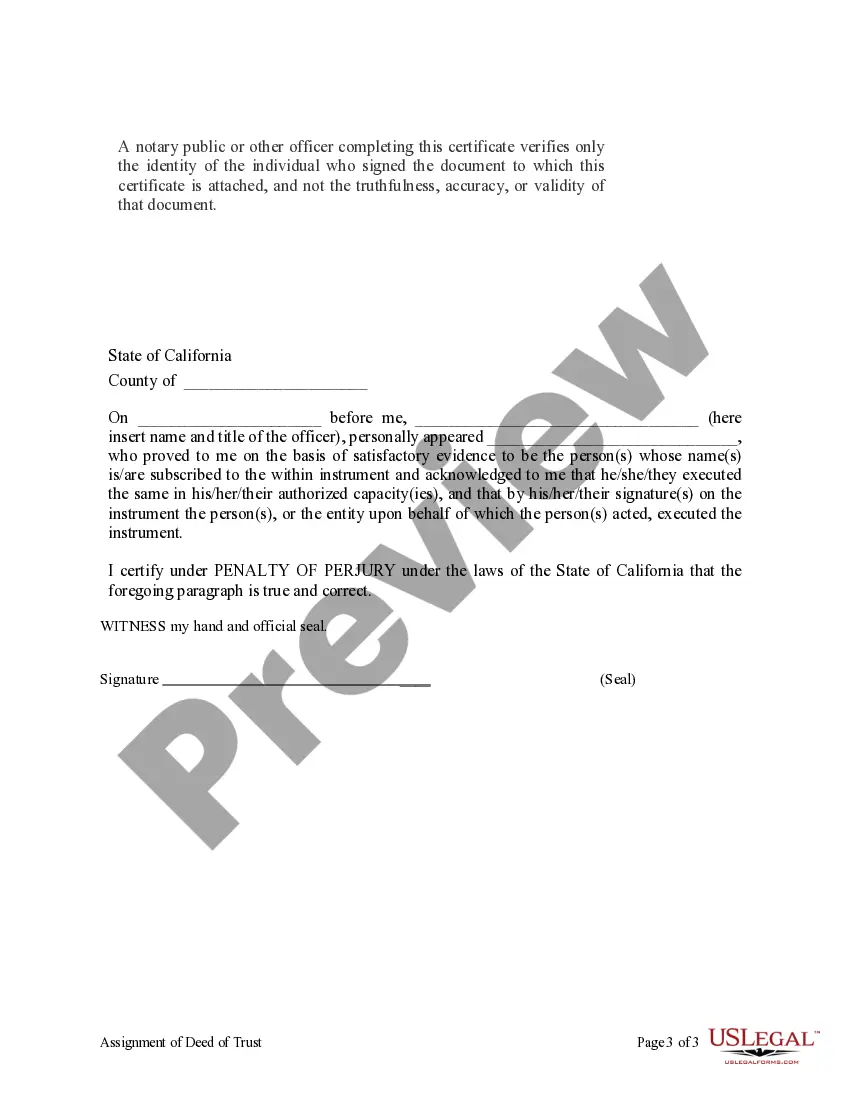

Title: Understanding Anaheim California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In Anaheim, California, the Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process that involves the transfer of a mortgage interest from a corporate mortgage holder to another party. This essential document plays a crucial role in real estate transactions and ensures the proper transfer of ownership rights. Let's delve into the details of this process, including its types and significance. Types of Anaheim California Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Full Assignment: A full assignment refers to the complete transfer of all mortgage rights and obligations from the corporate mortgage holder to another entity. This type of assignment occurs when the entire debt or loan is transferred, including all terms and conditions mentioned in the original deed of trust. 2. Partial Assignment: A partial assignment occurs when only a portion of the mortgage interest is transferred from the corporate mortgage holder to another party. This type of assignment often takes place when the mortgage holder wants to divide the loan into multiple entities or sell a percentage of their interest. 3. Temporal Assignment: A temporal assignment refers to the assignment of the mortgage interest for a specific period, usually accompanied by a temporary assumption of responsibilities. This type of assignment can occur when the corporate mortgage holder needs temporary financial assistance or wishes to share the burden of the loan temporarily. 4. Interim Assignment: The interim assignment involves the transfer of mortgage interest on a temporary basis until a specific condition or event occurs. This type of assignment could be triggered by factors such as pending legal proceedings, bankruptcy, or when certain terms mentioned in the original deed of trust need to be fulfilled before the loan ownership is transferred permanently. Significance and Process: The Anaheim California Assignment of Deed of Trust by Corporate Mortgage Holder is an important legal transaction that requires several steps to ensure a smooth transfer. The process typically involves the following: 1. Preparation of Assignment Document: The corporate mortgage holder, also known as the assignor, prepares an Assignment of Deed of Trust document, clearly stating the intention to transfer the mortgage interest to another party (assignee). 2. Execution and Notarization: Both the assignor and the assignee must sign the document to validate the transfer. Additionally, the document needs to be notarized to make it legally binding. 3. Recording with County Recorder: To make the assignment public record, the document is recorded with the County Recorder's Office of Anaheim. This step is crucial to ensure the assignee's rights are protected against any future claims or disputes. 4. Transfer of Responsibilities: Upon completion of the assignment, the assignee assumes all rights and responsibilities associated with the mortgage interest, such as collecting payments, managing liens, and issuing foreclosure notices if necessary. Conclusion: The Anaheim California Assignment of Deed of Trust by Corporate Mortgage Holder facilitates the seamless transfer of mortgage interests between corporate entities. Understanding the different types of assignments and following the proper legal procedures ensures a transparent and secure transaction for all parties involved.Title: Understanding Anaheim California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In Anaheim, California, the Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process that involves the transfer of a mortgage interest from a corporate mortgage holder to another party. This essential document plays a crucial role in real estate transactions and ensures the proper transfer of ownership rights. Let's delve into the details of this process, including its types and significance. Types of Anaheim California Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Full Assignment: A full assignment refers to the complete transfer of all mortgage rights and obligations from the corporate mortgage holder to another entity. This type of assignment occurs when the entire debt or loan is transferred, including all terms and conditions mentioned in the original deed of trust. 2. Partial Assignment: A partial assignment occurs when only a portion of the mortgage interest is transferred from the corporate mortgage holder to another party. This type of assignment often takes place when the mortgage holder wants to divide the loan into multiple entities or sell a percentage of their interest. 3. Temporal Assignment: A temporal assignment refers to the assignment of the mortgage interest for a specific period, usually accompanied by a temporary assumption of responsibilities. This type of assignment can occur when the corporate mortgage holder needs temporary financial assistance or wishes to share the burden of the loan temporarily. 4. Interim Assignment: The interim assignment involves the transfer of mortgage interest on a temporary basis until a specific condition or event occurs. This type of assignment could be triggered by factors such as pending legal proceedings, bankruptcy, or when certain terms mentioned in the original deed of trust need to be fulfilled before the loan ownership is transferred permanently. Significance and Process: The Anaheim California Assignment of Deed of Trust by Corporate Mortgage Holder is an important legal transaction that requires several steps to ensure a smooth transfer. The process typically involves the following: 1. Preparation of Assignment Document: The corporate mortgage holder, also known as the assignor, prepares an Assignment of Deed of Trust document, clearly stating the intention to transfer the mortgage interest to another party (assignee). 2. Execution and Notarization: Both the assignor and the assignee must sign the document to validate the transfer. Additionally, the document needs to be notarized to make it legally binding. 3. Recording with County Recorder: To make the assignment public record, the document is recorded with the County Recorder's Office of Anaheim. This step is crucial to ensure the assignee's rights are protected against any future claims or disputes. 4. Transfer of Responsibilities: Upon completion of the assignment, the assignee assumes all rights and responsibilities associated with the mortgage interest, such as collecting payments, managing liens, and issuing foreclosure notices if necessary. Conclusion: The Anaheim California Assignment of Deed of Trust by Corporate Mortgage Holder facilitates the seamless transfer of mortgage interests between corporate entities. Understanding the different types of assignments and following the proper legal procedures ensures a transparent and secure transaction for all parties involved.