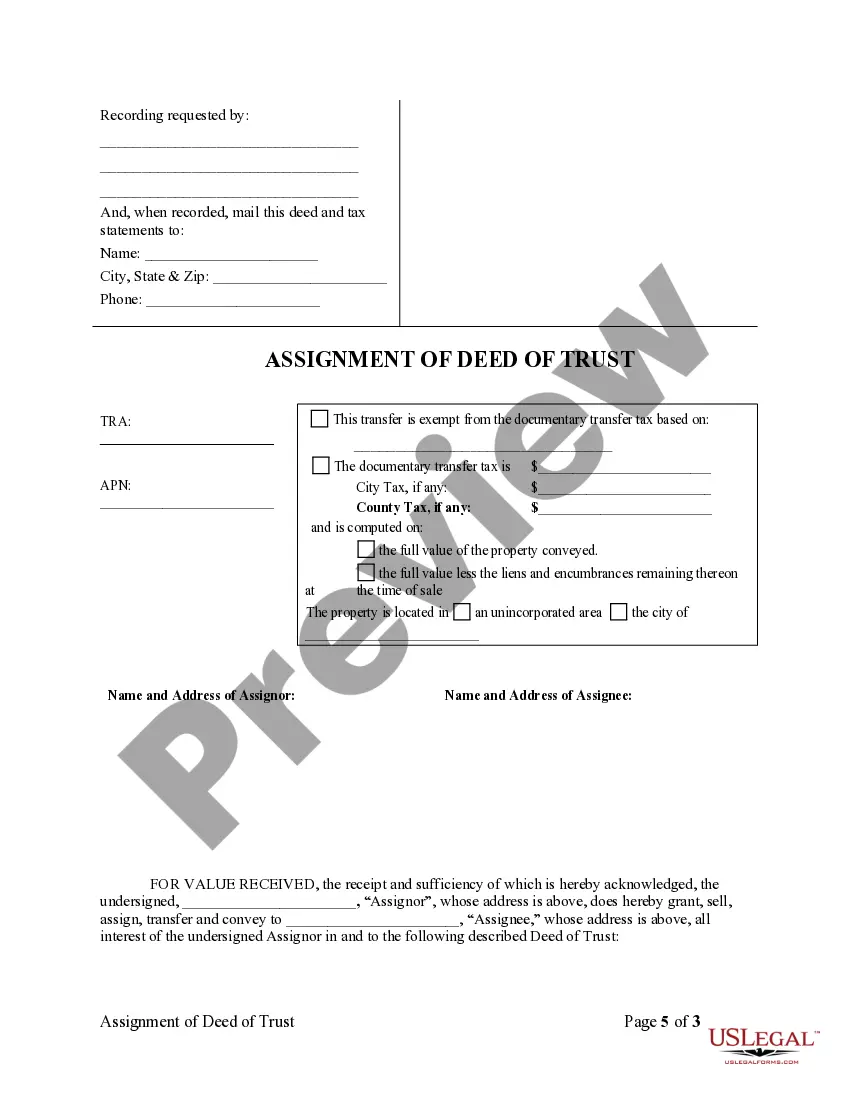

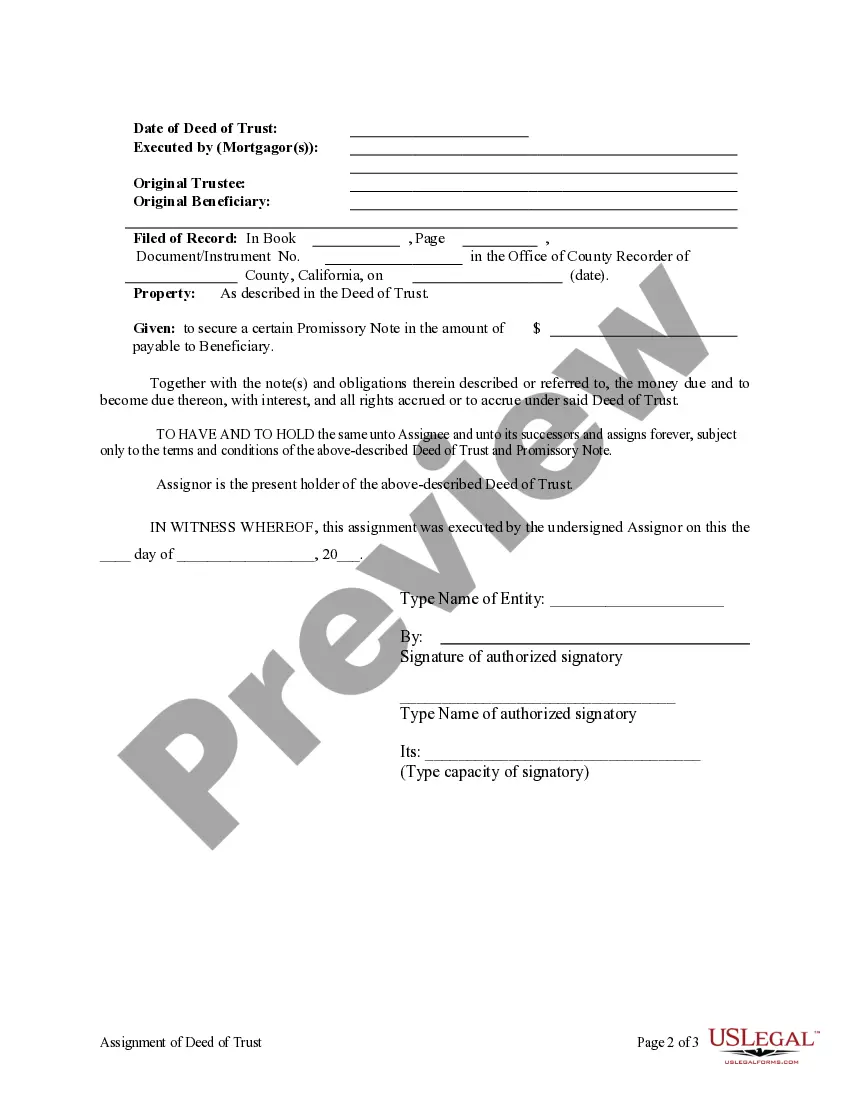

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

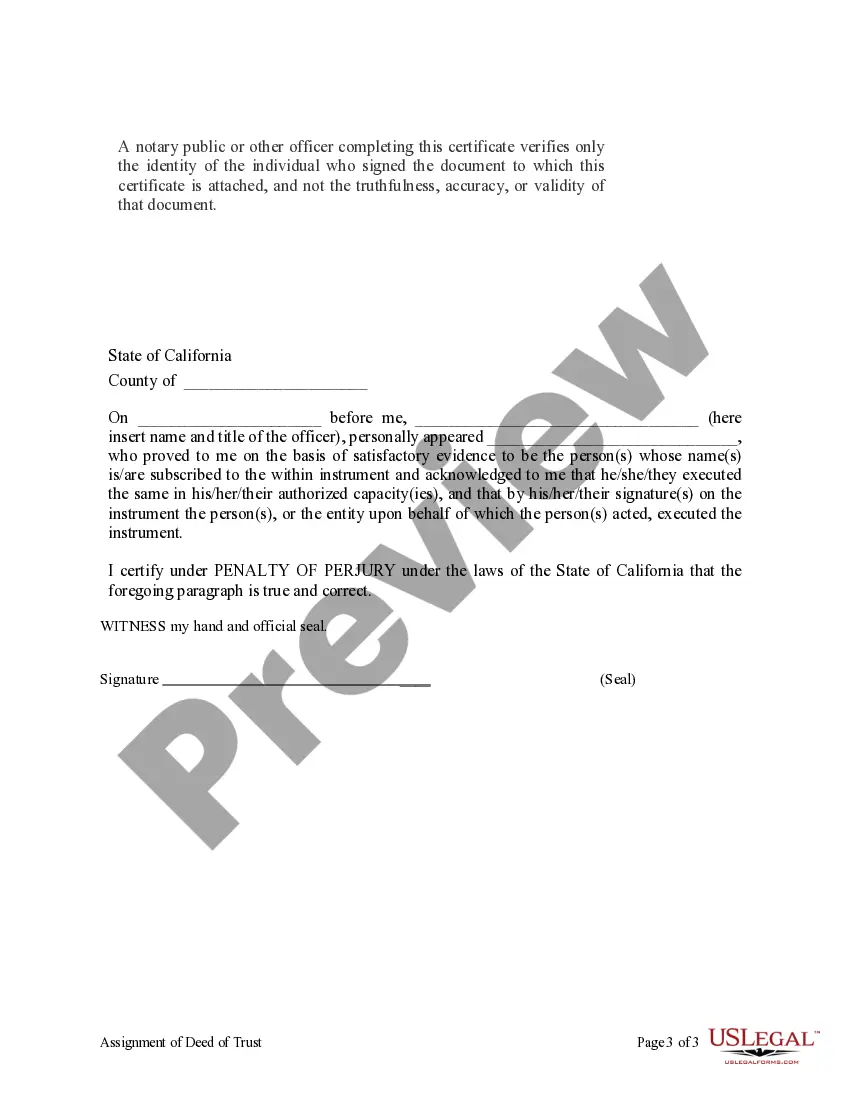

Title: Understanding Burbank California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In the real estate industry, the process of transferring a property's ownership rights is a complex one. One specific aspect of property transfer in Burbank, California is the Assignment of Deed of Trust by Corporate Mortgage Holder. This article will delve into the intricacies of this topic, shedding light on its importance and different types. 1. What is a Burbank California Assignment of Deed of Trust by Corporate Mortgage Holder? A Burbank California Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal process wherein a corporate mortgage holder assigns their rights and interests in a property to another party. This assignment typically occurs when the original mortgage holder sells, transfers, or assigns their loan to a different entity, such as another mortgage company, financial institution, or investment firm. 2. The Importance of Burbank California Assignment of Deed of Trust: The Assignment of Deed of Trust plays a vital role in securing the mortgage lender's interests and maintaining an accurate record of ownership rights to a property in Burbank, California. By clearly documenting the transfer of mortgage rights, this process ensures legal protection for both the mortgage holder and the new entity assuming the mortgage. 3. Types of Burbank California Assignment of Deed of Trust by Corporate Mortgage Holder: a) Complete Assignment: In this type, the corporate mortgage holder transfers their entire rights, interests, and title to the property to the new entity. The new entity becomes the legal mortgage holder, responsible for collecting payments, modifying the loan terms, if required, or initiating foreclosure, if necessary. b) Partial Assignment: In certain cases, the corporate mortgage holder may choose to assign only a portion of their rights and interests in a property to another entity. This partial assignment can occur when a mortgage is divided into different portions held by multiple entities. Each assigned party assumes responsibility for the designated portion of the mortgage. c) Assignment for Collateral Assignment: In some instances, corporations or investors may use a property's mortgage as collateral for a loan or investment. The corporate mortgage holder assigns a collateral interest to the entity providing the loan, ensuring repayment and securing their investment if necessary. This type of assignment limits the assigned entity's rights and is released once the loan is repaid. Conclusion: Burbank California Assignment of Deed of Trust by Corporate Mortgage Holder is a crucial process that facilitates the transfer of mortgage rights from one corporate entity to another. Through complete or partial assignment or collateral assignment, the mortgage holder ensures the legal and financial stability of their interests while giving the assigned entity control over the property's mortgage. Professional legal guidance and meticulous documentation are essential to ensure a smooth and legally valid assignment process.Title: Understanding Burbank California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In the real estate industry, the process of transferring a property's ownership rights is a complex one. One specific aspect of property transfer in Burbank, California is the Assignment of Deed of Trust by Corporate Mortgage Holder. This article will delve into the intricacies of this topic, shedding light on its importance and different types. 1. What is a Burbank California Assignment of Deed of Trust by Corporate Mortgage Holder? A Burbank California Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal process wherein a corporate mortgage holder assigns their rights and interests in a property to another party. This assignment typically occurs when the original mortgage holder sells, transfers, or assigns their loan to a different entity, such as another mortgage company, financial institution, or investment firm. 2. The Importance of Burbank California Assignment of Deed of Trust: The Assignment of Deed of Trust plays a vital role in securing the mortgage lender's interests and maintaining an accurate record of ownership rights to a property in Burbank, California. By clearly documenting the transfer of mortgage rights, this process ensures legal protection for both the mortgage holder and the new entity assuming the mortgage. 3. Types of Burbank California Assignment of Deed of Trust by Corporate Mortgage Holder: a) Complete Assignment: In this type, the corporate mortgage holder transfers their entire rights, interests, and title to the property to the new entity. The new entity becomes the legal mortgage holder, responsible for collecting payments, modifying the loan terms, if required, or initiating foreclosure, if necessary. b) Partial Assignment: In certain cases, the corporate mortgage holder may choose to assign only a portion of their rights and interests in a property to another entity. This partial assignment can occur when a mortgage is divided into different portions held by multiple entities. Each assigned party assumes responsibility for the designated portion of the mortgage. c) Assignment for Collateral Assignment: In some instances, corporations or investors may use a property's mortgage as collateral for a loan or investment. The corporate mortgage holder assigns a collateral interest to the entity providing the loan, ensuring repayment and securing their investment if necessary. This type of assignment limits the assigned entity's rights and is released once the loan is repaid. Conclusion: Burbank California Assignment of Deed of Trust by Corporate Mortgage Holder is a crucial process that facilitates the transfer of mortgage rights from one corporate entity to another. Through complete or partial assignment or collateral assignment, the mortgage holder ensures the legal and financial stability of their interests while giving the assigned entity control over the property's mortgage. Professional legal guidance and meticulous documentation are essential to ensure a smooth and legally valid assignment process.