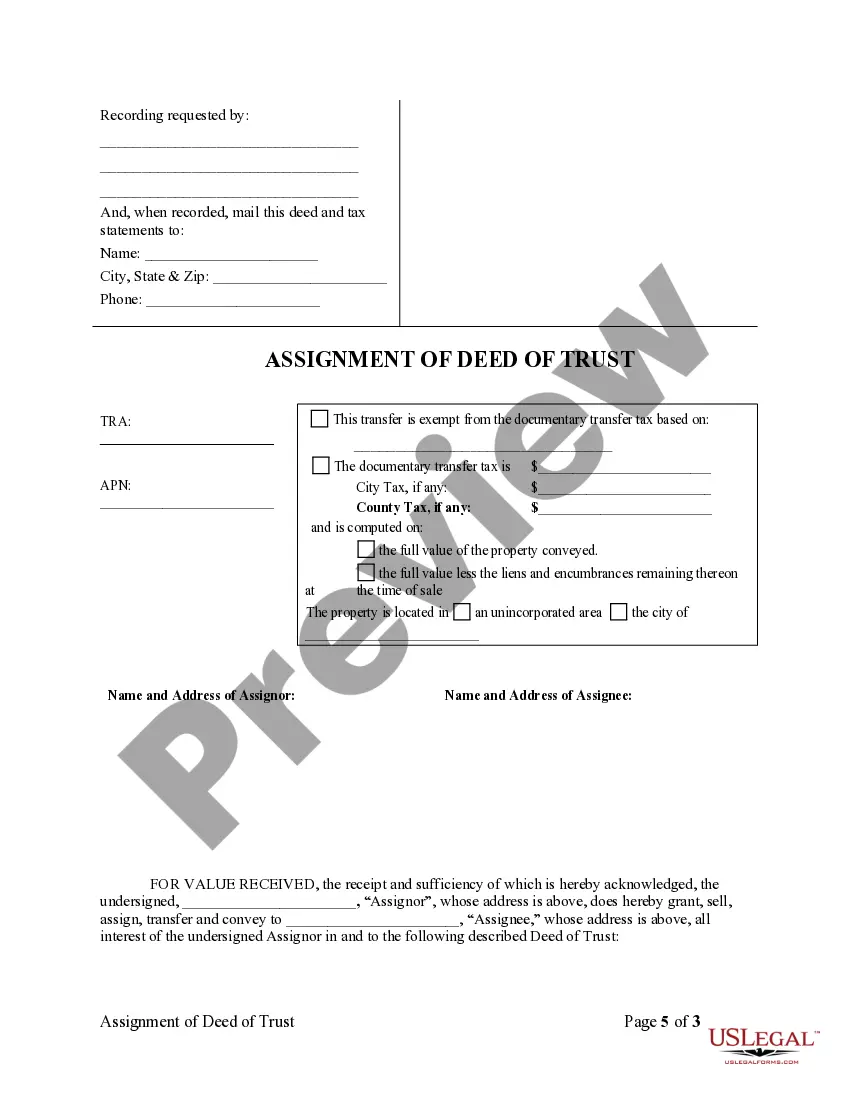

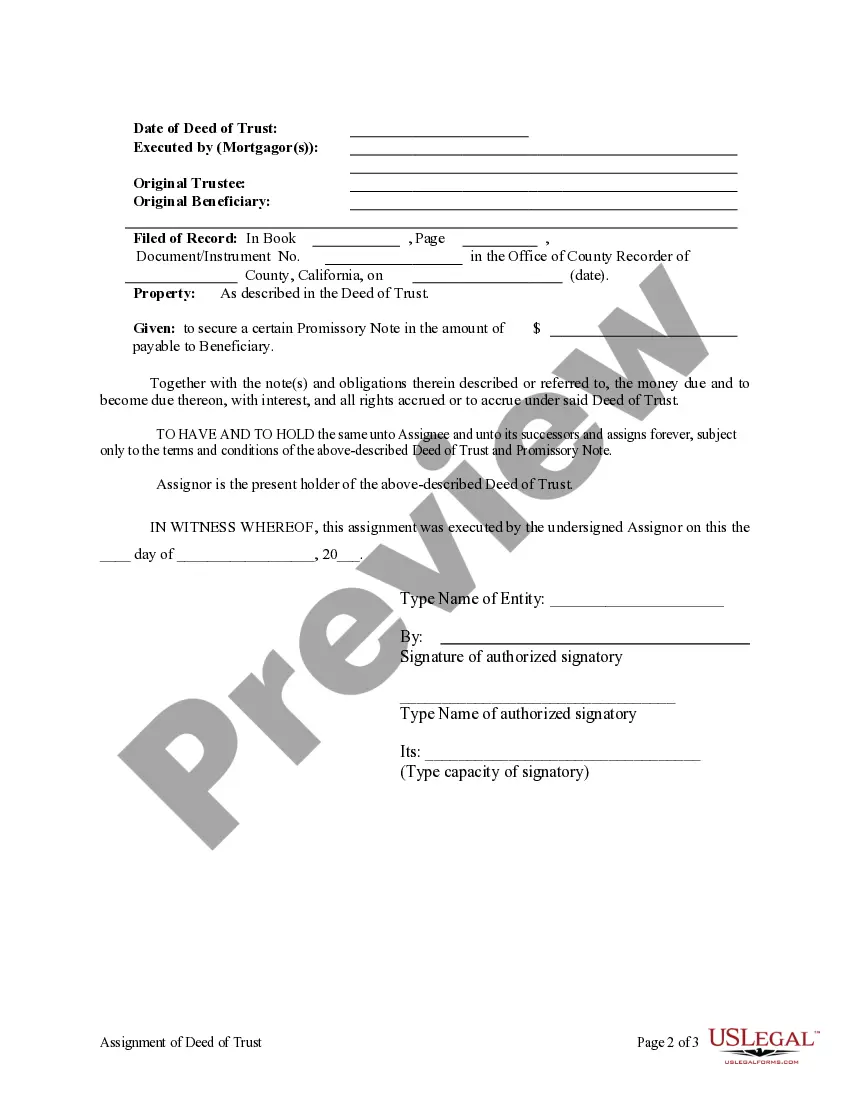

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Chico California Assignment of Deed of Trust by Corporate Mortgage Holder

Description

How to fill out California Assignment Of Deed Of Trust By Corporate Mortgage Holder?

If you have previously made use of our service, Log In to your profile and save the Chico California Assignment of Deed of Trust by Corporate Mortgage Holder onto your device by clicking the Download button. Ensure that your subscription is active. If not, renew it in accordance with your payment plan.

If this is your initial experience with our service, follow these straightforward steps to obtain your document.

You have ongoing access to every document you have purchased: you can find it in your profile within the My documents section whenever you wish to use it again. Utilize the US Legal Forms service to effortlessly find and save any template for your personal or business needs!

- Ensure that you have found a suitable document. Review the description and use the Preview feature, if available, to verify if it suits your requirements. If it does not, use the Search tab above to find the right one.

- Acquire the template. Click the Buy Now button and choose a monthly or yearly subscription plan.

- Create an account and process your payment. Use your credit card details or the PayPal option to finalize the transaction.

- Obtain your Chico California Assignment of Deed of Trust by Corporate Mortgage Holder. Select the file format for your document and download it to your device.

- Fill out your document. Print it or utilize professional online editors to complete and sign it electronically.

Form popularity

FAQ

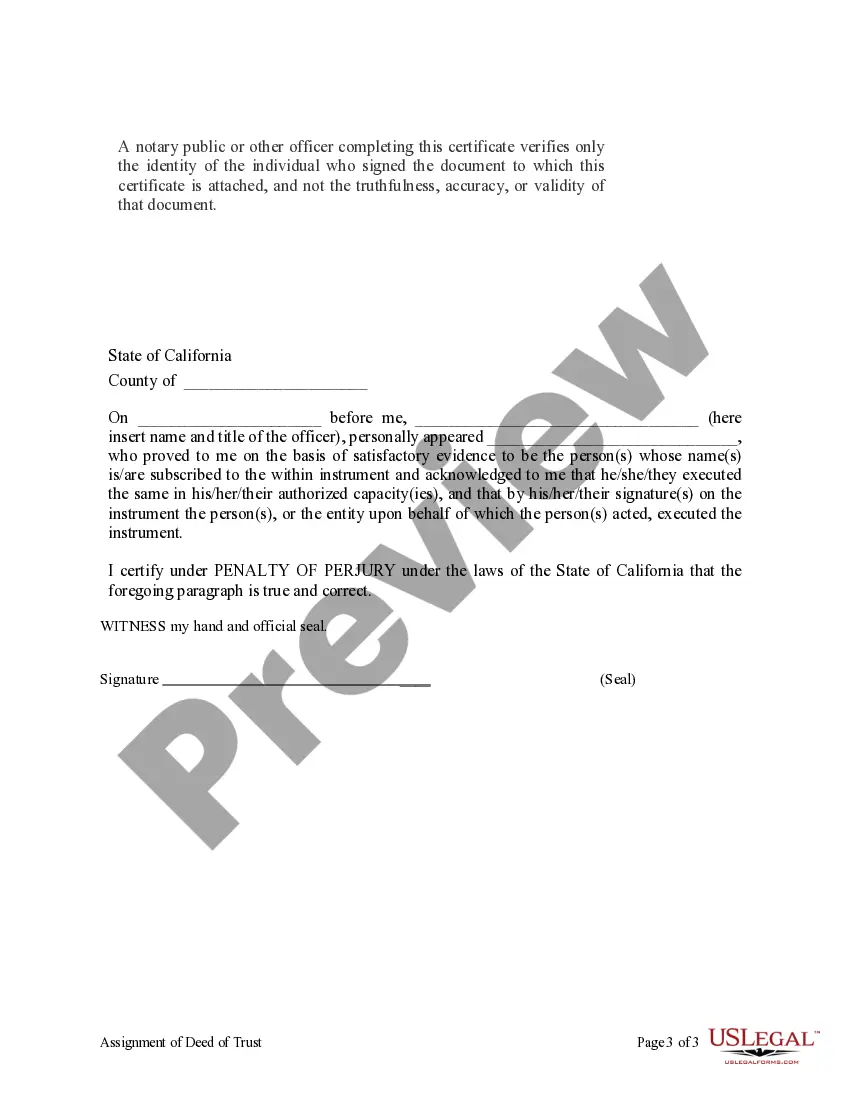

In Chico, California, the Assignment of Deed of Trust by Corporate Mortgage Holder requires signatures from the current mortgage holder. This could be an individual or a corporate entity, depending on the ownership of the mortgage. Additionally, the parties receiving the assignment must also sign the document to acknowledge the transfer. It is essential to have these signatures notarized to ensure the assignment is legally binding and recognized by the county.

The assignment of trust refers to the legal process of transferring one's beneficial interest in a trust to another party. This action becomes significant when dealing with financial obligations, such as the Chico California Assignment of Deed of Trust by Corporate Mortgage Holder. It ensures that all parties are aware of their rights and duties while promoting transparency in real estate transactions.

A corporate assignment occurs when a corporate entity transfers its rights and obligations under a specific contract or agreement. This move is often necessary when a company sells or reallocates its interests in real estate. Within the framework of the Chico California Assignment of Deed of Trust by Corporate Mortgage Holder, a corporate assignment allows businesses to manage their financial assets efficiently and to maintain compliance with legal standards.

A deed conveys ownership of property, while a deed of assignment transfers rights and benefits under an existing agreement. In the case of the Chico California Assignment of Deed of Trust by Corporate Mortgage Holder, understanding this distinction is essential, as it clarifies the obligations each party accepts during the transaction. The deed of assignment allows for the seamless transition of responsibilities, ensuring all parties remain informed.

The Assignment of a mortgage or deed of trust is a legal process where a mortgage holder transfers their interests or rights to another entity. This transfer is crucial for maintaining the flow of financial responsibilities and helps ensure that the new entity can enforce the terms of the mortgage. In the context of a Chico California Assignment of Deed of Trust by Corporate Mortgage Holder, this process plays a critical role in financial dealings and property management.

A deed of trust can become invalid if it fails to meet the legal requirements, such as lacking proper signatures or acknowledgments, or if it is not recorded with the county. Additionally, improper execution or non-compliance with state laws may also invalidate the deed. For anyone involved in a Chico California Assignment of Deed of Trust by Corporate Mortgage Holder, ensuring compliance with all legal standards is vital to maintain the effectiveness of the deed.

A deed of transfer conveys ownership of property, effectively changing title, whereas a deed of Assignment primarily delegates rights and responsibilities without altering the ownership of the property. In the case of a Chico California Assignment of Deed of Trust by Corporate Mortgage Holder, understanding these nuances is key to ensuring the correct legal procedures are followed during property transactions.

California requires certain elements for a deed of trust to be valid, including the signatures of the parties involved, a clear description of the property, and acknowledgment by a notary. Additionally, it must be recorded with the county to establish public notice and protect the rights of the involved parties. For those engaged in transactions related to a Chico California Assignment of Deed of Trust by Corporate Mortgage Holder, adhering to these requirements is essential.

Assignment of a contract involves transferring the rights and obligations of that contract to another party, while a transfer may encompass both rights and ownership. In the context of a Chico California Assignment of Deed of Trust by Corporate Mortgage Holder, it is crucial to recognize that the assignment allows for a continuation of the original agreement without altering ownership. Knowing these terms helps in navigating legal documentation effectively.

Generally, an Assignment does not transfer ownership of the property itself; instead, it transfers the rights and obligations associated with a deed of trust. Ownership remains with the original party unless a deed of transfer simultaneously occurs. For those dealing with a Chico California Assignment of Deed of Trust by Corporate Mortgage Holder, understanding this distinction is important for proper legal handling.