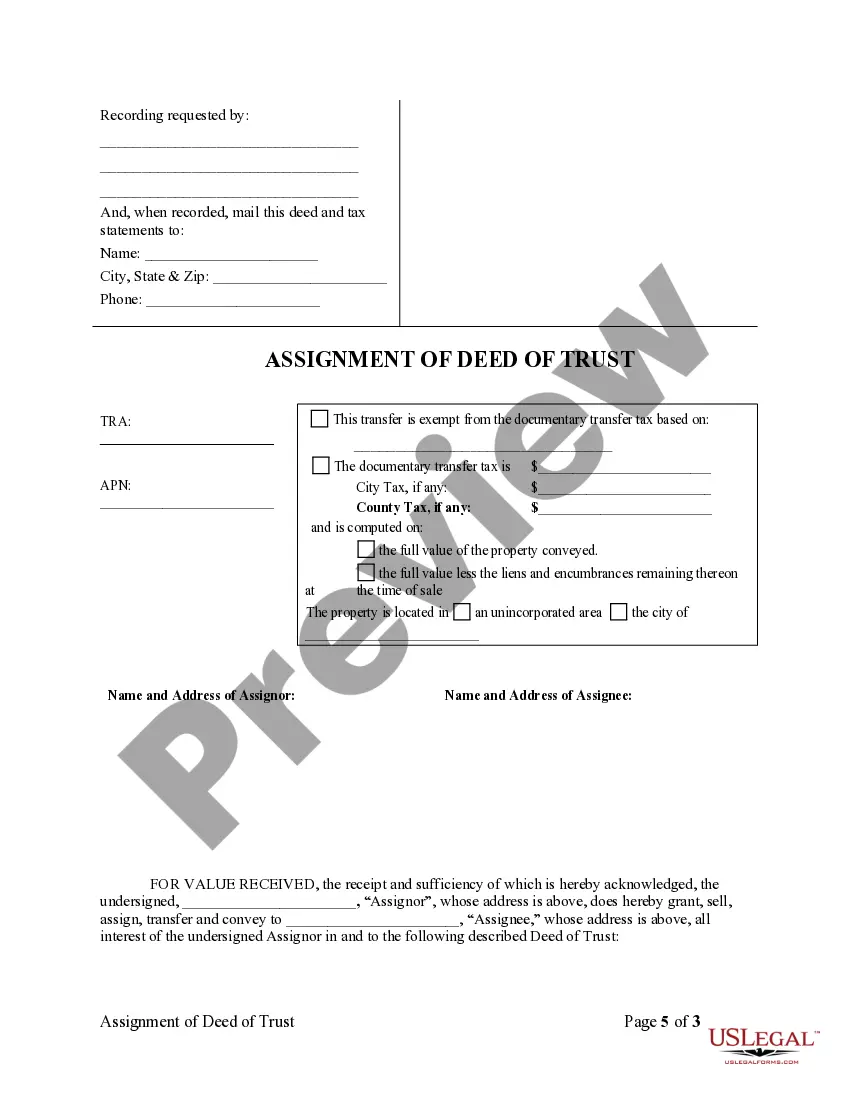

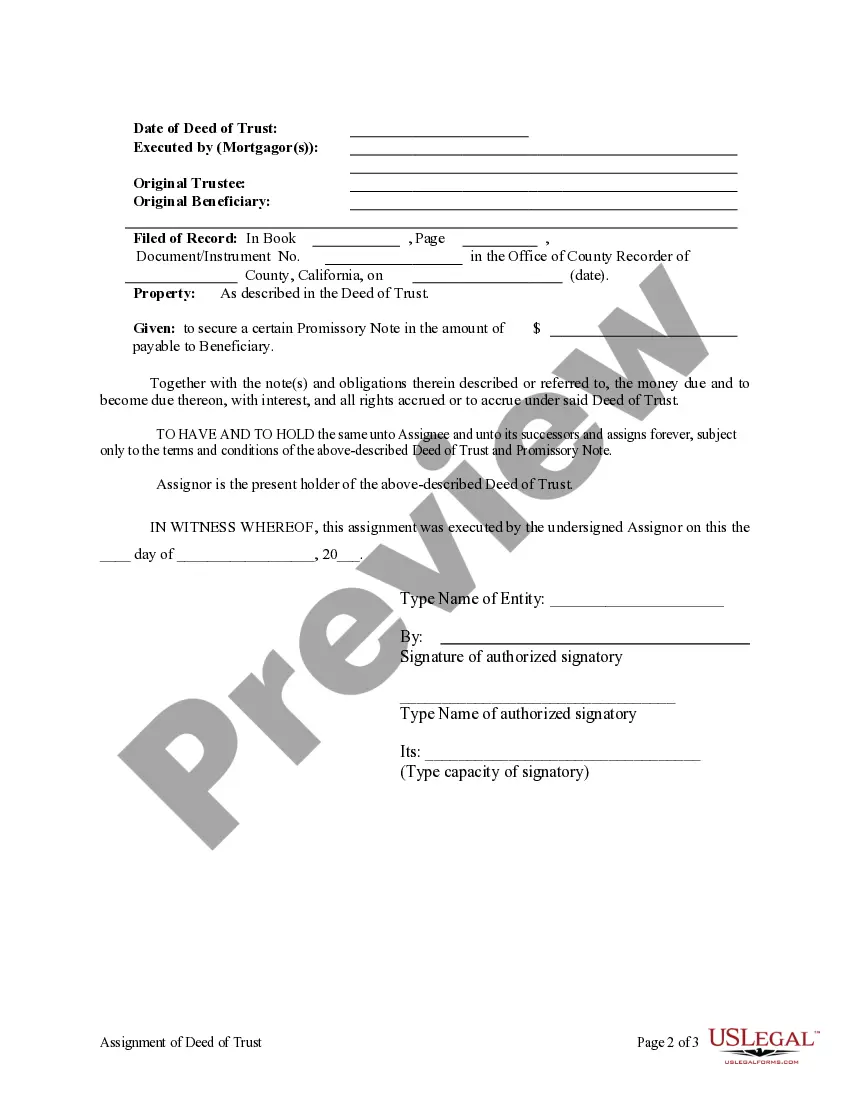

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Contra Costa County, located in California, often witnesses real estate transactions involving the Assignment of Deed of Trust by Corporate Mortgage Holder. This process allows a corporate mortgage holder to transfer their rights and interests in a property's deed of trust to another party. Through this assignment, the new assignee assumes the role of the mortgage holder, along with all associated rights and responsibilities. Keywords: Contra Costa County, California, Assignment of Deed of Trust, Corporate Mortgage Holder, real estate transaction, transfer of rights, property's deed of trust, assignee, mortgage holder. There are several types of Contra Costa California Assignment of Deed of Trust by Corporate Mortgage Holder based on specific circumstances and purposes: 1. Assignment for Transfer of Loan Ownership: In this type, the corporate mortgage holder transfers the ownership of the loan and associated deed of trust to another corporate entity. This assignment generally occurs due to financial arrangements between mortgage lenders and corporations, such as banks selling mortgage portfolios to different financial institutions. 2. Assignment for Loan Servicing: Sometimes, the corporate mortgage holder assigns the deed of trust to a third-party loan service. Loan services are responsible for managing various aspects of the loan, such as collecting payments, handling escrow accounts, and addressing borrower inquiries. This type of assignment allows the corporate mortgage holder to outsource loan servicing operations while retaining ownership. 3. Assignment for Securitization: In cases of securitization, the corporate mortgage holder assigns the deed of trust to a Special Purpose Vehicle (SPV), which pools multiple mortgages to create mortgage-backed securities (MBS). These MBS are then sold to investors, providing the corporate mortgage holder with liquidity to originate new loans. The SPV manages the cash flows from the bundled mortgages and ensures investors receive their expected returns. 4. Assignment for Default or Foreclosure Proceedings: If a borrower defaults on their mortgage, the corporate mortgage holder may assign the deed of trust to a trustee or foreclosure attorney. This assignment enables the trustee to initiate foreclosure proceedings, aiming to recover the outstanding loan amount through the sale of the property. These assignments are typically executed to protect the interests of the corporate mortgage holder and may involve the transfer of legal authority to conduct foreclosure actions. In Contra Costa County, California, various circumstances can lead to the Assignment of Deed of Trust by Corporate Mortgage Holder. These assignments involve transferring ownership, loan servicing, securitization, or initiating foreclosure proceedings to safeguard the corporate mortgage holder's interests. Understanding these different types of assignments is essential for both parties involved in the real estate transaction, ensuring a smooth transfer of rights and responsibilities.Contra Costa County, located in California, often witnesses real estate transactions involving the Assignment of Deed of Trust by Corporate Mortgage Holder. This process allows a corporate mortgage holder to transfer their rights and interests in a property's deed of trust to another party. Through this assignment, the new assignee assumes the role of the mortgage holder, along with all associated rights and responsibilities. Keywords: Contra Costa County, California, Assignment of Deed of Trust, Corporate Mortgage Holder, real estate transaction, transfer of rights, property's deed of trust, assignee, mortgage holder. There are several types of Contra Costa California Assignment of Deed of Trust by Corporate Mortgage Holder based on specific circumstances and purposes: 1. Assignment for Transfer of Loan Ownership: In this type, the corporate mortgage holder transfers the ownership of the loan and associated deed of trust to another corporate entity. This assignment generally occurs due to financial arrangements between mortgage lenders and corporations, such as banks selling mortgage portfolios to different financial institutions. 2. Assignment for Loan Servicing: Sometimes, the corporate mortgage holder assigns the deed of trust to a third-party loan service. Loan services are responsible for managing various aspects of the loan, such as collecting payments, handling escrow accounts, and addressing borrower inquiries. This type of assignment allows the corporate mortgage holder to outsource loan servicing operations while retaining ownership. 3. Assignment for Securitization: In cases of securitization, the corporate mortgage holder assigns the deed of trust to a Special Purpose Vehicle (SPV), which pools multiple mortgages to create mortgage-backed securities (MBS). These MBS are then sold to investors, providing the corporate mortgage holder with liquidity to originate new loans. The SPV manages the cash flows from the bundled mortgages and ensures investors receive their expected returns. 4. Assignment for Default or Foreclosure Proceedings: If a borrower defaults on their mortgage, the corporate mortgage holder may assign the deed of trust to a trustee or foreclosure attorney. This assignment enables the trustee to initiate foreclosure proceedings, aiming to recover the outstanding loan amount through the sale of the property. These assignments are typically executed to protect the interests of the corporate mortgage holder and may involve the transfer of legal authority to conduct foreclosure actions. In Contra Costa County, California, various circumstances can lead to the Assignment of Deed of Trust by Corporate Mortgage Holder. These assignments involve transferring ownership, loan servicing, securitization, or initiating foreclosure proceedings to safeguard the corporate mortgage holder's interests. Understanding these different types of assignments is essential for both parties involved in the real estate transaction, ensuring a smooth transfer of rights and responsibilities.