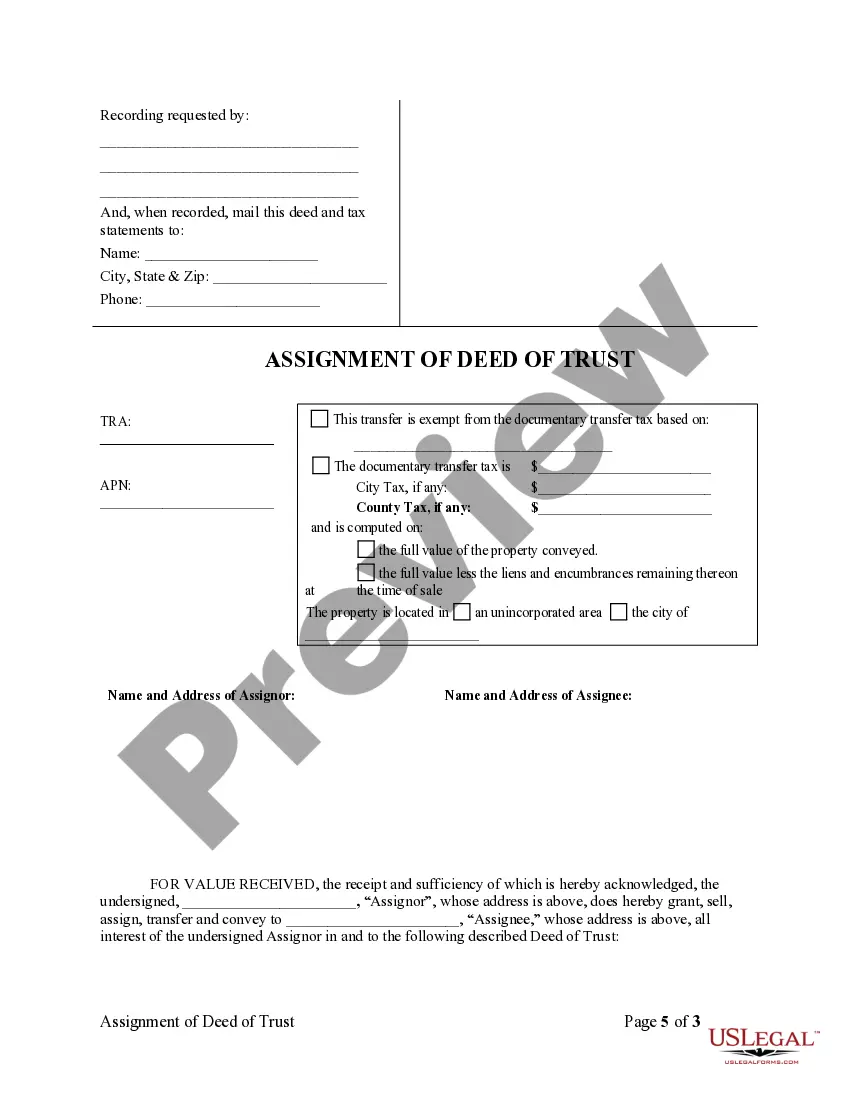

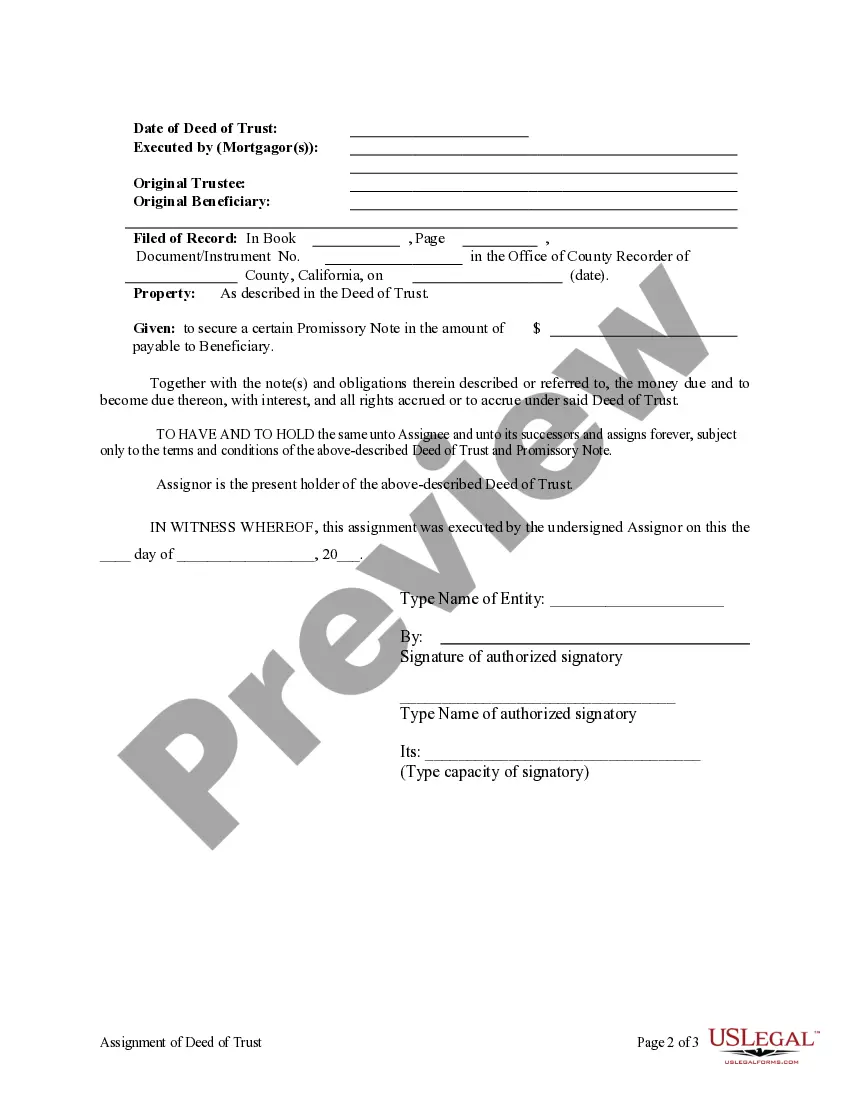

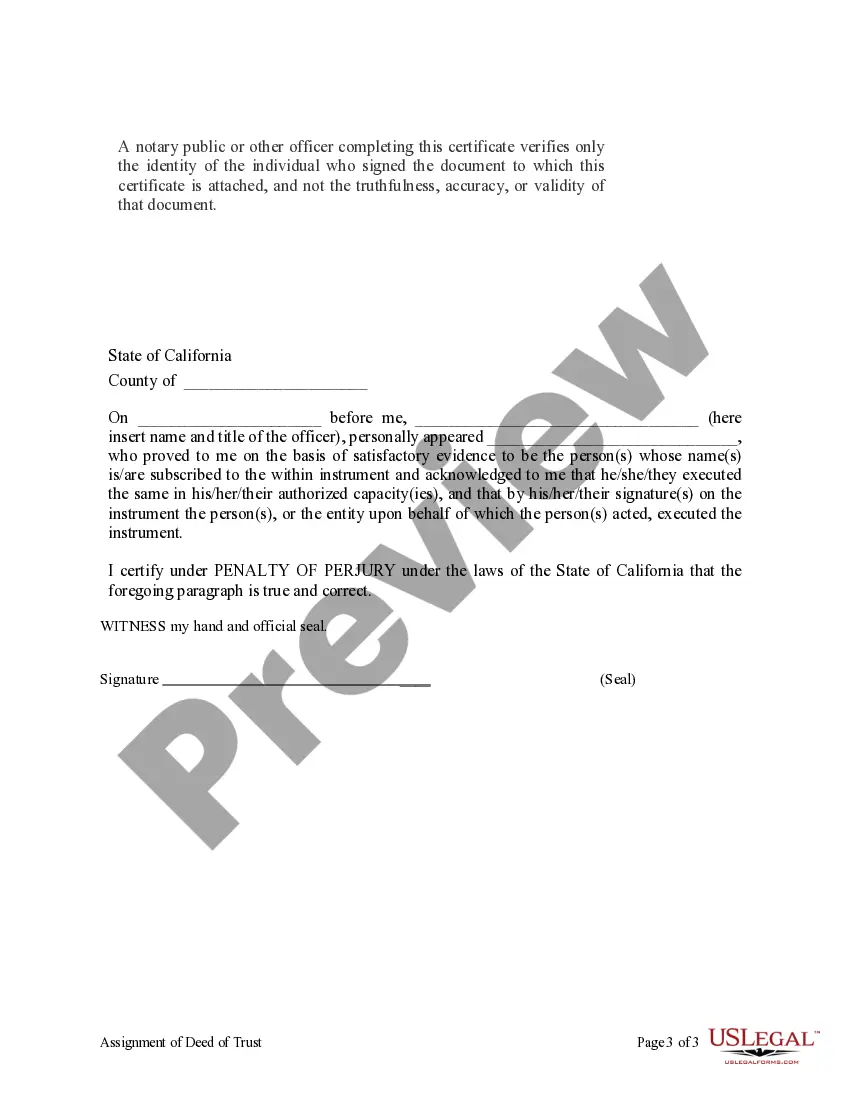

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

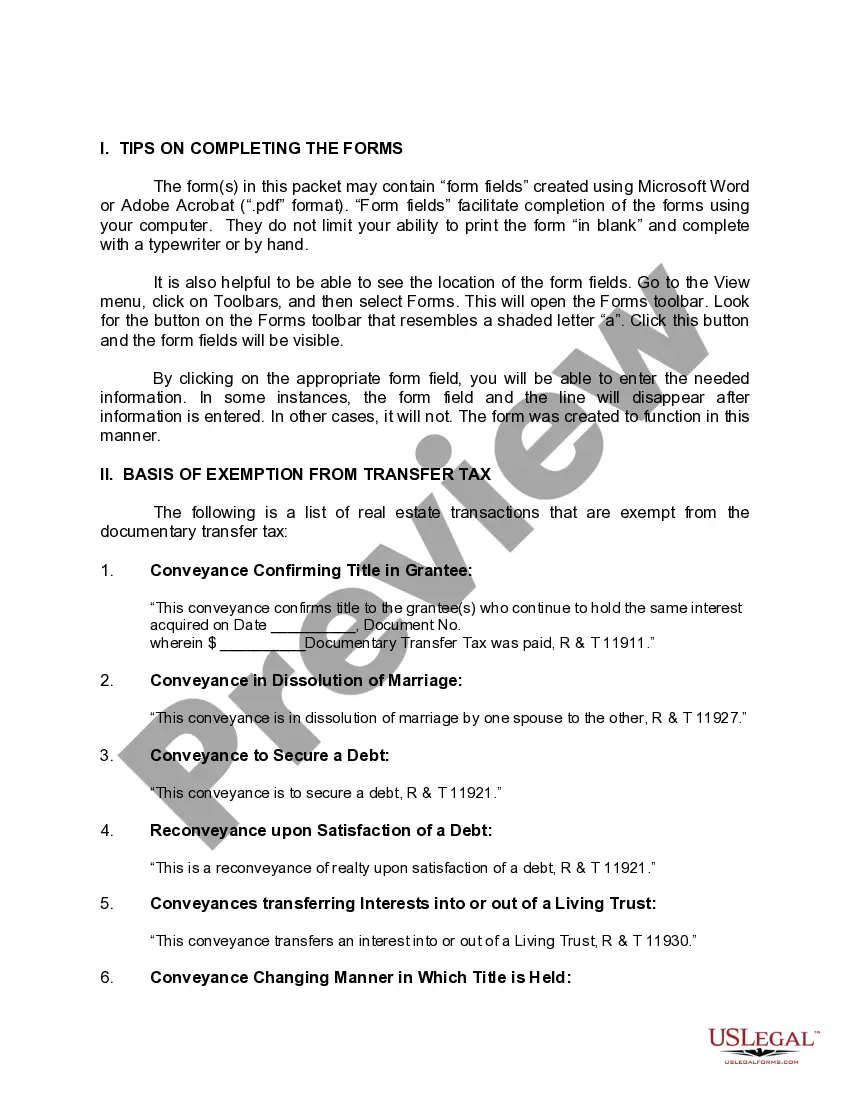

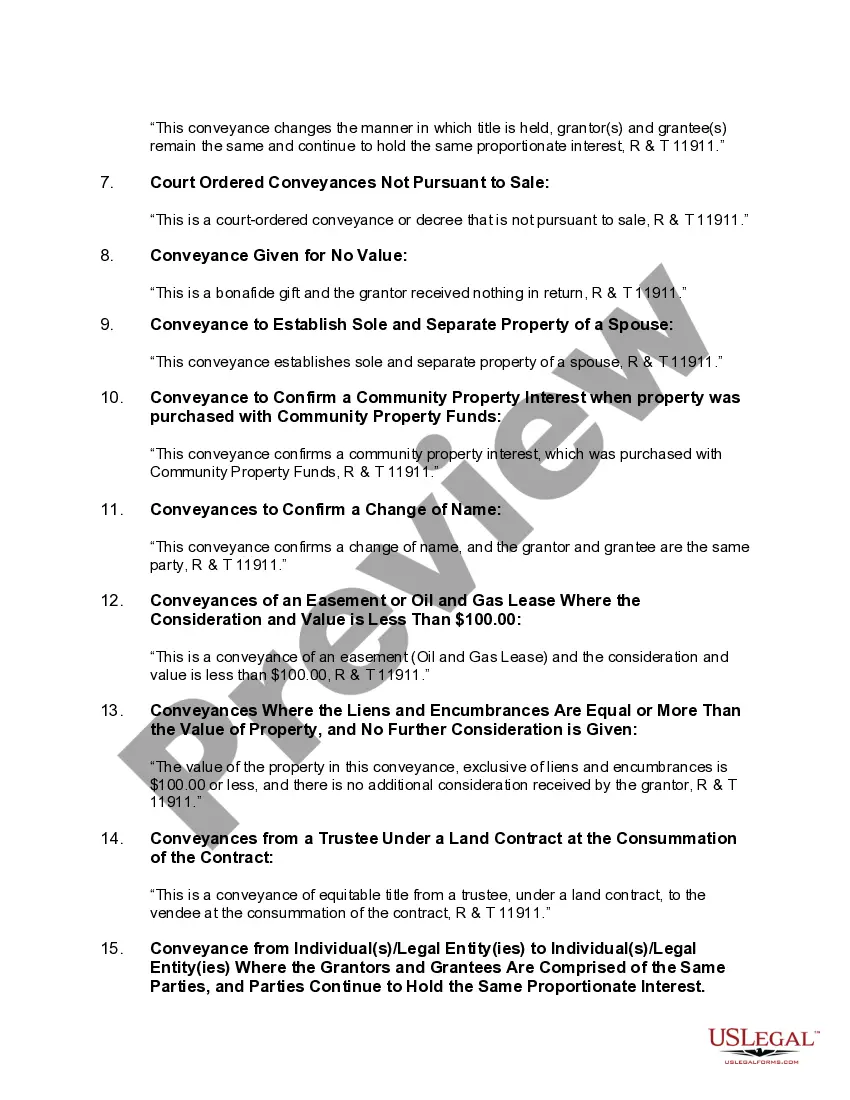

Title: Understanding El Monte California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: The El Monte California Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process that involves the transfer of a mortgage loan from one corporate mortgage holder to another. This assignment allows the new mortgage holder to assume the rights and responsibilities associated with the original loan. In this article, we will delve into the essential aspects of this assignment and explore its various types if applicable. 1. What is an Assignment of Deed of Trust? An Assignment of Deed of Trust refers to the legal instrument used to transfer the interest in a mortgage loan from one party to another. In El Monte, California, this instrument enables corporate mortgage holders to transfer their mortgage loans to other corporate entities in a regulated manner. 2. The Role of Corporate Mortgage Holders: Corporate mortgage holders are often financial institutions or lending corporations that hold the legal rights to a mortgage loan. They typically lend money to borrowers and secure the loan using the borrower's property as collateral. Once the assignment of the deed of trust occurs, the corporate mortgage holder no longer retains the rights or obligations associated with the loan. 3. Key Elements of El Monte California Assignment of Deed of Trust: a. Parties Involved: The assignment process involves at least three parties: the current corporate mortgage holder (assignor), the new corporate mortgage holder (assignee), and the borrower. b. Legal Documentation: The assignment is documented using a written Assignment of Deed of Trust document that outlines the terms of the transfer and is recorded with the local county recorder's office in El Monte, California. c. Transfer of Mortgage Rights: The assignor relinquishes all rights, benefits, and obligations connected to the original mortgage loan to the assignee. d. Recording Fees and Requirements: The assignment document must meet specific legal requirements and be accompanied by appropriate filing fees when recorded in the county recorder's office. 4. Types of El Monte California Assignment of Deed of Trust by Corporate Mortgage Holder: While there aren't specific types of assignments associated with El Monte, California, variations can occur based on the terms negotiated by the assignor and assignee. Potential variations may include: a. Full Assignment: In this type, the assignee assumes full control and responsibility for the mortgage loan. b. Partial Assignment: Here, the assignor transfers only a portion of the loan to the assignee while retaining their rights to the remaining balance. c. Assignment with Recourse: This type implies that the assignor remains liable for the mortgage loan should the assignee default and cannot fulfill their obligations. Conclusion: Understanding the El Monte California Assignment of Deed of Trust by Corporate Mortgage Holder is essential for both lenders and borrowers involved in the mortgage assignment process. By providing a legal framework for transferring mortgage loans, this process allows corporate mortgage holders to efficiently manage their portfolios while providing new opportunities for potential lenders.Title: Understanding El Monte California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: The El Monte California Assignment of Deed of Trust by Corporate Mortgage Holder is a legal process that involves the transfer of a mortgage loan from one corporate mortgage holder to another. This assignment allows the new mortgage holder to assume the rights and responsibilities associated with the original loan. In this article, we will delve into the essential aspects of this assignment and explore its various types if applicable. 1. What is an Assignment of Deed of Trust? An Assignment of Deed of Trust refers to the legal instrument used to transfer the interest in a mortgage loan from one party to another. In El Monte, California, this instrument enables corporate mortgage holders to transfer their mortgage loans to other corporate entities in a regulated manner. 2. The Role of Corporate Mortgage Holders: Corporate mortgage holders are often financial institutions or lending corporations that hold the legal rights to a mortgage loan. They typically lend money to borrowers and secure the loan using the borrower's property as collateral. Once the assignment of the deed of trust occurs, the corporate mortgage holder no longer retains the rights or obligations associated with the loan. 3. Key Elements of El Monte California Assignment of Deed of Trust: a. Parties Involved: The assignment process involves at least three parties: the current corporate mortgage holder (assignor), the new corporate mortgage holder (assignee), and the borrower. b. Legal Documentation: The assignment is documented using a written Assignment of Deed of Trust document that outlines the terms of the transfer and is recorded with the local county recorder's office in El Monte, California. c. Transfer of Mortgage Rights: The assignor relinquishes all rights, benefits, and obligations connected to the original mortgage loan to the assignee. d. Recording Fees and Requirements: The assignment document must meet specific legal requirements and be accompanied by appropriate filing fees when recorded in the county recorder's office. 4. Types of El Monte California Assignment of Deed of Trust by Corporate Mortgage Holder: While there aren't specific types of assignments associated with El Monte, California, variations can occur based on the terms negotiated by the assignor and assignee. Potential variations may include: a. Full Assignment: In this type, the assignee assumes full control and responsibility for the mortgage loan. b. Partial Assignment: Here, the assignor transfers only a portion of the loan to the assignee while retaining their rights to the remaining balance. c. Assignment with Recourse: This type implies that the assignor remains liable for the mortgage loan should the assignee default and cannot fulfill their obligations. Conclusion: Understanding the El Monte California Assignment of Deed of Trust by Corporate Mortgage Holder is essential for both lenders and borrowers involved in the mortgage assignment process. By providing a legal framework for transferring mortgage loans, this process allows corporate mortgage holders to efficiently manage their portfolios while providing new opportunities for potential lenders.