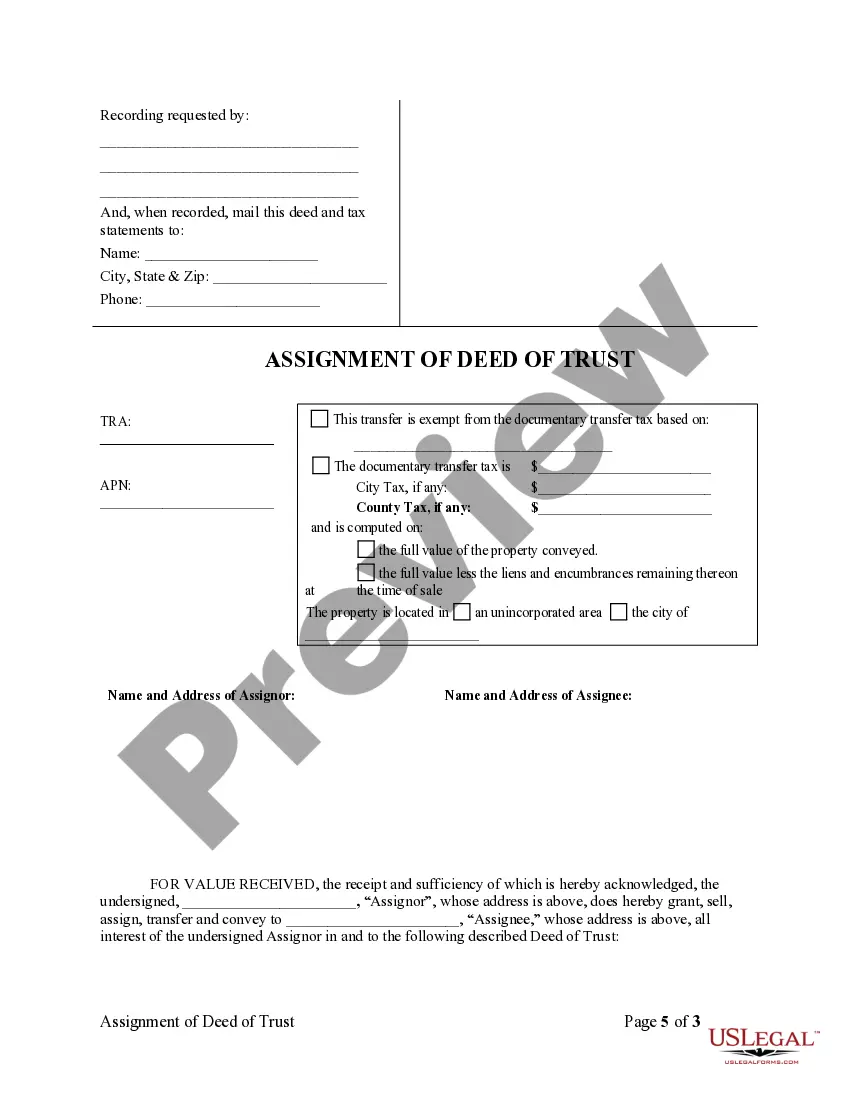

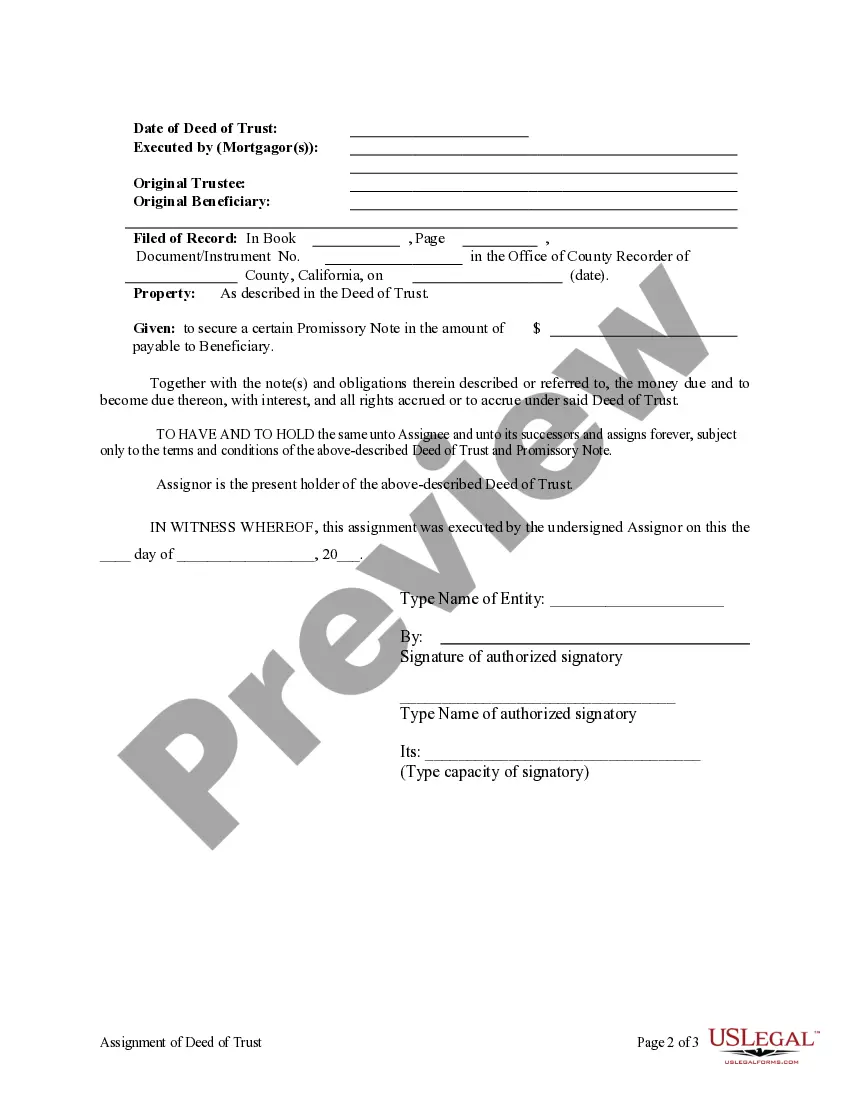

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

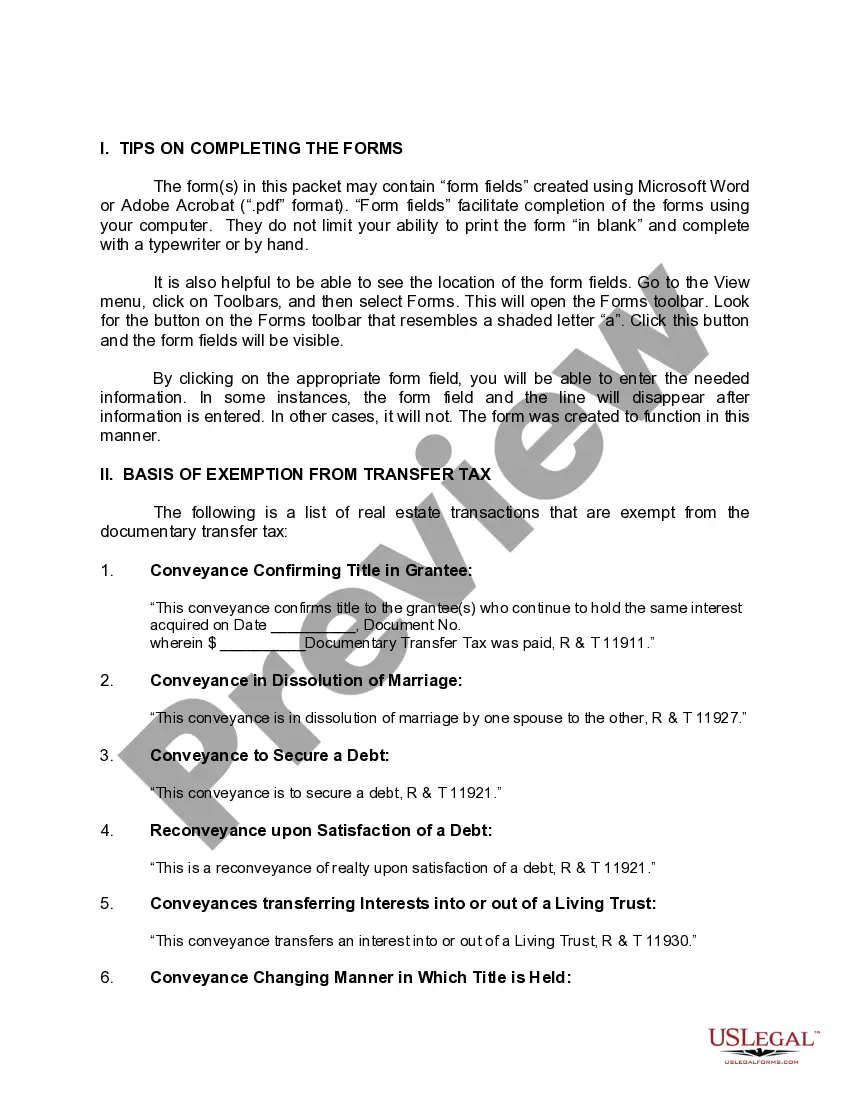

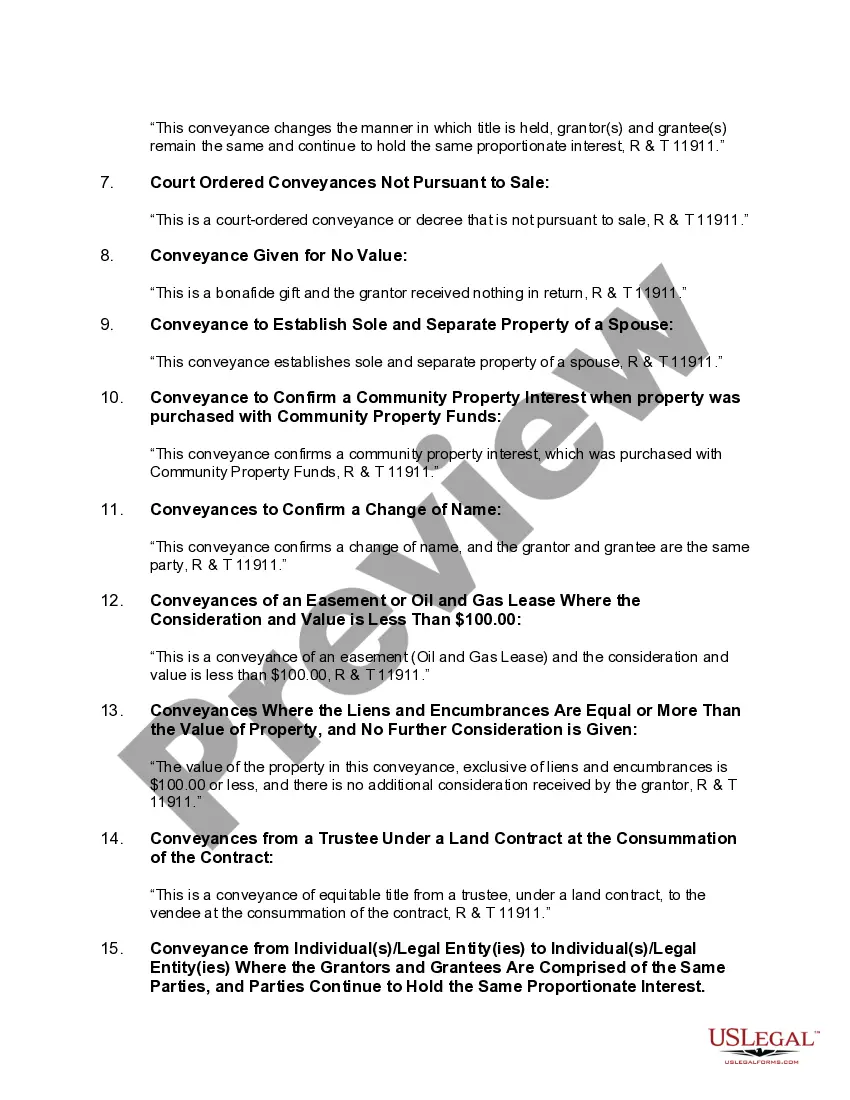

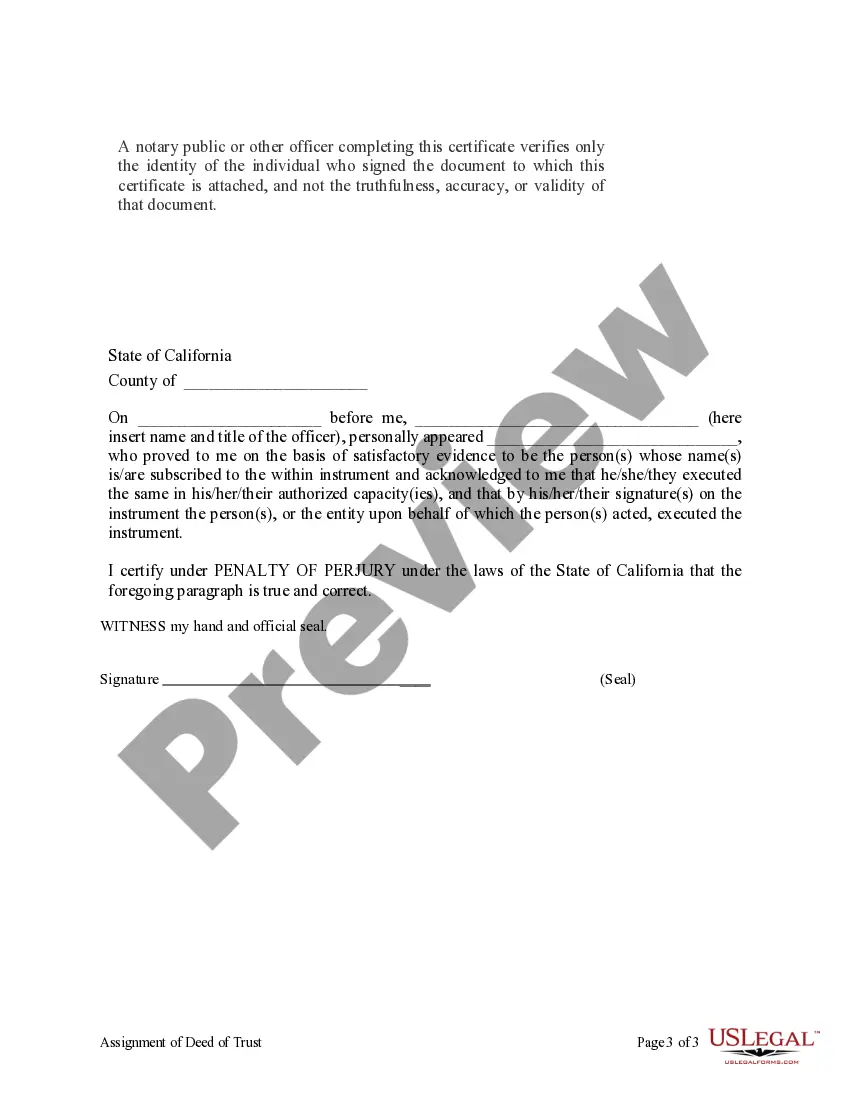

Title: Understanding Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder Keywords: Escondido California Assignment of Deed of Trust, Corporate Mortgage Holder, legal procedure, mortgage transfer, mortgage assignment types, responsibilities, benefits Introduction: An Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder is a legal procedure wherein a corporate entity transfers its rights as the mortgage holder to another individual or entity. This assignment typically occurs when the original corporation wishes to transfer the mortgage loan or the interest in the property securing the loan. In this article, we will delve into the various aspects of Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder, different types, responsibilities, and benefits associated with it. Types of Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Partial Assignment: In this type, the corporate mortgage holder transfers a portion of the mortgage loan to another entity, usually with specific terms and conditions defined in the assignment agreement. 2. Full Assignment: A full assignment occurs when the corporate mortgage holder transfers the entire mortgage loan, including all associated rights and interests, to another individual or entity. 3. Assignment with Assumption: This type involves the transfer of both the mortgage loan and the rights and responsibilities associated with it from the corporate mortgage holder to a new borrower. This new borrower "assumes" the existing loan and becomes responsible for its repayment. Responsibilities of the Parties Involved: 1. Corporate Mortgage Holder: The assigning corporate entity is responsible for ensuring that the assignment adheres to all legal requirements and contractual obligations. They must properly assign and convey the deed of trust and provide all relevant documents to the assignee. 2. Assignee: The individual or entity receiving the assignment must carefully review and understand the terms, conditions, and responsibilities associated with the mortgage. They must also ensure that the assignment complies with all legal requirements and record the assignment properly. Benefits of Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Mortgage Loan Transfer: Assigning the mortgage loan allows the corporate mortgage holder to transfer the financial risk and responsibility associated with the loan to a new party, thereby reducing their ongoing obligations. 2. Liquidity: By assigning the deed of trust, corporate mortgage holders can access immediate liquidity by selling or transferring the mortgage, which can be beneficial for managing their financial needs. 3. Efficiency: Assignments streamline the mortgage transfer process, enabling the corporate mortgage holder to focus on core operations while transferring the loan to a party more equipped to handle its repayment. Conclusion: Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder is a legal procedure that facilitates the transfer of mortgage loans, interests, and responsibilities from a corporate entity to an assignee. Understanding the different types, responsibilities, and benefits associated with this process helps both parties navigate the assignment process smoothly and efficiently. It is crucial to consult legal professionals to ensure compliance with all legal requirements and to protect the interests of all parties involved.Title: Understanding Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder Keywords: Escondido California Assignment of Deed of Trust, Corporate Mortgage Holder, legal procedure, mortgage transfer, mortgage assignment types, responsibilities, benefits Introduction: An Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder is a legal procedure wherein a corporate entity transfers its rights as the mortgage holder to another individual or entity. This assignment typically occurs when the original corporation wishes to transfer the mortgage loan or the interest in the property securing the loan. In this article, we will delve into the various aspects of Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder, different types, responsibilities, and benefits associated with it. Types of Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Partial Assignment: In this type, the corporate mortgage holder transfers a portion of the mortgage loan to another entity, usually with specific terms and conditions defined in the assignment agreement. 2. Full Assignment: A full assignment occurs when the corporate mortgage holder transfers the entire mortgage loan, including all associated rights and interests, to another individual or entity. 3. Assignment with Assumption: This type involves the transfer of both the mortgage loan and the rights and responsibilities associated with it from the corporate mortgage holder to a new borrower. This new borrower "assumes" the existing loan and becomes responsible for its repayment. Responsibilities of the Parties Involved: 1. Corporate Mortgage Holder: The assigning corporate entity is responsible for ensuring that the assignment adheres to all legal requirements and contractual obligations. They must properly assign and convey the deed of trust and provide all relevant documents to the assignee. 2. Assignee: The individual or entity receiving the assignment must carefully review and understand the terms, conditions, and responsibilities associated with the mortgage. They must also ensure that the assignment complies with all legal requirements and record the assignment properly. Benefits of Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder: 1. Mortgage Loan Transfer: Assigning the mortgage loan allows the corporate mortgage holder to transfer the financial risk and responsibility associated with the loan to a new party, thereby reducing their ongoing obligations. 2. Liquidity: By assigning the deed of trust, corporate mortgage holders can access immediate liquidity by selling or transferring the mortgage, which can be beneficial for managing their financial needs. 3. Efficiency: Assignments streamline the mortgage transfer process, enabling the corporate mortgage holder to focus on core operations while transferring the loan to a party more equipped to handle its repayment. Conclusion: Escondido California Assignment of Deed of Trust by Corporate Mortgage Holder is a legal procedure that facilitates the transfer of mortgage loans, interests, and responsibilities from a corporate entity to an assignee. Understanding the different types, responsibilities, and benefits associated with this process helps both parties navigate the assignment process smoothly and efficiently. It is crucial to consult legal professionals to ensure compliance with all legal requirements and to protect the interests of all parties involved.