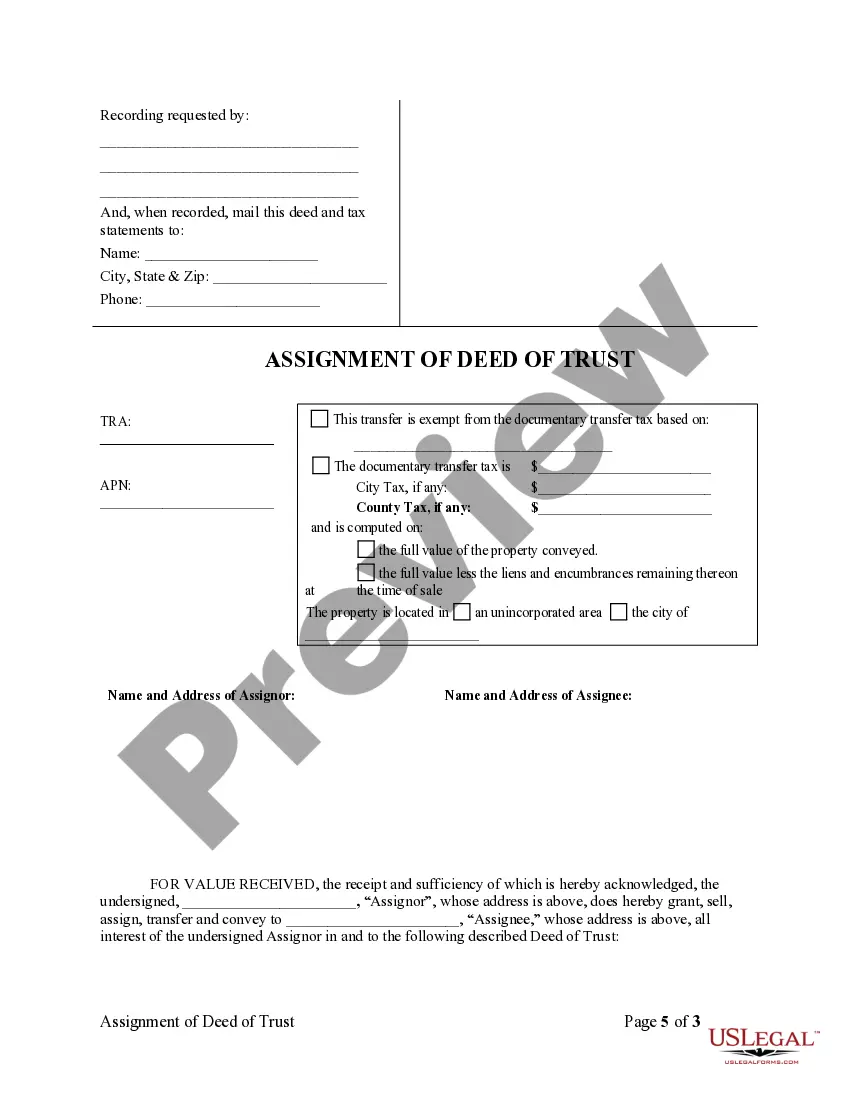

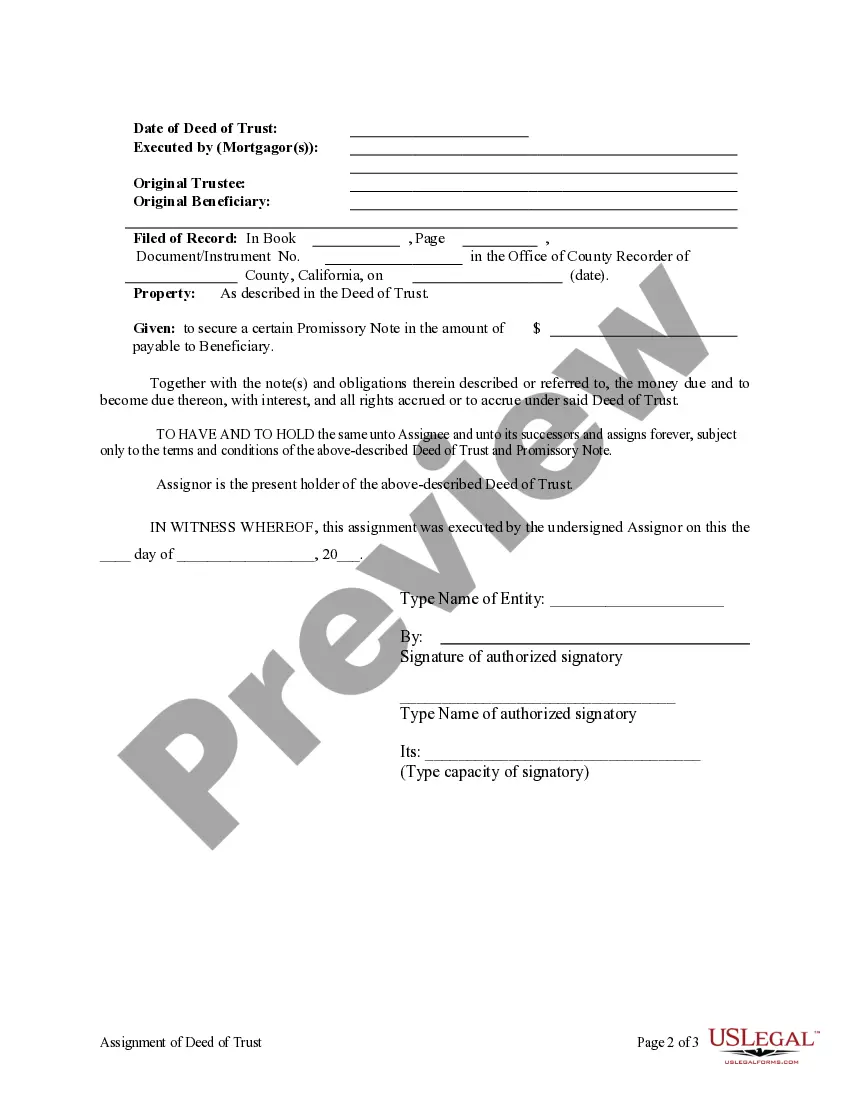

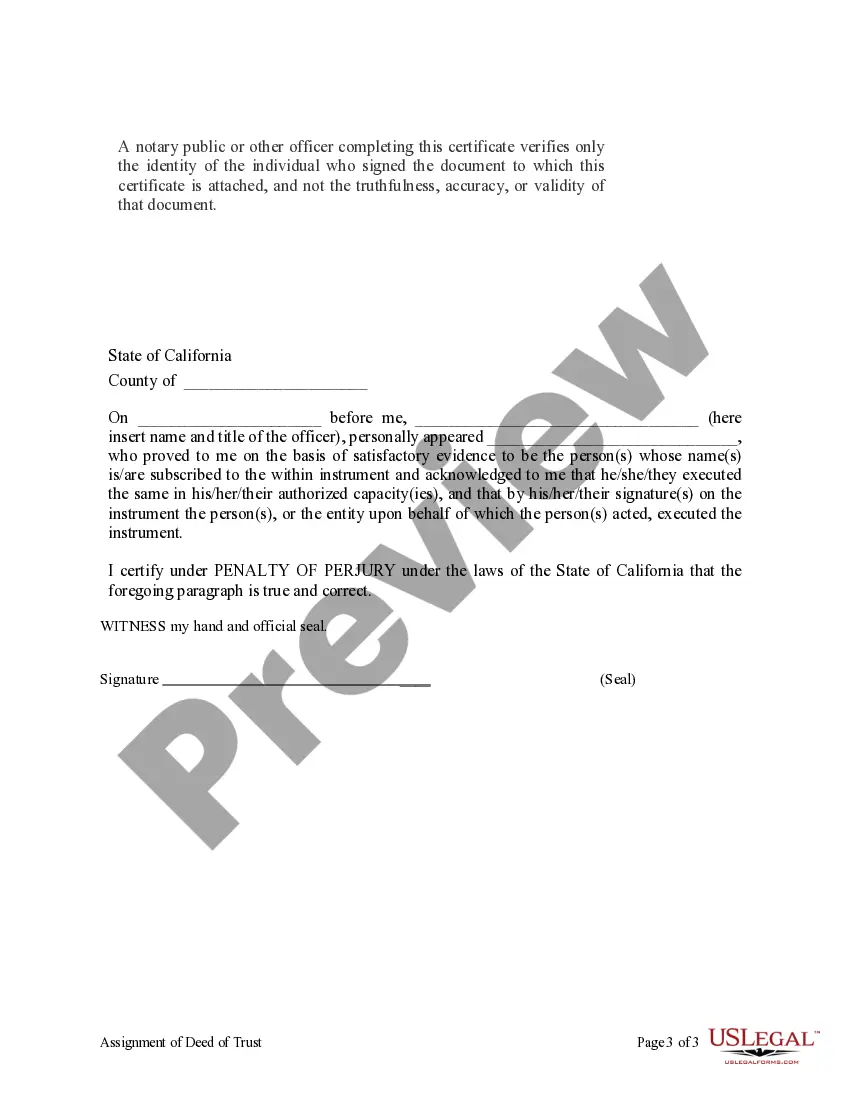

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

Irvine, California Assignment of Deed of Trust by Corporate Mortgage Holder: Comprehensive Explainer In the realm of real estate transactions and mortgage agreements, an Irvine, California Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal process by which a corporation or business entity transfers its rights and interests in a mortgage to another party. This transfer typically occurs when the original lender (the corporate mortgage holder) decides to assign or sell their loan and associated security interest to a new entity. Keywords: Irvine, California, Assignment of Deed of Trust, Corporate Mortgage Holder, real estate transactions, mortgage agreements, legal process, transfer, lender, loan, security interest, new entity. Types of Irvine, California Assignment of Deed of Trust by Corporate Mortgage Holder 1. Standard Assignment of Deed of Trust by Corporate Mortgage Holder: This type of assignment involves the transfer of a mortgage loan from a corporate mortgage holder to a new party, such as another financial institution or investor. The new entity then assumes all rights, interests, and the responsibilities associated with the original mortgage. 2. Substitution of Trustee: In some cases, a corporate mortgage holder may decide to substitute the trustee named in the original deed of trust. This substitution typically occurs to comply with legal requirements or to replace the trustee with a party chosen by the new entity acquiring the mortgage. 3. Release of Deed of Trust: Under certain circumstances, a corporate mortgage holder may decide to release their security interest in a property by issuing a Release of Deed of Trust. This is commonly seen when a mortgage is paid off in full, and the lender releases their claim on the property's title. 4. Assignment and Assumption Agreement: While not limited to corporate mortgage holders, an assignment and assumption agreement can also be relevant in Irvine, California. This type of agreement occurs when the corporate mortgage holder transfers both the rights and obligations associated with the mortgage loan to the new entity. In this case, the original borrower remains liable to make payments to the new entity. 5. Partial Assignment of Deed of Trust: Partial assignment is a common variant wherein a corporate mortgage holder assigns only a portion of their interest in the mortgage to a new party. This type of assignment is often observed when multiple lenders are involved in the financing of a property, and they assign their shares to different entities. 6. Assignment of Deed of Trust with All-Inclusive Note and Additional Financing: This complex form of assignment involves the transfer of an existing mortgage loan, an "all-inclusive note," and additional financing to a new corporate mortgage holder. This type of transaction often occurs in cases where the borrower needs additional funds and the original lender is unable or unwilling to provide them. In conclusion, an Irvine, California Assignment of Deed of Trust by Corporate Mortgage Holder encompasses various legal processes involved in transferring or assigning mortgage loans from corporate mortgage holders to new entities. These assignments could be standard, involve substitutions, releases, or additional financing, depending on the specific circumstances of the mortgage agreement.Irvine, California Assignment of Deed of Trust by Corporate Mortgage Holder: Comprehensive Explainer In the realm of real estate transactions and mortgage agreements, an Irvine, California Assignment of Deed of Trust by Corporate Mortgage Holder refers to the legal process by which a corporation or business entity transfers its rights and interests in a mortgage to another party. This transfer typically occurs when the original lender (the corporate mortgage holder) decides to assign or sell their loan and associated security interest to a new entity. Keywords: Irvine, California, Assignment of Deed of Trust, Corporate Mortgage Holder, real estate transactions, mortgage agreements, legal process, transfer, lender, loan, security interest, new entity. Types of Irvine, California Assignment of Deed of Trust by Corporate Mortgage Holder 1. Standard Assignment of Deed of Trust by Corporate Mortgage Holder: This type of assignment involves the transfer of a mortgage loan from a corporate mortgage holder to a new party, such as another financial institution or investor. The new entity then assumes all rights, interests, and the responsibilities associated with the original mortgage. 2. Substitution of Trustee: In some cases, a corporate mortgage holder may decide to substitute the trustee named in the original deed of trust. This substitution typically occurs to comply with legal requirements or to replace the trustee with a party chosen by the new entity acquiring the mortgage. 3. Release of Deed of Trust: Under certain circumstances, a corporate mortgage holder may decide to release their security interest in a property by issuing a Release of Deed of Trust. This is commonly seen when a mortgage is paid off in full, and the lender releases their claim on the property's title. 4. Assignment and Assumption Agreement: While not limited to corporate mortgage holders, an assignment and assumption agreement can also be relevant in Irvine, California. This type of agreement occurs when the corporate mortgage holder transfers both the rights and obligations associated with the mortgage loan to the new entity. In this case, the original borrower remains liable to make payments to the new entity. 5. Partial Assignment of Deed of Trust: Partial assignment is a common variant wherein a corporate mortgage holder assigns only a portion of their interest in the mortgage to a new party. This type of assignment is often observed when multiple lenders are involved in the financing of a property, and they assign their shares to different entities. 6. Assignment of Deed of Trust with All-Inclusive Note and Additional Financing: This complex form of assignment involves the transfer of an existing mortgage loan, an "all-inclusive note," and additional financing to a new corporate mortgage holder. This type of transaction often occurs in cases where the borrower needs additional funds and the original lender is unable or unwilling to provide them. In conclusion, an Irvine, California Assignment of Deed of Trust by Corporate Mortgage Holder encompasses various legal processes involved in transferring or assigning mortgage loans from corporate mortgage holders to new entities. These assignments could be standard, involve substitutions, releases, or additional financing, depending on the specific circumstances of the mortgage agreement.