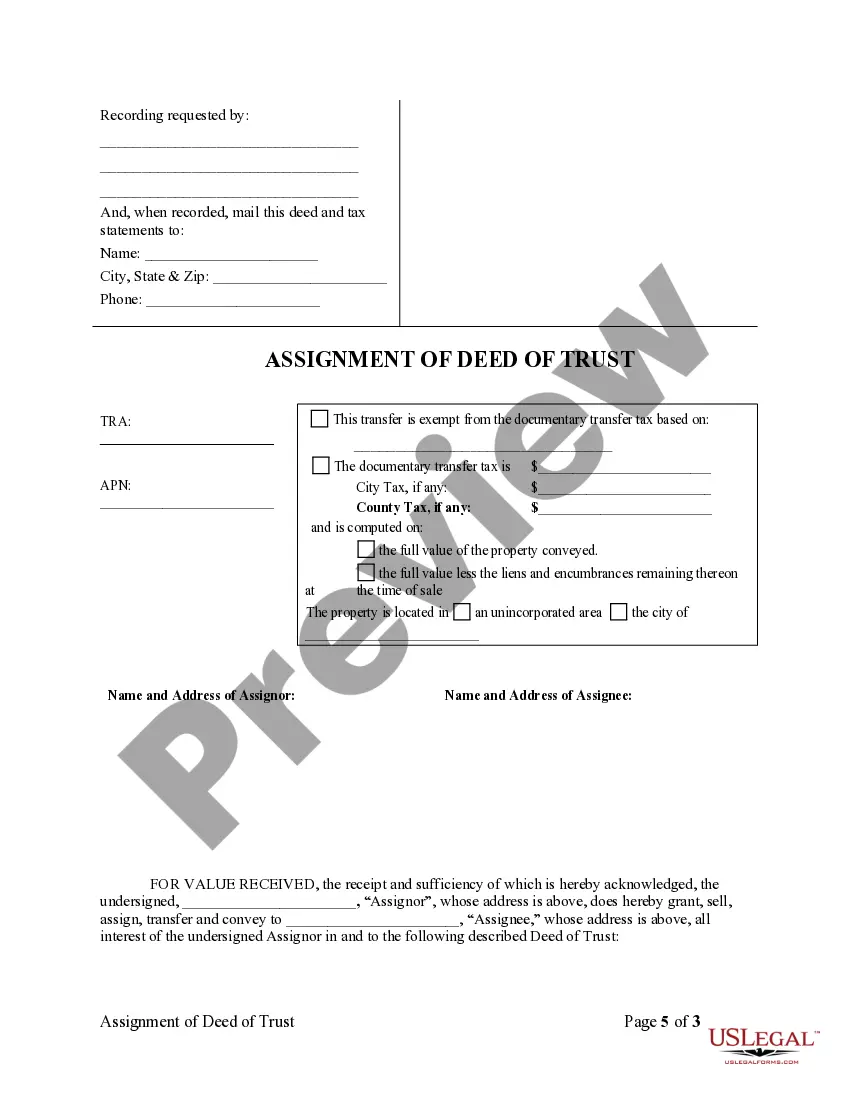

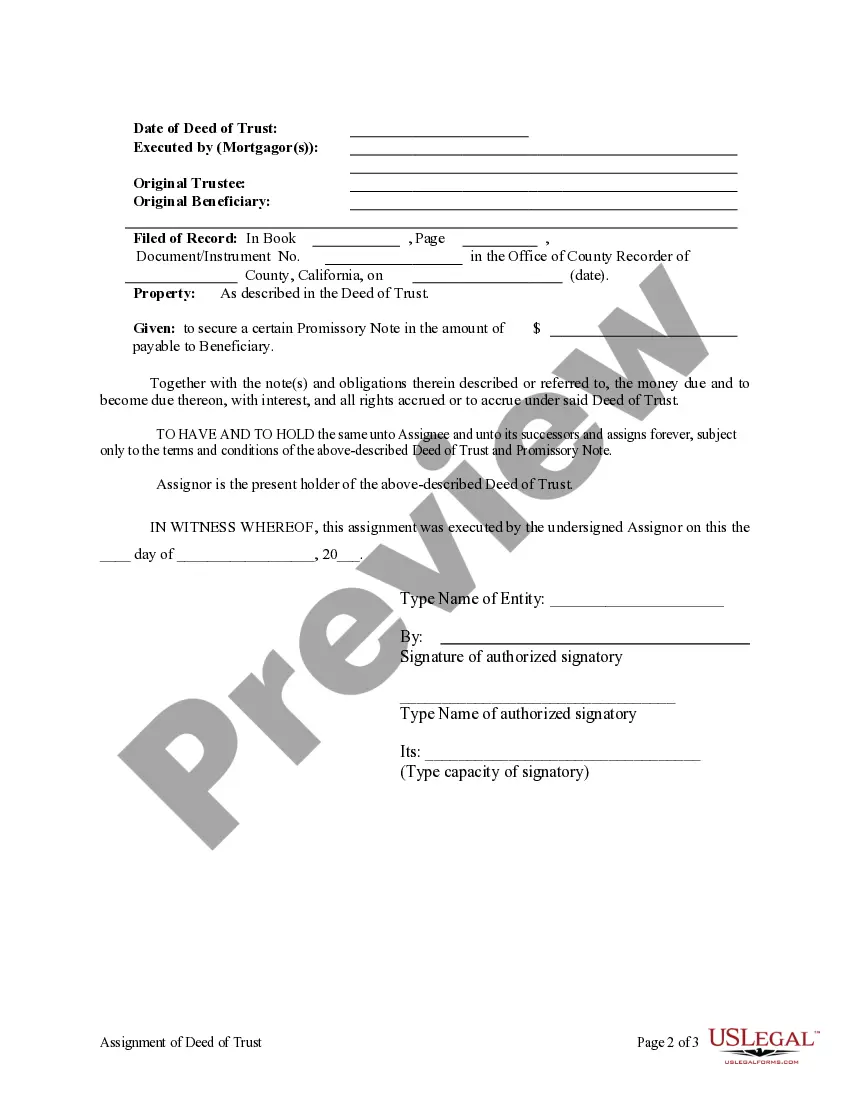

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

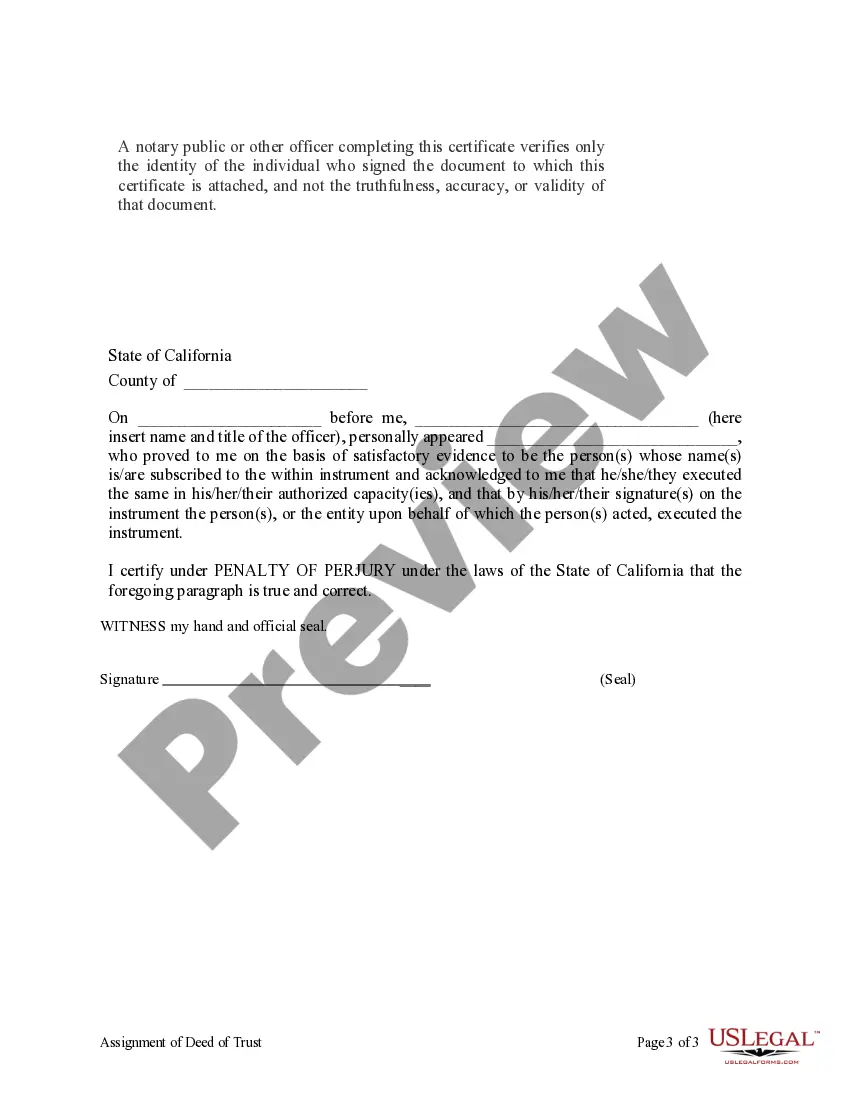

Title: Understanding Rancho Cucamonga California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: Rancho Cucamonga, located in California, is a charming suburban city known for its beautiful homes and a thriving real estate market. In this bustling city, it is not uncommon to come across transactions involving assignments of deeds of trust by corporate mortgage holders. This article aims to provide a detailed description of what an assignment of deed of trust entails in Rancho Cucamonga and explore different types that may exist. Keywords: Rancho Cucamonga, California, assignment of deed of trust, corporate mortgage holder, real estate market, transactions 1. Definition and Purpose: An assignment of deed of trust refers to the legal process where a corporate mortgage holder transfers their rights and interests in a property's mortgage to another party. This assignment allows the new party to become the beneficiary of the mortgage and gives them the right to collect mortgage payments and enforce the loan terms. 2. Process and Legal Documentation: The assignment of deed of trust in Rancho Cucamonga typically involves a series of steps. Firstly, the original mortgage holder (the assignor) drafts an assignment document outlining the transfer of rights. This document needs to comply with California's mortgage laws and should include explicit details regarding the specifics of the assignment. Once drafted, the assignment document must be notarized and recorded at the relevant county recorder's office. 3. Role of a Corporate Mortgage Holder: Corporate mortgage holders, such as banks or lending institutions, play a significant role in the real estate market of Rancho Cucamonga. These entities hold mortgages as financial investments and often participate in assignments of deeds of trust to transfer or sell these investments to other interested parties. 4. Types of Assignments: a) Full assignment: In this type, the corporate mortgage holder transfers the entire mortgage and all associated rights to the assignee. The assignee becomes the new beneficiary, responsible for collecting payments and enforcing loan terms. b) Partial assignment: In some instances, a corporate mortgage holder may opt for a partial assignment, transferring only a portion of the mortgage to another party. This allows the assignor to retain an interest while allowing for potential risk mitigation or investment diversification purposes. c) Assignment with recourse: When assigning a deed of trust with recourse, the corporate mortgage holder remains partially liable in case the assignee defaults on the loan. This helps protect the assignee from potential losses and encourages smoother transactions. d) Assignment without recourse: In this type, the corporate mortgage holder absolves themselves of any liability once the assignment is completed. The assignee assumes full responsibility for the mortgage, including defaults. Conclusion: Rancho Cucamonga, California, experiences various assignments of deeds of trust by corporate mortgage holders due to the dynamic real estate market. Understanding the intricacies of these assignments is crucial for anyone involved in real estate transactions. Whether it's a full or partial assignment, with or without recourse, the process always requires legal documentation and compliance with California's mortgage laws. By comprehending Rancho Cucamonga California assignments of deeds of trust, buyers, sellers, and investors can navigate the real estate landscape more confidently.Title: Understanding Rancho Cucamonga California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: Rancho Cucamonga, located in California, is a charming suburban city known for its beautiful homes and a thriving real estate market. In this bustling city, it is not uncommon to come across transactions involving assignments of deeds of trust by corporate mortgage holders. This article aims to provide a detailed description of what an assignment of deed of trust entails in Rancho Cucamonga and explore different types that may exist. Keywords: Rancho Cucamonga, California, assignment of deed of trust, corporate mortgage holder, real estate market, transactions 1. Definition and Purpose: An assignment of deed of trust refers to the legal process where a corporate mortgage holder transfers their rights and interests in a property's mortgage to another party. This assignment allows the new party to become the beneficiary of the mortgage and gives them the right to collect mortgage payments and enforce the loan terms. 2. Process and Legal Documentation: The assignment of deed of trust in Rancho Cucamonga typically involves a series of steps. Firstly, the original mortgage holder (the assignor) drafts an assignment document outlining the transfer of rights. This document needs to comply with California's mortgage laws and should include explicit details regarding the specifics of the assignment. Once drafted, the assignment document must be notarized and recorded at the relevant county recorder's office. 3. Role of a Corporate Mortgage Holder: Corporate mortgage holders, such as banks or lending institutions, play a significant role in the real estate market of Rancho Cucamonga. These entities hold mortgages as financial investments and often participate in assignments of deeds of trust to transfer or sell these investments to other interested parties. 4. Types of Assignments: a) Full assignment: In this type, the corporate mortgage holder transfers the entire mortgage and all associated rights to the assignee. The assignee becomes the new beneficiary, responsible for collecting payments and enforcing loan terms. b) Partial assignment: In some instances, a corporate mortgage holder may opt for a partial assignment, transferring only a portion of the mortgage to another party. This allows the assignor to retain an interest while allowing for potential risk mitigation or investment diversification purposes. c) Assignment with recourse: When assigning a deed of trust with recourse, the corporate mortgage holder remains partially liable in case the assignee defaults on the loan. This helps protect the assignee from potential losses and encourages smoother transactions. d) Assignment without recourse: In this type, the corporate mortgage holder absolves themselves of any liability once the assignment is completed. The assignee assumes full responsibility for the mortgage, including defaults. Conclusion: Rancho Cucamonga, California, experiences various assignments of deeds of trust by corporate mortgage holders due to the dynamic real estate market. Understanding the intricacies of these assignments is crucial for anyone involved in real estate transactions. Whether it's a full or partial assignment, with or without recourse, the process always requires legal documentation and compliance with California's mortgage laws. By comprehending Rancho Cucamonga California assignments of deeds of trust, buyers, sellers, and investors can navigate the real estate landscape more confidently.