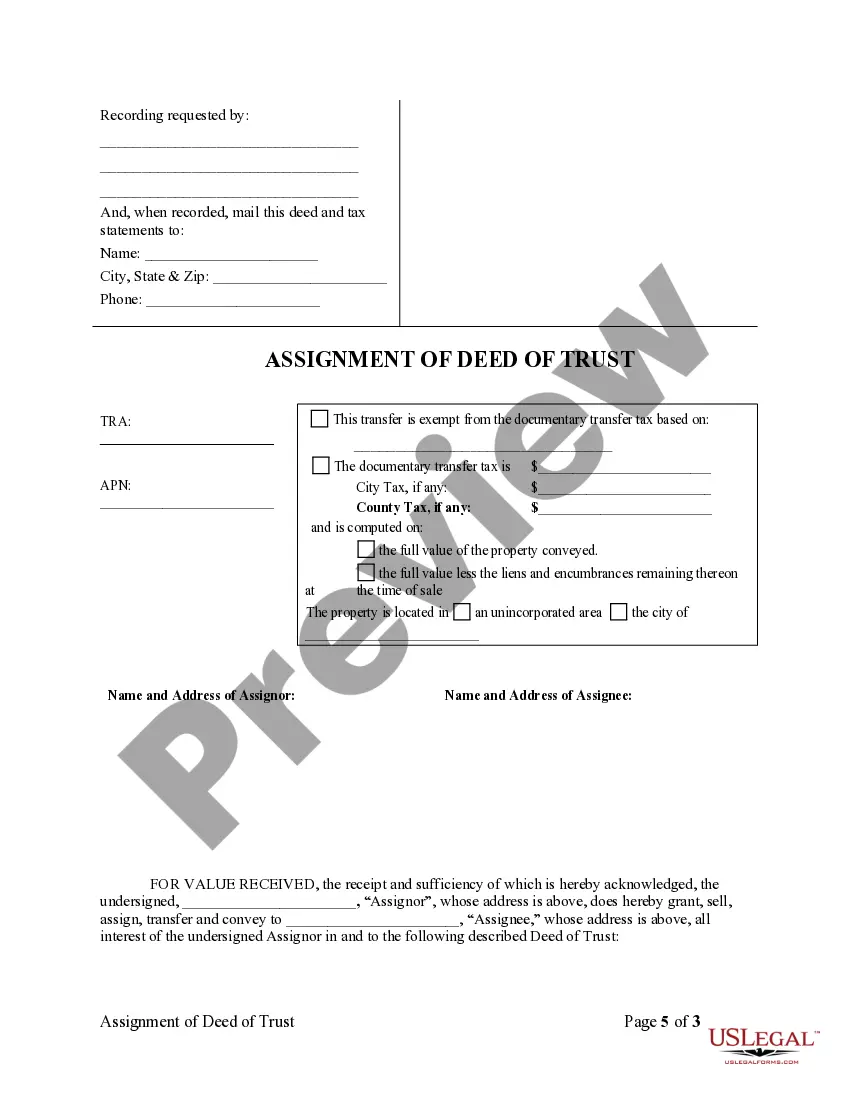

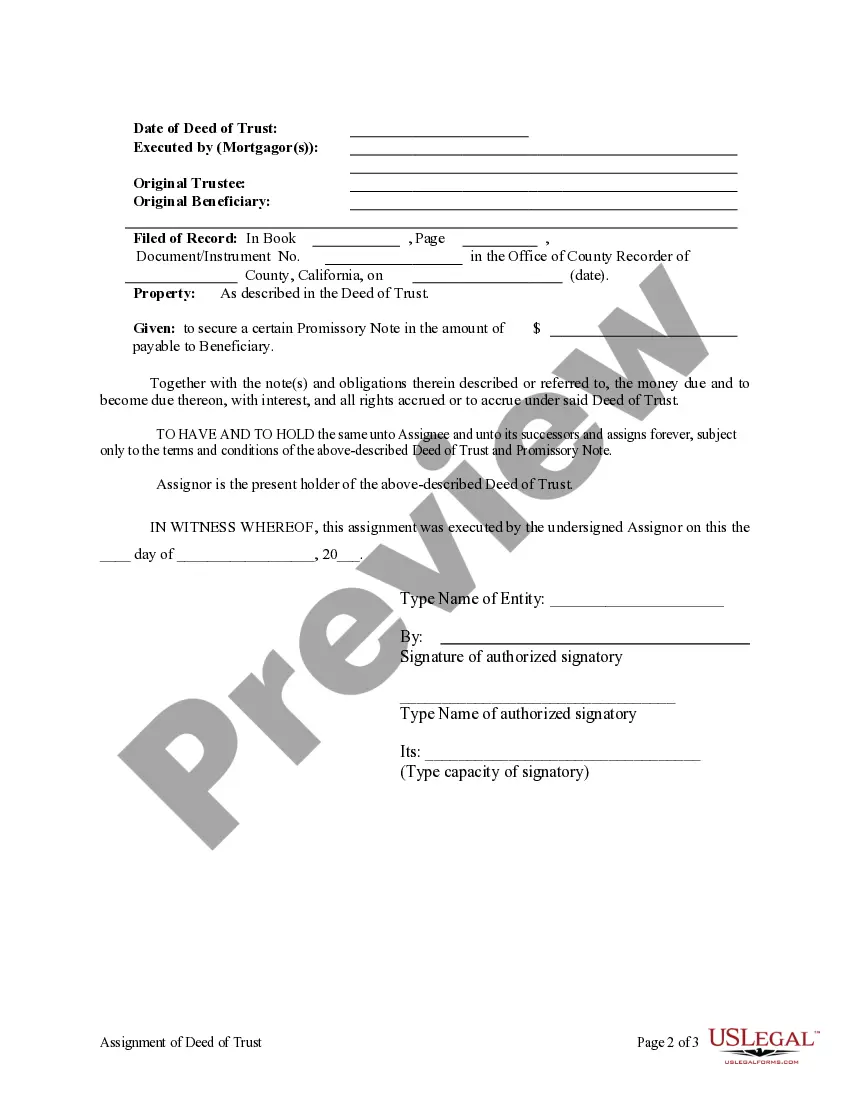

This is an assignment of mortgage/deed of trust form where the owner of the deed of trust/mortgage conveys the owner's interest in the deed of trust/mortgage to a third party. The holder of the deed of trust/mortgage is a corporation.

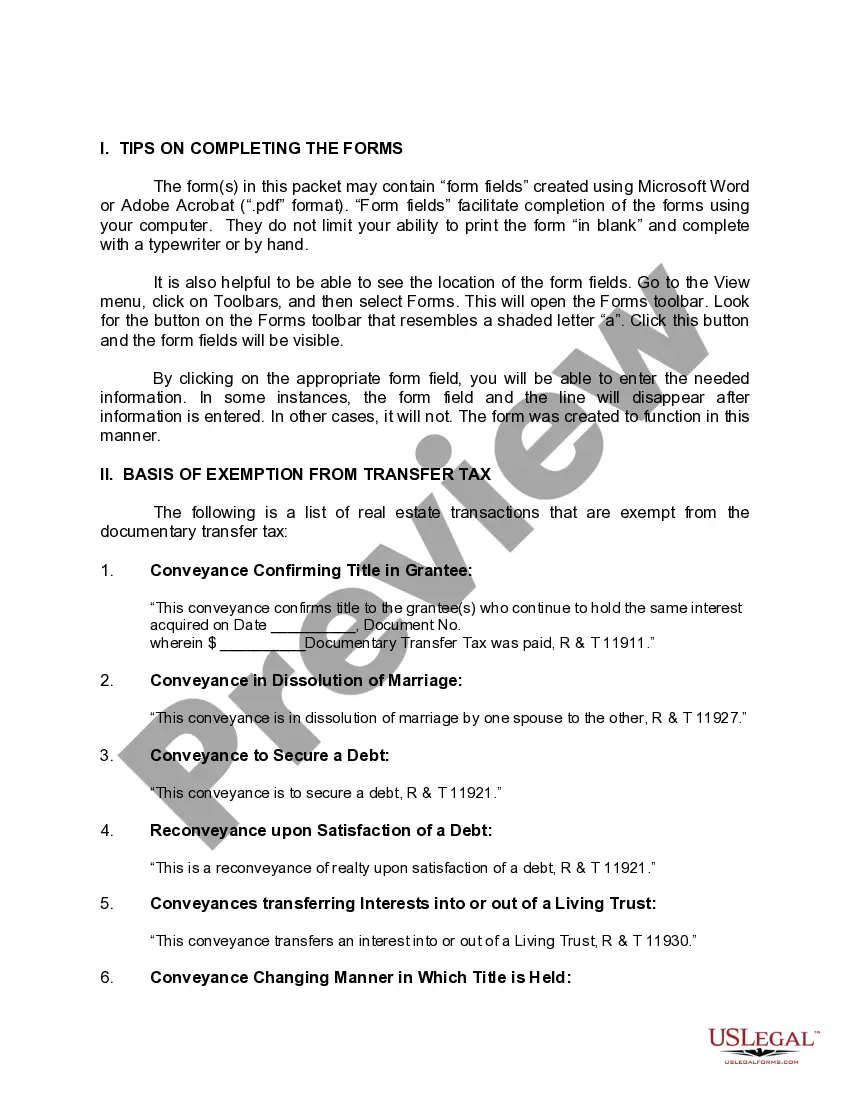

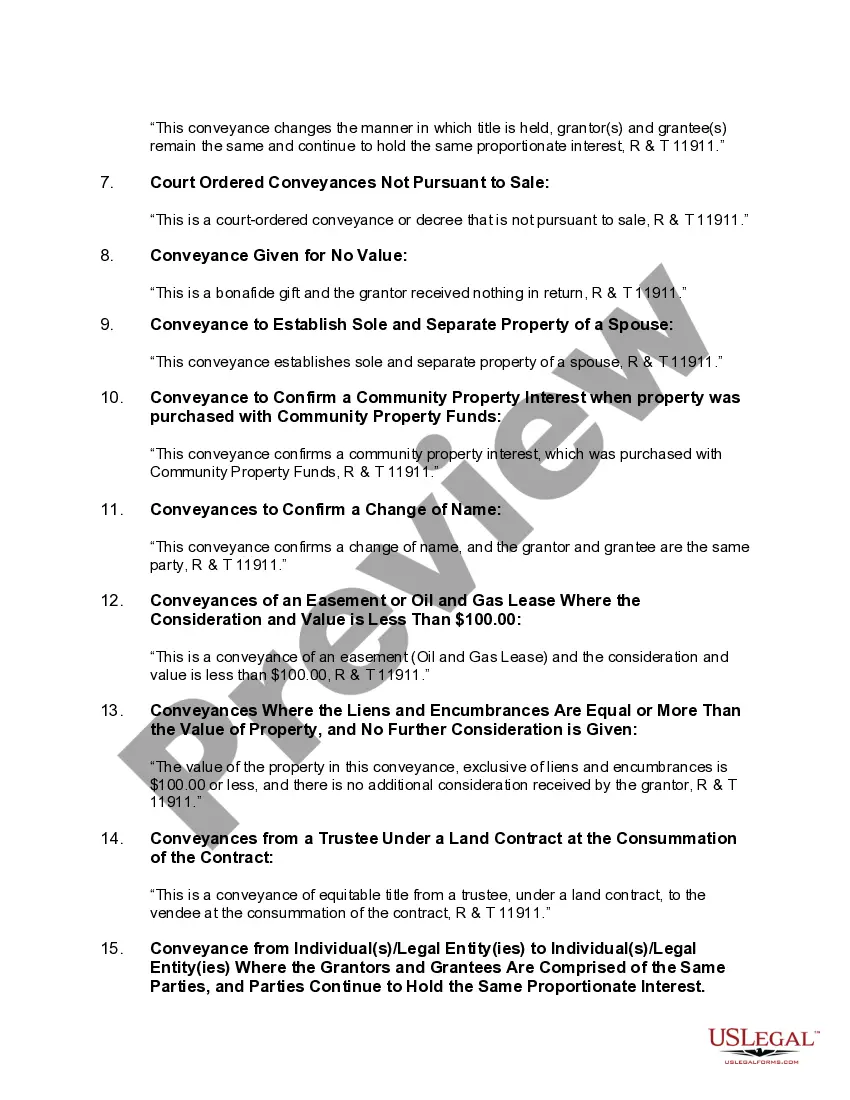

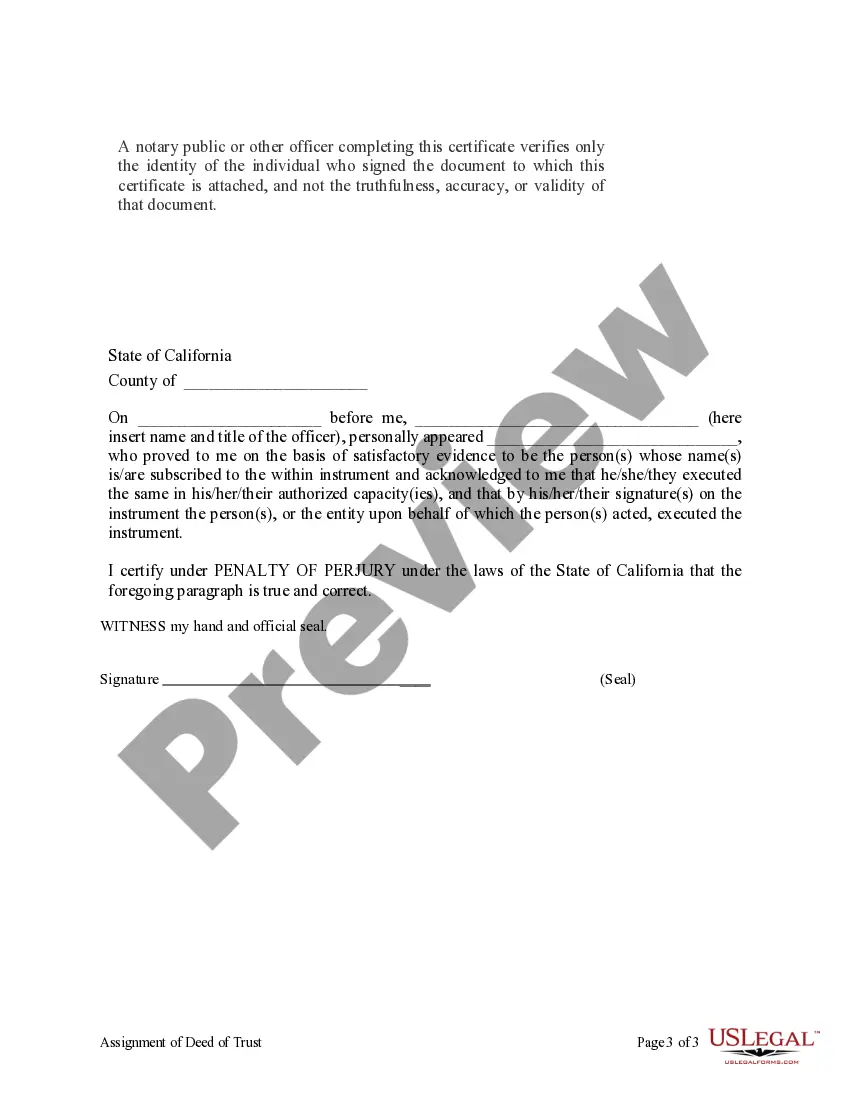

Title: Understanding the Rialto California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In Rialto, California, the Assignment of Deed of Trust by Corporate Mortgage Holder plays a significant role in real estate transactions. This legal document allows a corporate mortgage holder to transfer or assign their interest in a property to another party. Whether considering a traditional assignment or a related assignment, this article will provide a detailed description of this process, its importance, and different types of Assignment of Deed of Trust in Rialto. 1. Understanding the Assignment of Deed of Trust by Corporate Mortgage Holder: The Assignment of Deed of Trust refers to the transfer of a mortgage holder's interest in a property to another party, which can be an individual, a corporation, or another entity. In Rialto, this legal document serves as proof of the transfer, outlining the terms and conditions of the assignment. 2. Importance of the Assignment of Deed of Trust: 2.1 Ensuring Legal Clarity: The Assignment of Deed of Trust by Corporate Mortgage Holder safeguards the legal rights of all parties involved in the transaction, providing a clear record of the transfer and ensuring transparency. 2.2 Securing the Interests of the New Mortgage Holder: The assignment protects the interests of the new mortgage holder by documenting their legal right to collect mortgage payments and benefit from the property's collateral in case of default. 2.3 Facilitating Real Estate Transactions: The Assignment of Deed of Trust streamlines the transfer of ownership by allowing mortgage holders to assign their interests without needing to go through lengthy refinancing processes or creating new loans. 3. Types of Rialto California Assignment of Deed of Trust by Corporate Mortgage Holder: 3.1 Traditional Assignment: In a traditional assignment, the corporate mortgage holder transfers their interest in the property to a new mortgage holder, who becomes responsible for collecting payments and managing the mortgage. 3.2 Assignment of Deed of Trust Due to Change in Corporate Structure: This type of assignment occurs when a corporate mortgage holder undergoes a structural change, such as a merger or acquisition. The assignment transfers the mortgage interests to reflect the new corporate entity that is responsible for managing the loan. 3.3 Assignment of Deed of Trust for Investment Purposes: This type of assignment involves the transfer of the mortgage interests from a corporate mortgage holder to a real estate investment firm. This allows the investment firm to benefit from the generated income, mortgage payments, or potential foreclosure profits. Conclusion: The Rialto California Assignment of Deed of Trust by Corporate Mortgage Holder is an essential legal process in real estate transactions. It ensures the transfer of interests is properly recorded and protects the rights of all parties involved. Understanding the importance of this document and the different types of assignments can assist in navigating real estate transactions with clarity and confidence.Title: Understanding the Rialto California Assignment of Deed of Trust by Corporate Mortgage Holder Introduction: In Rialto, California, the Assignment of Deed of Trust by Corporate Mortgage Holder plays a significant role in real estate transactions. This legal document allows a corporate mortgage holder to transfer or assign their interest in a property to another party. Whether considering a traditional assignment or a related assignment, this article will provide a detailed description of this process, its importance, and different types of Assignment of Deed of Trust in Rialto. 1. Understanding the Assignment of Deed of Trust by Corporate Mortgage Holder: The Assignment of Deed of Trust refers to the transfer of a mortgage holder's interest in a property to another party, which can be an individual, a corporation, or another entity. In Rialto, this legal document serves as proof of the transfer, outlining the terms and conditions of the assignment. 2. Importance of the Assignment of Deed of Trust: 2.1 Ensuring Legal Clarity: The Assignment of Deed of Trust by Corporate Mortgage Holder safeguards the legal rights of all parties involved in the transaction, providing a clear record of the transfer and ensuring transparency. 2.2 Securing the Interests of the New Mortgage Holder: The assignment protects the interests of the new mortgage holder by documenting their legal right to collect mortgage payments and benefit from the property's collateral in case of default. 2.3 Facilitating Real Estate Transactions: The Assignment of Deed of Trust streamlines the transfer of ownership by allowing mortgage holders to assign their interests without needing to go through lengthy refinancing processes or creating new loans. 3. Types of Rialto California Assignment of Deed of Trust by Corporate Mortgage Holder: 3.1 Traditional Assignment: In a traditional assignment, the corporate mortgage holder transfers their interest in the property to a new mortgage holder, who becomes responsible for collecting payments and managing the mortgage. 3.2 Assignment of Deed of Trust Due to Change in Corporate Structure: This type of assignment occurs when a corporate mortgage holder undergoes a structural change, such as a merger or acquisition. The assignment transfers the mortgage interests to reflect the new corporate entity that is responsible for managing the loan. 3.3 Assignment of Deed of Trust for Investment Purposes: This type of assignment involves the transfer of the mortgage interests from a corporate mortgage holder to a real estate investment firm. This allows the investment firm to benefit from the generated income, mortgage payments, or potential foreclosure profits. Conclusion: The Rialto California Assignment of Deed of Trust by Corporate Mortgage Holder is an essential legal process in real estate transactions. It ensures the transfer of interests is properly recorded and protects the rights of all parties involved. Understanding the importance of this document and the different types of assignments can assist in navigating real estate transactions with clarity and confidence.